Trillions in global capital remain on the sidelines of climate finance, not due to a lack of liquidity, but rather a lack of legal clarity.

A new policy analysis argues that modernised investment law and robust green taxonomies could unlock institutional flows at scale.

For emerging markets, particularly in Africa, the shift may determine whether climate ambition becomes a bankable reality.

Trillions Await Legal Certainty

Global institutional investors collectively control tens of trillions of dollars in assets. However, climate finance flows remain far below the levels required to meet international mitigation and adaptation goals.

Due to outdated bilateral investment treaties and ambiguous definitions of sustainability, a legal risk that inflates capital costs is inherent.

Investors seek predictability, clear dispute resolution mechanisms, enforceable standards and aligned definitions of sustainable activity.

In short, unlocking climate trillions requires modern legal infrastructure.

Aligning Investment Law With Green Standards

Green taxonomies, formal classification systems that define environmentally sustainable activities, have proliferated globally.

The European Union’s taxonomy framework is among the most advanced, while other jurisdictions are developing tailored systems.

However, misalignment across jurisdictions creates complexity for cross-border capital flows.

Structural Barriers to Climate Finance

Barrier | Impact on Investors |

|---|---|

Fragmented taxonomies | Higher compliance costs |

Legal uncertainty in treaties | Elevated sovereign risk |

Inconsistent ESG disclosure standards | Reduced comparability |

Weak dispute-resolution frameworks | Capital flight risk |

The analysis highlights that integrating sustainability clauses into investment treaties could provide clarity. Modernised agreements may embed environmental obligations while safeguarding investor rights—balancing protection with accountability.

For African economies seeking climate capital, coherent domestic taxonomies aligned with global standards could enhance credibility and reduce risk premiums.

Predictable Frameworks, Scalable Capital

The benefits of reform are potentially transformative. Clear taxonomies enable investors to identify eligible projects confidently. Harmonised investment law reduces the probability of costly arbitration disputes.

Potential Impact of Legal Alignment

Dimension | Expected Outcome |

|---|---|

Capital Mobilisation | Increased institutional participation |

Cost of Capital | Reduced risk premiums |

Policy Credibility | Strengthened investor trust |

Climate Impact | Accelerated mitigation and adaptation projects |

Market Integration | Improved cross-border flows |

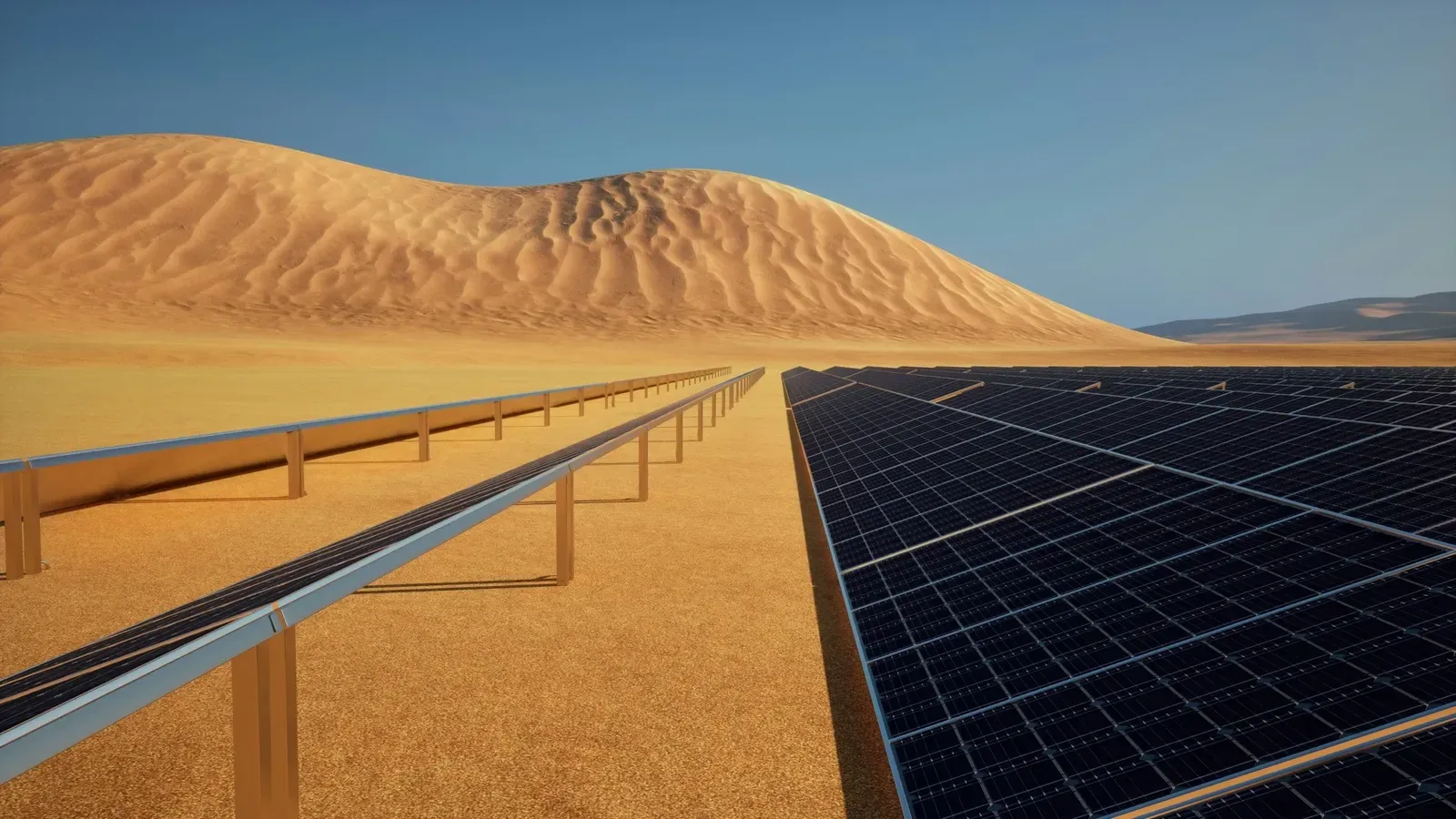

For Africa, where infrastructure deficits and climate vulnerability intersect, lower financing costs could unlock renewable energy, resilient agriculture and sustainable urban development at scale.

Moreover, embedding sustainability into legal frameworks aligns private investment with national development strategies.

Reforming Frameworks to Unlock Scale

The report calls for coordinated reforms at the multilateral and national levels. Policymakers are encouraged to update investment treaties to incorporate sustainability objectives, clarify investor protections and align domestic regulations with recognised taxonomy standards.

Regulators must also ensure transparency in ESG disclosures, enhancing comparability across markets. Without credible data and enforceable definitions, greenwashing risks undermine investor confidence.

Financial institutions, meanwhile, are urged to engage proactively in policy consultations to shape workable frameworks.

For developing markets, the opportunity lies in proactively designing taxonomy systems that reflect local realities while remaining interoperable with global capital standards.

Path Forward – Legal Reform Enables Climate Scale

Governments are increasingly reviewing investment treaties to embed sustainability clauses and align them with modern climate objectives. Harmonised green taxonomies are being developed to reduce fragmentation and investor uncertainty.

If coordinated effectively, these reforms could unlock large-scale institutional capital, lowering financing costs and accelerating climate infrastructure across emerging economies.