Private equity, infrastructure capital and alternative assets are rapidly reshaping global finance as traditional portfolio models falter under inflation, geopolitical volatility and rising interest rates.

Investors are pivoting toward infrastructure, digital assets and private credit to protect returns and unlock growth.

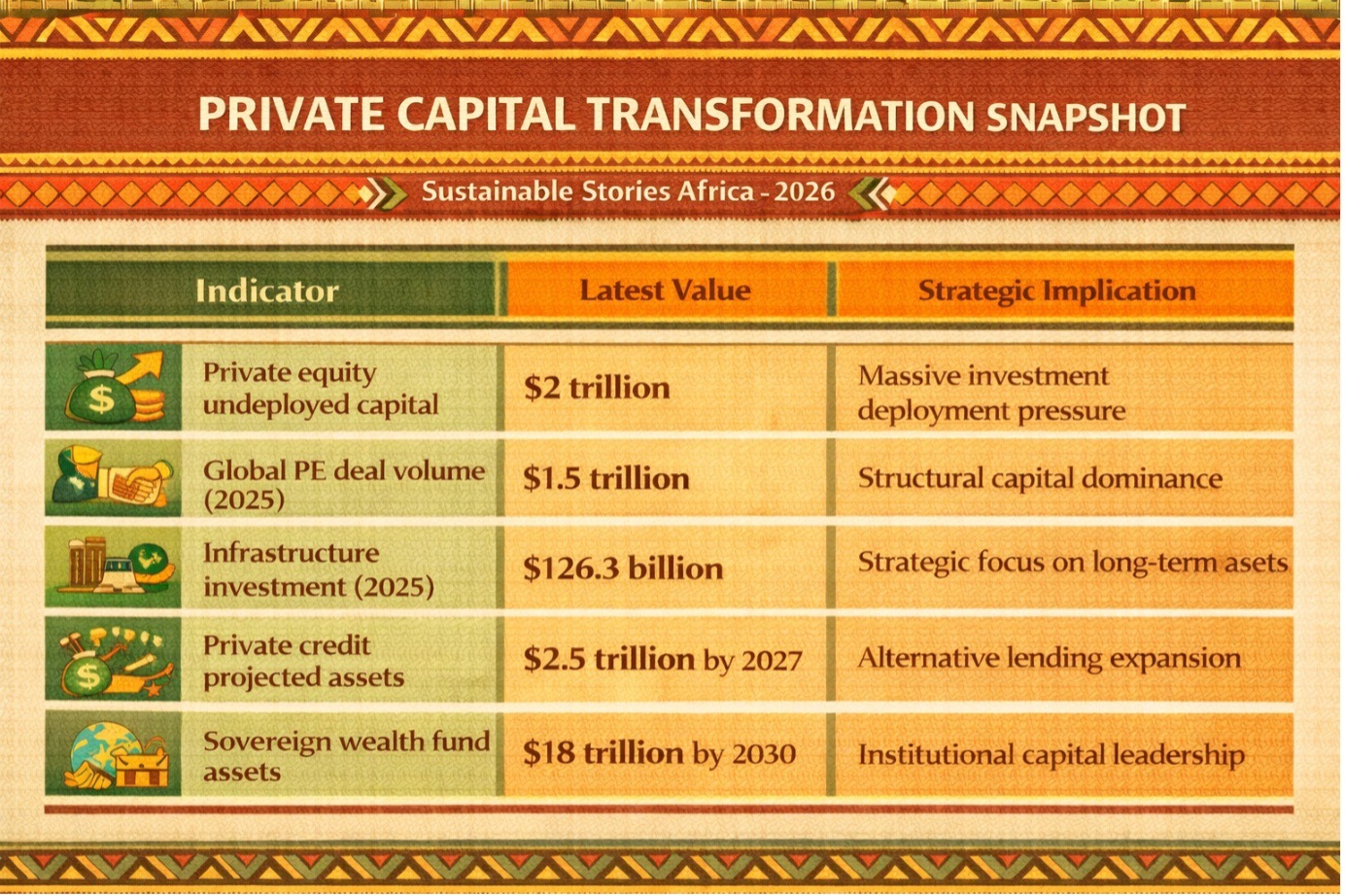

With over $2 trillion in undeployed private equity capital and global deal values approaching $1.5 trillion, a new financial regime is emerging, one defined by strategic exits, sovereign wealth partnerships and structural portfolio transformation.

Capital shifts redefine global finance dynamics

Global finance is undergoing a structural transformation as institutional investors abandon traditional portfolio strategies and reposition capital toward infrastructure, private equity and alternative assets.

