Ethiopia has the renewable energy, workforce, and industrial ambition to lead in climate-aligned manufacturing. However, private capital remains limited, certification costs are high, and green exports are limited.

A ACCPA policy brief argues that without fast-track reforms, blended finance, and standards acceleration, Ethiopia risks remaining stuck in a “pilot trap”, rich in green ambition, but short on scalable industrial gains.

Ethiopia’s Green Industry Inflexion Point

Ethiopia stands at a decisive crossroads.

Abundant hydropower, wind, solar and geothermal potential, combined with a youthful labour force and expanding industrial parks, position the country to compete in low-carbon textiles, agro-processing, circular economy manufacturing, and clean-tech components.

However, scaling green industry from pilot projects to export-ready pipelines remains constrained by finance, standards, and reliability bottlenecks, according to ACCPA’s August 2025 policy brief, Scaling Green Industry and Trade in Ethiopia.

The challenge is not vision. It is execution at scale.

Ethiopia’s Green Manufacturing Moment

Ethiopia’s Ten-Year Development Plan and updated NDCs place climate resilience and low-carbon industrialisation at the centre of economic transformation.

However, the financing gap is vast. Ethiopia estimates $316 billion in climate-related investment needs by 2030, with only 20% expected from the domestic market.

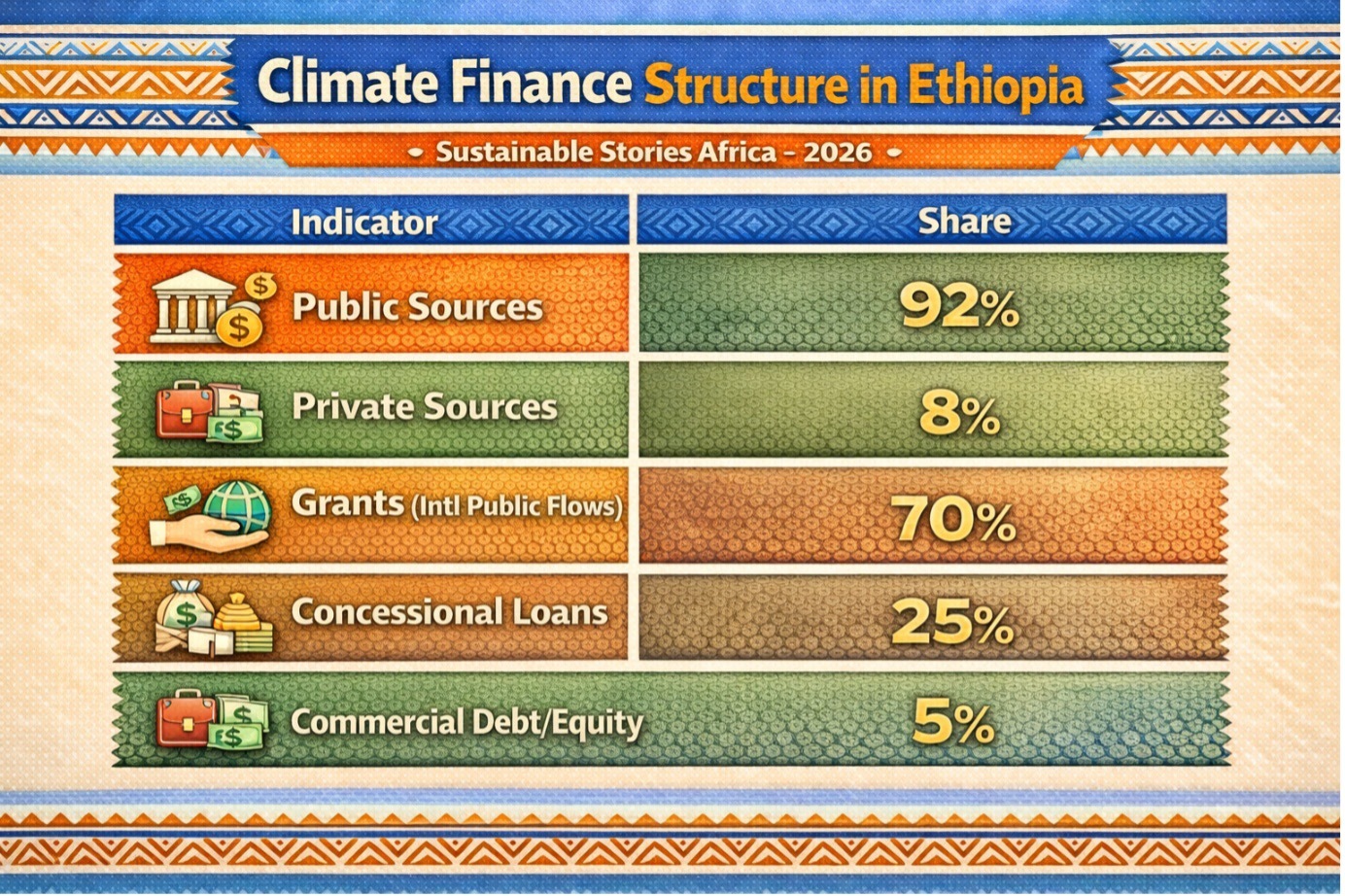

More critically, tracked climate finance remains overwhelmingly public.

