South Africa’s President has issued one of the continent’s clearest signals yet to global investors: Africa’s clean energy transition is not a risk; it is a frontier opportunity.

Speaking to international stakeholders at the Abu Dhabi Sustainability Week (ADSW), he framed the continent not as a climate burden but as a renewable powerhouse, calling for scaled capital flows, regulatory reform, and accelerated partnerships to unlock Africa’s vast energy potential.

Capital Must Follow Climate Ambition

Africa holds 60% of the world’s best solar resources; however, it accounts for less than 3% of global energy investment.

That imbalance was at the centre of South African President Cyril Ramaphosa’s address at the ADSW, where he called on global investors to close the financing gap and partner with African nations in scaling clean energy infrastructure.

Speaking in an interview against the backdrop of increasing climate risks and persistent power shortages across parts of the continent, Ramaphosa positioned Africa as both vulnerable and vital to the global energy transition.

He argued that international capital must align with Africa’s development realities, not merely its emissions profile.

The appeal comes at a time when energy security, geopolitical instability, and green industrial competition are reshaping global capital allocation. For Africa, the moment could be decisive.

Africa’s Renewable Power Is Undervalued

Ramaphosa’s message was direct: Africa is not asking for charity; it is offering partnership.

He reiterated that Africa’s clean energy potential, including solar, wind, green hydrogen and battery minerals, represents one of the largest untapped investment opportunities globally.

However, financing costs remain disproportionately high, and risk perceptions continue to constrain private sector flows.

The President pointed to structural barriers, including:

- Elevated sovereign risk premiums

- Currency volatility

- Infrastructure bottlenecks

- Limited blended finance instruments

Despite contributing minimally to historic emissions, African countries face severe climate vulnerability. However, the continent is also uniquely positioned to leapfrog to renewable-led growth models if capital mobilises at scale.

