Ghana’s green industrial ambitions are clear. Private capital, however, remains cautious.

A policy brief by the Africa-China Centre for Policy and Advisory (ACCPA) argues that without urgent de-risking, blended finance, and regulatory clarity, Ghana risks missing a critical window to scale sustainable industry and unlock green jobs.

Ghana’s Green Industry Capital Gap

Ghana has laid out one of West Africa’s most ambitious frameworks for green industrialisation.

However, private sector participation remains constrained by high-risk perceptions, limited technical capacity, and regulatory uncertainty, according to the August 2025 ACCPA policy brief in the Sino-Africa Green Finance Alliance (SAGFA) series.

The report positions private capital as the decisive lever for translating policy ambition into industrial transformation.

Without stronger domestic lending, de-risking mechanisms, and clearer incentives, Ghana’s low-carbon transition may remain policy-driven rather than market-led.

Ambition Meets Capital Constraints

Green industrialisation, as defined in the brief, involves decarbonising manufacturing, promoting circular economy models, and scaling renewable energy and clean technologies in industry.

Ghana’s commitment is substantial:

Policy Instrument | Key Targets |

|---|---|

Updated NDCs | Up to 45% emissions reduction by 2030 (15% unconditional, 30% conditional); over 1 million green jobs; resilience for nearly 38 million people |

Green Finance Taxonomy (2024) | Framework to classify sustainable economic activities and reduce greenwashing |

Energy Transition Plan | Net-zero by 2060; renewable-powered industrial parks |

Industrial Policy & NCCP | Integration of ESG standards and climate mainstreaming |

Despite this architecture, financing flows tell a different story.

