In 2024, Nigeria's Financial Reporting Council (FRC) released a strategic roadmap for adopting the IFRS Sustainability Disclosure Standards.

Introduction

Nigeria stands at the landmark of sustainability reporting, setting a bold benchmark for ESG transparency across African markets. This week, Sustainable Stories Africa, in its Opinion Editorial, looks at the phased roadmap unveiled by the Financial Reporting Council in 2024, which aligns Nigerian disclosure standards with global frameworks.

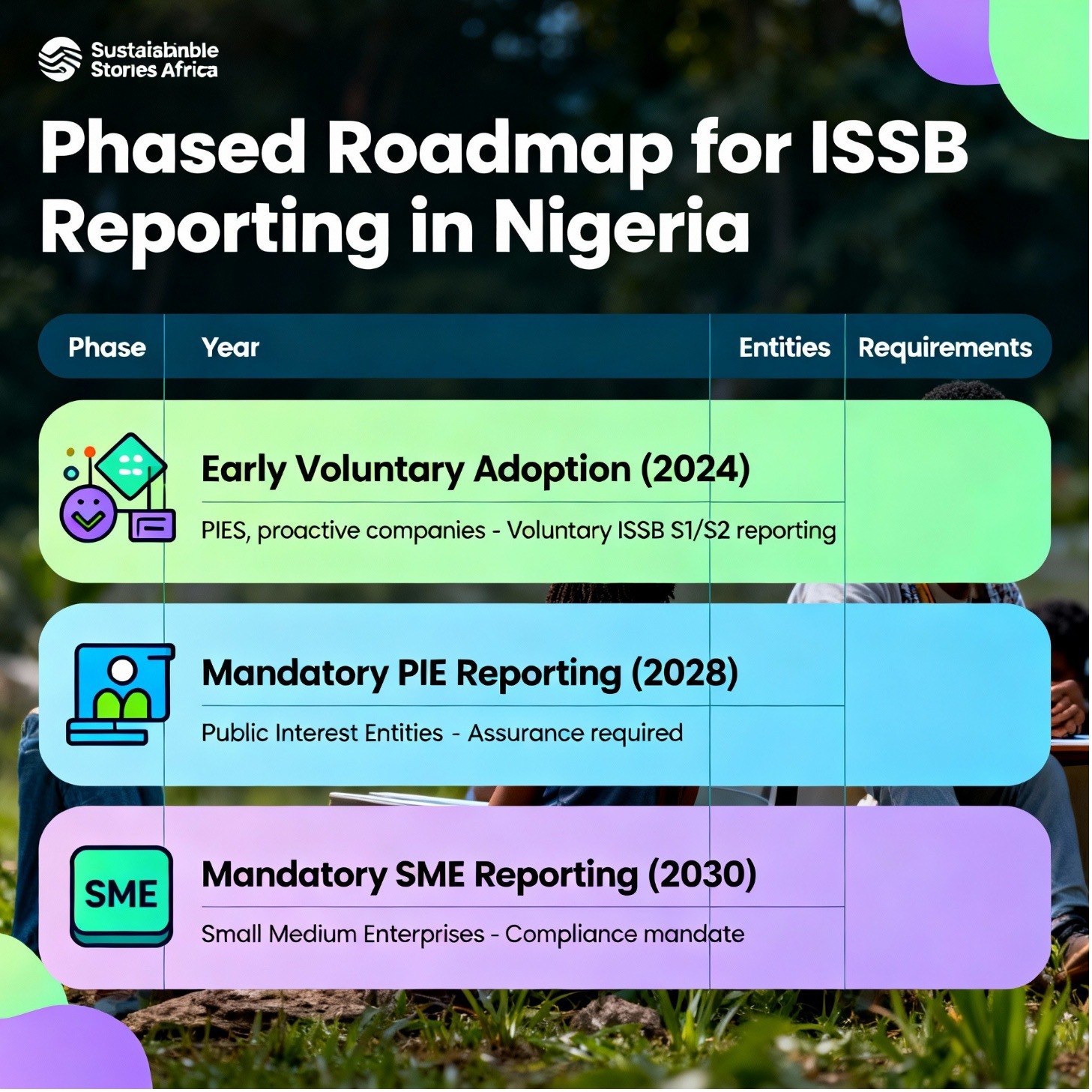

This, we believe, promises a stronger corporate accountability and sustainable growth. The initiative spells out voluntary adoption, which began in 2024, mandatory compliance for PIE by 2028, and SMEs' inclusion by 2030 and is supported by readiness assessments and capacity-building measures.

