Ghana requires between $900 million and $1.55 billion annually to meet its climate targets. However, the actual green finance flows stand at roughly $830 million, leaving a funding gap of up to $720 million.

The SAGFA Ghana 2025 report reveals a system in transition, enabling the expansion of climate finance, bold policy reforms, and increasing Chinese engagement under FOCAC, with momentum being threatened by fragmented coordination, underdeveloped private capital, and industrial misalignment.

Ghana’s Green Finance Industrial Crossroads

Ghana stands at a decisive industrial moment. Climate ambition is rising, but so too are fiscal constraints. The country has committed to reducing 64 million tonnes of CO₂ by 2030 and envisions 1.2 million green jobs through industrial transition.

Delivering on that ambition requires approximately $2.3 billion annually in green finance mobilisation.

The Sino-African Green Finance Alliance (SAGFA) Ghana 2025 report provides the clearest ecosystem mapping yet of how green finance is flowing or failing to flow into industrial transformation. It assesses public financing, multilateral flows, private capital participation, and China’s footprint under FOCAC.

The findings are encouraging but sobering: policy commitment is visible; implementation remains uneven. Green finance is expanding; coordination remains fragmented. Private sector participation is growing; risk perceptions remain high.

Ghana’s green industrial transition is no longer theoretical. It is financial.

The Climate Finance Gap Widens

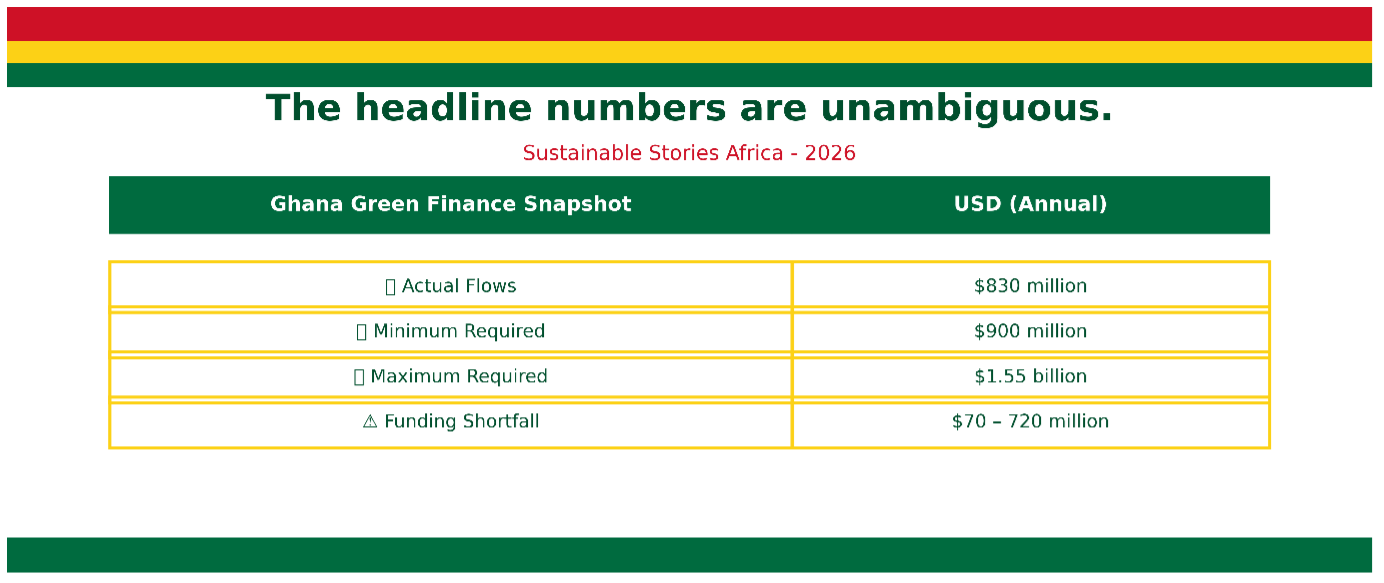

The headline numbers are unambiguous.

Annual green finance flows into Ghana stand at approximately $830 million, against a required range of $900 million to $1.55 billion to meet NDC targets.

Ghana Green Finance Snapshot | USD (Annual) |

|---|---|

Actual Flows | $830 million |

Minimum Required | $900 million |

Maximum Required | $1.55 billion |

Funding Shortfall | $70 – 720 million |

More striking is composition:

- 87% of climate finance originates from public source

- Only 12.8% comes from private capital

Public funding primarily using domestic budgets and multilateral flows dominates. Private industrial capital remains underleveraged.

For a country seeking green industrialization, that imbalance is consequential.

Mapping the Green Finance Ecosystem

Public Sector Foundations – Ghana has built significant institutional architecture:

- Green Climate Fund (GCF) readiness grants

- Sustainable Financing Framework (2021)

- Green Finance Taxonomy (2024)

- Bank of Ghana Sustainable Banking Principles (2019)

The Ministry of Finance established a Climate Financing Division in 2024 to coordinate budgeting and mobilisation.

Domestic climate allocations reached $271 million in 2019/2020.

However, enforcement gaps persist. Ghana lacks a binding Climate Change Act. ESG integration is largely self-reported rather than supervisory-driven.

International Climate Finance and FOCAC – Multilateral institutions contribute approximately $451 million annually.

Key instruments include:

- $40 million SREP concessional package

- Over $75 million Forest Investment Program

- $30.1 million GCF Shea Landscape project

- $16.2 million GCF Solar ASAP program

China’s engagement through FOCAC is increasingly prominent. The report highlights major Chinese-backed initiatives such as:

- Bui Solar Hybrid Plant

- Eco-industrial zone upgrades

- Renewable energy and infrastructure financing

However, the report highlights concerns regarding the clarity of reporting, local ownership, and alignment with Ghana’s green manufacturing priorities.

