At the Global Sukuk Summit 2025 in London, the Islamic Development Bank (IsDB) partnered with Financial Times (FT) Group to promote sustainable finance and the expansion of Islamic capital markets.

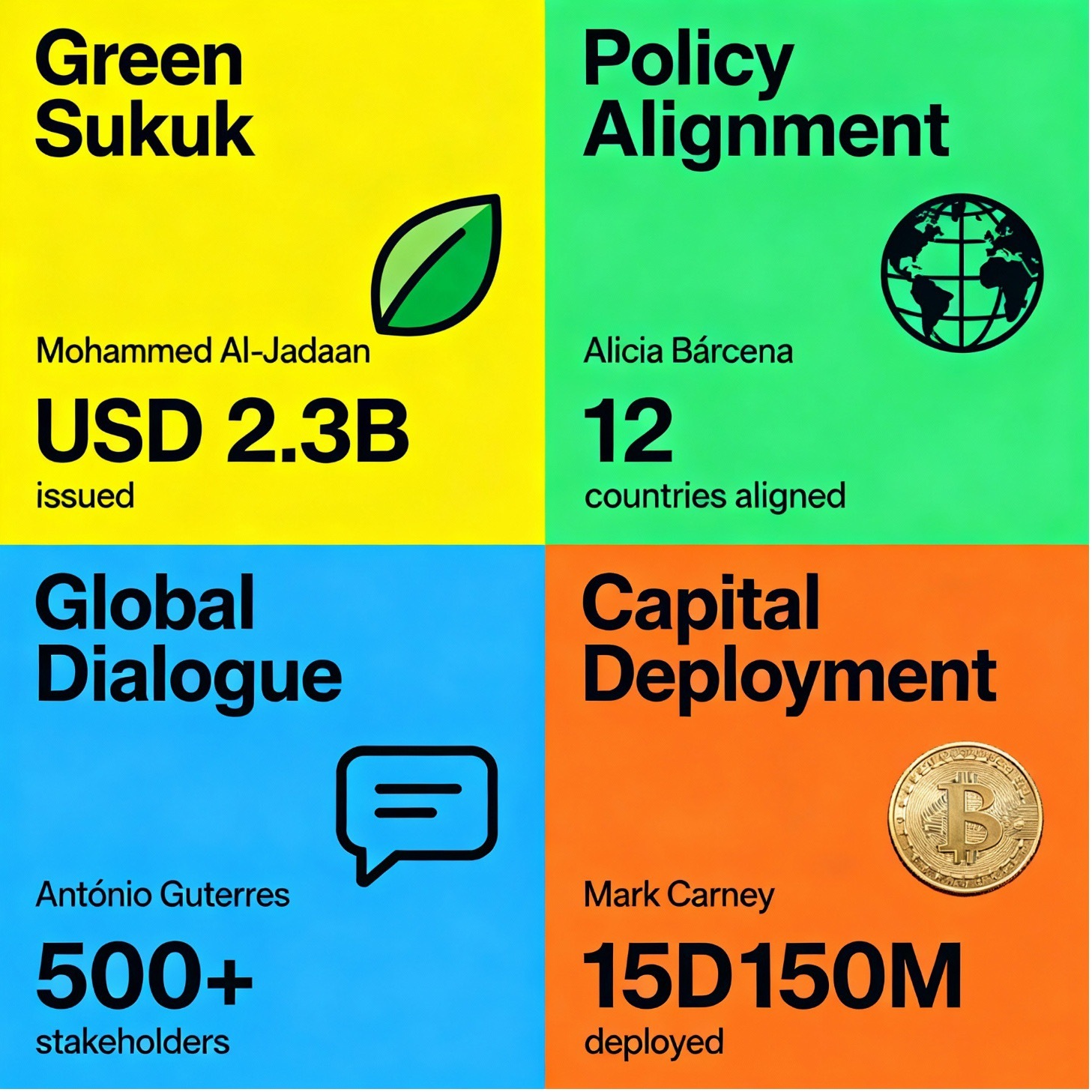

IsDB's €500 million Green Sukuk, listed at the London Stock Exchange, attracted five-times oversubscription. The summit gathered industry leaders, regulators, and investors, urging deeper cooperation and innovation to accelerate sustainable investment and leverage Sukuk for resilience in infrastructure, energy, healthcare, and food systems.

