Co-financing with the World Bank reached $7.6 billion in FY2025, surpassing the Bank’s own funding for co-financed projects for the first time.

As global development finance tightens, the World Bank’s 2025 Progress Report argues that pooling capital, harmonising rules, and sharing risk are no longer optional; they are the new architecture of multilateral impact.

Co-Financing Surges Past Bank Funding – Multilateral Capital Finds New Momentum

In a year marked by fiscal strain, debt distress, and shrinking aid envelopes, co-financing has emerged as one of the most consequential instruments in global development finance.

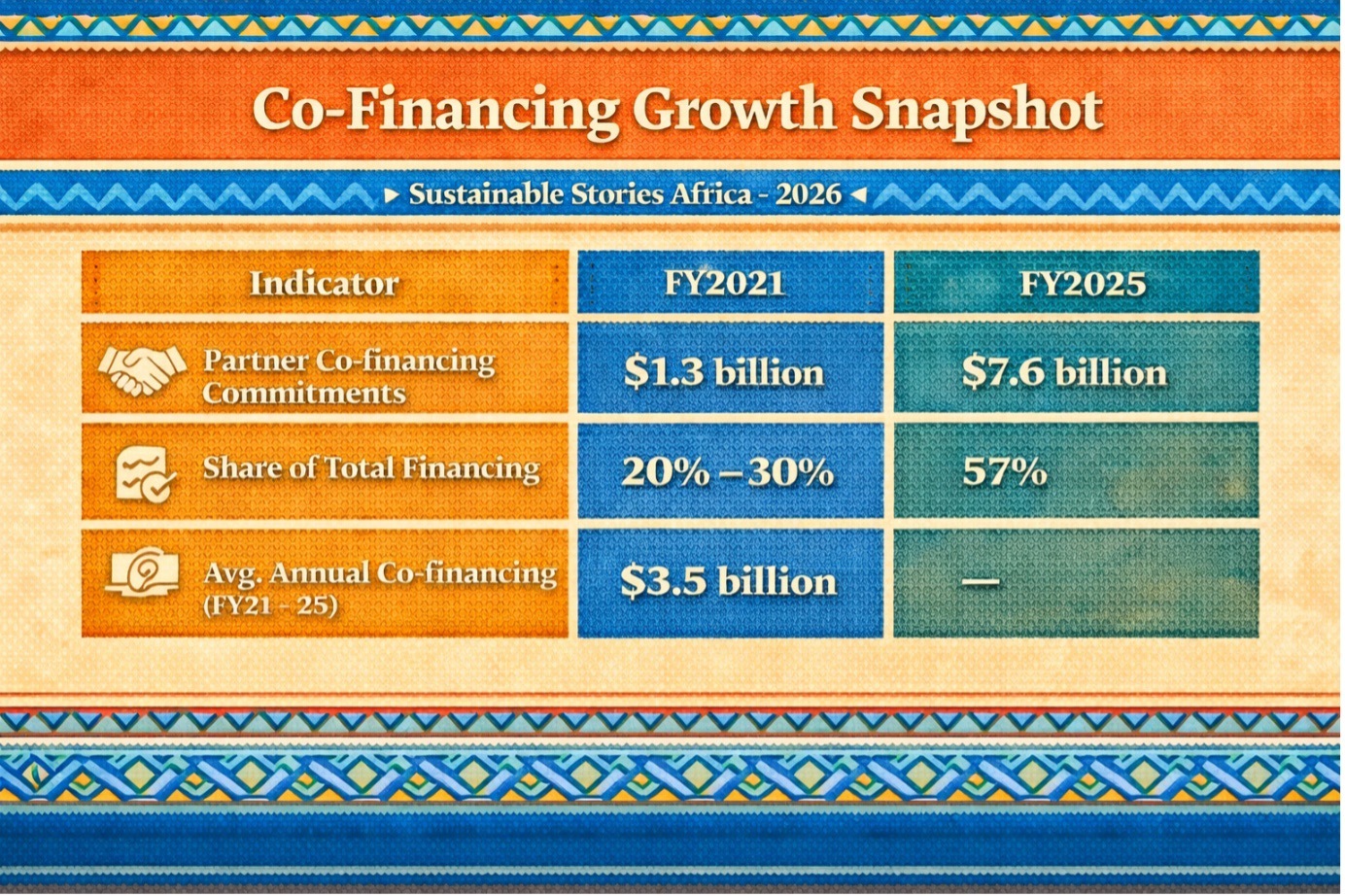

According to Building Together: Co-financing with the World Bank – Progress Report 2025, partner co-financing commitments reached $7.6 billion in fiscal year 2025, accounting for 57% of the total financing for 25 co-financed projects, surpassing the World Bank’s own $6.0 billion contribution to those projects for the first time.

