India’s fast payment revolution was never just about speed. It was about architecture: building rails that could carry inclusion, innovation, and economic formalisation at the national scale.

For African fintech ecosystems racing toward interoperability and instant transfers, India’s experience offers a deeper lesson: real transformation comes when payments become public infrastructure.

India’s Fast Payments Blueprint for Africa

India’s pioneering fast payments system has evolved from a real-time settlement tool into one of the most influential digital public infrastructures in the world, reshaping financial inclusion, merchant ecosystems, and government transfers at scale.

For African economies grappling with fragmented payment rails, high transaction costs, and cross-border inefficiencies, the story offers more than admiration. It offers a roadmap.

India’s Unified Payments Interface (UPI), launched in 2016, now processes billions of transactions monthly, becoming the backbone of retail digital payments in the country.

However, the deeper lesson lies not in volume metrics, but in institutional design: open architecture, regulatory coordination, and public-private execution working in concert.

For Africa’s fast-growing fintech markets, the question is no longer whether instant payments are possible, but how they can be structured to enable a systemic impact.

Speed Alone Doesn’t Transform Economies

Fast payments are often essential due to technological improvements to increase transfer speed, reduce friction, and provide a more user-friendly experience. India’s case demonstrates something more structural.

UPI was designed as an interoperable infrastructure, connecting banks, fintechs, merchants, and users through open APIs under regulatory oversight. The result was a network effect that dramatically reduced cash reliance, expanded merchant acceptance, and supported government-to-person transfers.

Transaction growth accelerated rapidly within a few years of launch, with digital payments displacing cash in urban and rural segments. The system became accessible via QR codes, feature phones, and smartphone apps, lowering barriers to entry.

For African markets, where mobile money is beginning to entrench its value, but interoperability remains uneven, the lesson is clear: infrastructure design determines scale outcomes.

Architecture, Governance, and Ecosystem Alignment

India’s experience highlights three structural pillars:

Public Digital Infrastructure Model – UPI operates as a shared payments layer, not a proprietary platform. This allowed multiple banks and fintech providers to innovate on top of common rails.

Regulatory Coordination – The central bank and payments authorities provided clarity on interoperability, consumer protection, and operational resilience.

Merchant Integration at Scale – Low-cost QR codes enabled rapid onboarding of small merchants, from street vendors to supermarkets.