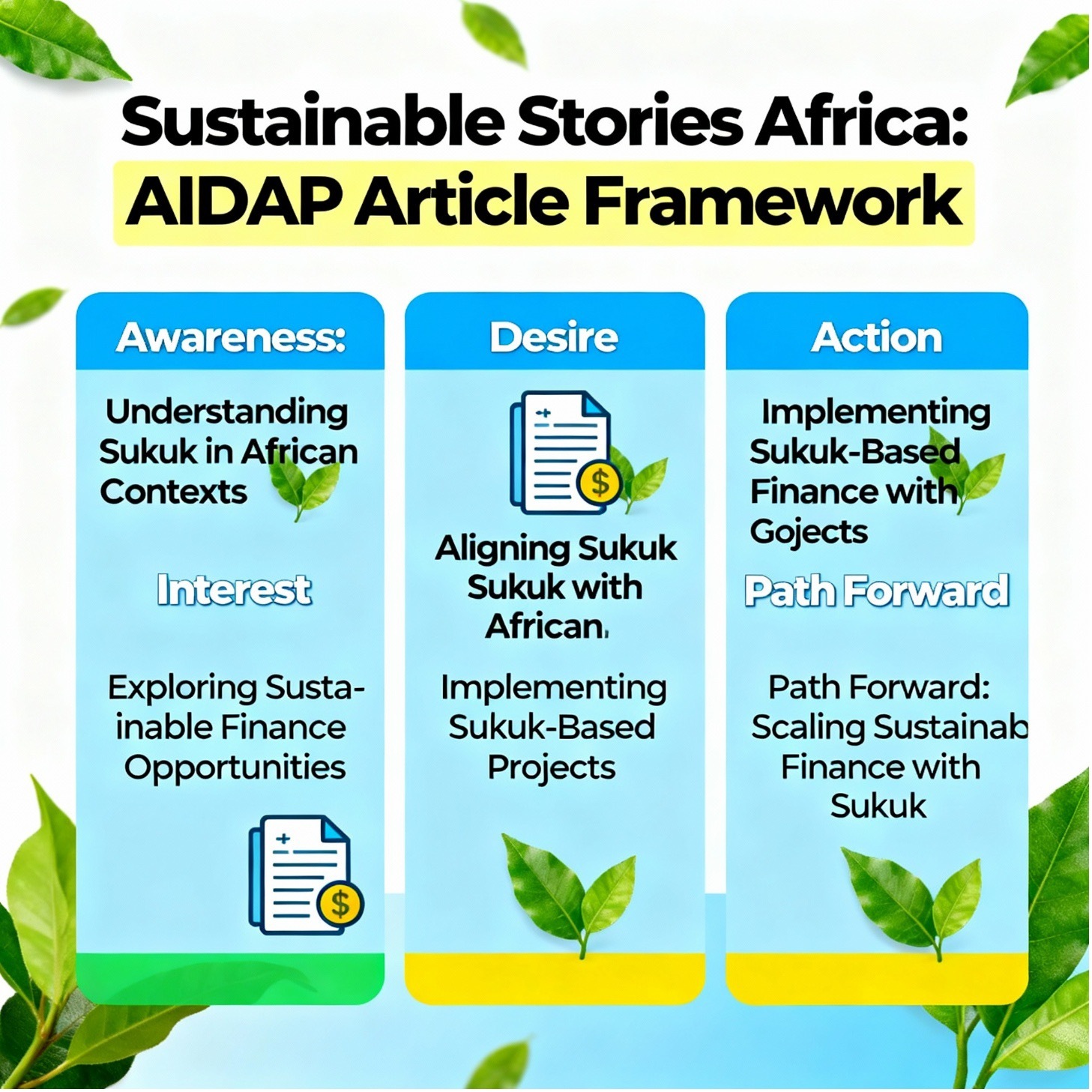

Sustainable Stories Africa AIDAP Article Framework Structure

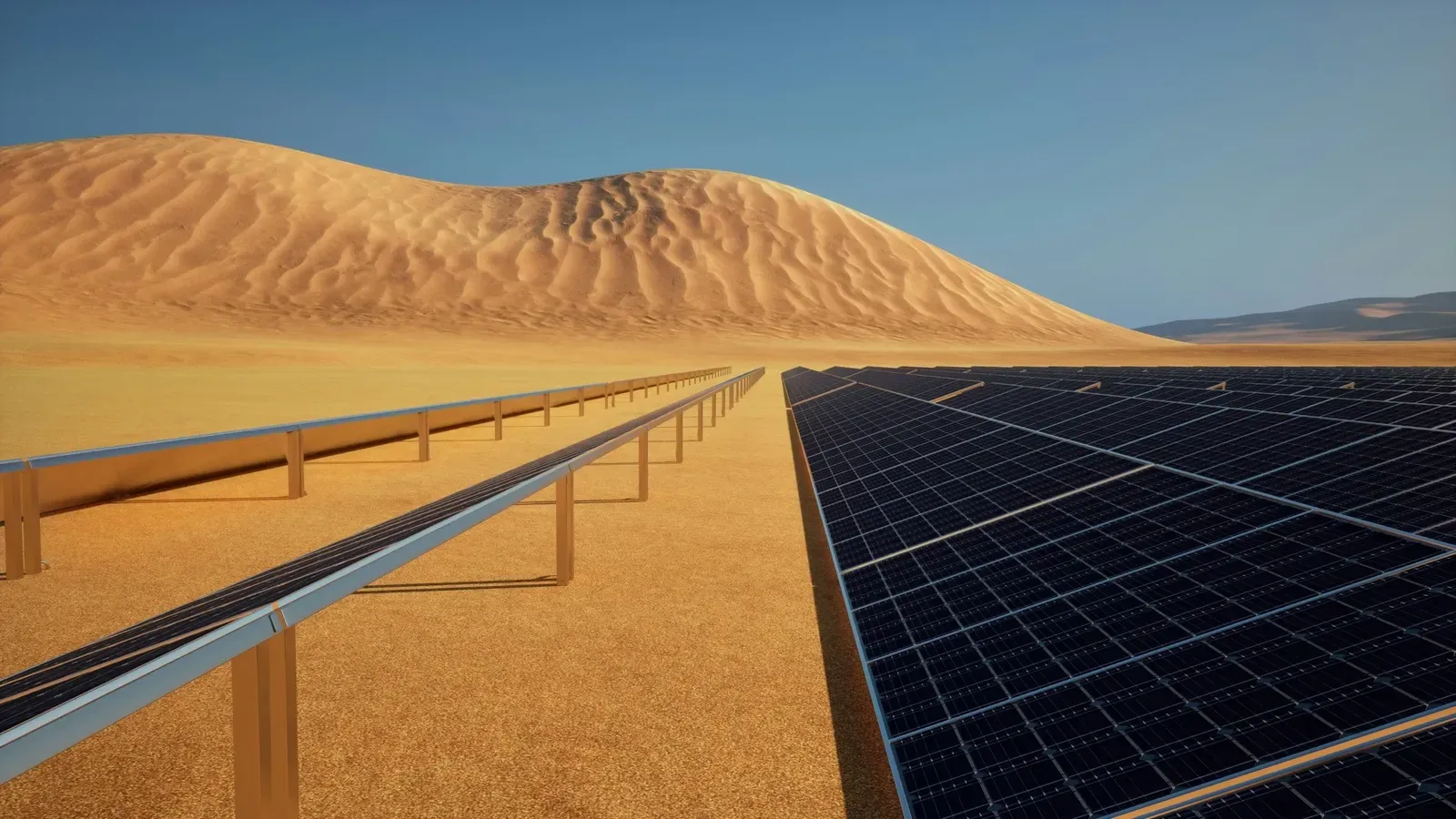

Global Sukuk Summit Sets Stage for Sustainable Finance Transformation

The Global Sukuk Summit in London saw the IsDB and FT Group convene world leaders for dialogue on expanding Islamic finance and delivering tangible, sustainable projects.

IsDB Chair Dr Muhammad Al Jasser called Sukuk "capital with purpose", channelling resources into infrastructure, renewable energy, and inclusive health and education, linking markets to real economy resilience.

Investors, Policymakers, Scholars Champion Green Sukuk and Market Expansion

Keynote discussions featured H.E. Ayman Al-Sayari, Bank of England's Victoria Saporta, and HSBC's Samir Assaf, highlighting ESG-aligned Sukuk as essential for diversifying portfolios and unlocking sustainable capital flows.

IsDB's €500 million Green Sukuk drew record investor interest, signalling global appetite for impact-driven instruments.

Islamic Finance Drives Real-World Impact Through ESG, Innovation

Leaders urged greater integration of Sukuk in financial frameworks, cross-border regulatory cooperation, and innovative issuances to support climate goals.

IsDB's commitment, US$6 billion in Green and Sustainability Sukuk, demonstrates focus on poverty reduction, renewable energy, and food system transformation across member nations.

Five-Fold Demand, New Listings, Cross-Border Collaboration Underscore Growth

The IsDB's €500 million Green Sukuk, five-times oversubscribed and listed on the London Stock Exchange, sets a new bar for global sustainable finance.

Standard-setters like the Financial Times, Institute of Chartered Management Accountants (ICMA), and Bank of England drove policy integration, while industry panels unlocked fresh innovation.

With capital partners including HSBC and the London Stock Exchange (LSE), funds now flow to renewable energy, health, and new infrastructure, thereby aligning global markets with real-world impact.

Summit panels and market-opening ceremonies emphasised the urgency for partnerships and frameworks to support multi-sector sustainable development.

Path Forward – Record Capital Mobilisation Reinforces Role of Sukuk in Sustainable Markets

IsDB, LSE, and FT leaders hailed capital mobilisation, showcasing Sukuk as a trusted, scalable tool for responsible finance. With calls for unified standards, regulatory innovation, and inclusive growth, the summit elevated Islamic capital markets as pillars for global sustainable investment.

Infographic: Green Sukuk Route to Transformative Investment