Artificial intelligence is rapidly redefining how ESG credibility is measured, verified and trusted.

What began as a reporting exercise is evolving into a data-driven accountability system now reshaping investment flows, risk management and corporate governance worldwide.

However, the transformation carries risks. Without transparency, ethical safeguards and Africa-centric data systems, AI could deepen global credibility gaps.

The opportunity and responsibility for Africa is to shape AI-enabled ESG systems that strengthen integrity, unlock capital and reinforce sustainable growth pathways.

Artificial intelligence transforms ESG credibility globally

Artificial intelligence is rapidly emerging as the new infrastructure of ESG credibility, reshaping how sustainability performance is measured, verified and trusted.

Across global financial markets, AI is shifting ESG from narrative-driven disclosure to data-verified accountability, transforming how investors allocate capital and evaluate risk.

This transformation is accelerating at unprecedented speed. Academic research analysing 898 ESG-AI publications between 2004 and 2025 shows a sharp surge in activity after 2015, driven by technological advances and regulatory pressure for more credible sustainability reporting.

For Africa, this moment presents both opportunity and urgency. AI could help close credibility gaps, strengthen investor trust and unlock sustainable capital; however, only if governance, transparency and ethical safeguards evolve alongside technological adoption.

AI shifts ESG credibility from narratives

For decades, ESG reporting had relied heavily on corporate voluntary disclosures, inconsistently verified and vulnerable to greenwashing. Today, artificial intelligence is fundamentally altering that model.

Machine learning, predictive analytics and natural language processing are enabling real-time ESG verification using alternative data sources, including satellite imagery, transaction data and digital monitoring systems.

This shift is profound. AI enables investors and regulators to independently verify sustainability claims rather than relying solely on corporate narratives. ESG performance is becoming measurable, comparable and auditable at scale.

The pace of transformation is accelerating rapidly. Research highlights an annual growth rate of nearly 19.75% in AI-ESG research publications, highlighting the explosive expansion of AI’s role in sustainable finance decision-making.

The implications extend far beyond academic discourse. AI is becoming the credibility infrastructure underlying sustainable finance markets.

Data-driven ESG transforms investment decision-making globally

Artificial intelligence is reshaping ESG analysis across three critical financial domains: risk assessment, performance verification and investment strategy.

