Africa’s power demand will more than double by 2050. However, per capita electricity use will still trail global averages. Governments have procured 25 GW of renewables, natural gas is set to supply 45% of power generation, and data centres are emerging as a new load driver.

The State of African Energy 2026 Outlook signals opportunity, but warns that infrastructure, regulatory reform and regional integration will determine whether ambition translates into access.

Africa’s Power Ambition Meets Infrastructure Reality

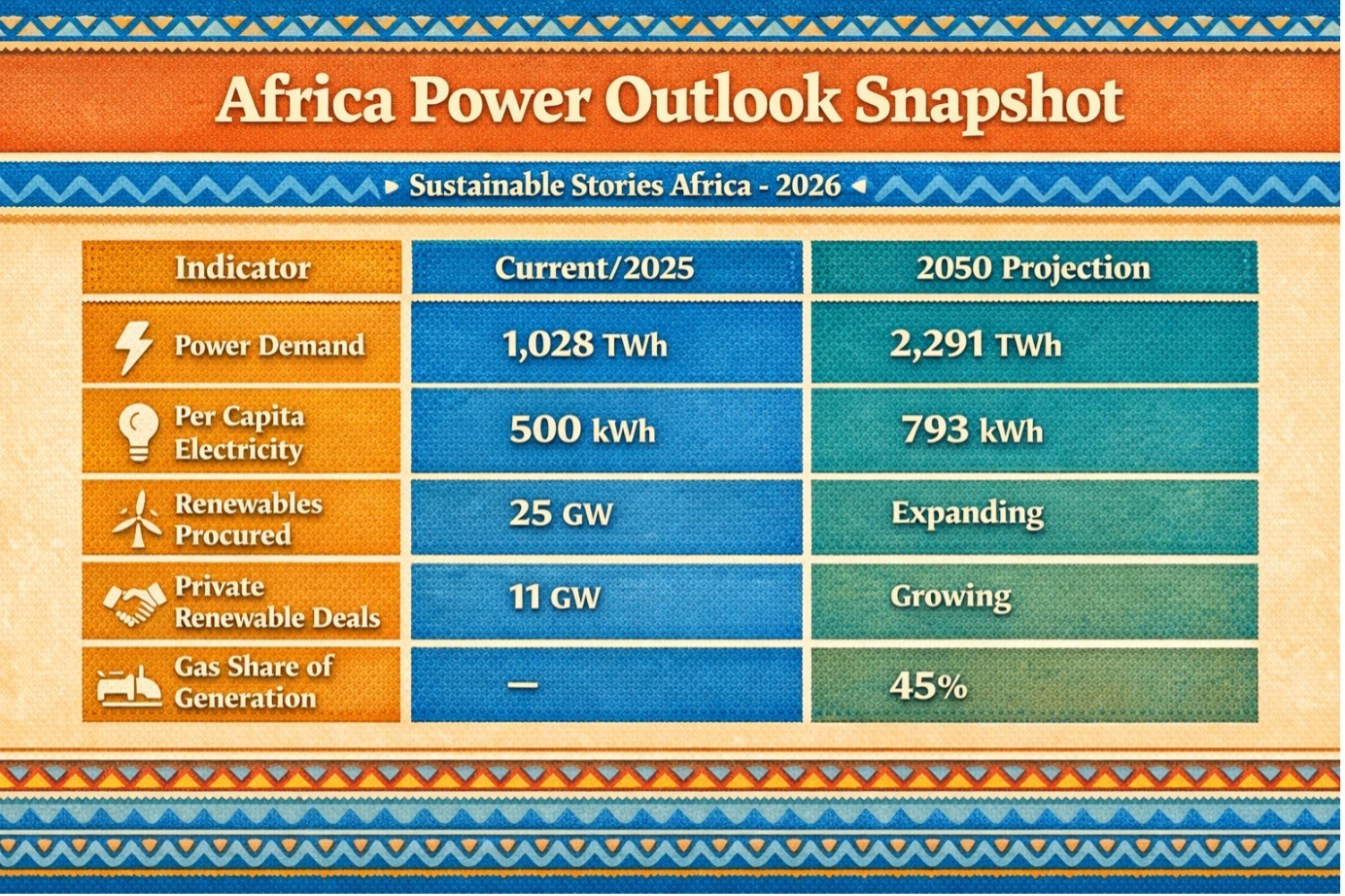

Africa’s electricity system is entering its most consequential phase in decades. Power demand is projected to rise from 1,028 TWh in 2025 to 2,291 TWh by 2050. This structural shift is propelled by population growth, urbanisation and digitalisation.

