Investment growth in emerging markets has slowed to half the pace of its 2000s pace, even as development financing needs surge into the trillions.

A new World Bank volume warns that without urgent reform packages, emerging and developing economies risk a lost decade of stagnation.

However, the data also show a path forward: when countries trigger sustained “investment accelerations,” growth doubles, productivity quadruples, and poverty falls sharply.

Investment Revival or Lost Decade Ahead

Investment in emerging and developing economies (EMDEs) has entered a prolonged slowdown, even as infrastructure gaps, climate transition costs, and employment pressures intensify.

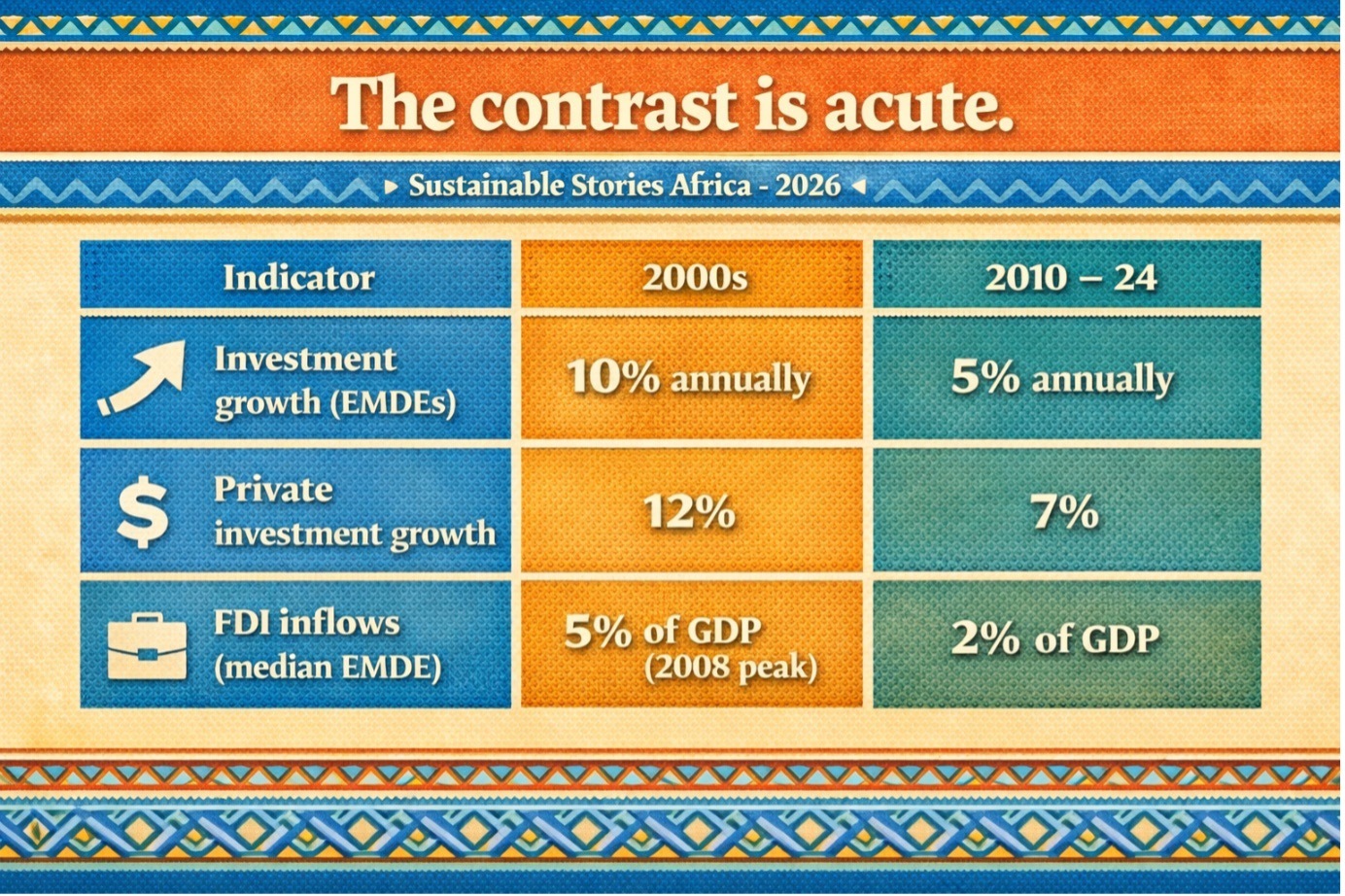

Since the global financial crisis, annual investment growth in EMDEs has fallen from roughly 10% in the 2000s to about 5% between 2010 and 2024.