Between FY2021 and 2025, co-financing averaged $3.5 billion annually, up from $2.9 billion in the previous five-year period, reflecting policy reforms, new framework agreements, and improved cost-sharing structures.

The numbers signal structural change.

When Capital Collaborates

Co-financing is not new. However, its scale, institutionalisation, and digital coordination have accelerated sharply since FY2023.

The report highlights that partner co-financing has increased by 484.61% from $1.3 billion in FY2021 to $7.6 billion in FY2025, alongside a corresponding increase in proportional weight relative to IBRD/IDA commitments.

Co-Financing Growth Snapshot

Indicator | FY2021 | FY2025 |

|---|---|---|

Partner Co-financing Commitments | $1.3 billion | $7.6 billion |

Share of Total Financing | 20% – 30% | 57% |

Avg. Annual Co-financing (FY21 – 25) | $3.5 billion | — |

The inflexion point coincided with the Bank’s revised cost-sharing framework and the formalisation of institutional agreements such as Co-financing Framework Agreements (CFAs) and Procurement Framework Agreements (PFAs).

In development finance, incentives matter.

Where the Emphasis Lies – Institutional Shift Toward MDB Collaboration

Multilateral Development Banks (MDBs) now dominate the co-financing landscape.

In FY2025, 80% of partner co-financing came from MDBs, overtaking bilateral donors.

The top five co-financiers by volume between FY2021–25 include:

- Asian Infrastructure Investment Bank (AIIB)

- Asian Development Bank (ADB)

- European Investment Bank (EIB)

- Inter-American Development Bank (IADB)

- Agence Française de Développement (AFD)

Sectoral Concentration

Over five years, 57% of co-financing commitments ($9.9bn) flowed into:

- Energy & Extractives

- Transport

- Health, Nutrition & Population

Infrastructure-heavy sectors dominate, precisely where scale and risk-sharing are most critical.

Regional Distribution

Africa and Europe & Central Asia received the largest volumes:

- Europe & Central Asia: $4.9bn (28%)

- Africa: $4.3bn (25%)

Digital Coordination – The Co-Financing Portal

In April 2024, the Bank and nine MDBs launched the Global Collaborative Co-financing Platform.

As of August 2025:

- 158 projects listed

- $110 billion in financing needs

- 17 projects worth $17 billion matched to co-financiers

The Portal functions as a secure digital marketplace, reducing information asymmetry and transaction costs.

Coordination, once fragmented, is now digitised.

Country Impact Stories

The report grounds data in tangible outcomes.

- Mozambique: Climate Resilience – Following Cyclones Idai and Kenneth, a joint $250 million package (World Bank, Netherlands, KfW) rebuilt Beira’s infrastructure, blending flood barriers and mangrove restoration.

- OMVG Interconnection Project – Eight co-financiers mobilised $700 million to connect The Gambia, Guinea, Guinea-Bissau, and Senegal, bringing electricity to 2.5 million households and businesses.

- Indonesia Health Systems Strengthening – Four co-financiers mobilised $4 billion, with procurement packages worth $700 million launched within 10 months.

Co-financing is not abstract. It delivers infrastructure, resilience, and public services at a faster rate.

Policy Architecture – Making Collaboration Easier

Three reforms underpin recent growth:

Framework Agreements (CFAs & PFAs) – Corporate-level agreements streamline procurement, supervision, and safeguards across partners.

Full Mutual Reliance Framework (FMRF) – With ADB, enabling reliance on a single set of operational policies.