Climate Finance Structure in Ethiopia

Indicator | Share |

|---|---|

Public Sources | 92% |

Private Sources | 8% |

Grants (Intl Public Flows) | 70% |

Concessional Loans | 25% |

Commercial Debt/Equity | 5% |

The signal is clear: private participation remains thin, and market-based instruments are underdeveloped.

Green Growth Is Industrial Policy

ACCPA’s central message is unequivocal: green growth is not a niche environmental agenda; it is industrial competitiveness policy.

Resource efficiency, renewable energy integration, and circular production:

- Reduce exposure to energy shocks

- Lower long-term production costs

- Open access to premium export markets

- Strengthen AfCFTA readiness

However, Ethiopia risks missing near-term value chain opportunities without targeted de-risking reforms.

Evidence of Structural Frictions

The brief’s Evidence Snapshot (ES) highlights systemic bottlenecks:

Finance Barriers for MSMEs (ES-4)

Manufacturers cite:

- High interest rates

- Stringent collateral requirements

- Lack of tailored green finance products

- Scarcity of bankable project pipelines

Export Hurdles (ES-5)

Firms struggle with:

- High certification costs

- Limited international recognition

- Weak regional trade facilitation

- Costly compliance with ISO/ecolabel standards

Operating Environment (ES-6)

Unreliable energy supply, fragmented institutional coordination, permitting delays, and limited infrastructure investment, notably in the expansion of green manufacturing.

Meanwhile, climate finance flows skew heavily toward adaptation (56%) compared to mitigation (38%), with underfunding in critical manufacturing sectors such as energy efficiency and industrial water systems.

From Pilots to Pipelines

The policy brief argues that Ethiopia is caught in a “pilot trap”, green demonstrations that fail to scale.

However, sectoral opportunities are crystallising:

- Energy systems

- Agro-processing

- Textiles

- Construction materials

- Waste and circular value chains

Domestic demand already absorbs most sustainable products, indicating latent internal market strength.

If standards, finance, and reliability are addressed simultaneously, Ethiopia could:

- Graduate domestic firms into AfCFTA value chains

- Attract export premiums

- Build local clean-tech manufacturing capacity

- Generate green jobs at scale

The objective is not incremental reform. It is a systemic upgrade.

Five Scale-Enabling Reforms

ACCPA proposes five mutually reinforcing actions:

- Fast-Track Green Investments via SLAs – Introduce Service Level Agreements across agencies (power, environment, industry) and reliability pacts in priority industrial zones to shorten approval timelines and strengthen bankability signals.

- Operationalise a Green Standards Accelerator – Create a national standards support platform offering:

- Certification assistance (ISO 14001, ecolabels)

- Testing labs

- Cost-sharing schemes for SMEs

- Conformity assessment services

This would enable firms to be compliant for export -readiness.

- Deploy Blended On-Lending Facilities – Channel concessional capital into structured on-lending windows paired with project preparation support and partial guarantees, shifting from grant dominance to blended market instruments.

- Launch a Green Enterprise Hub – A one-stop MSME support facility bundling:

- Technical assistance

- Documentation templates

- Working capital matchmaking

- Project preparation services

This addresses the MSME pipeline bottleneck directly.

- Build a National Green Registry – Develop a unified climate and green finance registry to track disbursements, commitments, and outcomes, improving transparency and enabling data-driven policy correction.

- Trade and Domestic Markets: Dual Track Strategy – The brief emphasises that domestic and export markets are complementary, not competing pathways.

Strengthening internal procurement signals and green certification within Ethiopia:

- Builds early firm capacity

- Reduces compliance costs

- Creates scale before export exposure

Once firms meet international standards, AfCFTA and global markets become accessible. This sequencing is strategic.

Institutional Leadership Required

The “Call to Action” section urges coordinated action across:

- Ministry of Industry

- IPDC and regulators

- Financial institutions

- Development Finance Institutions

- MSMEs

- International partners

The message is pragmatic: fragmented pilots and donor-driven initiatives are insufficient. Scale requires coordination, reliability, and de-risked capital.

From Margin to Mainstream

Ethiopia’s green industrial opportunity is significant. Its constraints are equally real.

With climate finance still 92% public and MSMEs constrained by credit and certification costs, the country’s next phase must focus on pipeline development, professionalisation of standards, and mobilisation of private capital.

If fast-track permitting, blended finance, standards acceleration, and enterprise support are executed together, Ethiopia can transition from isolated green experiments to scalable, export-ready industrial ecosystems.

The window is narrow. However, the platform is strong.

Path Forward – Fast-Track, De-Risk, Certify, Scale

Ethiopia must institutionalise fast-track permitting, deploy blended on-lending facilities, operationalise a Green Standards Accelerator, and establish a Green Enterprise Hub for MSMEs. A unified climate finance registry will improve accountability and coordination.

By aligning reliability compacts, export certification support, and private capital mobilisation, Ethiopia can move the green industry from pilot margin to industrial mainstream, strengthening AfCFTA competitiveness and climate resilience simultaneously.