Agtech in emerging markets is stabilising after a boom–bust cycle, but recovery is uneven. While broader startup funding shows early signs of recovery, Agtech lags.

Africa remains grant-heavy and donor-driven, South Asia is powered by domestic capital, and Latin America reflects commercial VC maturity. The next wave of agricultural innovation will be shaped less by hype — and more by who controls capital.

Agtech’s Recovery Is Unevenly Distributed

Startup funding across emerging markets may be entering a new recovery cycle after the 2021–2023 boom–bust correction. However, Agtech, while following a recognised trajectory, is recovering more slowly than the broader startup ecosystem.

Between 2020 and 2022, capital surged across Africa, Latin America, South Asia and Southeast Asia. By 2023–2024, funding retrenched sharply. In 2025, stabilisation is visible, but not uniformly distributed.

The Briter AgBase analysis makes a structural point: Agtech investment is not merely regional. It is shaped by funders and the incentives demanded.

Agtech Lags The Startup Recovery

The report highlights that broader startup funding is stabilising in 2025. However, the reports also demonstrate Agtech’s slower rebound.

Key signals:

- Agtech mirrors the broader boom–bust cycle

- Recovery remains shallow compared to general startup sectors

- Capital is increasingly selective

Agtech is not contracting; it is recalibrating.

Capital Markets Shape Agtech Models

- Geography of Funding – Agtech funding is driven by fewer than 20 countries globally. Regional leaders include:

- India: $1.9B cumulative

- Brazil: $654M

- Kenya: $408M

- Indonesia & Singapore: significant Southeast Asian hubs

The concentration underscores ecosystem maturity gaps.