Bridging The Investment Deficit

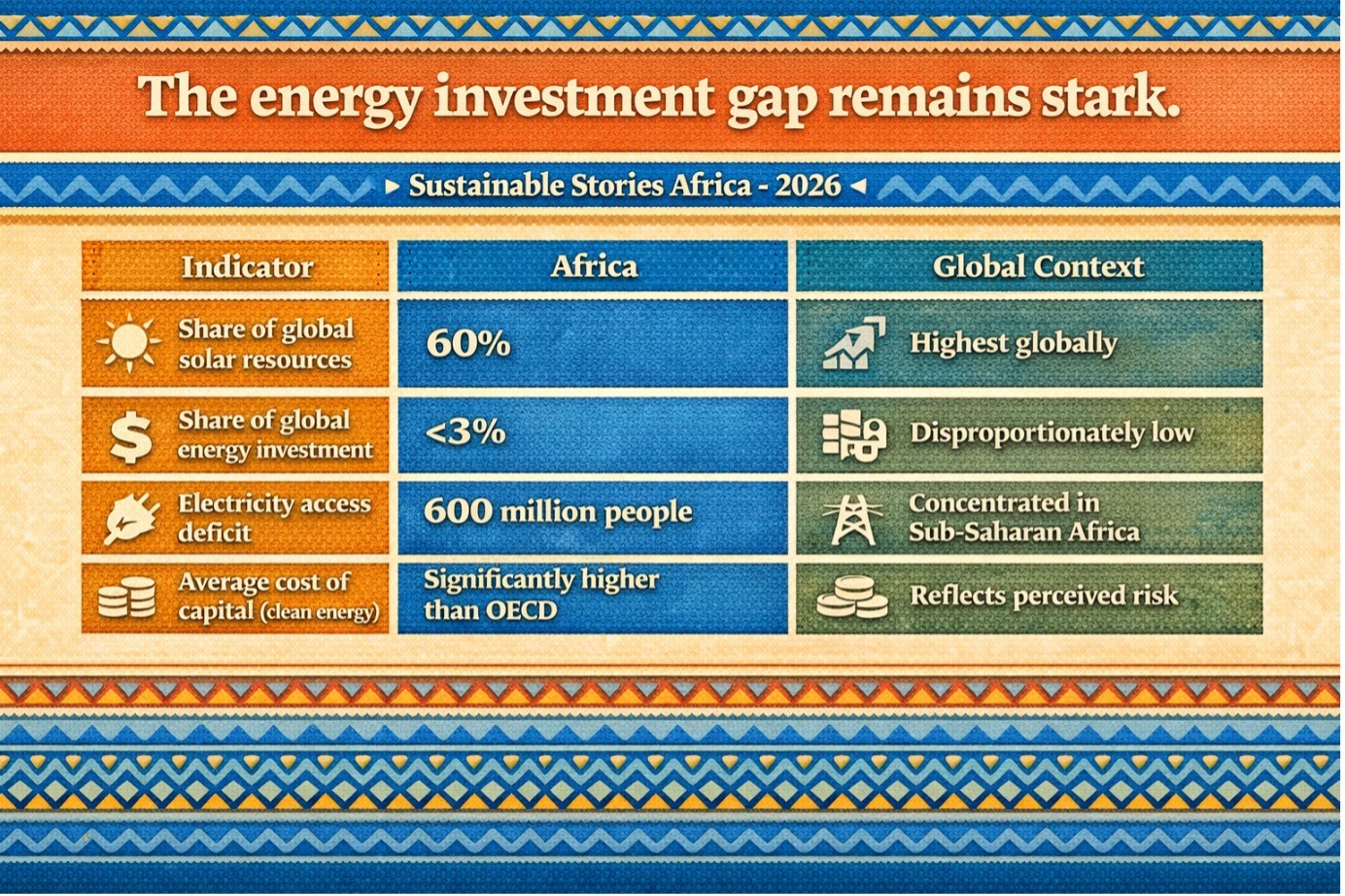

The energy investment gap remains stark.

Indicator | Africa | Global Context |

|---|---|---|

Share of global solar resources | 60% | Highest globally |

Share of global energy investment | <3% | Disproportionately low |

Electricity access deficit | 600 million people | Concentrated in Sub-Saharan Africa |

Average cost of capital (clean energy) | Significantly higher than OECD | Reflects perceived risk |

Ramaphosa emphasised that closing this gap requires:

- Scaling concessional and blended finance

- Expanding risk-mitigation mechanisms

- Strengthening regulatory frameworks

- Deepening public-private partnerships

South Africa’s own energy reforms, including accelerated renewable procurement and transmission expansion, were highlighted as part of a broader continental pivot toward structural reform.

The President framed clean energy not as climate mitigation but also an industrial strategy. From battery manufacturing to green hydrogen exports, Africa could capture greater value along emerging global supply chains, if capital flows increase.

Clean Energy As Economic Catalyst

The address moved beyond moral appeals to economic logic.

Investing in Africa’s clean energy transition, Ramaphosa argued, offers dual returns:

- Climate resilience

- Long-term growth markets

Renewables reduce fiscal exposure to volatile fossil imports. Distributed generation accelerates rural electrification. Green industrial corridors create employment and export diversification.

He positioned Africa as central to future supply chains in:

- Critical minerals

- Green hydrogen

- Low-carbon industrial production

The argument was clear: global investors seeking sustainable growth cannot overlook Africa’s demographic expansion, urbanisation trajectory, and infrastructure build-out needs.

In effect, the President reframed Africa’s energy transition as an opportunity for shared prosperity rather than a cost centre.

Investors Must Recalibrate Risk Perceptions

Ramaphosa called on development finance institutions, multilateral lenders, and private equity funds to:

- Adjust risk models

- Expand guarantee facilities

- Lower financing costs

- Support local capacity building

He stressed that African governments must also strengthen governance, transparency, and regulatory clarity to crowd in private capital.

The appeal reflects growing continental alignment around:

- Energy transition partnerships

- Regional power pools

- Market liberalisation reforms

Africa’s energy story is evolving from that of scarcity to a strategy; however, momentum depends on capital discipline and policy credibility.