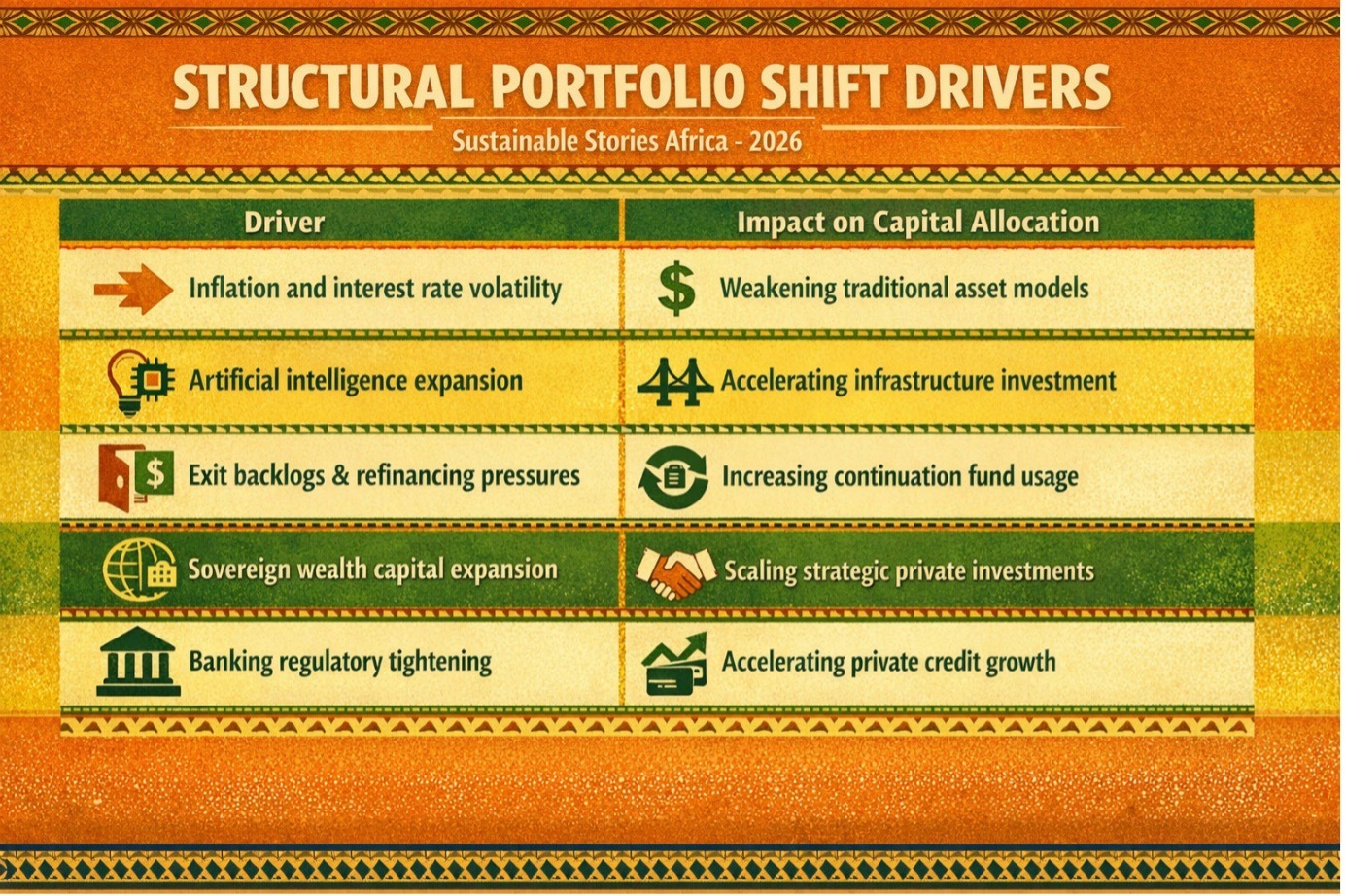

Inflation shocks, geopolitical fragmentation and technological disruption have exposed the limitations of legacy allocation models, forcing investors to rethink risk, liquidity and long-term value creation.

Private equity firms alone held approximately $2 trillion in undeployed capital by late 2025, intensifying pressure to deploy funds strategically. Lending backlogs and refinancing pressures reshaped portfolio management priorities.

At the same time, private capital is flowing into digital infrastructure, energy transition and artificial intelligence-linked assets, signalling the emergence of a new investment era driven less by passive diversification and more by active structural repositioning.

