Africa’s development future is increasingly tied to its ability to mobilise its own resources rather than rely on shrinking foreign aid.

With a $245 billion annual financing gap and declining concessional funding, the continent’s vast natural resource wealth and domestic revenue potential are emerging as the most reliable pathways to economic sovereignty.

The shift marks a structural turning point: Africa’s natural capital, tax systems, and financial governance will determine whether the continent achieves sustainable development or remains constrained by external dependency.

Africa’s Resource Sovereignty Shapes Development Future

Africa is entering a decisive phase in its development trajectory. The era when foreign aid and concessional finance dominated the continent’s economic model is coming to an end.

In its place, a new paradigm is emerging, one driven by domestic resource mobilisation, institutional reform, and strategic management of natural wealth. This is according to the Brookings Foresight Africa 2026 report, Pages 46-65.

This transition is unfolding against a stark backdrop. Sub-Saharan Africa faces an annual financing gap of at least $245 billion, reflecting the widening gulf between development needs and available capital. At the same time, official development assistance is falling sharply, declining by 9% in 2024 and projected to drop by a further 9% – 17% in 2025.

However, Africa holds unprecedented economic potential. Its natural resource wealth exceeds $6 trillion, positioning the continent to finance its own development, if governance systems, industrial strategies, and financial policies align effectively.

Africa’s future will not be determined by resource abundance alone, but by how effectively those resources are mobilised and managed.

Africa’s Financing Model Is Fundamentally Changing

Africa’s traditional development financing model is undergoing structural disruption. Foreign aid is declining, borrowing costs are rising, and global capital flows are becoming increasingly selective.

Debt servicing in Africa exceeded $101 billion in 2024 alone, significantly reducing investments in healthcare, infrastructure, and education. Meanwhile, global interest rate increases have sharply reduced access to affordable external financing.

The implications are profound. Africa can no longer rely primarily on external financing to sustain its development trajectory.

Instead, domestic resource mobilisation has become the continent’s most critical economic imperative.

The report highlights that Africa’s domestic savings rate remains below 20% of GDP, far below the 30% investment rate required to sustain development and industrialisation.

This structural financing deficit demands a new approach: Africa must increasingly finance its own future.

Africa’s Untapped Resource Wealth Offers Financing Opportunity

Africa’s natural resource wealth represents its largest untapped financing opportunity. The continent holds over $6 trillion in natural capital, especially renewable and non-renewable resources, including minerals, forests, oil, and gas.

Critical minerals alone could generate potential revenues of nearly $2 trillion over the next 25 years, driven by global demand for lithium, cobalt, copper, and nickel, which are essential for the energy transition.

Africa also holds:

- 30% of global critical mineral reserves

- 7.2% of global oil reserves

- 7.5% of global natural gas reserves

- Massive renewable energy potential capable of supplying over 80% of new generation capacity

However, much of this wealth remains underutilised due to structural constraints, including weak governance, limited industrial processing capacity, and unfavourable resource contracts.

The result is a persistent paradox: resource-rich economies constrained by financing shortages.

