Amid accelerating climate disclosure, Nigerian oil and gas companies face rising scrutiny over carbon reporting quality.

New research evidence shows foreign investors drive stronger transparency, but concentrated and institutional ownership often suppresses disclosure, threatening fair climate governance.

Growing diluted and managerial shareholdings are advancing openness, backed by robust audit assurance, yet sector liquidity pressures and governance conflicts persist.

Africa's energy sector is reaching a carbon intersection, where diverse ownership and global standards are reshaping sustainability outcomes and accountability.

Ownership Patterns Reshape Nigeria's Climate Accountability Standards

A climate accountability revolution is redefining Africa's oil and gas trajectory, with Nigeria's firms leading the charge. As nations rally around the United Nations Sustainable Development Goals, the spotlight on carbon measurement and transparent disclosure grows more intense, reshaping investor priorities, corporate boardroom norms, and regulatory agendas. Today, emission reporting standards are not just technical; they are the new litmus test for climate governance and sector credibility.

Groundbreaking research into Nigeria's 22 listed oil and gas companies reveals a pivotal insight: ownership structure decisively influences the quality of carbon disclosure. Foreign investors, driven by global sustainability imperatives, consistently demand sharper transparency and environmental integrity.

In contrast, firms with majority institutional or concentrated ownership report weaker disclosure, hampered by information gaps, agency tensions, and limited public visibility. Meanwhile, trends toward diluted and managerial ownership offer fresh hope; these structures foster broader stakeholder participation and stronger climate reporting.

The stakes could not be higher. Africa's energy sector stands at an intersection, confronting existential questions as it navigates a global shift to low-carbon economies. Audit assurance and data-driven governance are now essential, raising expectations for better practice industry-wide.

Nigeria's experience underscores both progress and risk for itself, and as a barometer for oil-rich nations across Africa. Ultimately, the intersection of ownership dynamics, audit standards, profitability, and capital discipline reveals a sector poised, if ready to meet public demands for responsible, science-driven climate action.

The Ownership Revolution – Who Controls Carbon Disclosure in Africa?

Global rules are remaking local realities as Nigeria's oil and gas sector navigates diverse ownership patterns that drive or discourage credible carbon emission reporting.

With over 76% diluted shareholding and 15% foreign ownership, companies face competing pressures from regulatory oversight, international investment mandates, and local governance traditions, all converging on carbon and sustainability transparency.