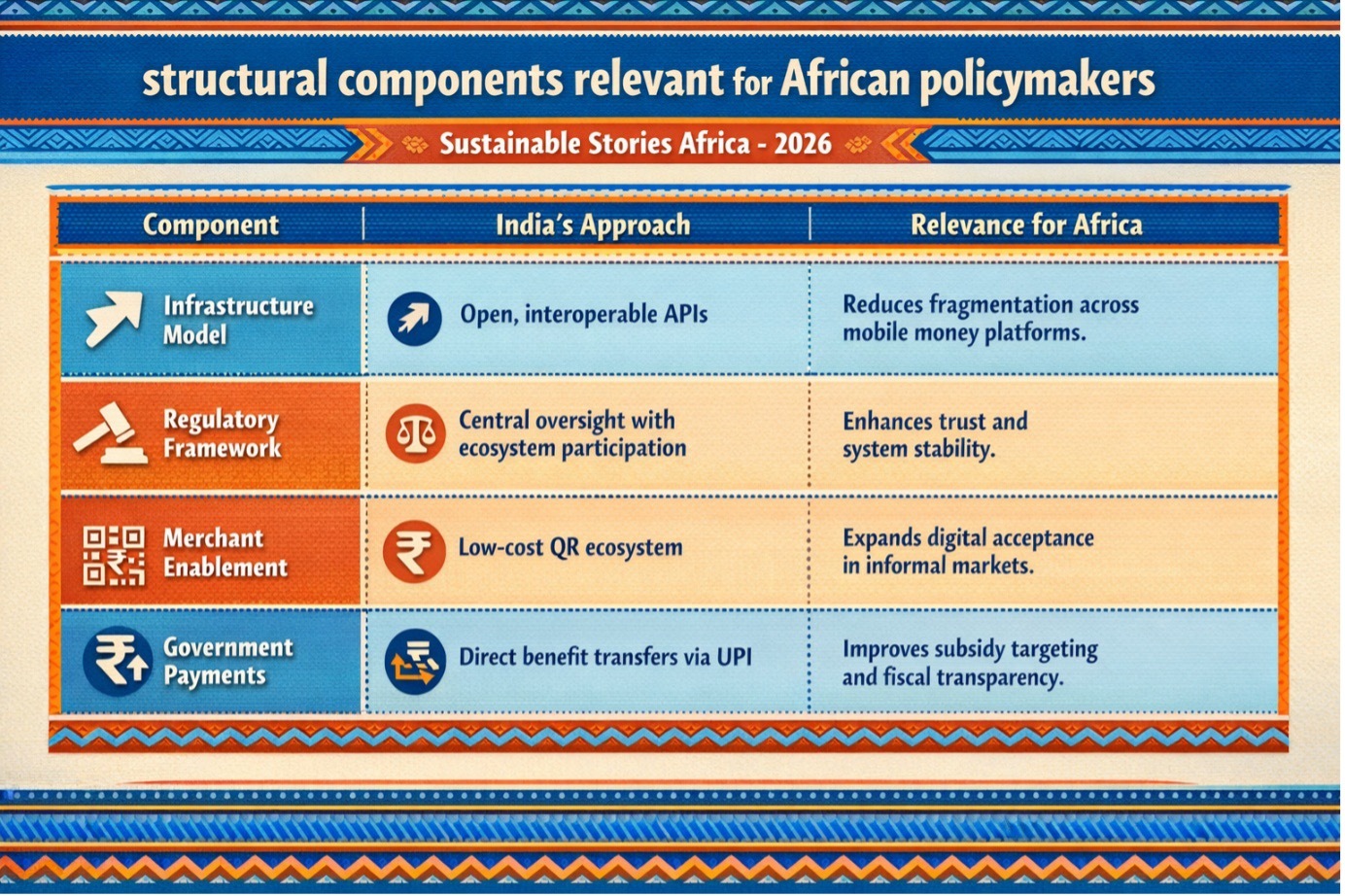

Below is a summary of structural components relevant for African policymakers:

Component | India’s Approach | Relevance for Africa |

|---|---|---|

Infrastructure Model | Open, interoperable APIs | Reduces fragmentation across mobile money platforms |

Regulatory Framework | Central oversight with ecosystem participation | Enhances trust and system stability |

Merchant Enablement | Low-cost QR ecosystem | Expands digital acceptance in informal markets |

Government Payments | Direct benefit transfers via UPI | Improves subsidy targeting and fiscal transparency |

This ecosystem design drove rapid network effects. As transaction volumes increased, costs invariably declined further, reinforcing adoption.

For African markets, especially Nigeria, Kenya, Ghana, and South Africa, where mobile money and fintech innovation are already advanced, integration across platforms remains the next frontier.

Financial Inclusion Beyond Transaction Volume

India’s fast payments system has supported broader economic objectives:

- Increased formalisation of micro-merchants

- Reduced cash-handling risks

- Enhanced traceability for government transfers

- Improved consumer convenience

Importantly, the system did not eliminate private competition. Instead, it enabled fintech firms to innovate on user interfaces, lending products, and value-added services layered on shared infrastructure.

African fintech sectors can replicate this layered model, separating infrastructure from competitive applications.