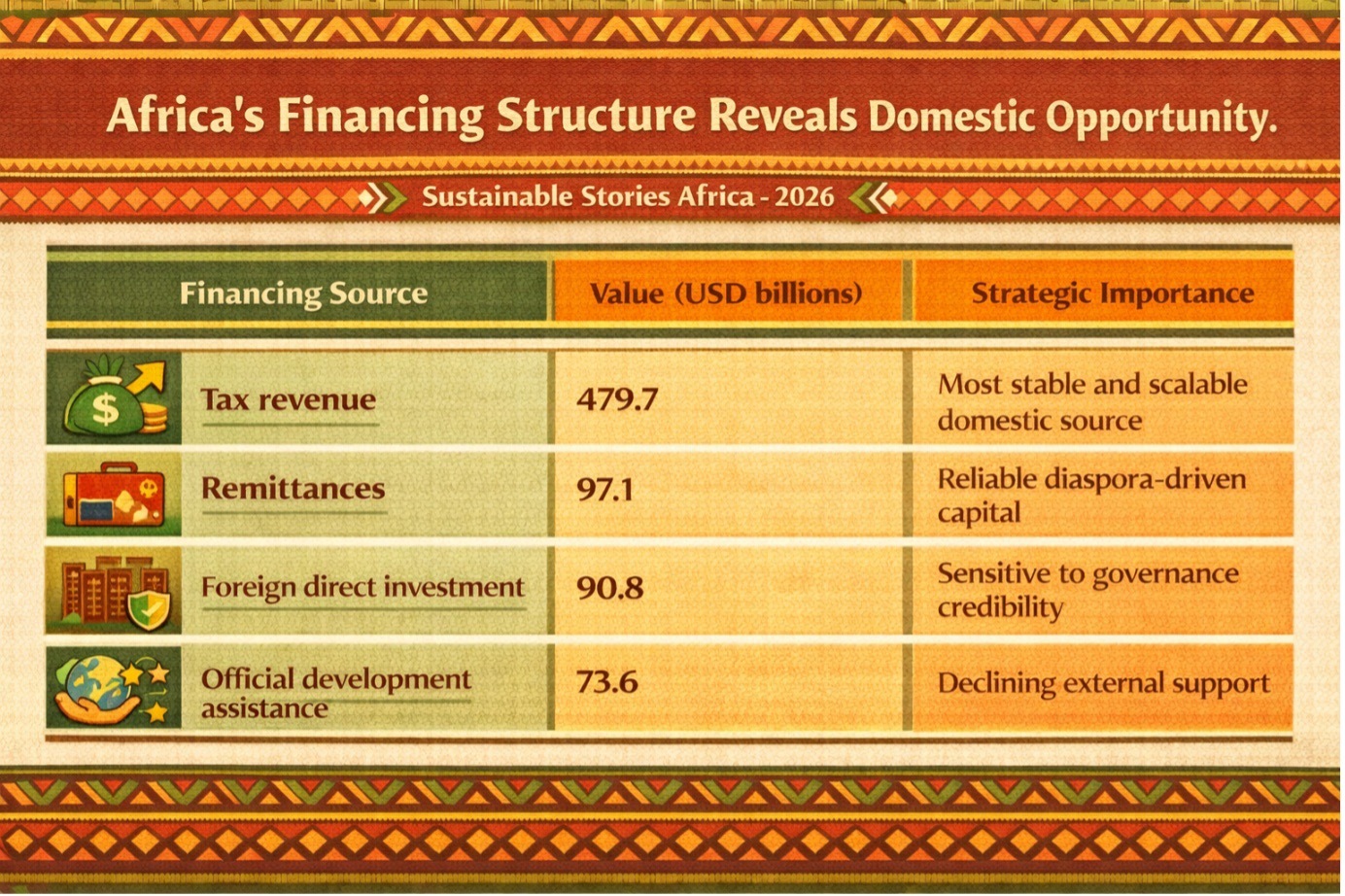

Africa’s Financing Structure Reveals Domestic Opportunity

Financing Source | Value (USD billions) | Strategic Importance |

|---|---|---|

Tax revenue | 479.7 | Most stable and scalable domestic source |

Remittances | 97.1 | Reliable diaspora-driven capital |

Foreign direct investment | 90.8 | Sensitive to governance credibility |

Official development assistance | 73.6 | Declining external support |

Tax revenue already exceeds foreign aid by more than six times, underscoring the central role of domestic financing.

Domestic Resource Mobilisation Unlocks Financial Independence

Africa’s development future depends on strengthening its domestic financing capacity. Improved tax collection alone could generate an additional $94 billion over five years by strengthening governance and broadening the tax base.

Curbing illicit financial flows offers even greater potential. Africa loses approximately $90 billion annually due to tax avoidance and financial leakages, highlighting the critical role of governance reform.

Harnessing natural resource wealth also presents transformative opportunities. By moving up the value chain and processing minerals locally, African countries can capture greater economic value, create jobs, and strengthen industrial capacity.

The potential economic gains are substantial:

- Increased export revenues

- Industrial development

- Job creation

- Fiscal stability

- Reduced reliance on foreign financing

Strategic resource management can transform Africa from a resource exporter into a value-creating industrial powerhouse.

Strategic Resource Governance Must Drive Transformation

Africa’s resource wealth alone will not guarantee development. Effective governance, industrial policy, and financial management will determine whether resources translate into prosperity.

Key strategic priorities include:

- Strengthening Tax Systems – Broadening tax bases, improving compliance, and reducing corruption can significantly expand government revenues.

- Negotiating Fair Resource Contracts – Transparent and equitable agreements can ensure Africa captures appropriate value from resource extraction.

The mining sector alone loses $470–$730 million annually due to profit shifting and tax avoidance.

- Developing Sovereign Wealth Funds – Africa’s sovereign wealth funds currently manage approximately $100 billion in assets. Expanding and strengthening these funds can stabilise economies and finance long-term development.

- Investing in Value Addition – Local processing of minerals and resources can dramatically increase economic returns and industrial growth.

- Implementing Dual Energy Strategies – Combining fossil fuel development with renewable energy investment offers a pragmatic pathway toward sustainable growth and energy transition.

This strategic shift represents a critical opportunity to transform Africa’s economic future.