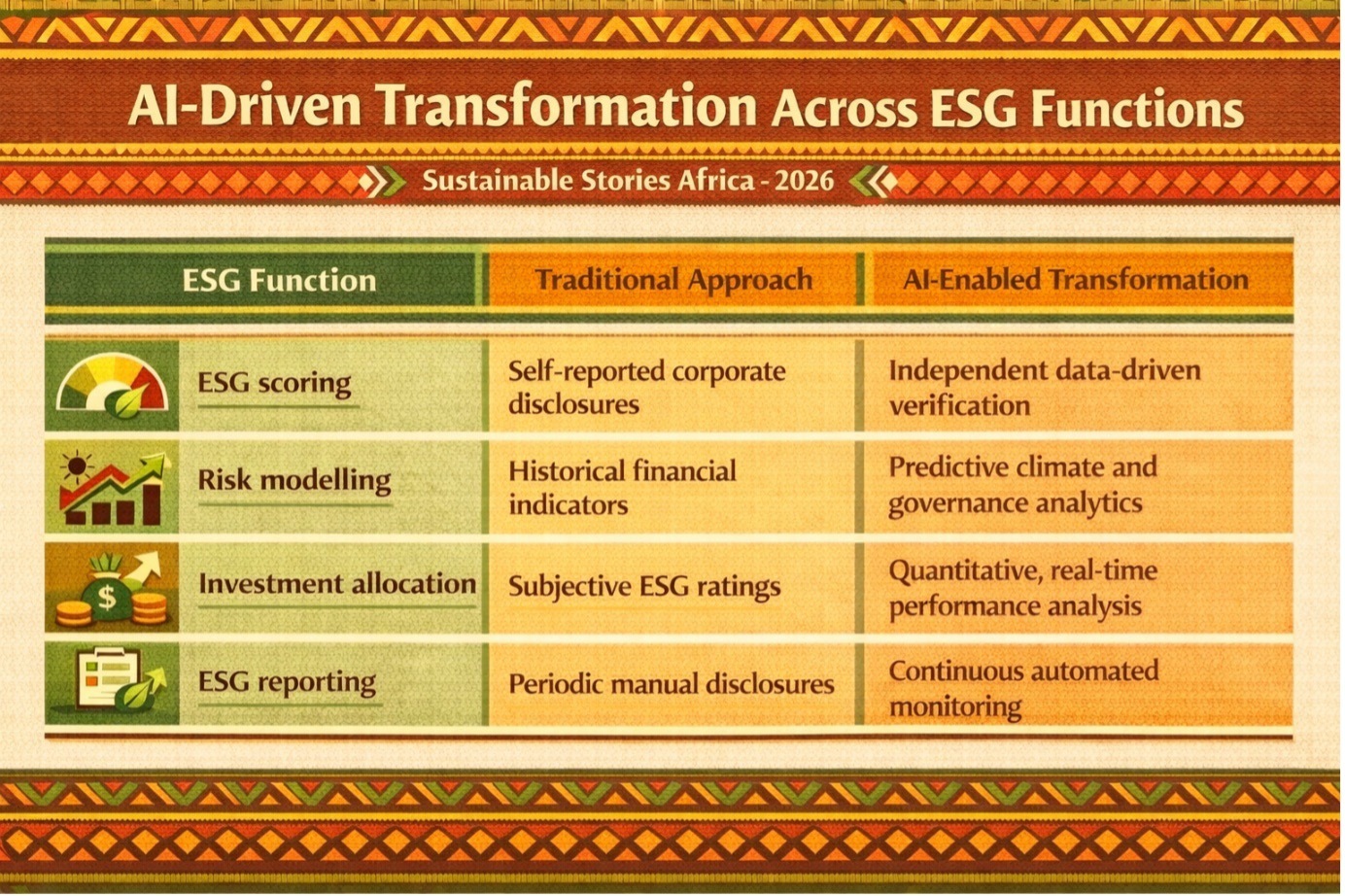

AI-Driven Transformation Across ESG Functions

ESG Function | Traditional Approach | AI-Enabled Transformation |

|---|---|---|

ESG scoring | Self-reported corporate disclosures | Independent data-driven verification |

Risk modelling | Historical financial indicators | Predictive climate and governance analytics |

Investment allocation | Subjective ESG ratings | Quantitative, real-time performance analysis |

ESG reporting | Periodic manual disclosures | Continuous automated monitoring |

AI algorithms now detect environmental violations, analyse climate risks and evaluate governance integrity using vast datasets beyond corporate reports.

Machine learning models improve the accuracy of ESG risk prediction, enhancing investor confidence and capital allocation efficiency.

Keyword analysis from ESG-AI research shows strong thematic clustering around prediction, optimisation, governance performance and sustainability management, demonstrating AI’s expanding role in ESG integration.

This shift reflects a fundamental transition, from ESG as a communication to ESG as measurable operational performance.

The implications for sustainable finance markets are significant: capital is increasingly flowing toward entities with verifiable sustainability performance.

Africa can leverage AI ESG leadership

Artificial intelligence provides Africa with a strategic opportunity to enhance its ESG credibility, attract investment and accelerate sustainable economic transformation.

AI enables emerging markets to overcome structural ESG credibility challenges by improving transparency, reducing reporting gaps and strengthening governance accountability.