Private investment growth has halved. Foreign direct investment (FDI) has retreated and become increasingly concentrated.

However, the development financing gap continues to widen. Meeting Sustainable Development Goals and climate targets could require an additional $1.5 and $2.7 trillion annually through 2030, increasing to $4 trillion when accounting for climate costs.

The message from the World Bank’s latest research is stark and hopeful: investment miracles have happened before. They can happen again if policymakers act decisively.

Investment Slowdown Meets Soaring Needs

The world faces a “pressing challenge” to meet development objectives amid slowing growth and geopolitical risks. From 2008 to 2009, investment growth in EMDEs slowed to about half its earlier pace.

FDI inflows, which peaked at 5% of GDP in 2008, have decreased to slightly over 2% between 2022 and 2023.

The contrast is acute:

Indicator | 2000s | 2010 – 24 |

|---|---|---|

Investment growth (EMDEs) | 10% annually | 5% annually |

Private investment growth | 12% | 7% |

FDI inflows (median EMDE) | 5% of GDP (2008 peak) | 2% of GDP |

However, infrastructure and climate investment requirements continue to mount. Roughly 740 million people still lack access to electricity.

Without renewed capital formation, EMDEs risk stalled income convergence and weakened job creation.

Why Investment Matters for Growth and Jobs

The report underscores three macroeconomic functions of investment:

Foundation of Long-Term Growth – Investment accounts for one-third of EMDE GDP growth since 2000 and more than half of potential output growth. Without sustained capital deepening, productivity and convergence falter.

- Engine of Job Creation – During “investment accelerations”, periods of sustained, rapid investment growth, employment rates increase, especially in manufacturing and services.

- Driver of Development Outcomes – Investment underpins electricity, water systems, transport, digital infrastructure, and climate resilience.

Between 1950 and 2022, 115 investment accelerations occurred across 59 EMDEs. During these episodes:

- Investment growth rose from 3% to over 10% annually.

- Per capita GDP growth doubled.

- Productivity growth quadrupled.

But these episodes have become rarer. Nearly half of EMDEs experienced accelerations in the 2000s. Between 2010 and 2022, only 23% did.

The Case for Reform Packages

The core finding is that investment accelerations are rarely accidental. They emerge from coordinated policy packages:

- Macroeconomic stabilisation

- Trade and financial integration

- Product market reforms

- Institutional strengthening

Individually, structural reforms boost private investment by between 1% and 2% cumulatively for three years. Implemented together, they significantly increase the probability of an investment acceleration by more than 10% points.

Public investment quality also matters. Growth payoffs are 50% higher in countries with strong fiscal space and efficient public investment management.

FDI delivers nearly three times the growth boost in countries with strong institutions and human capital.

The evidence is clear: coordinated reforms create multiplier effects.

Reigniting Investment Momentum

Policy priorities crystallise into three layers:

- Domestic Reform Imperatives

- Restore macro-fiscal stability

- Improve business climate and governance

- Strengthen public investment efficiency

- Deepen financial systems

- Invest in human capital and absorptive capacity

- Mobilising Private Capital – Private investment accounts for roughly 75% of total investment in EMDEs. Unlocking it requires predictable policy environments, reduced uncertainty, and improved contract enforcement.

- Global Cooperation – Domestic reform alone is insufficient. The report calls for:

- Predictable, rules-based trade and investment systems

- Scaled-up concessional finance

- Guarantees and technical assistance, especially for low-income and fragile states

Without global support, smaller EMDEs face structural constraints that reforms alone cannot overcome.

Path Forward – Coordinated Reform, Scaled Capital

Reigniting investment requires coordinated reform packages that stabilise macroeconomic conditions, strengthen institutions, and deepen global integration.

Public, private, and foreign investment must operate as complementary forces, not substitutes.

The priority is clear: rebuild fiscal space, improve public investment efficiency, restore investor confidence, and secure renewed international cooperation.

Without decisive action, convergence stalls. With it, EMDEs can unlock growth, jobs, and climate resilience.