Africa's private capital industry is making visible progress on gender diversity. Women now represent 44% of the workforce and 38% of investment teams, outperforming many global peers. However, representation drops sharply in the rooms where capital decisions are made.

Women Rising, Power Still Skewed

Africa's private capital ecosystem is experiencing a quiet yet significant transformation in gender. From Lagos to Nairobi, women are increasingly visible in investment teams, boardrooms, and leadership pipelines, challenging long-standing norms in one of the continent's most influential industries.

New data from the African Private Capital Association (AVCA) reveal that women now make up 44% of the total workforce and 38% of investment professionals across African private equity, venture capital, and infrastructure firms, figures that exceed global averages in Asia and Europe.

However, beneath the surface of this progress lies a more complex reality. As firms grow larger and capital pools expand, female representation declines sharply, especially in investment committees and executive leadership.

While Africa leads emerging markets in gender-balanced senior management, decision-making power remains disproportionately male-dominated. The continent's gender story in private capital is no longer about access; it is about influence.

Gender Gains, Leadership Gaps Persist

Africa is outperforming most emerging markets in gender diversity in private capital.

According to AVCA's 2026 report, women account for:

- 44% of the total workforce

- 38% of investment professionals

- 33% of investment committee members

- 32% of board directors

This compares favourably with global benchmarks, where only 12% of investment committee members and 21% of board directors are women.

However, the numbers reveal a troubling pattern: representation declines with seniority and scale. Only 18% of African private capital firms are led by female CEOs, closely reflecting global averages.

As firms manage larger assets, especially those overseeing more than $1 billion in value, female representation in investment committees drops to just 19%. These are the institutions controlling the largest pools of capital, shaping Africa's investment priorities and determining which businesses scale.

Progress, yes. Power parity, not yet.

Smaller Firms Lead Inclusion

Firm size matters and not in the way many might expect.

Smaller private capital firms in Africa show significantly higher female representation:

- Firms with fewer than five employees report 50% women in investment teams

- Women hold 44% of investment committee seats in these firms

By contrast, in firms with over 50 employees:

- Female investment team representation falls to 34%

- Investment committee representation drops to 26%

The pattern repeats when analysed by assets under management. Firms managing less than $50 million report 42% female investment committee membership. That figure collapses to 19% in billion-dollar firms.

These disparities matter because larger firms control the lion's share of capital. When women are excluded from decision-making at scale, capital allocation patterns also skew, often away from women-led enterprises.

In Africa's private capital ecosystem, inclusion is strongest where power is weakest.

Venture Capital Outperforms Other Asset Classes

Not all investment strategies are equal when it comes to gender diversity. Venture capital (VC) stands out as the most inclusive asset class:

- 45% of entry-level investment staff are women

- 44% of middle managers are women

- 35% of senior leaders are women

This narrow ten-point decline across career levels suggests VC firms retain female talent more effectively than other strategies.

By contrast, infrastructure and private debt funds show the steepest drop-offs. In infrastructure:

- Women comprise 59% of non-managerial staff

- Only 9% of senior leaders

Private equity and generalist funds also mirror this attrition, with female representation falling sharply as careers progress. Capital-intensive strategies appear to replicate legacy networks and male-dominated leadership pipelines, limiting women's advancement into influential roles.

Africa Leads Emerging Markets

Despite internal disparities, Africa outperforms its emerging-market peers.

One in three private equity firms and nearly two in five venture capital firms in Africa have gender-balanced senior management teams. No other emerging region matches this performance.

In South Asia, for example, just 22% of private equity firms and 0% of venture capital firms meet the same threshold. Latin America and Eastern Europe also lag significantly behind.

Africa's relative strength suggests the continent has already built a solid foundation for gender inclusion. The challenge now is deepening that progress, especially in decision-making roles.