However, even with this expansion, per capita electricity consumption stood at just 500 kWh in 2024, when compared to a global average of 3,700 kWh. By 2050, consumption is expected to rise to 793 kWh, still materially below global norms.

The message from Pages 71–100 of the 2026 Outlook is precise: Africa’s challenge is not demand. It is delivery.

Demand Is Rising Faster Than Systems

The report’s power outlook presents a clear trajectory:

- Power demand: 1,028 TWh (2025) → 2,291 TWh (2050)

- Renewable procurement: 25 GW government-awarded capacity as of 2024

- Private renewable offtake: 11 GW secured

- Clean power investment (2020–2025): $34 billion

- 52% solar

- 25% onshore wind

Natural gas is projected to account for 45% of total power generation by 2050, positioning it as the backbone of grid stability.

However, infrastructure bottlenecks, particularly transmission constraints, remain a structural barrier.

Africa’s power sector is scaling. But it is scaling unevenly.

Access, Data Centres, And Market Reform

- Electrification Gap – Despite progress, universal access remains a distant goal. The report emphasises distributed generation and microgrids as critical tools in Sub-Saharan Africa. Grid extension alone will not close the gap.

Electrification challenges include:

- Weak transmission infrastructure

- Financing constraints

- Regulatory capacity gaps

- Data Centres: A New Demand Driver – The continent’s digital economy is beginning to reshape power profiles.

- South Africa: Data centres projected to exceed 5 TWh of demand by 2030.

- Kenya: 0.7 TWh out of projected 19.2 TWh demand

While currently modest, the growth potential is significant.

Energy planning must now factor in digital infrastructure as a structural load, not a marginal one.

- Gas-to-Power Strategy – Several African countries have expressed their desire for gas-to-power ambitions (Table 6, p.84).

Gas offers:

- Baseload stability

- Grid reliability

- Industrial enablement

However, supply chain challenges and infrastructure gaps continue to slow implementation.

Africa Power Outlook Snapshot

Indicator | Current/2025 | 2050 Projection |

|---|---|---|

Power Demand | 1,028 TWh | 2,291 TWh |

Per Capita Electricity | 500 kWh | 793 kWh |

Renewables Procured | 25 GW | Expanding |

Private Renewable Deals | 11 GW | Growing |

Gas Share of Generation | — | 45% |

What Reform Could Unlock

The report highlights that regional power pools, such as the SAPP, provide meaningful efficiency gains.

Enhanced integration could:

- Optimise surplus capacity

- Reduce generation costs

- Improve reliability

- Enable cross-border trade

Public-Private Partnerships (PPPs) are identified as essential to assist in bridging Africa’s infrastructure financing gap.

Solar and wind costs remain competitive versus fossil fuel benchmarks (Figures 52 and 53 of the report).

Meanwhile, nuclear, though stable, faces high LCOE (~$120/MWh) and regulatory constraints.

Africa has choices. But capital will follow credibility.

