ESG in Africa is no longer a voluntary add-on; it now significantly represents the currency enabling capital access, regulatory approval, and market relevance.

A strategic brief argues that African firms that fail to integrate ESG into core business strategy risk higher financing costs, shrinking market access, and weakened stakeholder trust by 2025.

ESG Integration: Africa’s 2025 Business Reckoning

Africa’s boardrooms are facing a stark reality: ESG is no longer a compliance exercise. It is a capital imperative.

From Johannesburg to Nairobi and Accra, the convergence of investor scrutiny, stock exchange listing rules, development finance conditions, and climate risk pressures is reshaping how companies operate and compete. As outlined in ESG Integration: Africa’s Business Imperative for 2025, ESG performance is now directly linked to the cost of capital, license to operate, and long-term resilience.

The shift is structural and is accelerating.

Capital Is Now Conditional

The most immediate signal comes from capital markets.

African stock exchanges, including the JSE, NSE, and GSE, are embedding ESG disclosure into listing requirements.

Development finance institutions are increasingly setting ESG benchmarks as de facto conditions for financing. Climate risk integration is increasingly becoming central to lending decisions.

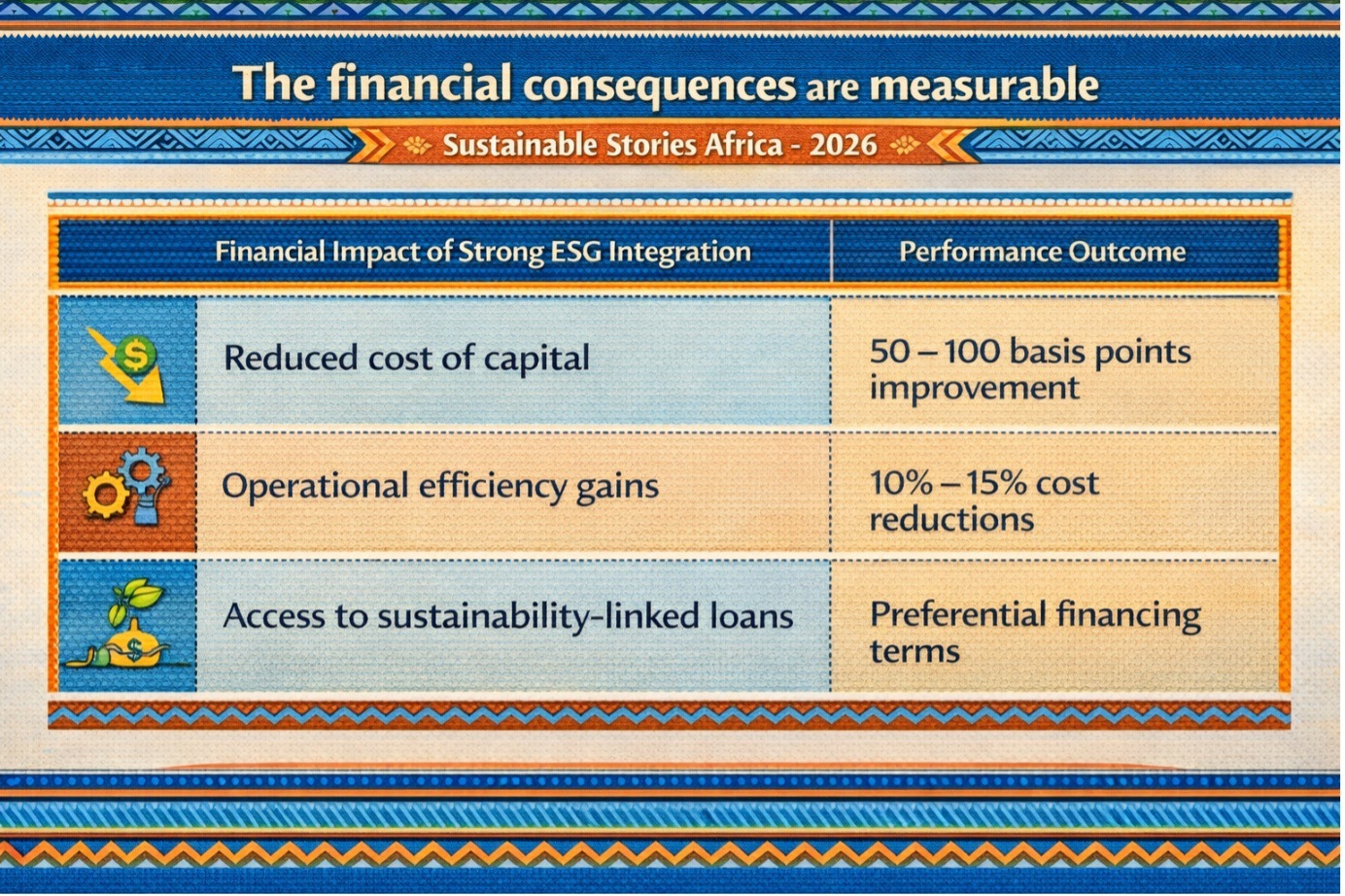

The financial consequences are measurable:

Financial Impact of Strong ESG Integration | Performance Outcome |

|---|---|

Reduced cost of capital | 50 – 100 basis points improvement |

Operational efficiency gains | 10% – 15% cost reductions |

Access to sustainability-linked loans | Preferential financing terms |

In short, capital is now conditional. Organisations that demonstrate credible ESG integration secure preferential financing and expanded access to funding. Those that lag face rising borrowing costs and restricted market entry.

