The African Private Capital Association (AVCA) is revitalising Africa's private investment environment in response to increasing political and economic uncertainty.

At the fourth Sustainable Investing in Africa Summit (SIAS) in London, AVCA convened global investors, DFIs, and entrepreneurs to mobilise sustainable finance, underscoring the region's demographic dividend, financial innovation, AI-powered development, and collaborative policy reforms.

Sustainable Stories Africa Article Framework Structure

Africa's Investment Climate Shifts – AVCA Leads Bold Summit

At the SIAS summit, AVCA CEO Abi Mustapha-Maduakor declared Africa's future as competitive and transformative.

The event spotlighted systematic cooperation, concrete action, and an urgent pivot towards sustainable capital flows, positioning Africa as key to global financial system transformation.

Global Investors Back Africa – New Returns in Sustainability

Global Limited Partners (LPs) and General Partners (GPs) in private equity management highlighted sustainability as essential for returns, reinforcing African resilience amid risk.

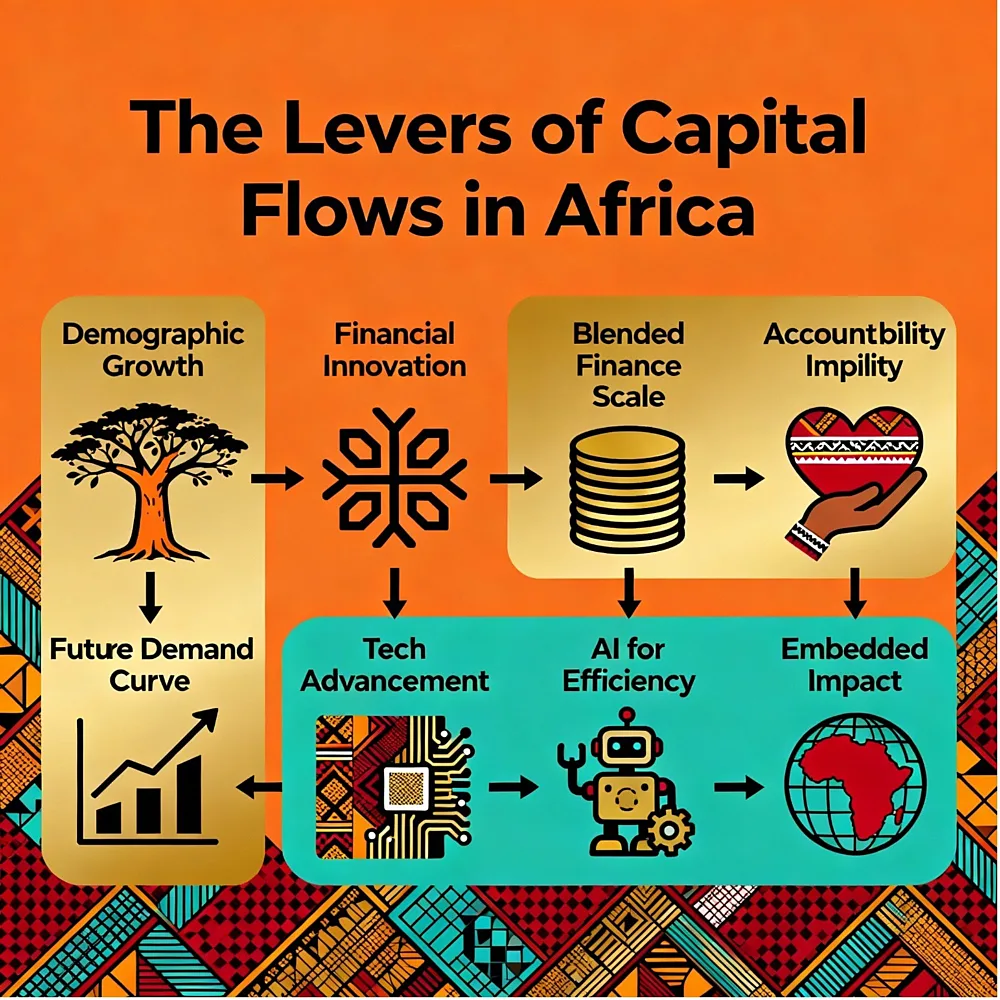

Development Finance Institutions (DFIs), LeapFrog Investments (LFIs), and the German Development Finance Institution (DEG) described how robust governance and long-term demand curves drive capital to impact-led businesses, while Africa's demographic strengths anchor the investment rationale.

