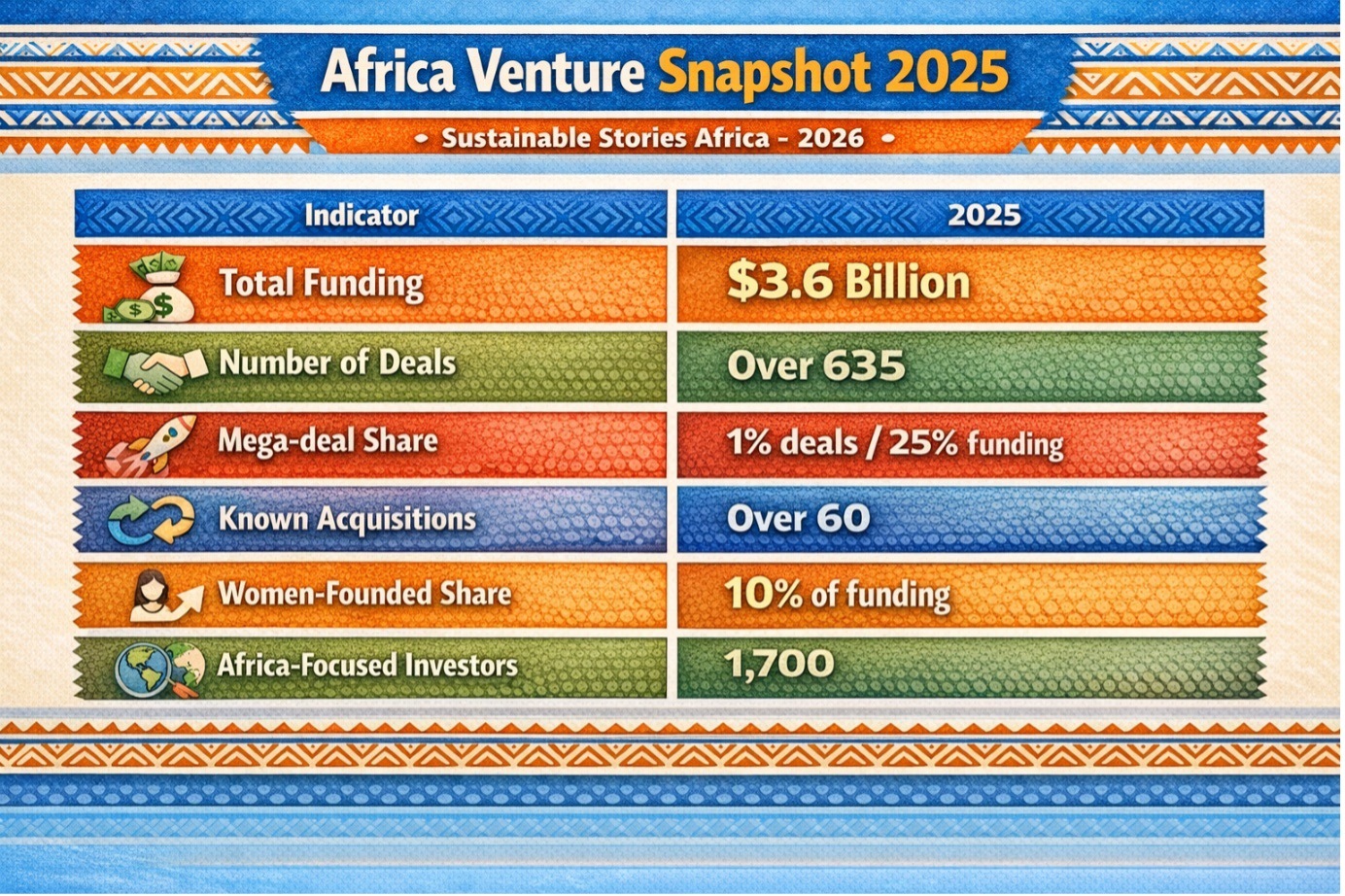

Africa’s startup ecosystem closed $3.6 billion in funding in over 635 deals in 2025, signalling resilience amid global capital tightening. Mega-deals accounted for just 1% of transactions but captured 25% of total value.

Climate, mobility, fintech, and agtech are reshaping the continent’s venture map, while Nigeria, Kenya, Egypt, and South Africa remain the dominant destinations.