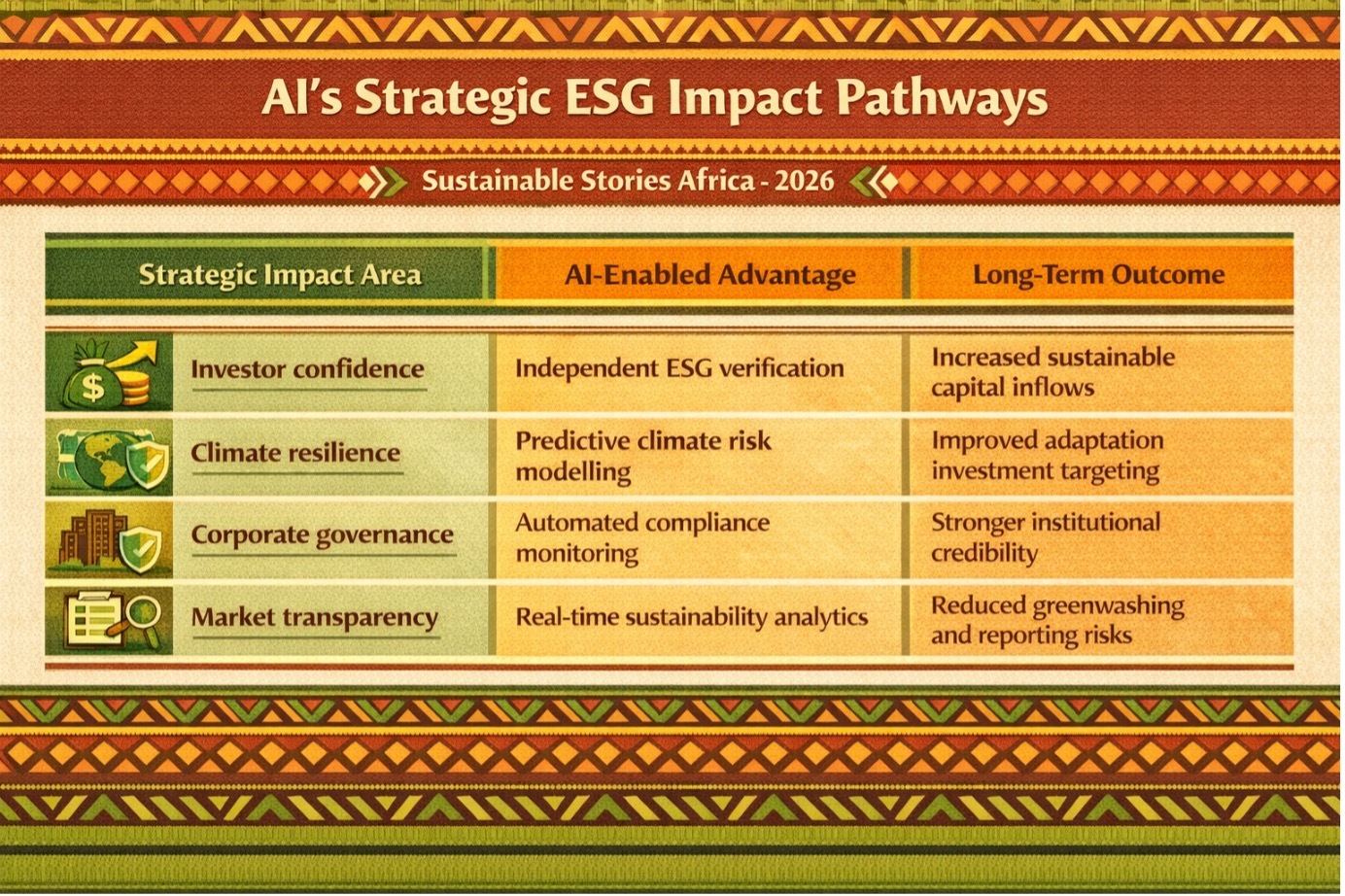

AI’s Strategic ESG Impact Pathways

Strategic Impact Area | AI-Enabled Advantage | Long-Term Outcome |

|---|---|---|

Investor confidence | Independent ESG verification | Increased sustainable capital inflows |

Climate resilience | Predictive climate risk modelling | Improved adaptation investment targeting |

Corporate governance | Automated compliance monitoring | Stronger institutional credibility |

Market transparency | Real-time sustainability analytics | Reduced greenwashing and reporting risks |

AI-enabled ESG analytics also enhance climate risk forecasting, enabling more effective infrastructure planning, investment prioritisation and resilience strategies.

For African markets competing for global sustainable capital, credibility is an increasingly decisive advantage. In the right hands, AI provides powerful tools to build and sustain that credibility.

Countries and companies that adopt AI-enabled ESG systems early will likely benefit from improved investor trust, lower capital costs and stronger global competitiveness.

Ethical governance must anchor AI ESG expansion

Despite its transformative potential, AI introduces new governance risks that must be addressed proactively.

Key challenges include:

- Data standardisation gaps

- Algorithmic bias risks

- Transparency limitations

- Ethical and accountability concerns

Researchers emphasise that transparency, explainability and ethical safeguards are essential for the responsible deployment of AI in ESG applications.

Without strong governance frameworks, AI could reinforce global inequalities by favouring markets with better data infrastructure and regulatory systems.

Africa must therefore prioritise building:

- Local ESG data infrastructure

- AI governance and regulatory frameworks

- Ethical AI deployment standards

- Institutional capacity for AI-enabled ESG verification

The opportunity is not simply to adopt global systems, but to shape Africa-centric ESG verification frameworks aligned with local realities.

PATH FORWARD – Africa must build trusted AI ESG systems

The future of Africa’s ESG credibility will increasingly depend on AI-enabled verification, governance transparency and locally relevant sustainability data systems.

Governments, regulators and institutions must invest in ESG data infrastructure, ethical AI frameworks and capacity-building to strengthen accountability and investor confidence.

By proactively shaping AI-enabled ESG ecosystems, Africa can transform credibility challenges into competitive advantages, unlocking sustainable capital, accelerating climate resilience and positioning the continent as a trusted leader in global sustainable finance.

SSA Reflection – AI is redefining ESG credibility architecture

Artificial intelligence is transforming ESG from a reporting obligation into a verifiable, measurable and investable performance framework. The shift is structural, irreversible and accelerating.

For Africa, the stakes are high, but so is the opportunity.

By embracing AI responsibly, strengthening governance and investing in transparency infrastructure, Africa can redefine its ESG credibility, unlock sustainable capital and lead in shaping the future of trusted sustainable finance.