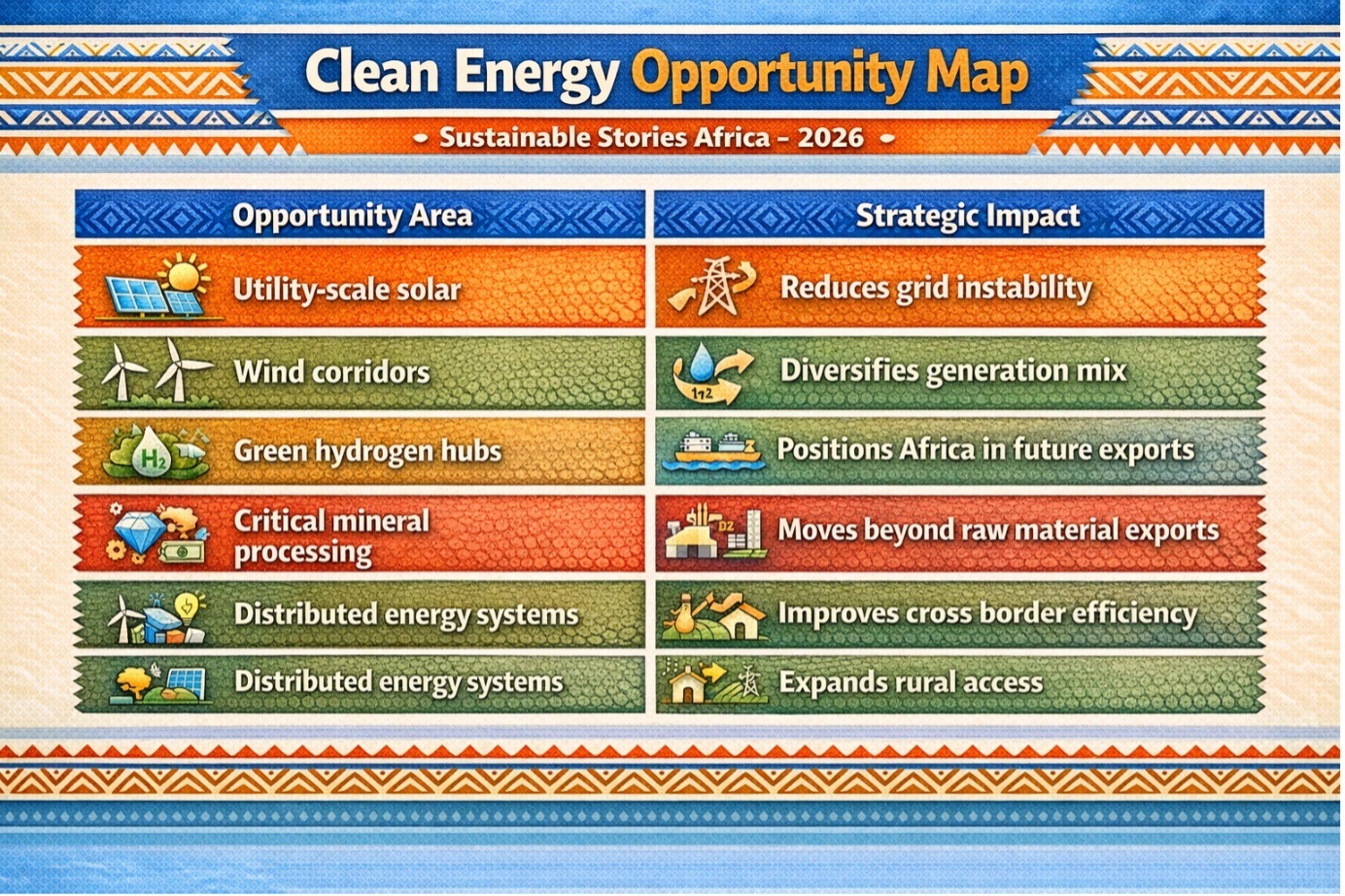

Clean Energy Opportunity Map

Opportunity Area | Strategic Impact |

|---|---|

Utility-scale solar | Reduces grid instability |

Wind corridors | Diversifies generation mix |

Green hydrogen hubs | Positions Africa in future exports |

Critical mineral processing | Moves beyond raw material exports |

Distributed energy systems | Expands rural access |

The strategic thrust is integration, aligning digital infrastructure, industrial policy, and power planning.

PATH FORWARD – Scaling Finance, Securing Reform

Africa’s clean energy future hinges on two priorities: lowering capital costs and strengthening policy credibility.

Blended finance instruments, sovereign guarantees, and multilateral partnerships must expand rapidly to close the investment gap.

Simultaneously, African governments must accelerate regulatory reform, grid modernisation, and governance transparency.

The transition will not be delivered by ambition alone; it will be unlocked by disciplined capital deployment and credible institutional frameworks.

Why This Moment Matters

Ramaphosa’s call arrives amid tightening global capital markets and intensifying geopolitical competition over energy supply chains. Africa’s leverage lies in its resources, demographics, and strategic geography.

However, without structural financing reform, the continent risks remaining resource-rich but capital-constrained.

The speech signals a broader continental narrative shift: Africa is repositioning itself not merely as a climate-vulnerable region, but as a foundational pillar of the global energy transition. The real test now is execution.