Africa emits just 5% of global energy-related emissions; however, it holds some of the world’s largest untapped gas and critical mineral reserves.

The 2026 Outlook reiterates that the continent’s energy transition will be significantly different from that of Europe.

Gas monetisation, critical minerals, hydrogen exports and regulatory adaptation to global carbon rules will be critical for its future.

Africa’s Energy Transition Crossroads

Africa’s energy future will be shaped less by ideology and more by arithmetic.

By 2050, the continent’s population is projected to reach nearly 2.4 billion, while GDP is expected to triple, increasing to $7.8 trillion.

However, per capita electricity consumption stood at just 500 kWh in 2024, compared with a global average of 3,700 kWh.

Against that backdrop, The State of African Energy 2026 Outlook pages 101 - 118 makes a clear case: Africa must expand supply, industrialise gas, comply with emerging carbon regimes and position itself as a critical minerals and hydrogen powerhouse simultaneously.

The transition will rely on development and decarbonisation.

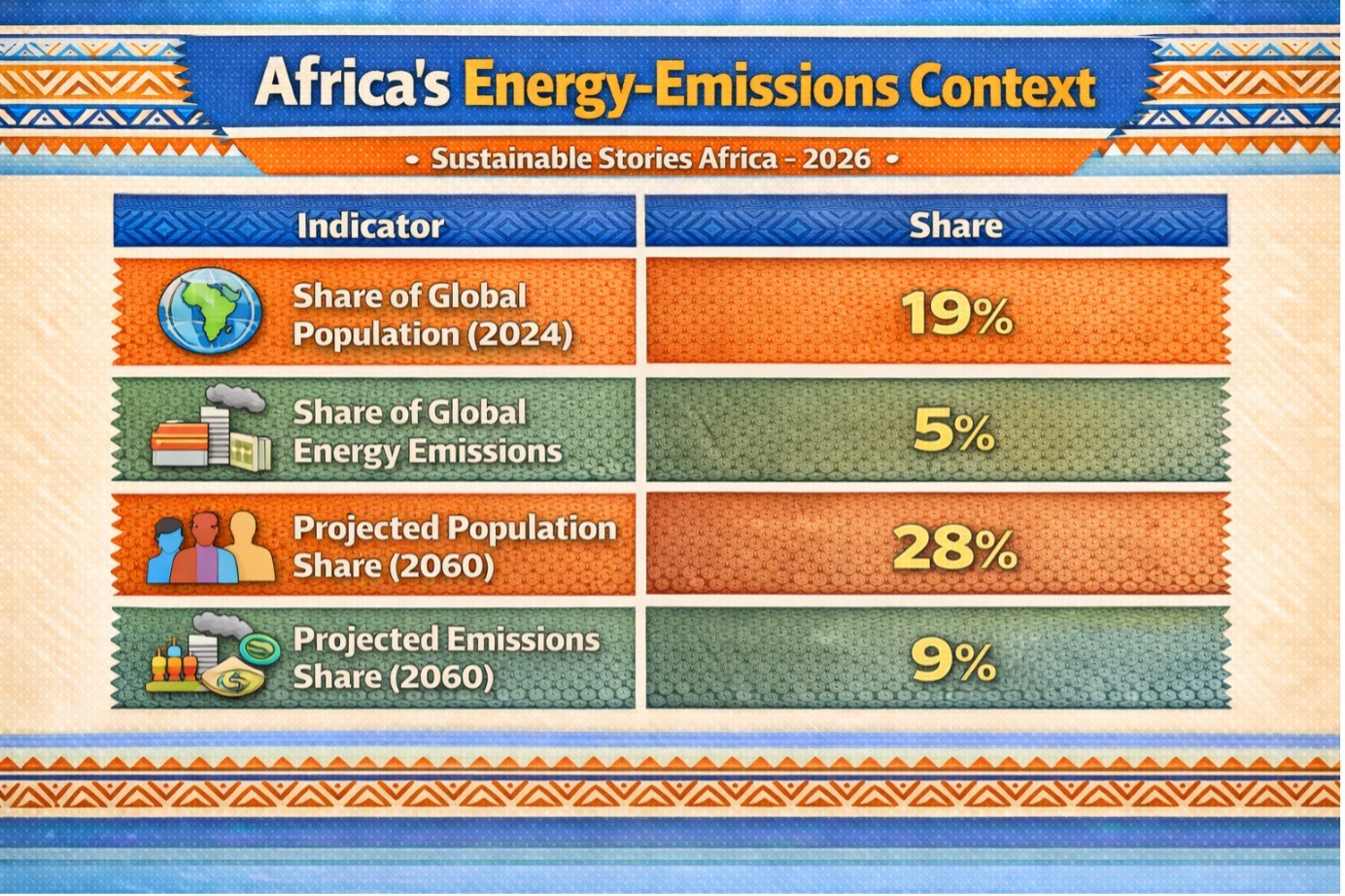

Africa’s Emissions Paradox

Africa contributes just 5% of global energy-related emissions, despite accounting for 19% of the world’s population.