Private capital drives unprecedented strategic repositioning

Private capital is rapidly becoming the dominant force reshaping global corporate finance. Faced with inflation, rising interest rates and volatile equity markets, investors are abandoning traditional asset allocation strategies in favour of private equity, infrastructure and alternative investments.

Global private equity deal volume reached $1.5 trillion across the first three quarters of 2025, despite a decline in overall deal count, highlighting a decisive shift toward fewer but larger strategic transactions.

This transition reflects a broader structural reality: capital is no longer chasing market beta; it is pursuing strategic control, infrastructure ownership and long-term structural value creation.

Portfolio strategies pivot amid structural market volatility

Traditional investment models are under unprecedented pressure. The long-standing 60/40 portfolio framework, once an essential for stable returns for decades, has weakened under inflation shocks and rising interest rates, forcing investors toward diversified multi-asset strategies.

Private credit is emerging as a significant replacement for traditional bank lending, with global private credit assets projected to exceed $2.5 trillion by 2027.

Private equity firms are simultaneously accelerating portfolio monetisation strategies. Exit backlogs, prolonged holding periods and elevated financing costs have led to increased use of continuation funds, which accounted for $41 billion in exits in just the first half of 2025, representing 19% of all industry sales.

Infrastructure investment has also become a central pillar of capital allocation, with private equity investment in infrastructure and transport reaching $126.3 billion by the third quarter of 2025.

This capital migration reflects a deeper recalibration, from liquid public markets toward illiquid, long-duration assets capable of delivering inflation protection and stable returns.

Alternative assets unlock long-term resilience opportunities

The pivot toward private capital and alternative assets is unlocking powerful structural advantages for investors and economies.

Digital infrastructure, including data centres, has attracted over $100 billion in private equity investment between 2021 and 2024, driven by the expansion of artificial intelligence and demand for cloud computing.

Sovereign wealth funds are also reshaping the investment landscape, with global sovereign assets projected to reach $18 trillion by 2030. These investors are partnering with private equity firms to fund large-scale strategic assets, from energy infrastructure to technology platforms.

The benefits extend beyond investors.

Infrastructure capital accelerates energy transition, strengthens digital connectivity and supports long-term economic resilience. Private credit fills financing gaps left by banks that are constrained by regulatory capital requirements. And private equity ownership provides operational restructuring that can revive distressed companies.

These forces collectively signal the emergence of private capital as a stabilising backbone of global economic transformation.

Strategic repositioning defines the next decade’s financial leadership

The implications for investors, policymakers and corporate leaders are profound.

Private equity firms are accelerating investments in infrastructure, digital assets and energy transition to capture structural growth opportunities. Sovereign wealth partnerships are expanding, creating new channels for large-scale deployment of capital.

Investors are adopting adaptive portfolio models that incorporate alternatives, commodities, infrastructure and real assets to hedge inflation and geopolitical volatility.

At the corporate level, distressed restructuring and opportunistic mergers and acquisitions are expected to accelerate as companies rebalance debt, optimise capital structures and reposition for long-term growth.

The message is clear: financial resilience will increasingly depend on strategic capital allocation, not passive diversification.

Those who reposition early will shape the next global economic cycle.

PRIVATE CAPITAL TRANSFORMATION SNAPSHOT

Indicator | Latest Value | Strategic Implication |

|---|---|---|

Private equity undeployed capital | $2 trillion | Massive investment deployment pressure |

Global PE deal volume (2025) | $1.5 trillion | Structural capital dominance |

Infrastructure investment (2025) | $126.3 billion | Strategic focus on long-term assets |

Private credit projected assets | $2.5 trillion by 2027 | Alternative lending expansion |

Sovereign wealth fund assets | $18 trillion by 2030 | Institutional capital leadership |

STRUCTURAL PORTFOLIO SHIFT DRIVERS

Driver | Impact on Capital Allocation |

|---|---|

Inflation and interest rate volatility | Weakening traditional asset models |

Artificial intelligence expansion | Accelerating infrastructure investment |

Exit backlogs and refinancing pressures | Increasing continuation fund usage |

Sovereign wealth capital expansion | Scaling strategic private investments |

Banking regulatory tightening | Accelerating private credit growth |

PATH FORWARD – Private capital will shape financial resilience

Private capital is rapidly becoming the backbone of global finance, driving infrastructure development, digital transformation and economic resilience.

Investors are prioritising strategic ownership, adaptive portfolios and infrastructure exposure to navigate structural volatility.

Long-term investment horizons and strategic partnerships defined by the agility of capital will drive the new wave of financial leadership. Firms that align deployment of capital with structural megatrends, including technology, energy and infrastructure, will define the global financial architecture of the coming decade.