As international stakeholders watch for progress, early adopters among Nigeria's largest corporates have already begun publishing ISSB-aligned reports, thereby charting a course for others to follow.

Strategic Shift to Sustainability Disclosure Takes Centre Stage

Nigeria's 2025 roadmap formalises the phased transition to IFRS S1 (general sustainability disclosures) and S2 (climate-specific disclosures), aligning business practices with global ESG expectations.

Early voluntary adoption allows major corporates to develop systems, providing retrospective insights and capacity-building for future mandatory phases.

| Phase | Timeline | Entities | Key Steps |

| Early Voluntary Adoption | 2024 | PIEs, proactive companies | Voluntary ISSB S1/S2 reporting |

| Mandatory PIE Reporting | 2028 | Public Interest Entities | Assurance required |

| Mandatory SME Reporting | 2030 | Small Medium Enterprises | Compliance mandate |

Implementation Steps and Sector Readiness

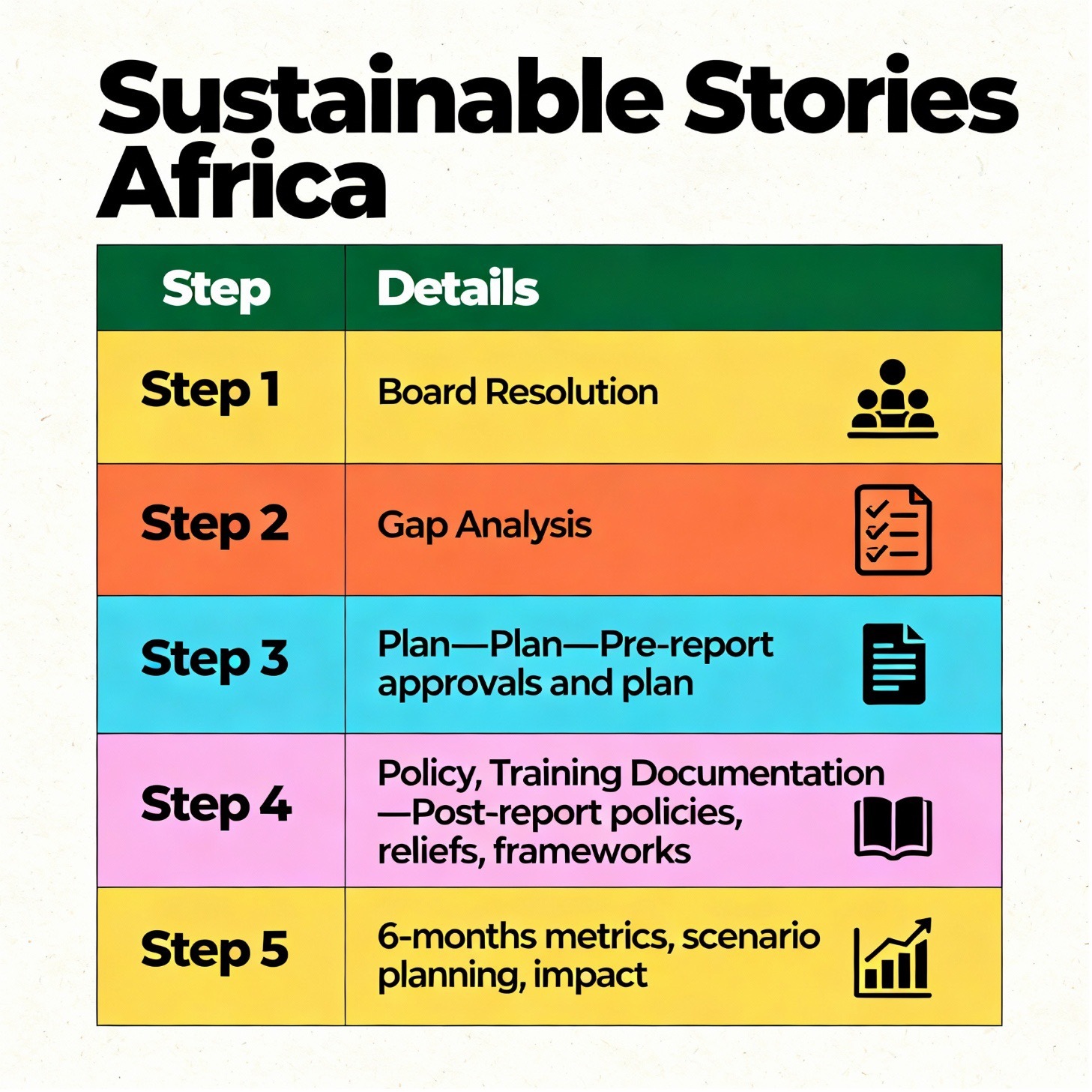

The FRC's Adoption Readiness Working Group (ARWG) guides sector rollout, emphasising gap analysis, board commitment, training, and robust documentation.

PIEs will face mandatory assurance from 2028, SMEs by 2030, with entities undergoing assessments before, during, and after reporting.

Readiness Test Steps | Reporting Phases |

Board Resolution, Gap Analysis, Plan | Pre-report approvals and plan |

Policy, Training Documentation | Post-report policies, reliefs, frameworks |

| 6-month metrics, scenario planning, impact |

Creating Market Value Through Sustainability

More stakeholders are highlighting the clear benefits of ISSB adoption, which include increased transparency, better risk management, improved investor confidence, and reputational gains.

Early compliance unlocks capital, market access, and global investor visibility, while non-compliance risks regulatory action and diminished opportunities.