By 2060, the population share could reach 28%, while emissions remain around 9%, underscoring low historical responsibility and a relatively low-carbon starting point.

Africa’s Energy-Emissions Context

Indicator | Share |

|---|---|

Share of Global Population (2024) | 19% |

Share of Global Energy Emissions | 5% |

Projected Population Share (2060) | 28% |

Projected Emissions Share (2060) | 9% |

The implication is strategic: Africa’s transition must prioritise growth, access and industrialisation, not premature contraction.

International Regulations Reshape Trade

Three global regulatory shifts will influence Africa’s energy exports:

- EU Methane Regulation – New EU rules tighten methane reporting and performance standards, increasing scrutiny on upstream gas operations.

- Carbon Border Adjustment Mechanism (CBAM) – The EU’s CBAM imposes carbon pricing on imports such as aluminium, cement and steel, sectors central to African industrial ambitions.

- IMO Maritime Rules – International Maritime Organisation rules are accelerating demand for low-carbon marine fuels.

These regulations create both compliance risk and export opportunity.

Producers that reduce flaring, curb methane, and decarbonise industrial value chains gain access to premium markets.

Gas: Bridge Fuel or Missed Opportunity?

Africa produced over 300 Bcm of natural gas in 2024, accounting for 8.5% of global LNG supply (34.7 MMt).

However, vast volumes remain undeveloped:

- Rovuma Basin (Mozambique): 129 Tcf recoverable gas

- Niger Delta: 113 Tcf recoverable gas

Domestic monetisation remains constrained by infrastructure gaps and limited regional pipeline integration.

Meanwhile, flaring remains significant:

- Algeria: 7.9 Bcm flared (2024)

- Nigeria: 6.5 Bcm

- Libya: 6.3 Bcm

Gas monetisation presents a triple dividend:

- Reduced emissions

- Export earnings

- Industrial feedstock supply

The balance between LNG exports and domestic gas-to-power remains delicate.

Hydrogen: Long-Term Strategic Bet

Africa’s renewable potential positions it as a competitive producer of low-carbon hydrogen and derivatives.

Early-stage hydrogen projects, particularly those co-located with renewable energy opportunities and aligned with export markets, could unlock first-mover advantage.

Domestic demand sectors include:

- Fertilisers

- Steel

- Ammonia

- Transport fuels

However, infrastructure, offtake agreements and capital costs remain hurdles.

Critical Minerals: Africa’s Strategic Leverage

The demand for transition-critical minerals is expected to increase fivefold by 2035.

Africa holds dominant reserves of:

- Cobalt

- Copper

- Lithium

- Platinum Group Metals (PGMs)