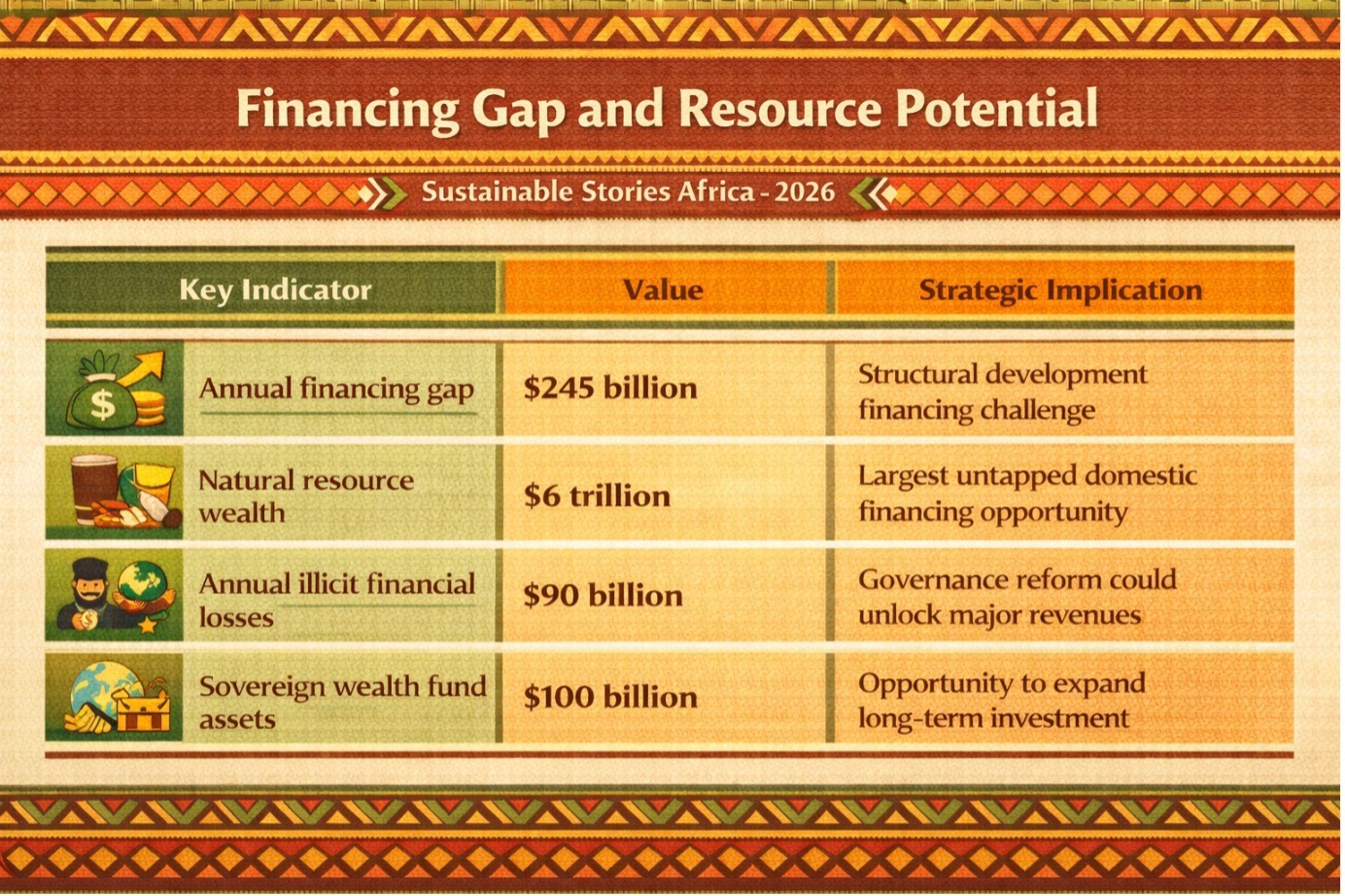

Financing Gap and Resource Potential

Key Indicator | Value | Strategic Implication |

|---|---|---|

Annual financing gap | $245 billion | Structural development financing challenge |

Natural resource wealth | $6 trillion | Largest untapped domestic financing opportunity |

Annual illicit financial losses | $90 billion | Governance reform could unlock major revenues |

Sovereign wealth fund assets | $100 billion | Opportunity to expand long-term investment |

Path Forward – Resource Governance Drives Financial Sovereignty

Africa’s development future increasingly depends on its ability to mobilise domestic resources, strengthen governance systems, and capture greater value from its natural wealth.

Resource sovereignty has become the foundation of economic independence.

By aligning governance reform, industrial strategy, and financial management, African countries can unlock sustainable financing, accelerate development, and build resilient economies capable of shaping their own future.