Where Women Lead, Capital Follows

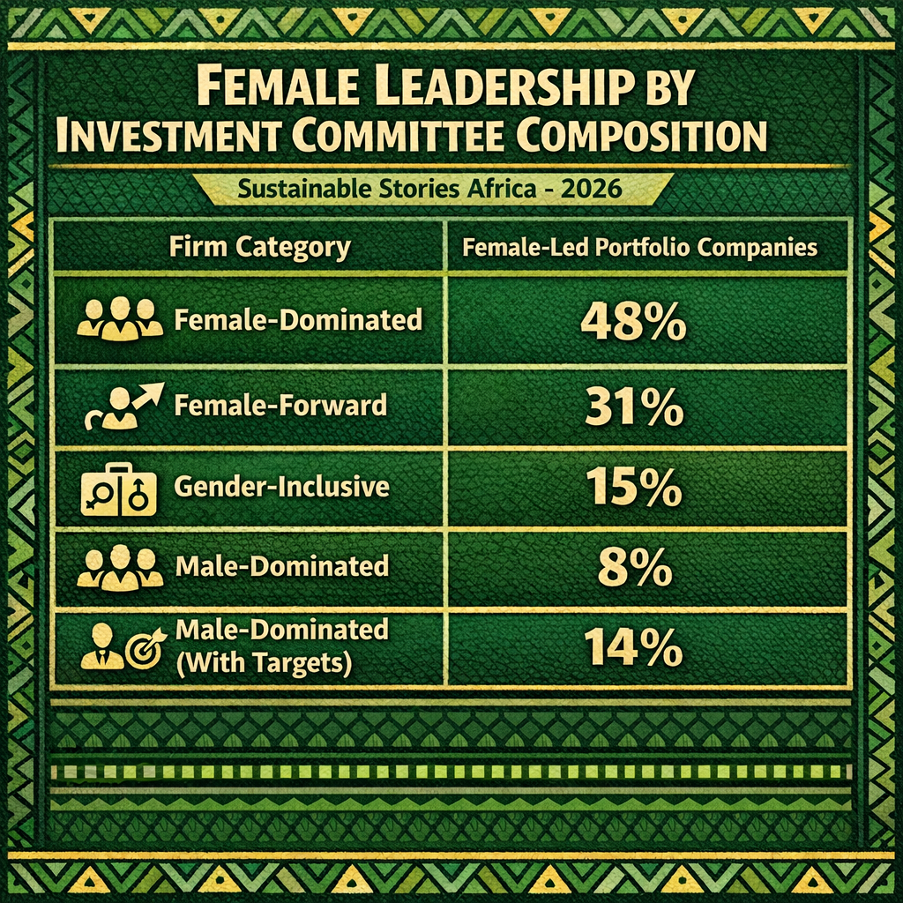

Leadership composition shapes capital flows.

Firms with majority-female investment committees back six times more women-led companies than male-dominated firms:

- Female-dominated firms: 48% of portfolio companies are female-led

- Male-dominated firms: just 8%

When firms introduce targets for measurable gender diversity, the impact improves.

In male-dominated firms, the share of female-led portfolio companies jumps from 1% to 14%.

However, only 22% of male-dominated firms have such targets.

The implication is clear: representation alone is not enough. Intentionality drives outcomes.

Female Leadership by Investment Committee Composition

| Firm Category | Female-Led Portfolio Companies |

|---|---|

| Female-Dominated | 48% |

| Female-Forward | 31% |

| Gender-Inclusive | 15% |

| Male-Dominated | 8% |

| Male-Dominated (With Targets) | 14% |

When firms introduce targets for measurable gender diversity, the impact improves. In male-dominated firms, the share of female-led portfolio companies jumps from 1% to 14%. However, only 22% of male-dominated firms have such targets.

Intentionality drives outcomes.

Female Leadership by Investment Committee Composition

(See table above)

Performance Rewards Inclusion

Gender-diverse leadership is not just equitable; it is profitable.

From 2023 to 2024:

- Female-led companies grew revenues by 32%

- Male-led companies grew by 14%

Female-founded firms also outperformed:

- 18% revenue growth vs 5% for male-founded peers

Women-led companies employ more women, too:

- Female-founded firms: 52% female workforce

- Male-founded firms: 30%

This "lift effect" mirrors global trends, where female leadership correlates with more inclusive hiring, stronger performance, and improved organisational culture.

In Africa's private capital ecosystem, gender diversity is increasingly a commercial advantage—not just a social objective.

The Portfolio Company Gender Gap

Despite progress at the fund level, women remain marginalised among funded entrepreneurs.

Between 2015 and mid-2025, private capital investors deployed over $50 billion across 3,475 deals in Africa. However:

- Only 7% of portfolio companies are female-founded

- Just 12% are led by female CEOs

- 79% are male-founded

- 88% led by male CEOs

The disconnect is stark. Africa's private capital firms may employ women internally, but capital allocation remains overwhelmingly skewed towards males.

Early-Stage Entry, Late-Stage Exit

Women are most visible at the venture capital stage. Nearly 60% of female-led and female-founded companies receive funding at the VC stage. But representation collapses as firms scale:

- Only 36% of female-founded firms reach private equity

- Less than 2% enter infrastructure or real estate

Structural barriers intensify as capital becomes more conservative:

- Network asymmetries

- Risk perception biases

- Gendered assumptions about scale

Africa's challenge is not attracting women into entrepreneurship; it is keeping them funded as businesses grow.

Geography Shapes Opportunity

West Africa leads the continent:

- 39% of female-founded companies

- 31% of female-led firms

East Africa follows with a stronger representation of female CEOs. Southern Africa, despite its large investment market, underperforms in areas of gender inclusion. North Africa and multi-region firms show the weakest outcomes, constrained by labour participation gaps and capital access barriers.

Regional ecosystems matter. Where gender-lens investors and accelerators cluster, women thrive.

Sector Matters Too

Women dominate consumer-facing sectors:

- Consumer goods

- Hotels and leisure

- Retail

But remain nearly absent from:

- Energy

- Telecoms

- Industrial goods

- Infrastructure

Technology offers a rare exception: more women serve as CEOs than founders, suggesting that investors are recruiting women into leadership, but not funding them early enough.

Africa's gender inclusion challenge is sector-specific, capital-intensive, and deeply structural.

What Must Change Now

Africa's private capital industry stands at a crossroads. The continent leads emerging markets in gender diversity. Women are entering investment firms, shaping teams, and proving their commercial value. But power remains uneven, especially in:

- Investment committees

- Executive leadership

- Capital allocation decisions

If Africa wants inclusive growth, it must move from representation to reimagination:

- Set measurable gender targets

- Diversify investment committees

- Fund women beyond the startup stage

- Reform risk perception frameworks

- Expand sector access for female founders

Gender-smart capital is no longer a niche; it is a competitive advantage.

PATH FORWARD – Power, Policy, Purpose, Parity, Performance, Progress

Africa's private capital ecosystem must institutionalise gender inclusion through measurable targets, diverse investment committees, and intentional funding strategies for women-led enterprises, especially beyond the venture stage.

By aligning leadership structures with inclusive objectives, investors can unlock stronger performance, broader talent pipelines, and more resilient growth outcomes across the continent.