Ethiopia requires $316 billion by 2030 to achieve its climate and industrial commitments; however, 80% of that must come from international partners.

Public finance dominates, private capital lags, and execution bottlenecks, from permitting delays to power reliability, are slowing green manufacturing.

The SAGFA Ethiopia 2025 report makes one thing clear: the country has ambition, partners, and renewable potential. What it needs now is coordination, bankable pipelines, and disciplined implementation.

Ethiopia’s Green Finance Industrial Reckoning

Ethiopia is attempting one of Africa’s most ambitious green industrial transitions. Anchored in the Climate-Resilient Green Economy (CRGE) Strategy, the Ten-Year Development Plan (10YDP), and updated NDCs, the country aims to transform from an agrarian economy into a renewable-powered manufacturing hub.

The scale of ambition is immense. Ethiopia’s updated NDC estimates $316 billion in financing needs by 2030, with only 20% expected from local financing and 80% from international sources. However, green finance remains thinly structured, heavily public, and unevenly distributed across sectors.

The SAGFA Ethiopia 2025 report provides the most comprehensive ecosystem mapping yet, examining who funds what, which sectors benefit, and why industrial-scale transformation remains constrained.

The story is not one of failure, but of unfinished architecture.

Ambition Outpaces Market Depth

The financing gap is systemic.

- $316 billion required by 2030

- 87% mitigation focus

- 80% expected from international partners

However, Ethiopia’s green finance market remains in its early stages and is dependent heavily on Public financing.

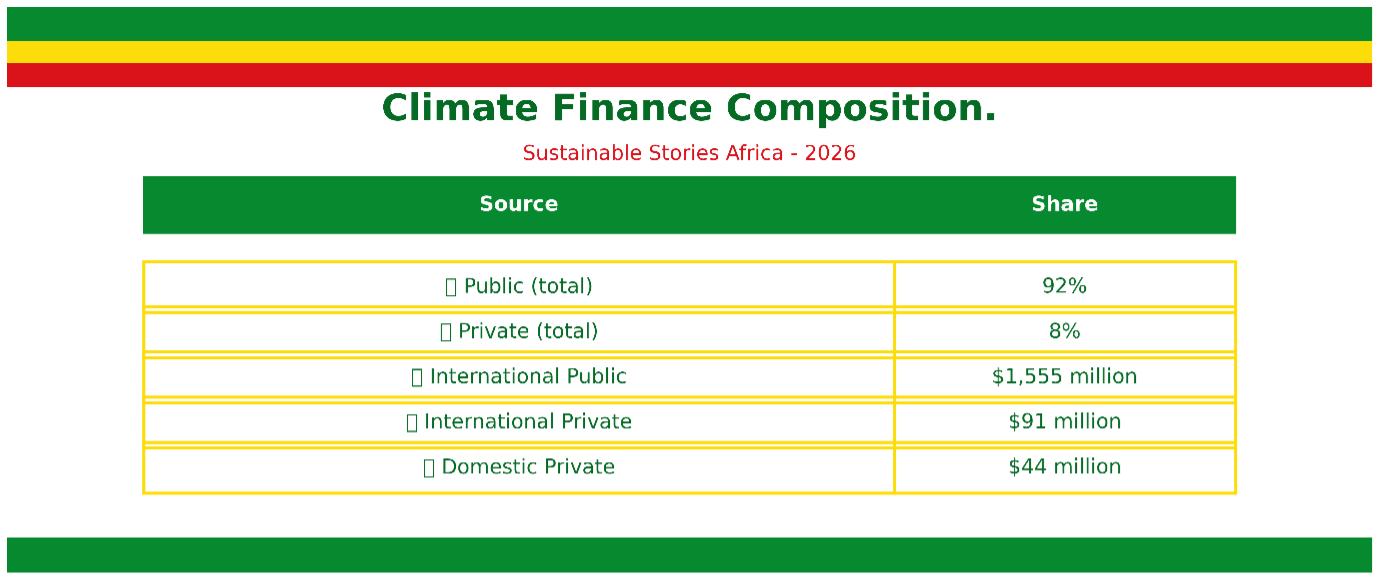

Climate Finance Composition

Source | Share |

|---|---|

Public (total) | 92% |

Private (total) | 8% |

International Public | $1,555 million |

International Private | $91 million |

Domestic Private | $44 million |

International public flows dominate, with at least 70% of international public climate finance arriving as grants, 25% as concessional loans, and only 5% as commercial loans.

Equity instruments remain nearly absent. The implication is stark: Ethiopia’s green transition depends on concessional flows, not scalable capital markets.