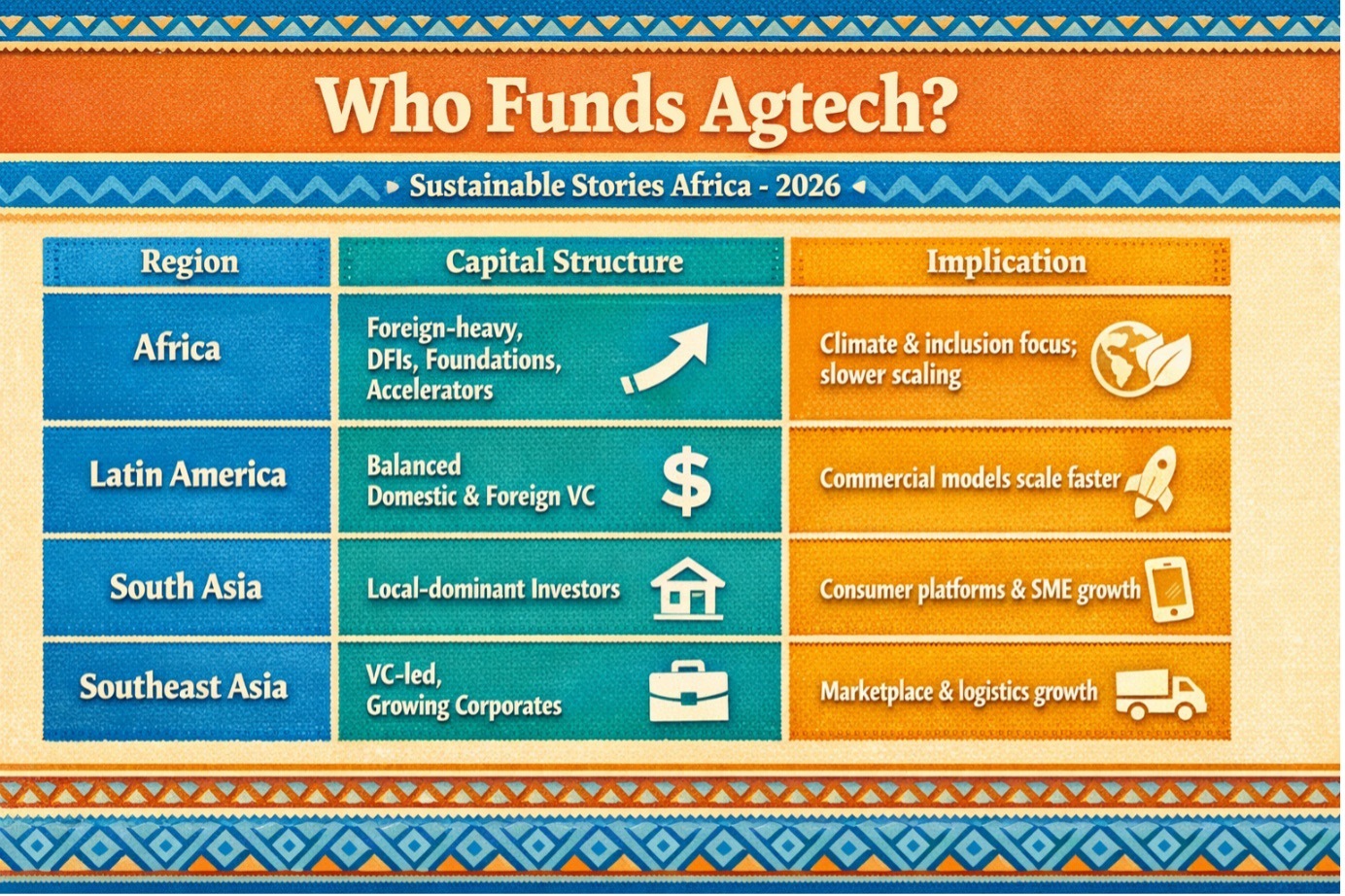

Who Funds Agtech?

Funder composition differs sharply by region

Region | Capital Structure | Implication |

|---|---|---|

Africa | Foreign-heavy, DFIs, foundations, accelerators | Climate & inclusion focus; slower scaling |

Latin America | Balanced domestic & foreign VC | Commercial models scale faster |

South Asia | Local-dominant investors | Consumer platforms & SME growth |

Southeast Asia | VC-led, growing corporates | Marketplace & logistics growth |

South Asia stands out with strong domestic capital participation, unlike Africa, where foreign capital dominates, and local VC remains thin.

The report notes: “Product-market fit follows capital-market fit.”

- Deal Sizes Reflect Market Maturity – Deal-size breakdown shows:

- Africa & LatAm dominated by sub-$5M rounds

- South Asia & Southeast Asia show stronger later-stage representation

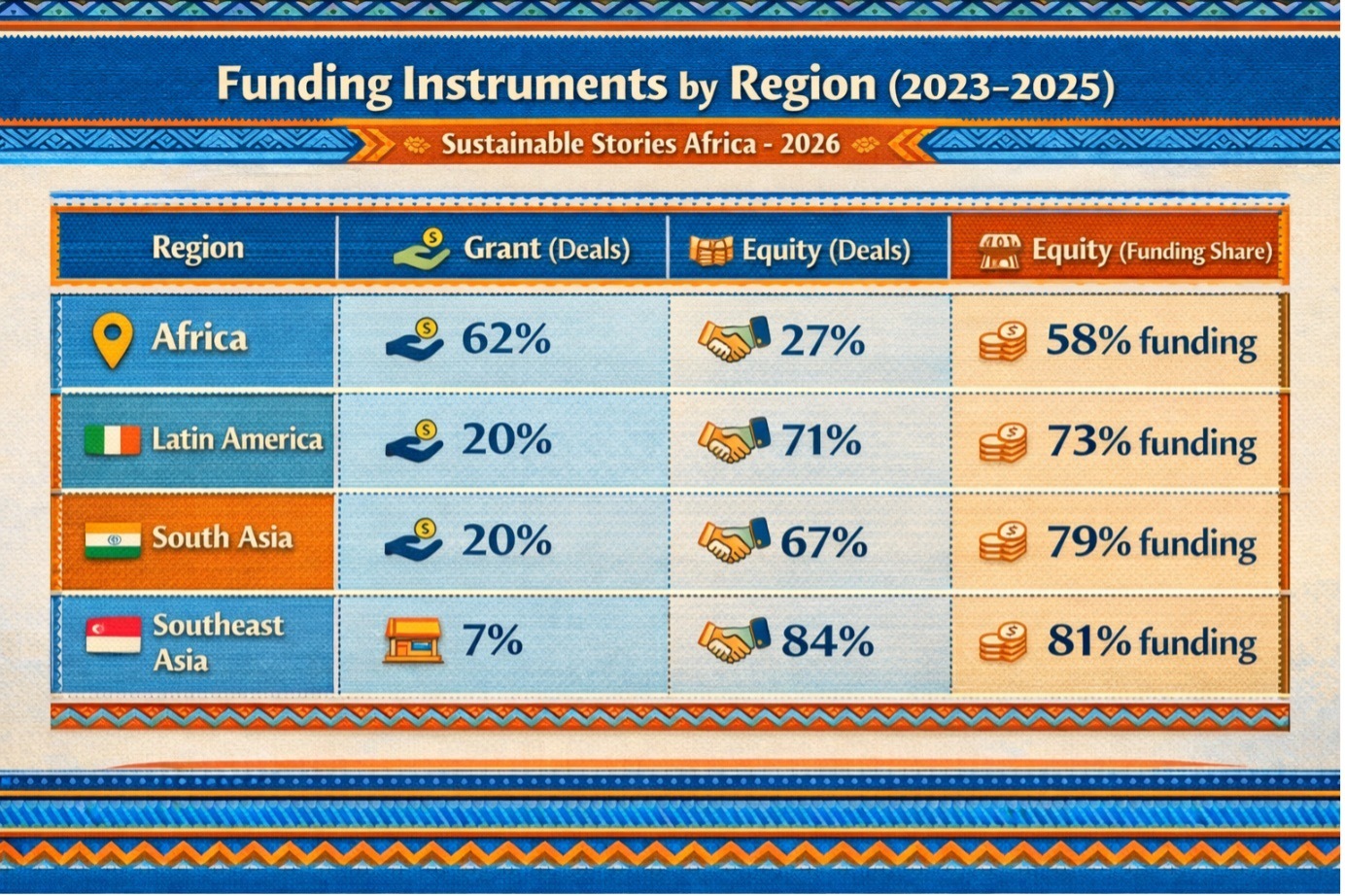

Funding instruments further diverge:

- Africa: 62% of deals are grants; lowest equity share

- South Asia & LatAm show higher equity shares

- Debt plays a significant role in Africa due to capital-intensive models

Grants dominate deal count in Africa, but debt and equity still drive most of the capital volume.

Funding Instruments by Region (2023–2025)

Region | Grant (Deals) | Equity (Deals) | Equity (Funding Share) |

|---|---|---|---|

Africa | 62% | 27% | 58% funding |

Latin America | 20% | 71% | 73% funding |

South Asia | 20% | 67% | 79% funding |

Southeast Asia | 7% | 84% | 81% funding |

Agtech Is Moving Upstream

The next wave of Agtech reflects structural shifts:

- On-farm activity is moving upstream toward biotech, climate and capital-intensive models

