Africa’s next economic transformation will not be driven entirely by aid or external financing, but by integration, digital innovation and new financing architectures such as tokenisation.

These tools are emerging as critical infrastructure for unlocking investment, scaling enterprises and accelerating structural change.

However, success depends on sequencing reforms, strengthening governance and aligning technology with local realities. Africa’s ability to mobilise capital, build trust and integrate markets will ultimately determine whether this transformation delivers shared prosperity or deepens structural fragmentation.

Integration and technology redefine Africa’s prosperity

Africa stands at a defining crossroad of structural change. As global aid declines, rising borrowing costs, and geopolitical competition intensify, the continent must increasingly rely on integration, innovation and domestic capacity to finance its future development.

The African Continental Free Trade Area (AfCFTA), digital transformation and emerging financial technologies now offer powerful tools to accelerate structural change, unlock investment and create jobs at scale.

These tools can transform fragmented national markets into a unified economic ecosystem capable of competing in a global market.

However, technology alone is not enough. Africa’s success will depend on sequencing reforms, strengthening institutions and aligning global innovation with local economic realities, ensuring integration translates into shared prosperity rather than uneven growth.

Integration creates Africa’s historic transformation opportunity

Africa’s integration agenda represents one of the most consequential economic shifts in the continent’s modern history.

For decades, fragmented markets, limited scale, constrained investment and weakened industrial competitiveness have plagued.

Individual national economies were often too small to attract large-scale industrial investment or compete effectively in global markets.

The African Continental Free Trade Area now fundamentally changed that equation.

By creating a unified continental market, integration enables:

- Larger consumer markets

- Economies of scale for firms

- Stronger investment attractiveness

- More efficient cross-border production

Integration is not simply a trade initiative—it is an industrialisation strategy.

According to the Foresight Africa 2026 report, pages 106 - 206, regional integration is one of Africa’s most powerful levers for accelerating job creation, structural transformation and economic resilience.

This transformation is essential because Africa must dramatically increase investment to sustain development and absorb its rapidly expanding workforce.

Without integration, Africa risks remaining a fragmented collection of small economies.

With integration, it becomes one of the world’s largest unified markets.

Technology enables Africa’s integration and scaling breakthrough

Technology is emerging as the critical enabler of Africa’s integration and economic scaling.

Digital platforms reduce transaction costs, facilitate cross-border trade and enable businesses to access larger markets more efficiently.

Financial technologies are particularly transformative, improving access to capital for small and medium-sized enterprises, the backbone of Africa’s economy.