Where Finance Flows and Where It Doesn’t – Adaptation Bias, Energy Underserved

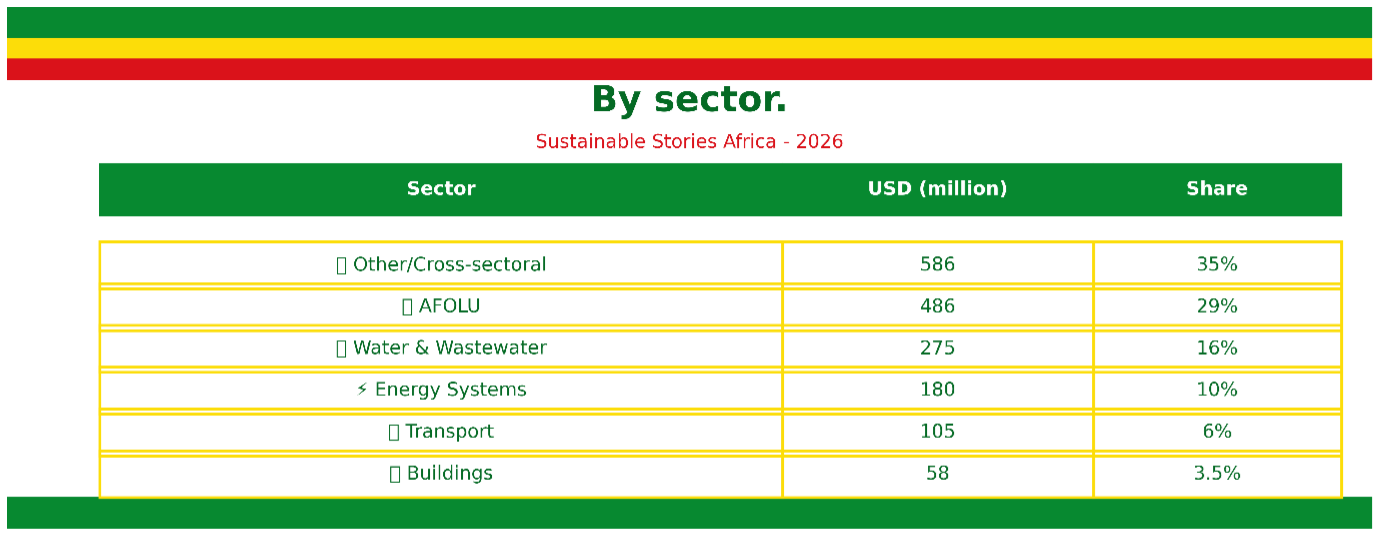

Climate finance is skewed toward adaptation (56%), compared to mitigation (38%).

By sector:

Sector | USD (million) | Share |

|---|---|---|

Other/Cross-sectoral | 586 | 35% |

AFOLU | 486 | 29% |

Water & Wastewater | 275 | 16% |

Energy Systems | 180 | 10% |

Transport | 105 | 6% |

Buildings | 58 | 3.5% |

Energy and transport, critical to green industrialisation, receive comparatively modest allocations.

This imbalance reflects vulnerability realities. However, it also exposes significant industrial risks. Ethiopia cannot green its manufacturing base without scaling power, grid reliability, and clean transport.

FDI and China’s Footprint

Between 2011 and 2024, Ethiopia mobilised $5.7 billion in international green finance.

China stands as the second-largest contributor, providing $850 million (14.9%), primarily through bilateral concessional loans for hydropower, wind, grid and rail projects.

World Bank Group contributions total $2.1 billion (36.9%), followed by the US, the AfDB, Germany and the EU.

China’s role under FOCAC is described as significant yet undercounted, due to differences in classification and reporting gaps.

FOCAC-linked projects have delivered productivity and environmental gains, but alignment with Ethiopia’s green industrial priorities remains uneven.

Institutional Outcomes: Mixed but Promising

Survey data from 41 institutions and 52 workshop participants reveal uneven but tangible impacts:

- 32.67% reported improvements in resource efficiency

- 26.73% cited sustainable logistics gains

- Renewable energy and agro-processing sectors benefited most (30% and 29% respectively)

However, nearly all institutions reported nothing in dedicated green supply chain initiatives.

The missing link is execution architecture.

The Promise of Industrial Green Upscaling

Ethiopia’s fundamentals are compelling:

- Over 45 GW hydropower potential

- Expanding solar and wind investments

- Green industrial parks

- Strong state coordination capacity

If blended finance structures, bank readiness, and permitting reforms align, Ethiopia could:

- Graduate over 200 MSMEs into bankable pipelines

- Issue sovereign/municipal green bonds

- Institutionalise climate-budget tagging

- Position itself as East Africa’s renewable manufacturing hub

The report proposes three immediate advocacy priorities:

- Green Enterprise Hub – A coordinated platform to build MSME pipelines.

- National Green Finance Registry & MRV System.

- Fast-Track Permitting & Power Reliability Pact.

These are not cosmetic reforms. They are structural enablers.

Stakeholders were clear: “We don’t lack projects, we lack instruments that understand green risk.”

Barriers include:

- High interest rates and collateral demands

- Limited green product knowledge among banks

- Birr non-convertibility constraints

- Delays in environmental clearances

- Inconsistent power supply

The roadmap outlines phased reforms:

- 0–18 months – Launch Green Hub, beta registry, permitting SLAs

- 2027–2030 – Scale hub nationally, expand registry to outcome metrics

- 2031 and beyond – Embed green finance into supervision and sectoral decarbonization pathways

Ethiopia’s green transition now hinges on institutional coherence, not just capital volume.

PATH FORWARD – From Architecture to Execution Discipline

Ethiopia’s green finance ecosystem has ambition, partners, and renewable potential. What remains is disciplined execution: operationalising the Green Enterprise Hub, launching a unified finance registry with MRV capacity, and guaranteeing power reliability for green industry.

If these three pillars are implemented swiftly, Ethiopia can convert public-heavy finance flows into scalable industrial pipelines, unlocking private capital, strengthening competitiveness, and anchoring sustainable manufacturing at a continental scale.