- Funding flows mirror funder types

- Agtech still lags broader startup recovery

- Climate solutions are growing, but regionally differentiated

- Traceability remains concentrated in South Asia

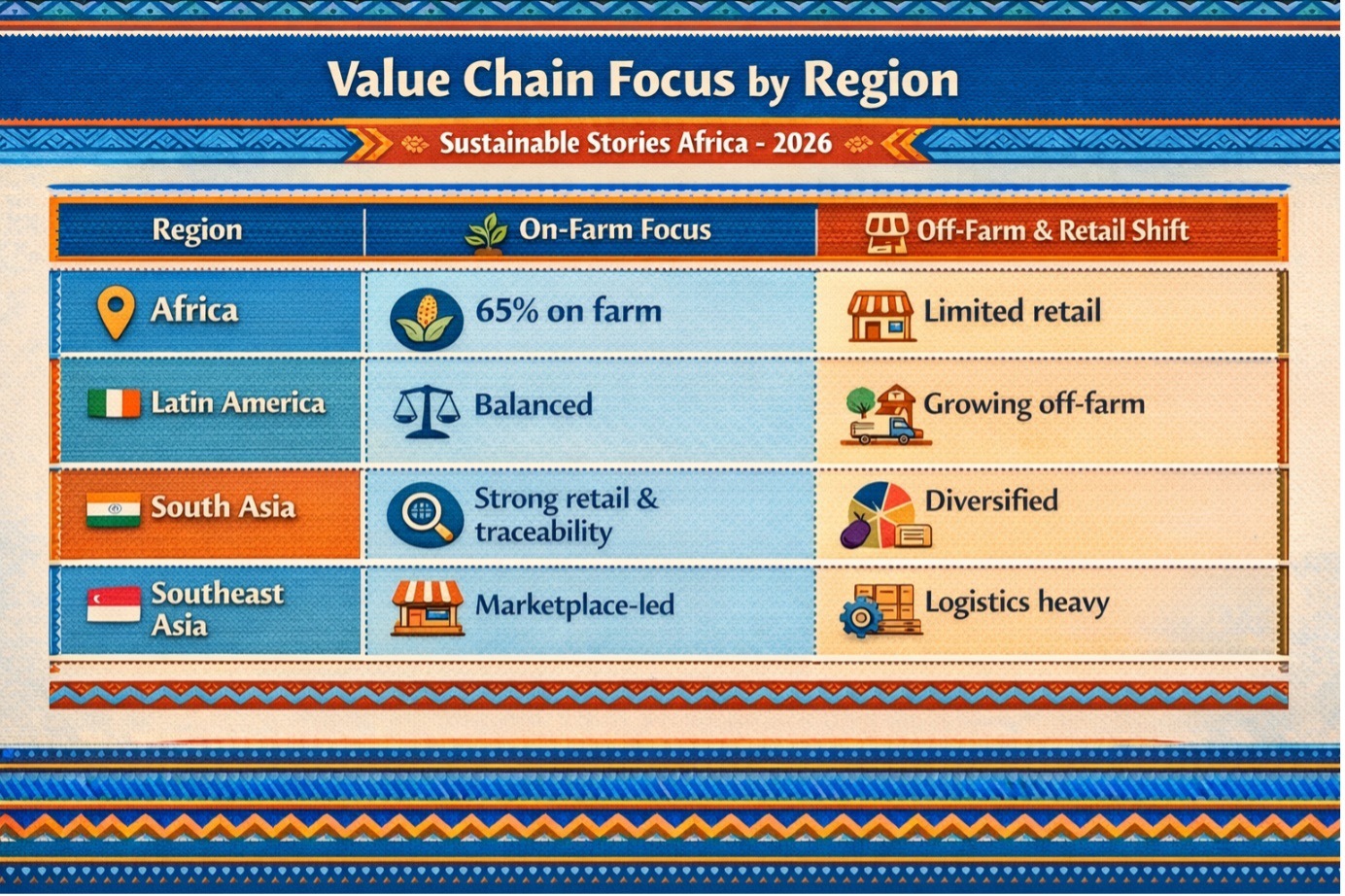

Value Chain Reallocation

Funding is shifting beyond farm-level tools toward off-farm and retail solutions:

- Africa remains focused on on-farm models (65%)

- South Asia & LatAm allocate more to retail and off-farm

Marketplaces dominate off-farm digital models, while traceability is rising, particularly in South Asia.

Climate-linked solutions feature prominently in African on-farm digital models.

Agtech is becoming increasingly capital-intensive, not less.

Value Chain Focus by Region

Region | On-Farm Focus | Off-Farm & Retail Shift |

|---|---|---|

Africa | 65% on farm | Limited retail |

Latin America | Balanced | Growing off-farm |

South Asia | Strong retail & traceability | Diversified |

Southeast Asia | Marketplace-led | Logistics heavy |

Exit Pathways Determine Sustainability

Exit patterns mirror funder landscapes:

- South Asia dominates diversified exits, including IPOs

- Africa sees more startup mergers than institutional exits

- Exit clusters include climate-linked solutions, farm management, processing and retail tech

Without exit liquidity, grant-heavy ecosystems risk stagnation.

The report concludes that Agtech investment is structurally shaped by capital markets, not simply innovation pipelines.

Africa, ≠ Latin America ≠ and South Asia allow the implementation of capital architectures that differ fundamentally.

PATH FORWARD – Local Capital, Climate Alignment, Scalable Models

Agtech’s next phase will depend on strengthening domestic capital pools, aligning climate finance with commercial scalability, and enabling clearer exit pathways. Regions with deeper local investors show stronger resilience.

For Africa, moving from donor-aligned pilots to equity-led scaling will define long-term ecosystem maturity. Capital-market fit will determine product-market success.