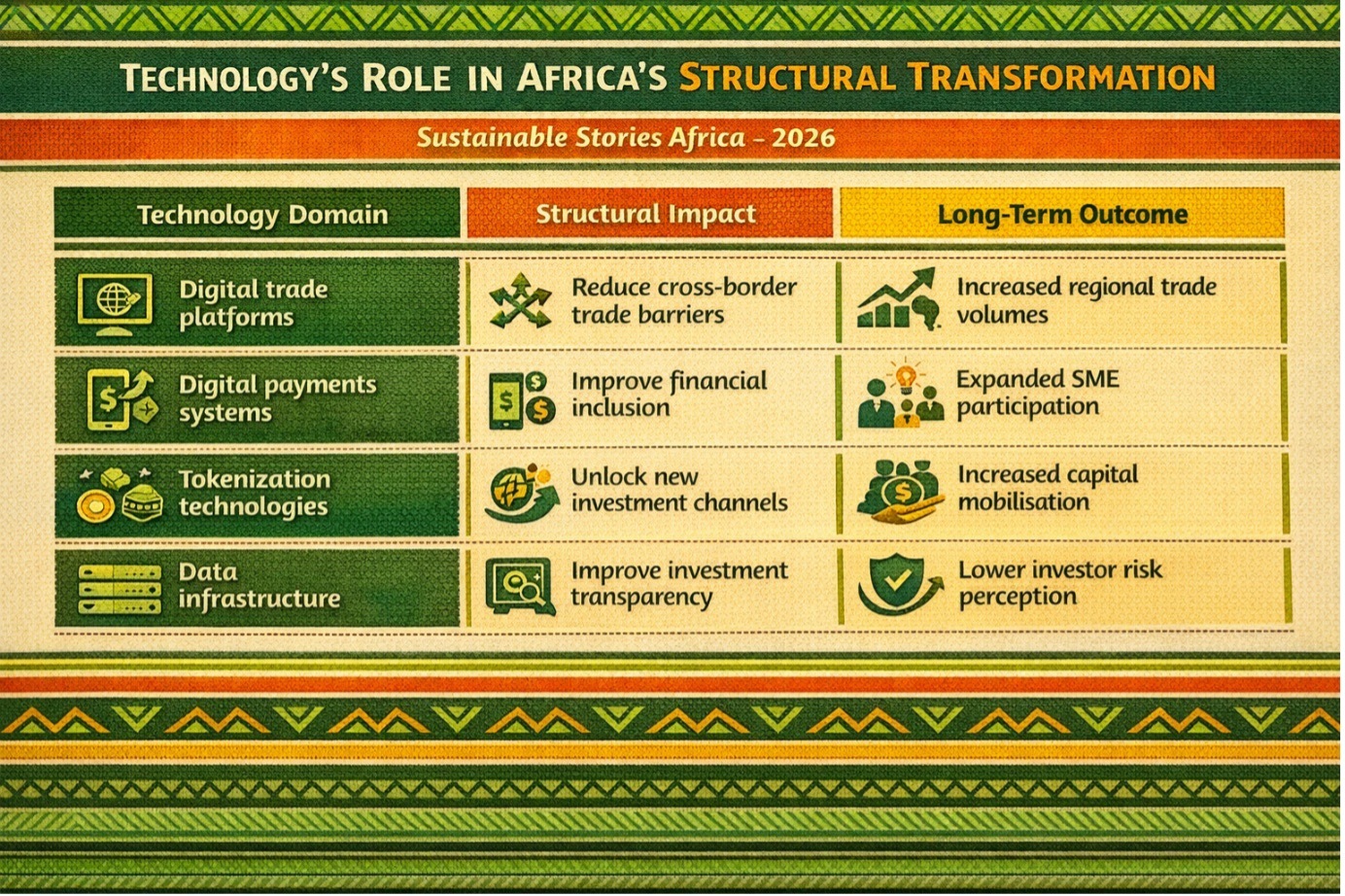

Technology’s Role in Africa’s Structural Transformation

Technology Domain | Structural Impact | Long-Term Outcome |

|---|---|---|

Digital trade platforms | Reduce cross-border trade barriers | Increased regional trade volumes |

Digital payments systems | Improve financial inclusion | Expanded SME participation |

Tokenization technologies | Unlock new investment channels | Increased capital mobilisation |

Data infrastructure | Improve investment transparency | Lower investor risk perception |

Tokenisation, the digital representation of assets on blockchain infrastructure, offers particularly transformative potential.

It enables previously illiquid assets, such as infrastructure, real estate or SME financing, to become investable at a larger scale.

This can unlock new capital pools, including:

- Institutional investors

- Diaspora investors

- Retail investors

- Global sustainable finance markets

Tokenisation enables capital to flow where traditional financial systems could not reach efficiently.

Tokenisation unlocks Africa’s investment and financing future

Africa faces one of the world’s largest development financing challenges, but also one of the greatest opportunities.

Traditional financing channels remain insufficient to meet the needs of infrastructure, industrial and social investments.

Tokenisation offers a powerful alternative by enabling fractional ownership, improving liquidity and lowering investment barriers.