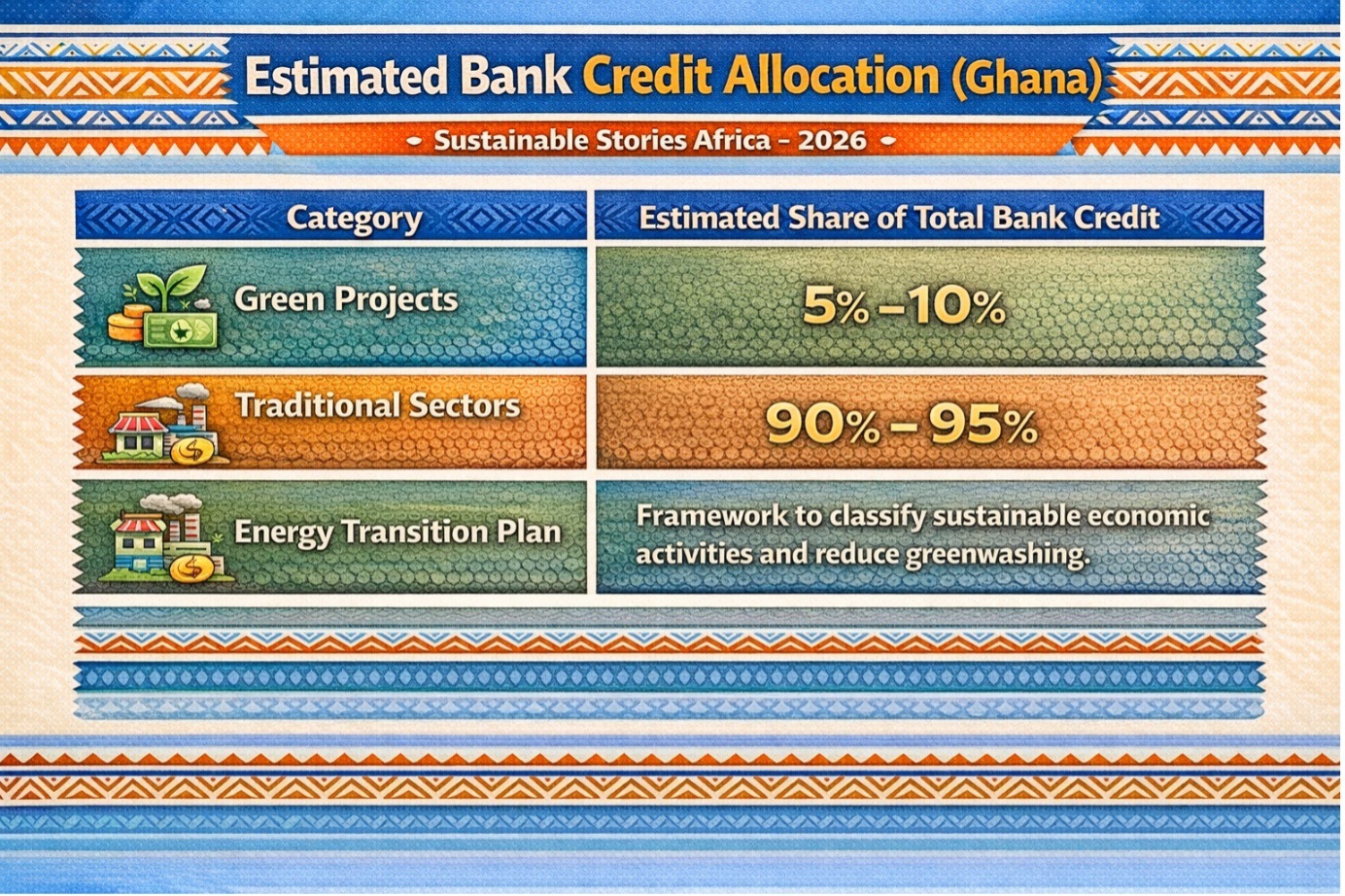

Green Lending Remains Marginal

Green lending in Ghana’s banking system is still nascent. The brief estimates that green finance likely represents only 5–10% of total bank lending, while traditional sectors account for 90–95%.

Key structural realities include:

- Over 90% of renewable energy funding has come from development finance institutions.

- Only 6 of 24 universal banks have introduced dedicated green credit schemes.

- Commercial banks cite limited short-term profitability in green finance.

This imbalance highlights a structural financing gap.

Estimated Bank Credit Allocation (Ghana)

Category | Estimated Share of Total Bank Credit |

|---|---|

Green Projects | 5% – 10% |

Traditional Sectors | 90% – 95% |

Investor surveys cited in the report highlight strong interest in the energy and waste sectors; however, barriers persist, including small project sizes, high-risk perception, weak co-financing, and limited technical expertise.

Three Structural Barriers

High-Risk Perception – Weak project pipelines, currency depreciation risks, and conservative bank classifications of green SMEs limit credit flows.

Technical and Capacity Gaps – SMEs often lack:

- Bankable project design skills

- Access to clean technology and performance data

- Awareness of international climate finance instruments

Policy and Regulatory Uncertainty – Unpredictable implementation of environmental incentives, weak enforcement of green standards, and fragmented institutional coordination discourage long-term investment.

The cumulative effect is a private sector that recognises opportunity but prices in uncertainty.

Global Lessons Show What Works

The brief draws on comparative examples:

- Kenya mobilised over $4 billion in green industrial investments through structured public-private partnerships and de-risking tools.

- Morocco, with EBRD and GCF support, scaled SME access to green loans.

- Vietnam leveraged green bonds and concessional finance to accelerate renewable energy expansion.

These examples demonstrate a pattern: public capital reduces risk; private capital scales impact.

For Ghana, the potential upside is substantial:

- Expanded domestic manufacturing

- Renewable-powered industrial parks

- Competitive access to EU-aligned supply chains

- Enhanced ESG compliance for export markets

The alternative? A policy framework without proportional capital mobilisation.

Four Priority Reform Levers

The brief proposes a coordinated reform package:

Deploy De-Risking Instruments

- Partial credit guarantees

- First-loss capital structures

- Risk-sharing mechanisms via Ghana EXIM Bank and MoTI

- Adaptation of models such as Climate Investor One

Scale Blended Finance

- Embed green bonds, loans, insurance, and grants

- Mobilise concessional capital from GCF, AfDB, IFC

- Promote PPPs in renewable energy and eco-industrial parks

- Leverage GIIF for co-financing

Build SME Investment Readiness

- Strengthen the Ghana Climate Innovation Centre

- Launch Green SME Accelerator Programs

- Facilitate integration into sustainable global value chains

Improve Regulatory Certainty

- Stable, long-term green industrial policies

- Tax relief and carbon credit mechanisms

- Faster permitting processes via digital platforms

- Alignment with ECOWAS and ISO 14001 standards

Implementation Architecture: Institutional Coordination

A central recommendation is the establishment of a National Green Industrialisation Taskforce, comprising MoTI, MoF, MoEn, GIPC, AGI, MoCC&S, and financial institutions.

Its mandate would include:

- Harmonising policy instruments

- Designing green bond frameworks

- Aligning NDC targets with industrial incentives

- Monitoring KPIs for green finance flows

A Monitoring and Evaluation framework with measurable KPIs, including volume of green finance disbursed to SMEs and emissions reductions achieved, would underpin accountability.

Capital Determines Credibility

The policy brief concludes that Ghana’s green industrial transition will hinge less on declarations and more on institutional coherence and risk management.

The architecture exists. The incentives are emerging. However, until private lenders and investors see structured risk mitigation, regulatory predictability, and investable project pipelines, capital will remain cautious.

Ghana’s opportunity is not merely environmental. It is industrial, fiscal, and competitive. Green industrialisation is now a question of capital allocation.

Path Forward – Capital, Coordination, Credibility

Ghana must urgently institutionalise a National Green Industrialisation Taskforce, deploy de-risking facilities, and scale blended finance instruments to crowd in private capital.

Clear regulatory signals and measurable KPIs will anchor investor confidence.

With coordinated execution, Ghana can convert climate ambition into bankable industrial growth, positioning itself as West Africa’s hub for low-carbon manufacturing and sustainable export competitiveness.