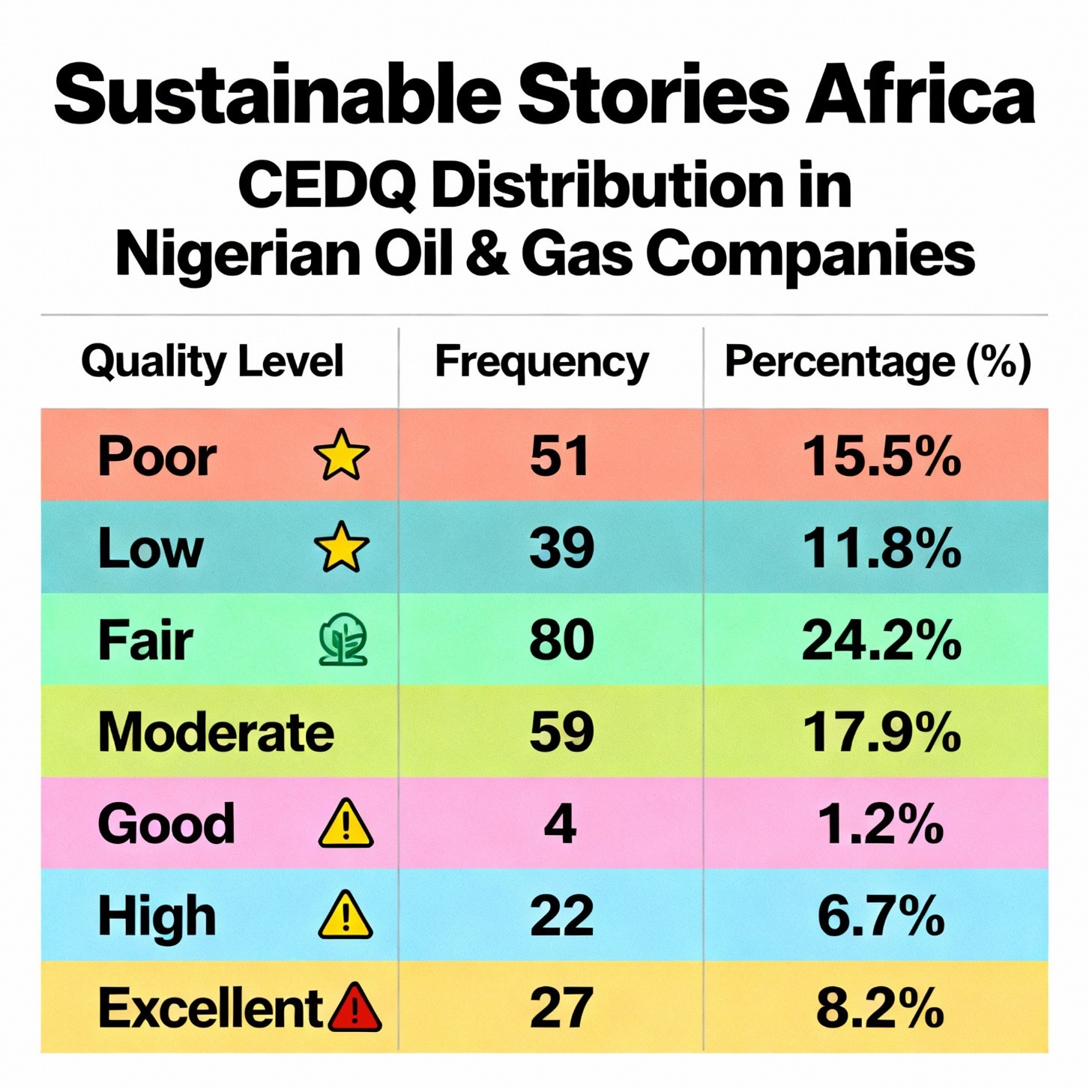

CEDQ Distribution in Nigerian Oil & Gas Companies

| Quality Level | Frequency | Percentage (%) |

|---|---|---|

| Poor | 51 | 15.5 |

| Low | 39 | 11.8 |

| Fair | 80 | 24.2 |

| Moderate | 59 | 17.9 |

| Good | 4 | 1.2 |

| High | 22 | 6.7 |

| Excellent | 27 | 8.2 |

Infographic: Carbon Emission Disclosure Quality in Nigerian Oil & Gas Companies]

Foreign Investment Drives Progress – Concentrated Ownership Fears Persist

Foreign stakeholders are spearheading climate transparency, their influence correlating with improved disclosure standards.

Yet, the research warns of risks: institutional investors and block holders tend to withhold sensitive information, compromising public trust and competitive parity. Managerial ownership shows a nuanced effect, with executive shareholding increasing disclosure at moderate levels while risk of entrenchment grows if unchecked.