Africa's Future Demand Curve Fuels Smart Economics and Innovation

LeapFrog's Karima Ola stressed Africa's population boom will shape world demand by 2050.

Mauritius's Minister advocated for shifting perceptions on risk, prioritising stability and macro resilience.

The summit's AI panel showcased how technology enables scalable opportunities, active risk mitigation, and efficiency across health and energy.

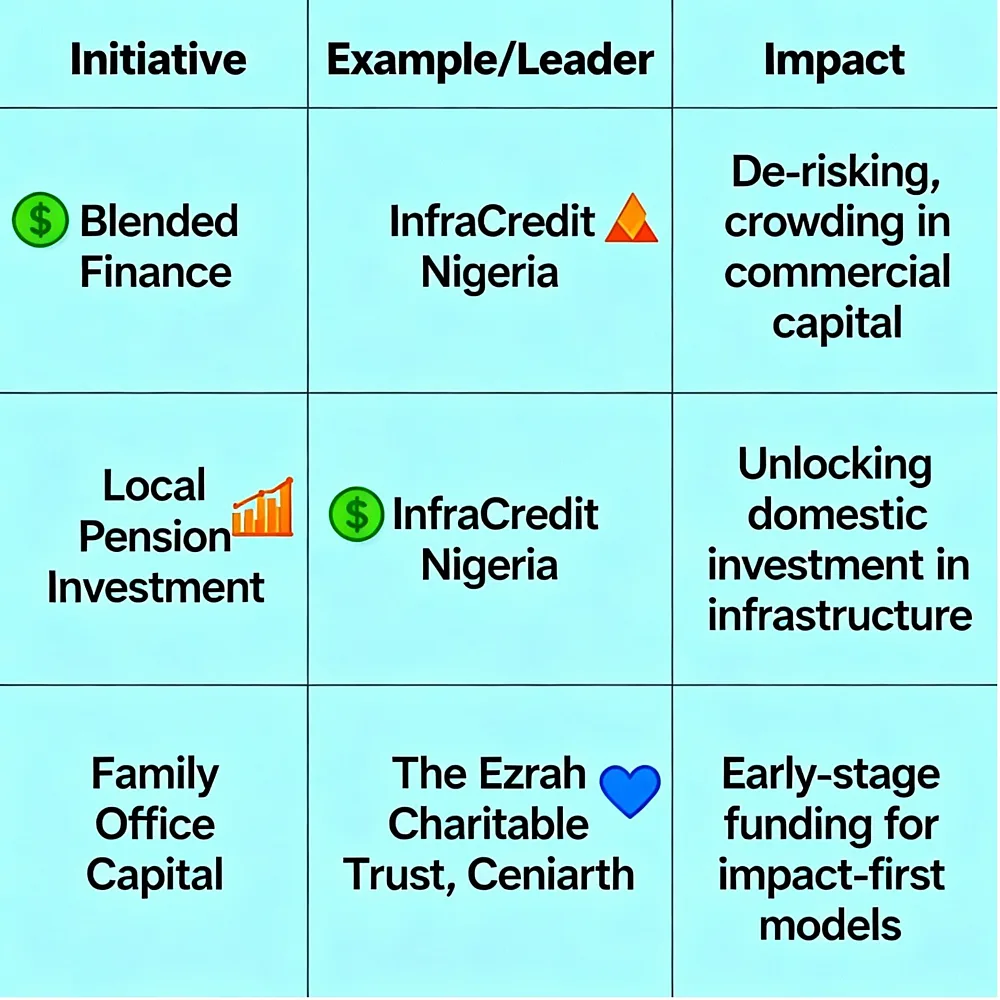

Blended Finance, Local Pension Funds, and Impact-First Ventures

AVCA and partners called for standardised investment structures, enabling environments, and stronger collaboration among regulators, investors, and civil society.

Path Forward – Accountability, Standard Models, and Tech-Driven Growth Spur Scale

Africa's journey from intent to action is visible in how fund managers embed accountability and real impact at the core of sustainability strategies. Across panel discussions, leaders amplified the role of AI-driven solutions, standard blended finance, and collaborative risk management.

These innovations support Africa's push for scale, ensuring that sustainability moves from policy pledge to practical transformation. The continent's energy is now focused on measurable change.

The Levers of Capital Flows in Africa

Culled From: https://newtelegraphng.com/stakeholders-move-to-scale-sustainable-capital-flows-in-africa/