However, beneath the surface, francophone and frontier ecosystems are building depth, not just headlines.

Capital Flows Signal Structural Realignment

Africa’s venture capital market is not retreating; it is recalibrating. The Africa Investment Report 2025 shows a disclosure of $3.6 billion in funding and over 635 deals across the continent. While headline totals appear modest compared with the pandemic-era surge, the data reveal deeper ecosystem maturation.

Mega-deals remain minimal, representing just 1% of transactions but capturing 25% of funding, thus signifying concentration risk. However, early-stage activity remains structurally strong.

Beyond the “Big Four” markets, new regional dynamics are emerging. Climate solutions, mobility, agtech and AI are reshaping capital allocation patterns across Africa’s innovation economy.

$3.6 Billion, But Concentrated

According to the 2025 Africa Investment Report:

- $3.6B total funding (2025)

- Over 635 disclosed deals

- Mega-deals: 1% of transactions, 25% of funding

- Over 60 known acquisitions

- 10% of funding to companies with at least one woman founder

- 9,814 tracked companies

- 8,500 all-time deals

- 1,700 Africa-focused investors

The data reflect structural investor caution globally, but not withdrawal.

Capital is consolidating around scalable sectors and mature ecosystems.

Africa Venture Snapshot 2025

Indicator | 2025 |

|---|---|

Total Funding | $3.6 Billion |

Number of Deals | Over 635 |

Mega-deal Share | 1% deals/25% funding |

Known Acquisitions | Over 60 |

Women-Founded Share | 10% of funding |

Africa-Focused Investors | 1,700 |

Geography Is Stable – But Evolving

The Big Four ecosystems, namely Nigeria, Kenya, Egypt, and South Africa, remain dominant, consistently capturing the majority of the funding across cycles.

However, the report introduces a three-tier market view:

- Big Four – Nigeria, Kenya, Egypt, South Africa

- Breakout Markets – Ghana, Morocco, Tanzania, Uganda, etc.

- Frontier Ecosystems – Smaller but increasingly active hubs

Francophone Africa signifies “depth building beneath the surface,” with over 480 rounds recorded and 32 companies raising capital. Senegal, Côte d’Ivoire and Rwanda are gradually increasing visibility.

Regional diversification is emerging gradually.