Infographic: Roadmap Benefits

- Transparency: Boosts trust in ESG disclosures

- Risk Management: Strengthens company resilience

- Investor Access: Facilitates entry to international capital markets

- Reputation: Early movers gain recognition and growth

Practical Reporting Phases and Compliance Checklist

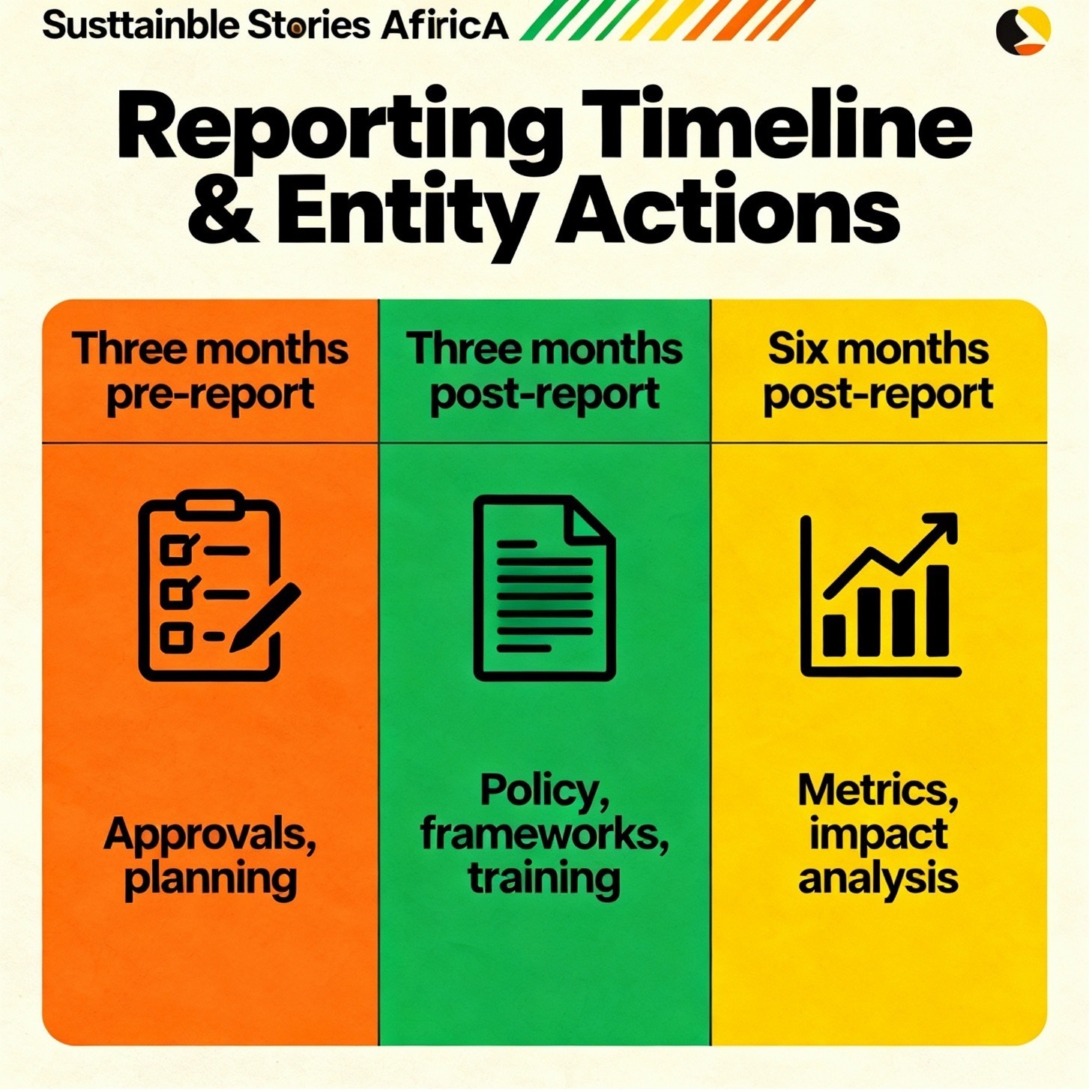

Entities must file board approvals, gap analyses, and action plans three months before disclosure.

Within three months post-reporting, policies, frameworks, and training evidence are submitted.

Six months later, metrics, scenario-planning, and business impact reporting close the assessment loop. The ARWG supports ongoing engagement and assurance.

| Reporting Timeline | Entity Action |

| Three months pre-report | Approvals, planning |

| Three months post-report | Policy, frameworks, training |

| Six months post-report | Metrics, impact analysis |

Path Forward – Nigeria Sets Regional Standard for Responsible ESG Disclosure

By delivering a structured, sector-wide approach, Nigeria is positioned to lead ESG transparency across the continent.

If rigorously followed and successfully implemented, the roadmap will foster responsible business conduct, boost investor trust, and align local practice with global benchmarks.

| Regional Impact | Market Promise | Future Prospects |

| Nationwide ESG Standard | Investor Confidence | Sustainable Finance |

| Regulatory Leadership | Market Integration | International Alignment |

Nigeria's staggered timetable toward mandatory sustainability reporting places market opportunities at the forefront of ESG transformation in Africa. The FRC's roadmap, we believe, signals both ambition and caution, enabling early voluntary adoption and tiered mandates for PIEs and SMEs.

Investors, regulators, and boards are watching as leading corporates pioneer ISSB-compliant disclosures, gaining fast-tracked access to global capital and reputational rewards.

Yet, beneath this momentum, sector readiness and boardroom assurance remain critical hurdles. Market laggards may face exclusion amid increased regulatory scrutiny, while successful entities that invest in documentation, training, and scenario planning unlock new growth pathways and investor trust.

Robust execution will determine Nigeria's standing in the rapidly shifting landscape, especially in the area of sustainable finance.

Eventually, Nigeria's journey to full IFRS-aligned sustainability reporting will shape how transparency drives market growth and resilience.

For stakeholders committed to early compliance and ongoing assessments, this roadmap offers a compelling opportunity to lead Africa's corporate transition toward responsible, opportunity-rich disclosure.