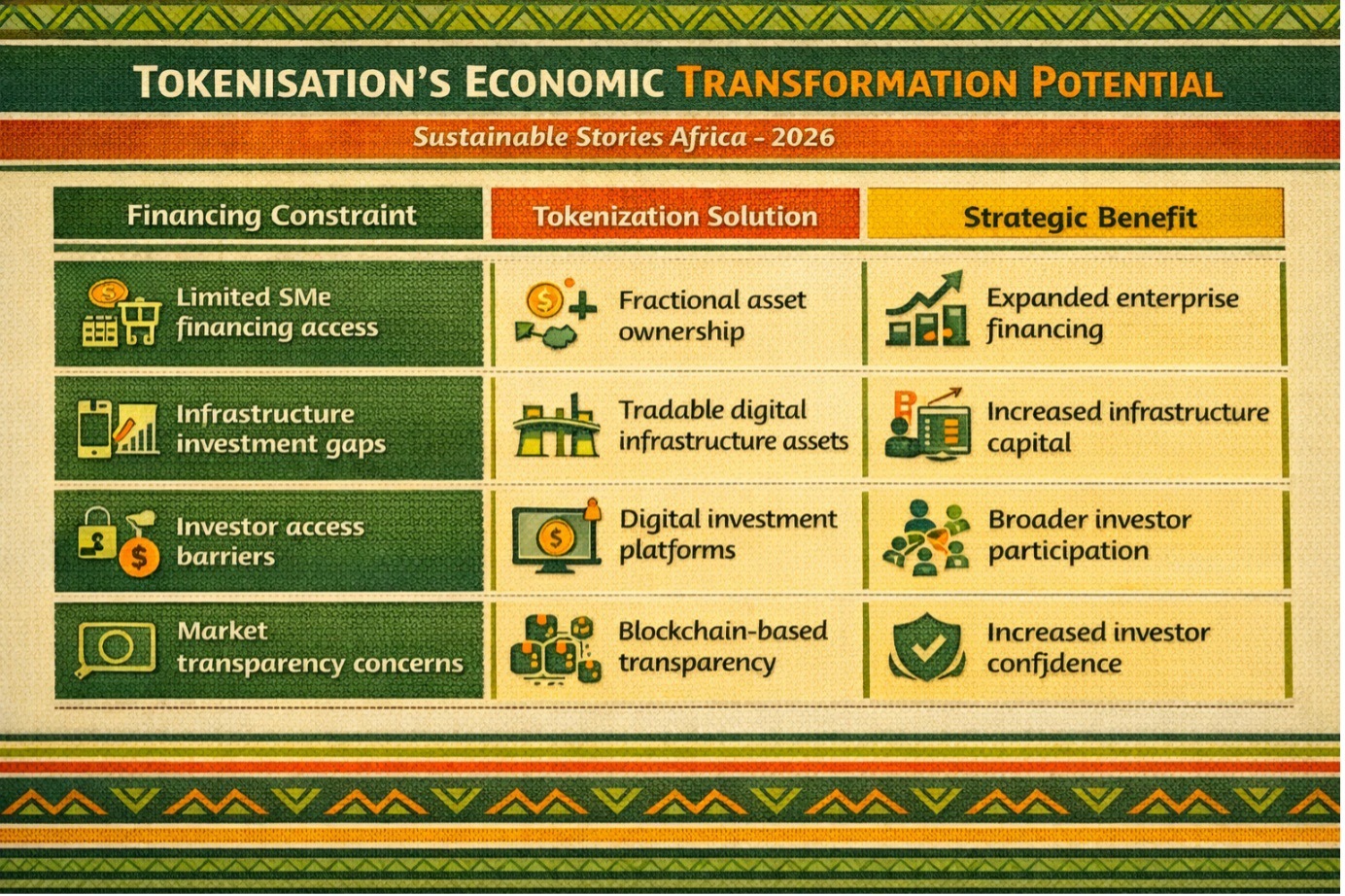

Tokenisation’s Economic Transformation Potential

Financing Constraint | Tokenization Solution | Strategic Benefit |

|---|---|---|

Limited SME financing access | Fractional asset ownership | Expanded enterprise financing |

Infrastructure investment gaps | Tradable digital infrastructure assets | Increased infrastructure capital |

Investor access barriers | Digital investment platforms | Broader investor participation |

Market transparency concerns | Blockchain-based transparency | Increased investor confidence |

This transformation is particularly important for Africa’s SME sector.

SMEs account for most of the employment but face severe financing constraints.

Tokenisation enables new financing models that expand access, reduce costs and improve investment efficiency.

This creates powerful new pathways for inclusive economic growth.

Sequencing reforms ensures Africa maximises integration benefits

Despite its promise, integration and technological transformation must be carefully sequenced.

Premature or poorly sequenced adoption could create instability, inefficiencies or unequal outcomes.

Policy priorities include:

- Strengthening regulatory frameworks

- Improving institutional capacity

- Investing in digital infrastructure

- Ensuring governance transparency

Technology adoption must align with economic readiness, institutional strength and development priorities.

Governments must also ensure innovation supports real economic transformation—not speculative financial activity.

Sequencing reforms ensures sustainable, stable and inclusive transformation.

Integration and technology must reinforce, rather than replace, structural economic foundations.

PATH FORWARD – Africa must sequence integration and innovation strategically

Africa’s development future depends on aligning integration, digital transformation and financing innovation within coordinated national and continental strategies.

Governments must strengthen regulatory frameworks, invest in digital infrastructure and enable tokenisation platforms that expand access to capital and scale enterprise growth.

However, with careful sequencing of reforms and aligning technology with economic priorities, Africa can unlock investment, accelerate structural transformation and position itself as a globally competitive, resilient and prosperous economic powerhouse.

Strategic Editorial Analysis (SSA Perspective) - Integration and tokenisation redefine Africa’s economic future

Africa’s development trajectory is entering a decisive new phase.

Integration, digital innovation and tokenisation offer powerful tools to unlock investment, scale industries, and accelerate structural transformation.

However, success is not guaranteed.

It will depend on governance, sequencing and strategic alignment.

Africa’s greatest opportunity is no longer external aid; it is internal integration, innovation and institutional strength.

The continent’s ability to harness these forces will determine whether its transformation delivers shared prosperity or missed potential.