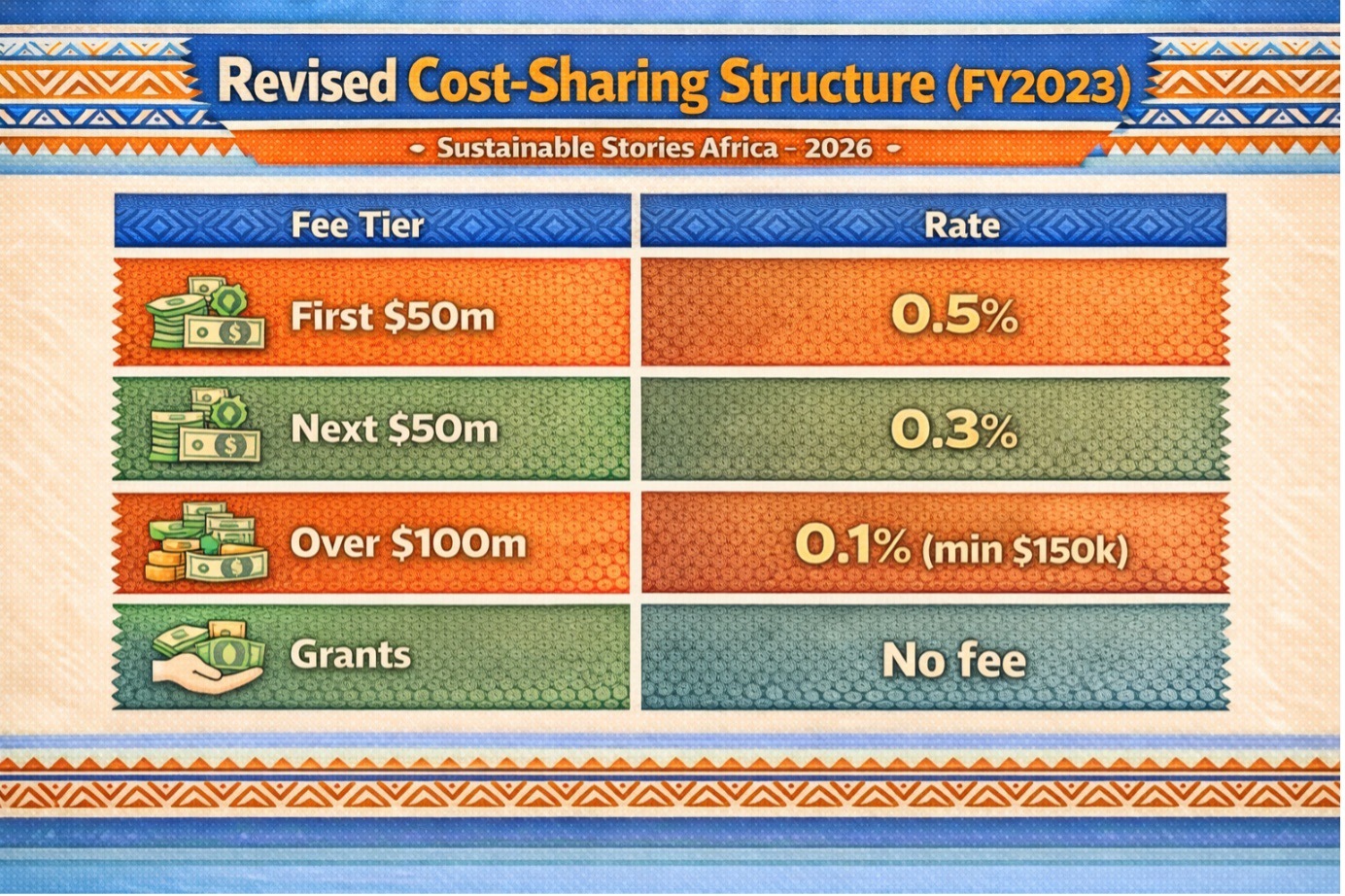

Revised Cost-Sharing Structure (FY2023)

Fee Tier | Rate |

|---|---|

First $50m | 0.5% |

Next $50m | 0.3% |

Over $100m | 0.1% (min $150k) |

Grants | No fee |

Lower fees incentivised concessional participation.

Institutional friction declined.

Mission 300: Energy as a Coalition

Under Mission 300, the Bank and AfDB aim to deliver electricity access to 300 million people in Sub-Saharan Africa by 2030.

As of early 2025:

- 12 African Heads of State launched National Energy Compacts

- $6 billion in new pledges announced

- 35 World Bank projects seeking ~$7 billion in co-financing

Energy access is increasingly financed as a coalition effort.

Multilateralism Recalibrated

The 2025 report frames co-financing as a pragmatic response to the constrained global liquidity.

By harmonising rules, delegating supervision, pooling risk, and leveraging digital coordination, the Bank and its partners are building scale without increasing fragmentation.

In an era of constrained budgets, cooperation becomes a multiplier.

The next frontier lies in multiphase programming approaches (MPAs), including $25.6 billion in active programs across Eastern and Southern Africa, relating to energy, healthcare, food systems, and digital connectivity.

Co-financing has moved from experiment to a structural pillar.

Path Forward – Scale, Simplify, Systematise

The World Bank and its partners are prioritising deeper framework agreements, expanded digital matchmaking through the Co-financing Portal, and greater use of multiphase programming to align long-term capital flows.

If sustained, this architecture can reduce aid fragmentation, crowd in concessional finance, and anchor job-creating infrastructure, ensuring multilateral capital delivers measurable impact at scale.