Nigeria's sustainability landscape is entering a decisive phase, driven by climate finance, energy reforms, and rising ESG expectations.

From corporate accountability to renewable energy expansion, new priorities are reshaping how businesses and policymakers approach environmental and social risks.

The coming years will test whether ambition translates into measurable impact for communities, investors, and the economy.

Nigeria's Sustainability Turning Point

Nigeria's sustainability agenda is shifting from rhetoric to action, with climate finance, energy transition, and corporate accountability emerging as the country's most influential priorities.

Analysts highlight three high-impact trends shaping the next phase of Nigeria's sustainability journey: growing demand for climate-aligned financing, accelerating energy-transition reforms, and stronger expectations for environmental, social, and governance (ESG) performance.

These trends reflect rising climate risks, investor scrutiny, and the need for economic resilience in Africa's largest economy.

Why Sustainability Is Now Central

Climate change is already affecting Nigeria's food systems, infrastructure, and energy security. Flooding, heat stress, and water scarcity are leading to increas ed economic losses and social vulnerability.

At the same time, Nigeria faces:

- Rising energy demand

- Limited grid capacity

- Heavy reliance on fossil fuels

- Growing urbanisation pressures

Sustainability is no longer viewed only as an environmental issue. It is now a core economic and investment concern.

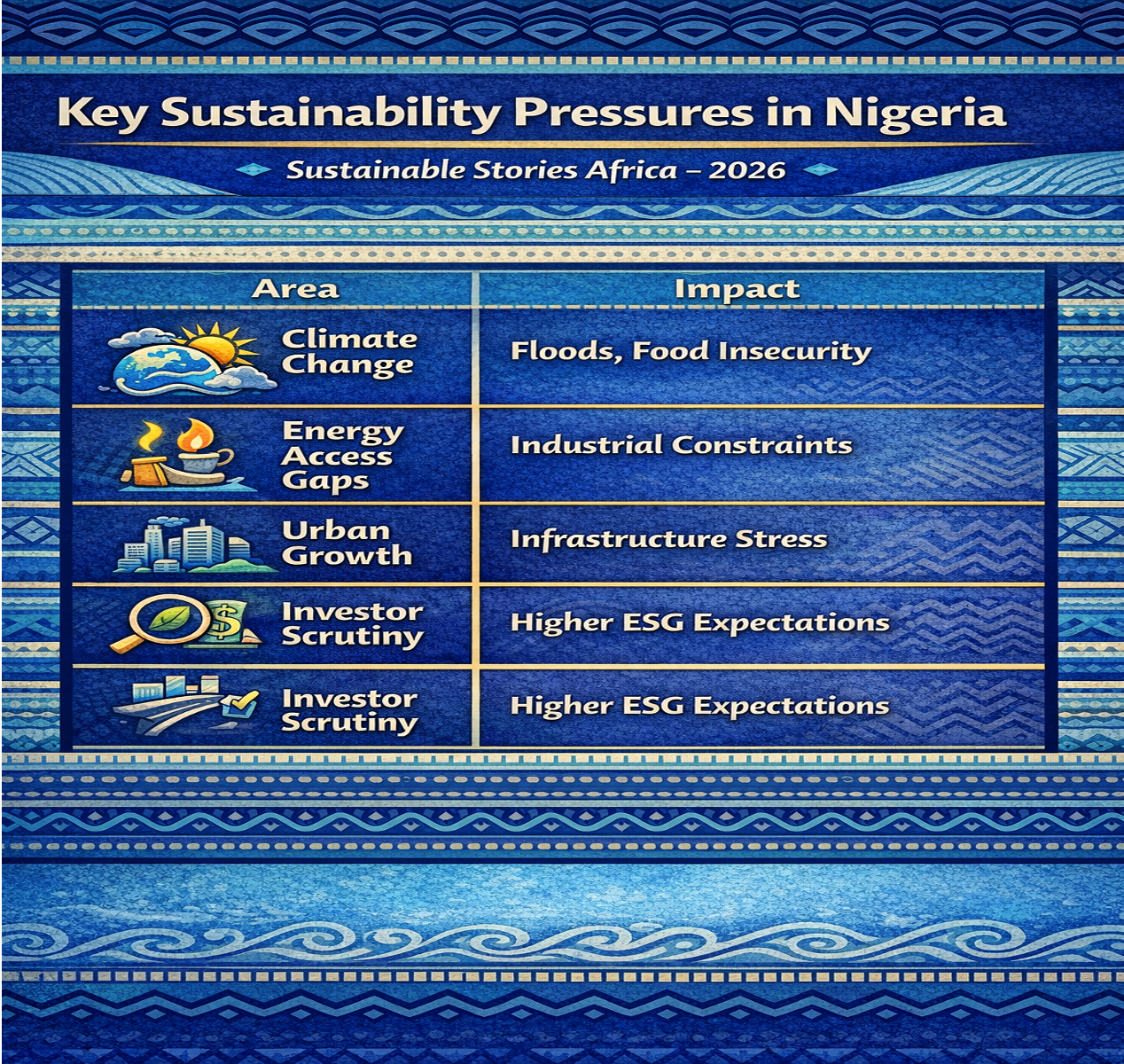

Key Sustainability Pressures in Nigeria

| Area | Impact |

|---|---|

| Climate change | Floods, food insecurity |

| Energy access gaps | Industrial constraints |

| Urban growth | Infrastructure stress |

| Investor scrutiny | Higher ESG expectations |

Investors are increasingly assessing climate and social risks when allocating capital, especially regarding emerging markets such as Nigeria.