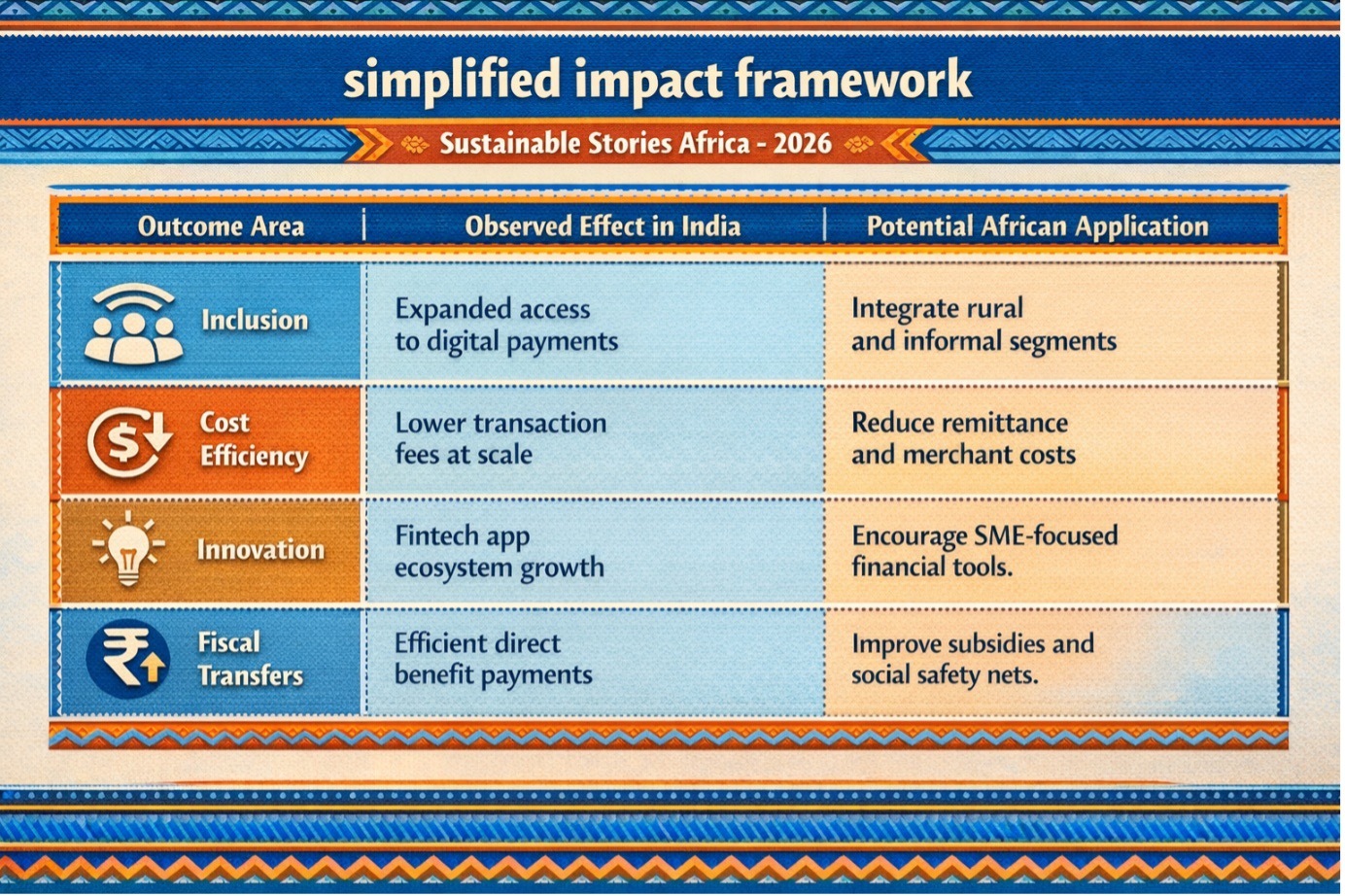

Below is a simplified impact framework:

Outcome Area | Observed Effect in India | Potential African Application |

|---|---|---|

Inclusion | Expanded access to digital payments | Integrate rural and informal segments |

Cost Efficiency | Lower transaction fees at scale | Reduce remittance and merchant costs |

Innovation | Fintech app ecosystem growth | Encourage SME-focused financial tools |

Fiscal Transfers | Efficient direct benefit payments | Improve subsidies and social safety nets |

The deeper insight: fast payments become transformational when embedded within broader digital identity and regulatory systems.

Africa’s digital ID expansions, mobile penetration growth, and regional payment initiatives (such as cross-border settlement platforms) position the continent at a strategic inflexion point.

Build Infrastructure Before Competition

African regulators and fintech leaders face a strategic choice: pursue fragmented proprietary growth or prioritise interoperable national and regional rails.

India’s experience suggests five practical priorities:

- Establish interoperable standards across banks and mobile money operators.

- Develop low-cost merchant onboarding mechanisms.

- Strengthen cybersecurity and operational resilience.

- Align fast payment systems with government transfer programs.

- Enable cross-border linkages across African markets.

The African Continental Free Trade Area (AfCFTA) framework amplifies the urgency. Without interoperable payment rails, the efficiency of intra-African trade remains constrained.

The objective is not to replicate India identically, but to internalise its structural logic: public digital infrastructure can unlock private innovation.

PATH FORWARD – Infrastructure First, Inclusion Always

Africa’s fintech future will not be defined alone by the download of apps, but by the robustness of its shared payment architecture. Policymakers must prioritise interoperability, regulatory clarity, and merchant inclusion to unlock systemic impact.

If coordinated effectively, fast payments can reduce costs, expand digital inclusion, and strengthen cross-border trade, enabling the transformation of digital finance from convenience to economic infrastructure.