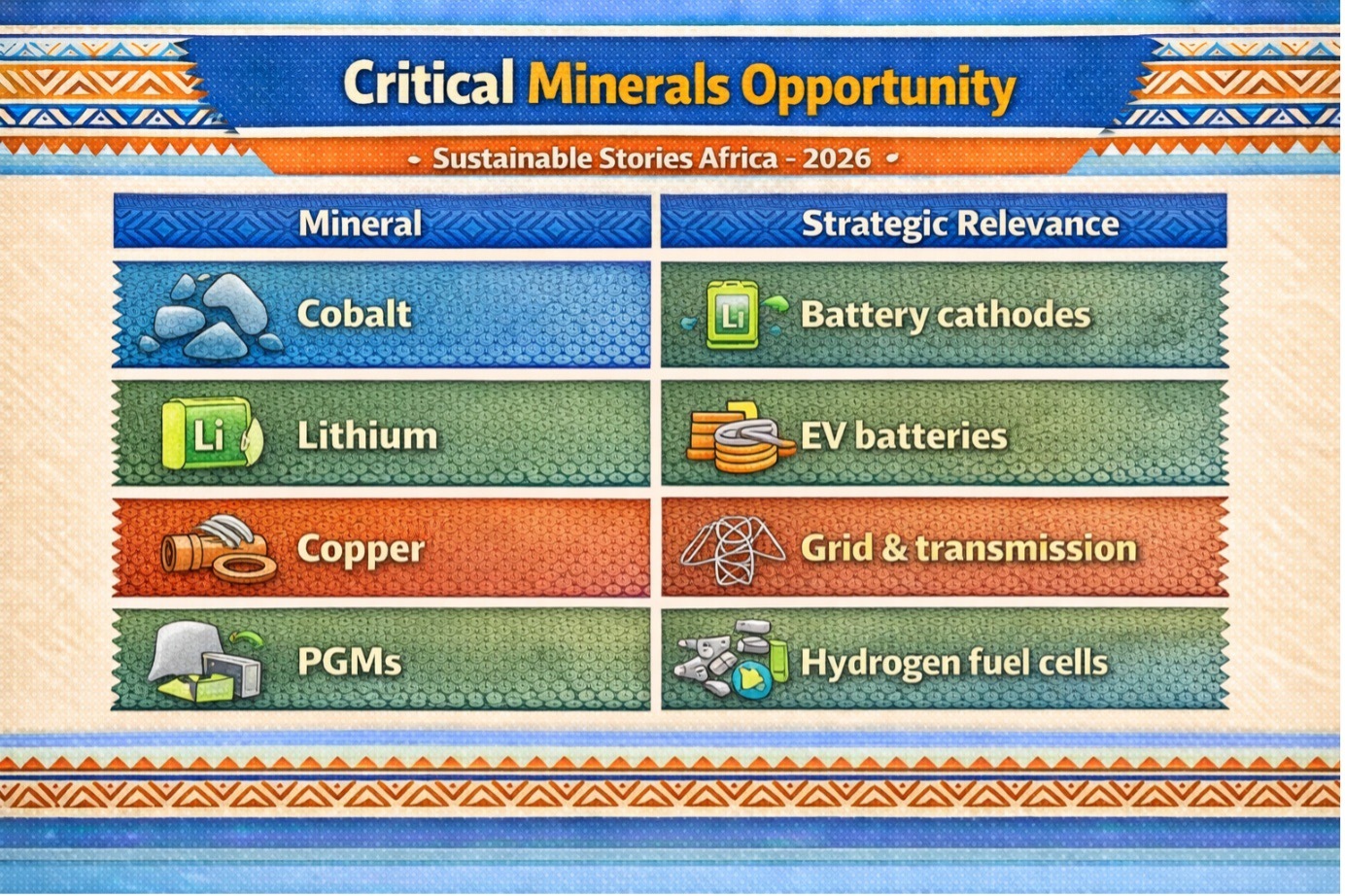

Critical Minerals Opportunity

Mineral | Strategic Relevance |

|---|---|

Cobalt | Battery cathodes |

Lithium | EV batteries |

Copper | Grid & transmission |

PGMs | Hydrogen fuel cells |

The opportunity extends beyond extraction.

Value-chain localisation, including refining, processing and battery component manufacturing, could multiply economic impacts.

However, mining lead times, infrastructure deficits and governance challenges remain barriers.

Reforming the Carbon Profile

Upstream emissions intensity remains high, with flaring accounting for nearly half of upstream emissions in 2024.

International initiatives such as:

- The Oil & Gas Decarbonisation Charter (OGDC)

- World Bank’s Global Flaring and Methane Reduction (GFRM)

are accelerating commitments toward zero routine flaring by 2030.

Reducing methane intensity not only improves ESG metrics but also safeguards access to European gas markets under new methane disclosure requirements.

Decarbonisation is no longer optional. It is market access insurance.

Balancing Development and Decarbonisation

Africa’s power demand is projected to rise from 1,028 TWh in 2025 to 2,291 TWh by 2050.

Natural gas could account for 45% of power generation by 2050, while renewable energy investment between 2020 and 2025 reached $34 billion.

Data centre demand, especially in South Africa and Kenya, adds a new layer of load growth.

Energy access remains foundational. Transition cannot outpace electrification.

Strategic Optionality, Not Ideology

The Outlook frames Africa’s transition as pragmatic:

- Monetise gas responsibly

- Reduce flaring and methane

- Invest in renewables and hydrogen

- Capture critical mineral value chains

- Reform fiscal and regulatory regimes

The continent’s advantage lies in optionality.

Africa can industrialise while decarbonising, provided infrastructure, capital and governance reforms align.

The transition is not about abandoning hydrocarbons. It is about reshaping them.

Path Forward – Monetise, Decarbonise, Industrialise

Africa must accelerate the reduction of flaring, invest in gas-to-power and regional pipelines, strengthen methane monitoring to meet EU standards, and support hydrogen pilot projects aligned with export markets.

Simultaneously, governments should incentivise in-continent mineral processing and adopt transparent regulatory frameworks that attract capital while protecting long-term competitiveness in global low-carbon supply chains.