Sectoral Transformation Is Underway

The transformation is sector-specific and visible.

- Financial Services – Standard Bank has mobilised over $4 billion in green financing initiatives. Ecobank launched a $750 million sustainable finance programme across 33 countries. These institutions are embedding climate risk assessment into lending models. ESG is no longer about philanthropy. It is embedded in credit scoring.

- Mining – Mining firms are redefining social license. AngloGold Ashanti has strengthened community engagement while reducing environmental incidents. Renewable integration, water stewardship, biodiversity protection, and local development frameworks are now strategic priorities. The reward? Improved access to capital, fewer operational disruptions, and stronger government partnerships.

- Energy & Oil – KenGen has built over 700MW of geothermal capacity. NNPC reduced gas flaring by over 70%. Eskom’s $8.5 billion just energy transition programme signals systemic restructuring. Energy transition is no longer a Western narrative. It is a financing strategy.

- State-Owned Enterprises – SOEs face a dual mandate: public accountability and commercial performance. Ethiopian Airlines’ fuel efficiency programme and Morocco’s OCP sustainability transformation demonstrate how governance, reporting, and transparency enhance public trust and access to international financing.

ESG as Competitive Advantage

The real story is not avoiding risk. It is value creation.

Organisations integrating ESG comprehensively are achieving:

- Stronger stakeholder relationships

- Reduced disruptions

- Enhanced resilience to climate shocks

- Greater access to international partnerships

- Improved brand equity and talent attraction

The report emphasises that ESG must be strategically integrated, not treated as standalone CSR.