Climate Finance Takes Priority

Access to climate finance is becoming one of Nigeria's most important sustainability tools.

Global funds, development banks, and private investors are expanding financing for:

- Renewable energy

- Climate-resilient agriculture

- Flood-control infrastructure

- Clean transportation

However, Nigeria still faces challenges in project preparation, data quality, and regulatory alignment. Many climate-focused projects struggle to reach bankability.

Stronger reporting systems, clearer climate policies, and improved governance are essential for attracting larger and more consistent funding flows.

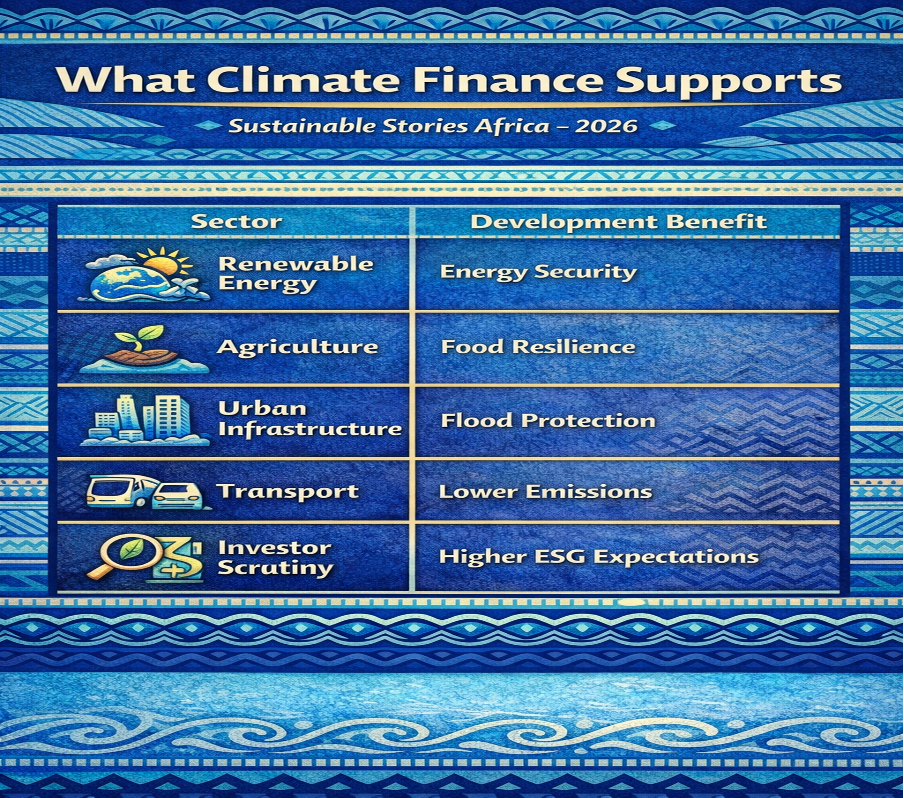

What Climate Finance Supports

| Sector | Development Benefit |

|---|---|

| Renewable energy | Energy security |

| Agriculture | Food resilience |

| Urban infrastructure | Flood protection |

| Transport | Lower emissions |

Without sustained climate investment, Nigeria risks increased economic losses from climate shocks.

Energy Transition Gains Momentum

Nigeria's energy transition is accelerating, driven by rising power demand and pressure to cut emissions.

Key trends include:

- Expansion of solar and mini-grid systems

- Increased interest in gas as a transition fuel

- Growing focus on energy efficiency

- Clean-cooking solutions for households

While fossil fuels remain dominant, renewables are gaining policy support. Off-grid energy is also helping to close access gaps in rural communities.

However, financing constraints, grid limitations, and policy uncertainty continue to slow progress.

Energy reform is now linked to sustainability goals, economic competitiveness, and climate commitments.

Corporate Accountability in Focus

Corporate sustainability expectations are rising in Nigeria.

Businesses face increasing pressure to:

- Disclose climate risks

- Improve ESG governance

- Address social impacts

- Align with global reporting standards

International investors and partners are demanding transparency, particularly in energy, finance, and manufacturing sectors.

Companies that fail to adapt risk losing access to capital, partnerships, and export markets.

Stronger ESG performance is becoming a competitive advantage rather than a compliance exercise.

PATH FORWARD – Turning Ambition into Measurable Impact

Nigeria's sustainability future will depend on how well climate finance, energy reform, and corporate accountability are integrated into national development strategies.

If policies improve, funding becomes more accessible, and businesses strengthen ESG practices, sustainability could support economic resilience, job creation, and climate adaptation.

Without coordinated action, progress may remain fragmented and uneven.

Culled From: https://www.linkedin.com/pulse/top-3-high-impact-predictions-sustainability-nigeria-abimbola-dba-gf29c/