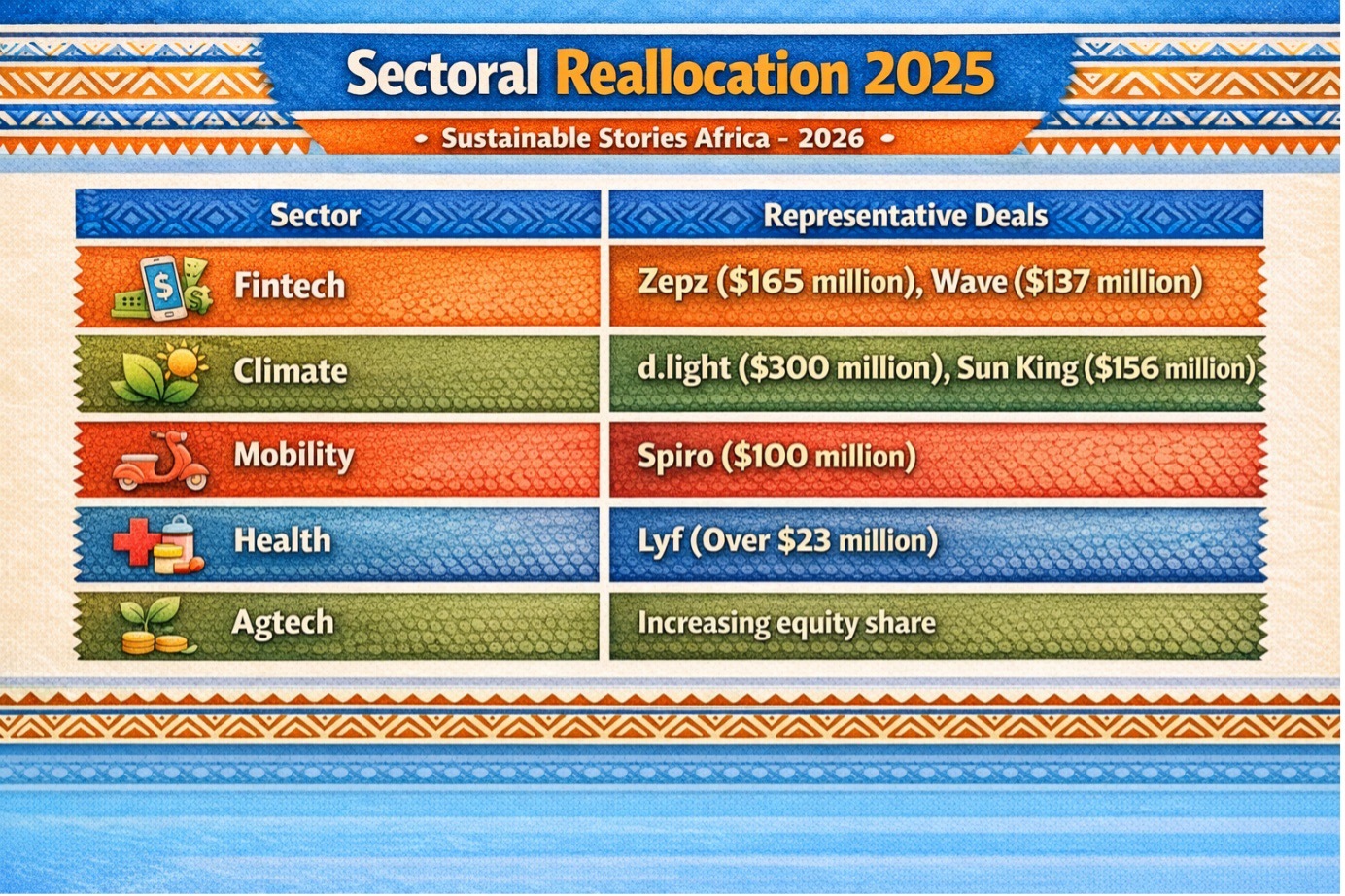

- Shift: Beyond Fintech – Fintech remains active, but the capital story is broadening.

Top 2025 Deals Include:

- Fintech: Zepz ($165M), Wave ($137M), Khokha ($93M), Moniepoint ($90M)

- Climate & Cleantech: d.light ($300M), Sun King ($156M), SolarAfrica ($98M), Burn ($80M)

- Mobility: Spiro ($100M)

- Health: Lyf/Hearing (Over $23M)

Climate funding trends highlight sustained value growth from 2016 to 2025, compelled by increased participation from corporate and development finance investors.

Agtech is also shifting toward more capital-intensive, integrated value-chain models, with equity and blended finance increasingly replacing grant-heavy structures.

Sectoral Reallocation 2025

Sector | Representative Deals |

|---|---|

Fintech | Zepz ($165 million), Wave ($137 million) |

Climate | d.light ($300 million), Sun King ($156 million) |

Mobility | Spiro ($100 million) |

Health | Lyf (Over $23 million) |

Agtech | Increasing equity share |

Ecosystem Depth Is Improving

The report identifies three structural shifts:

- Stage Normalisation – Series B+ rounds no longer dominate the narrative. Early-stage and growth-stage activity is stabilising.

- Angel & Early Support Networks – Angel investors and early-stage networks are expanding across Africa, helping bridge capital gaps in emerging ecosystems.

- Venture Studios Rising – Venture studios are becoming structural ecosystem players, offering governance, capital, and operational expertise from inception.

Corporate venture activity is also geographically diversified, with strong activity from Europe, North America, and increasingly players from the Middle East.

This is not a boom cycle. It is a consolidation cycle.

Capital Discipline Now Defines Growth

M&A activity is becoming increasingly visible, with structured exits being tracked across fintech, mobility, logistics, software, and healthcare sectors.

Key strategic implications:

- Funding is more concentrated

- Deal sizes are rationalised

- Equity share is rising in agtech

- Climate capital is scaling

- Corporate acquirers are active

Investors are demanding clearer revenue models, governance strength and regulatory clarity.

Africa’s capital story in 2025 is less about hype and more about resilience.

PATH FORWARD – Diversification, Governance, Climate and Regional Depth

Africa’s venture ecosystem is maturing through discipline. Climate, agtech and mobility are reshaping capital flows, while regional ecosystems beyond the Big Four are deepening institutional capacity.

Sustained growth will depend on the strength of governance, exit liquidity, expansion of angel networks, and infrastructure-linked innovation.

The next phase will reward ecosystems that combine capital access with operational depth.