FOCAC is evolving towards green industrial collaboration, rather than infrastructure financing; however, the depth of governance remains uneven.

Private Sector and Blended Finance – Private capital remains cautious.

Blended models, including UNREF Ghana, Wangara Green Ventures, AGF guarantees, and Development Bank Ghana’s Green Window, are emerging.

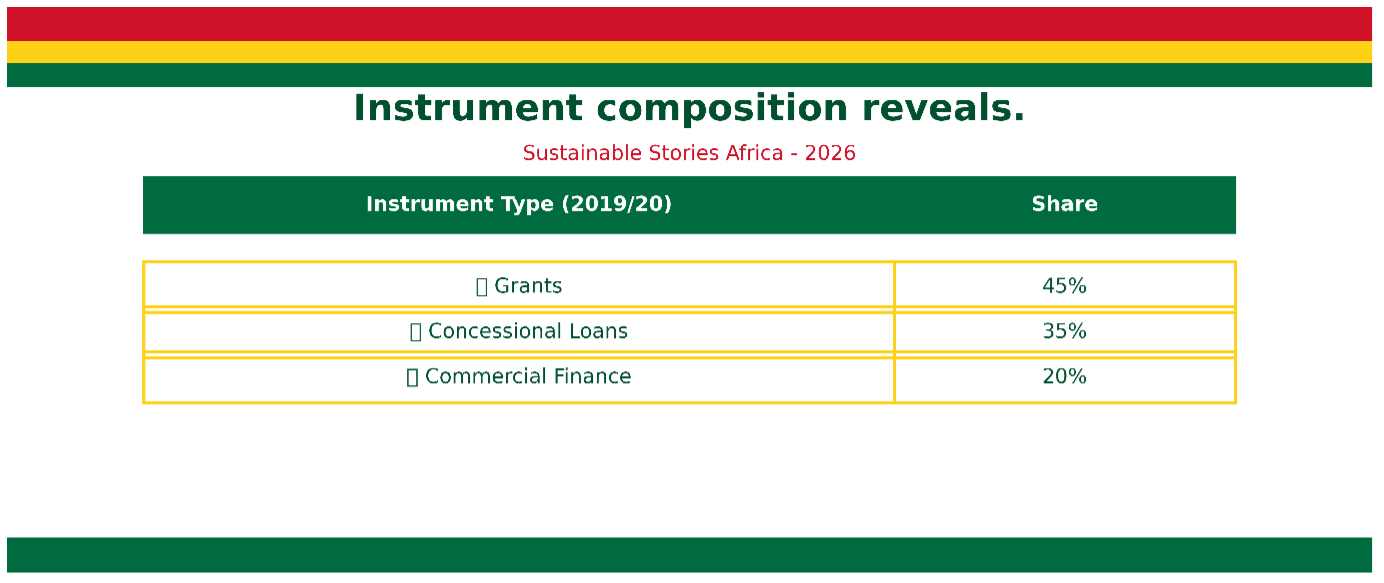

Instrument composition reveals why concessional support dominates:

Instrument Type (2019/20) | Share |

|---|---|

Grants | 45% |

Concessional Loans | 35% |

Commercial Finance | 20% |

Risk perceptions, shallow capital markets, SME bankability constraints, and technical capacity gaps continue to hinder the limits of green industrial scaling.

As one stakeholder noted in the report: “Green finance is growing, but funding flows often miss industrial transformation because the instruments issued by banks don’t align with project realities.”

Industrial Green Sectors Showing Promise

The report identifies several sectors where green finance is catalysing tangible transformation:

- Decentralised renewable energy (solar mini-grids)

- REDD+ forest conservation

- Women-led agro-processing (AFAWA)

- Climate-resilient agriculture

- Circular manufacturing pilots

Sectoral allocation reveals near parity between mitigation (47%) and adaptation (53%).

Energy dominates mitigation finance. Agriculture and water dominate adaptation flows.

This balance reflects Ghana’s vulnerability profile, but also signals opportunity: adaptation-linked agro-industrial value chains can become engines of inclusive green manufacturing.

If scaled strategically, Ghana could align:

- Industrialisation goals

- Climate resilience

- Gender inclusion

- SME development

- International green capital inflows

The potential is systemic, not marginal.

From Ecosystem Mapping to Execution Discipline

The SAGFA report outlines five priority advocacy actions:

- Establish a National Green Finance Registry

- Operationalise the Green Finance Taxonomy by 2025

- Create a Coordinated Support Platform for Green Enterprises

- Embed Climate Resilience as an Industrial Finance Criterion

- Strengthen Context-Specific Energy and Industrial Analysis

The roadmap is phased:

- 2025 – 2026: Build MRV systems, capacity, pilot success

- 2027 – 2030: Scale green bonds, institutional maturity

- 2031 and Beyond: Institutionalise sustainability as industrial core

The report is clear: Ghana must transition from passive recipient to strategic co-designer of international finance partnerships.

Green finance cannot remain grant-dependent. It must become capital-market enabled.

PATH FORWARD – Institutionalise Discipline, Scale Industrial Finance

Ghana’s green finance ecosystem is architecturally strong, but its execution remains uneven. Bridging the between $70 and $720 million funding gap requires deepening private participation, enforcing ESG compliance, aligning industrial policy with climate instruments, and strengthening MRV transparency.

Green finance must shift from project-based funding toward industrial systems financing, embedding climate resilience, local ownership, and manufacturing competitiveness at the core of Ghana’s economic strategy.