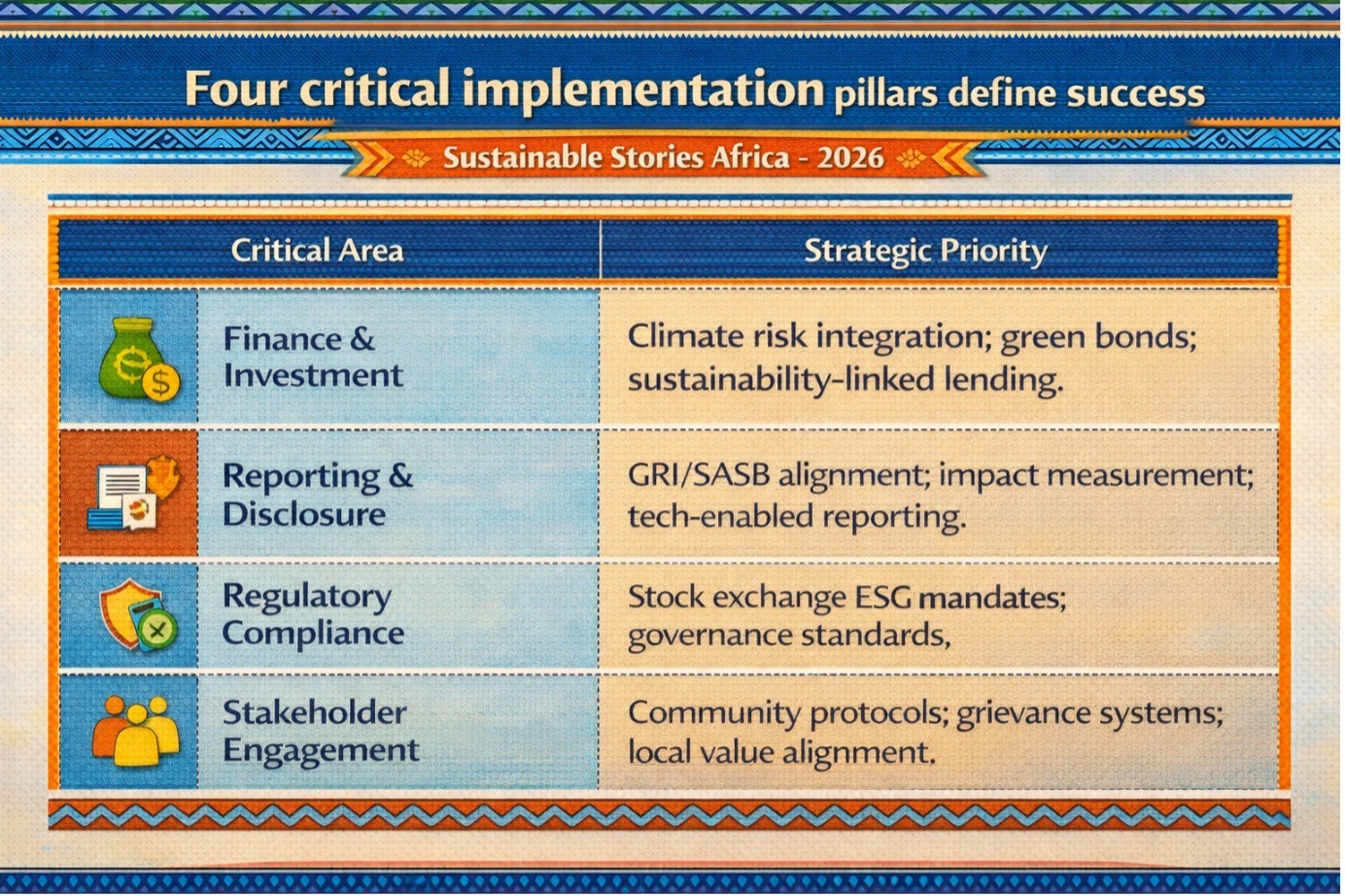

Four critical implementation pillars define success.

Critical Area | Strategic Priority |

|---|---|

Finance & Investment | Climate risk integration; green bonds; sustainability-linked lending. |

Reporting & Disclosure | GRI/SASB alignment; impact measurement; tech-enabled reporting. |

Regulatory Compliance | Stock exchange ESG mandates; governance standards. |

Stakeholder Engagement | Community protocols; grievance systems; local value alignment. |

Capacity building underpins all four. Boards must strengthen ESG oversight. Executives must integrate ESG into strategy. Technical teams require expertise in data and reporting.

The evidence is compelling: ESG capability is becoming a core organisational competency.

The Window for Passive Compliance Has Closed

The conclusion is unambiguous.

Organisations that lead in ESG integration secure tangible financial returns. Those who delay face a mounting risk of higher financing costs, regulatory friction, reputational damage, and loss of social license.

This is not a future risk. It is a present market condition.

Boards must elevate ESG oversight to a strategic function. CFOs must embed climate risk into financial modelling.

CEOs must align ESG performance with growth strategy. Regulators must strengthen disclosure frameworks without undermining competitiveness.

Africa’s development trajectory increasingly intersects with global sustainability expectations. ESG excellence is not a result of external pressure; it is a result of internal competitiveness.

The question is no longer whether to integrate ESG; it is whether organisations can afford not to.

Path Forward – Align Capital, Governance, Capability

African organisations are being called to integrate ESG into core strategy, not peripheral reporting. Priorities include integrating climate risk management with finance decision-making, standardised locally relevant reporting systems, building stronger board oversight, and structured stakeholder engagement.

The objective is clear: build resilient, investable, future-ready enterprises. ESG is positioned as both an access-to-capital strategy and a catalyst for national development.