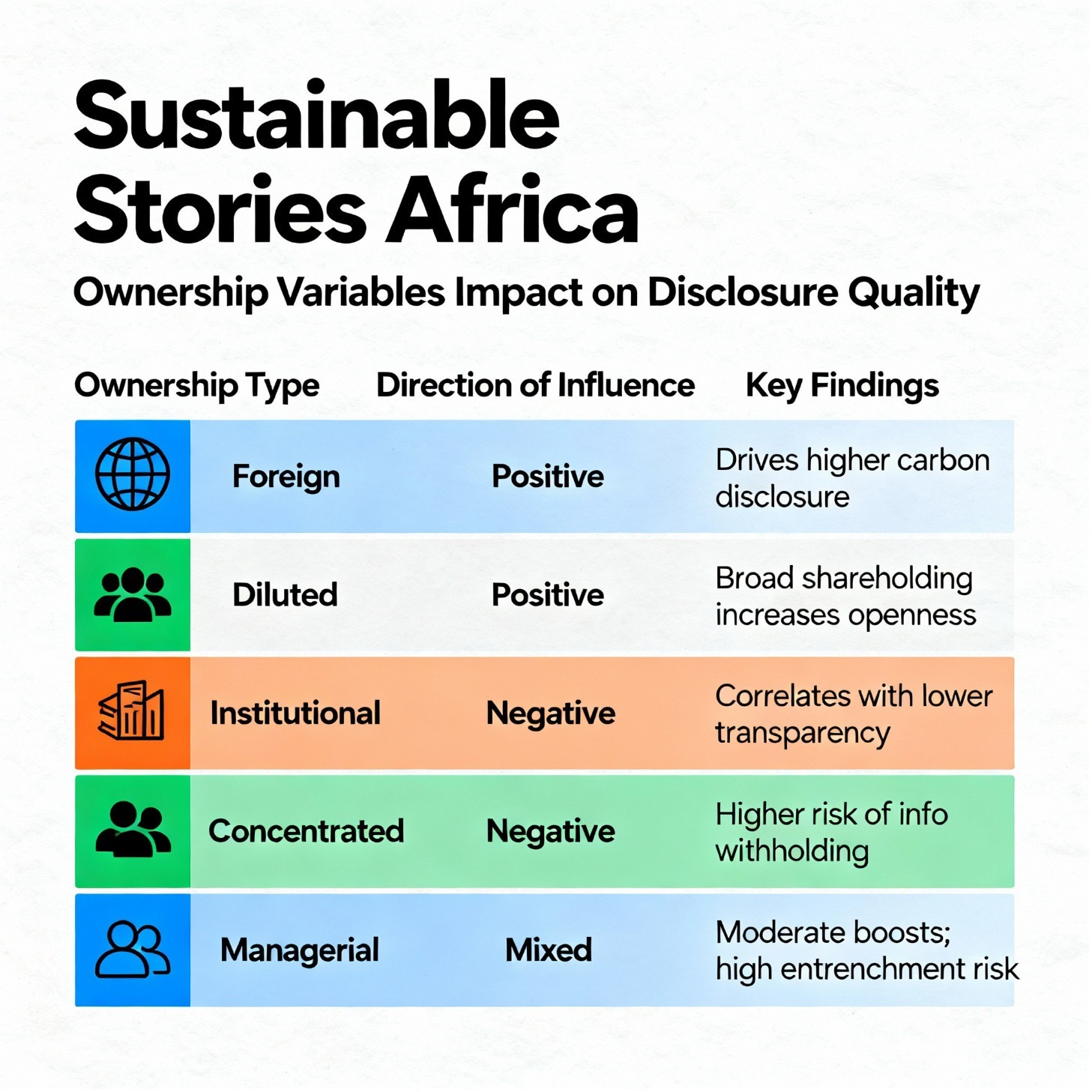

Ownership Variables Impact on Disclosure Quality

| Ownership Type | Direction of Influence | Key Findings |

|---|---|---|

| Foreign | Positive | Drives higher carbon disclosure |

| Diluted | Positive | Broad shareholding increases openness |

| Institutional | Negative | Correlates with lower transparency |

| Concentrated | Negative | Higher risk of info withholding |

| Managerial | Mixed | Moderate boosts; high entrenchment risk |

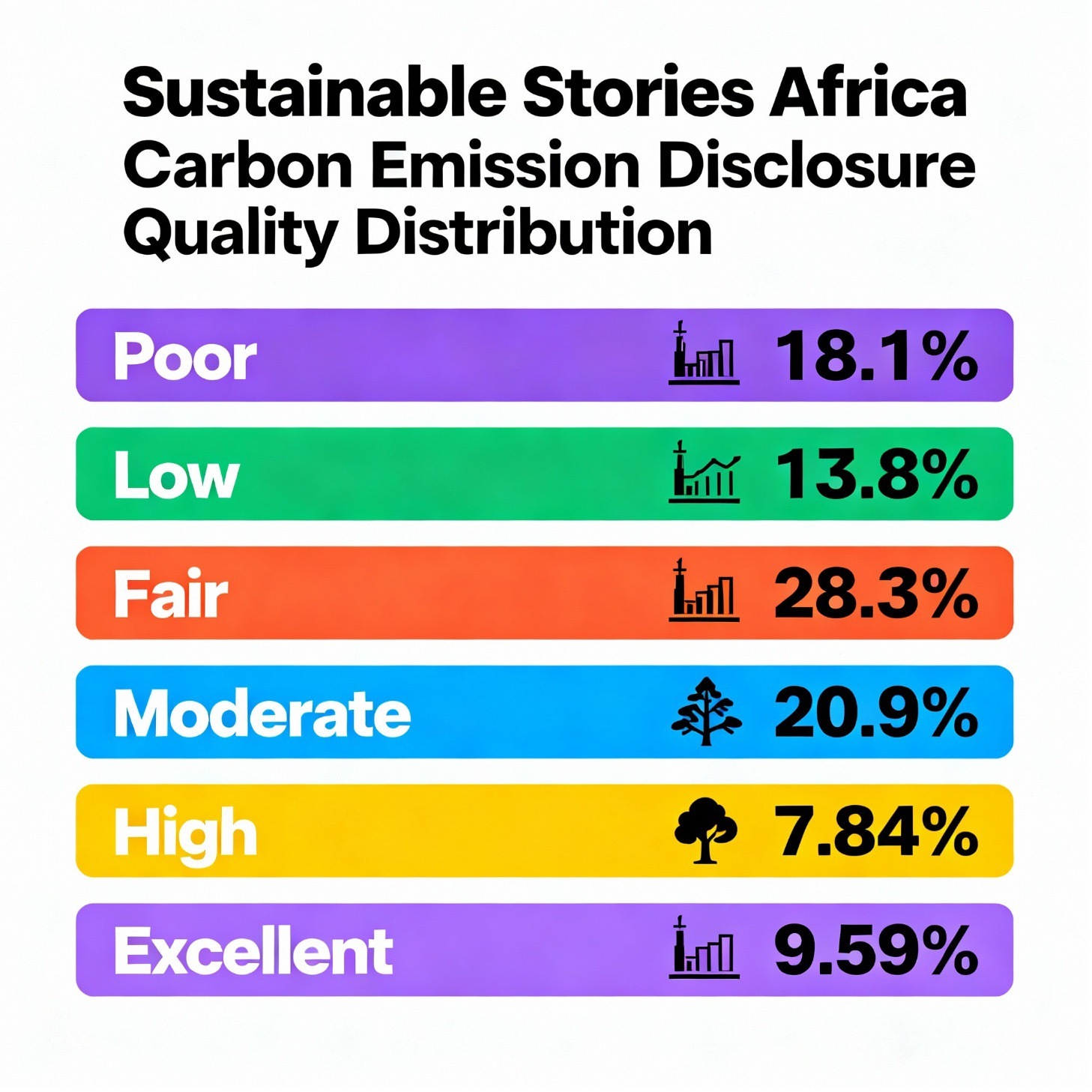

African Firms Leading Disclosure—What Can Be Achieved?

Broader ownership dispersion, audit assurance (mostly by Big 4 firms), profitability, and dynamic growth are potent drivers of credible disclosure.

With average sector ROCE at 14% and capital gearing far below global risk thresholds, Nigeria stands poised to accelerate climate leadership.

Stronger accountability mechanisms and stakeholder advocacy will enable African companies to set global benchmarks in carbon governance.

Stronger Standards, Empowered Audits, Inclusive Governance

- Regulators must incentivise boards to recognise proactive shareholders and deter dominance that weakens transparency.

- Policymakers should enforce limits on equity concentration and ensure external audit assurance on all climate disclosures.

- Companies should foster inclusive governance, champion open reporting, and integrate global standards to attract international investment and enhance climate resilience.

Path Forward – Stronger Governance, Clearer Climate Accountability

Nigeria’s oil and gas industry needs sharper carbon disclosure that is anchored by broad-based ownership, solid audit practices, and greater stakeholder involvement.

Tighter controls on concentrated shareholding, plus incentives for third-party climate audits, would strengthen transparency and lift industry standards.

African energy leaders must lead with open governance and align policies with global climate benchmarks.

Only by mainstreaming inclusion and independent oversight can the sector build investor confidence, shape sustainable futures, and uphold accountability to the next generation.