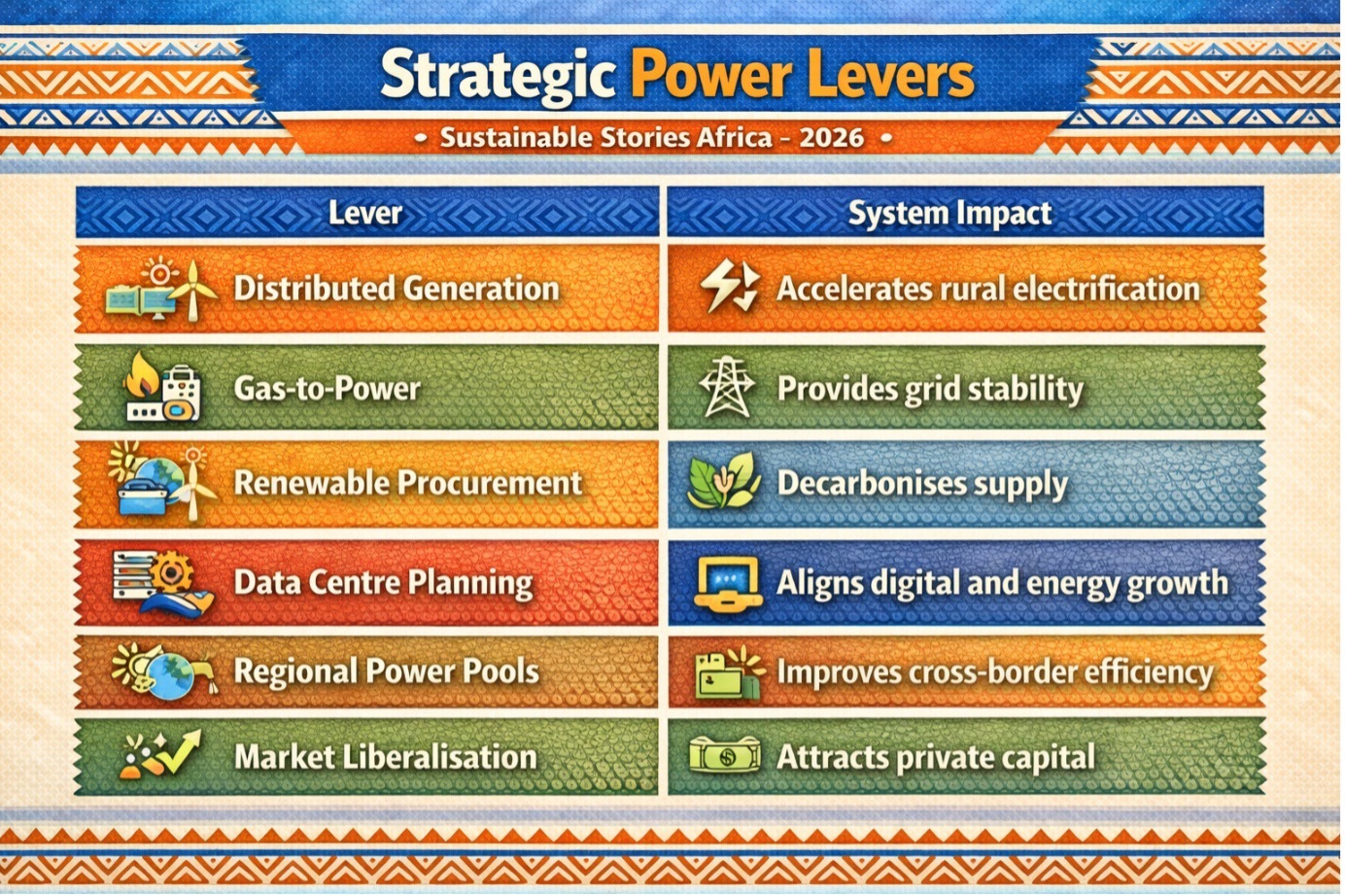

Strategic Power Levers

Lever | System Impact |

|---|---|

Distributed Generation | Accelerates rural electrification |

Gas-to-Power | Provides grid stability |

Renewable Procurement | Decarbonises supply |

Data Centre Planning | Aligns digital and energy growth |

Regional Power Pools | Improves cross-border efficiency |

Market Liberalisation | Attracts private capital |

Source:

Reform Determines Outcome

Pages 71–100 of the report highlight that market liberalisation remains incomplete across much of Africa.

Key constraints include:

- Regulatory capacity limitations

- Stakeholder engagement delays

- Incomplete unbundling reforms

Expansion of transmission infrastructure remains non-negotiable. Without it, renewable procurement will outpace grid integration.

The Outlook is clear: reform is not optional. It is foundational.

PATH FORWARD – Reform, Integration, Infrastructure, And Capital Discipline

Africa’s power ambition must now shift from procurement to performance. Strengthening transmission networks, accelerating regional integration and deepening regulatory reform will determine grid reliability and investor confidence.

Gas-to-power, renewables scaling and distributed generation must operate in coordinated frameworks.

With disciplined execution, Africa can deliver both access and competitiveness. It cannot be one at the expense of the other.