Africa’s development future increasingly depends not on aid flows or commodity cycles, but on governance credibility, institutional integrity, and financial transparency.

As global capital becomes more restricted and aid declines, countries with stronger governance systems will attract investment, lower borrowing costs, and accelerate development.

The shift marks a significant turning point. Governance is no longer a political abstraction; it has become Africa’s most critical economic infrastructure, determining access to capital, stability, and long-term prosperity.

Governance Credibility Now Africa’s Defining Asset

Africa stands at a structural inflexion point. The continent’s economic future is no longer shaped primarily by external aid, commodity cycles, or geopolitical alignment.

Instead, governance quality, how effectively institutions manage public resources, enforce accountability, and signal financial credibility, has emerged as the central determinant of development outcomes.

This shift is unfolding as Africa faces tightening global financial conditions, declining concessional financing, and rising investment competition.

External aid is falling sharply, while sovereign borrowing costs remain elevated, forcing governments to rely more heavily on domestic resource mobilisation and private capital.

The implications are profound: institutional strength is becoming Africa’s most valuable economic asset. This is according to FORESIGHT AFRICA TOP PRIORITIES FOR THE CONTINENT IN 2026 – Pages 67-87.

Countries that can strengthen their governance systems, improve transparency, and align financial credibility with development priorities will unlock unprecedented opportunities. Countries that fail risk deeper marginalisation in global capital markets.

Governance Determines Africa’s Economic Trajectory Today

Africa’s governance moment has arrived. For decades, development strategies have centred on aid flows, external borrowing, and resource exports.

However, the global financial landscape has experienced a fundamental change.

External aid is declining sharply, with official development assistance projected to fall significantly as donor countries reprioritise domestic spending.

At the same time, more than half of Africa’s low-income countries face high debt distress risks, limiting their ability to finance development through borrowing.

This has created a new reality: institutional credibility now determines access to capital.

Credit ratings illustrate this dynamic vividly. Only three African countries currently hold investment-grade sovereign ratings, while most face punitive borrowing costs due to perceived governance and institutional risks.

This governance premium or penalty has real consequences. Africa pays billions more annually in borrowing costs than warranted by underlying fundamentals, constraining investment and slowing development.

Governance has become economic infrastructure.

Institutional Strength Drives Investment and Financial Stability

The relationship between governance and development outcomes is no longer theoretical. It is quantifiable, measurable, and increasingly decisive.

Credit ratings, for example, serve as powerful financial signals that shape investor perceptions and determine borrowing costs.

Since 2003, 34 African countries have obtained sovereign credit ratings, enabling 21 countries to raise $155 billion in Eurobonds to finance infrastructure and development.

However, the benefits remain uneven. Most African countries still face high borrowing costs due to governance perception gaps, limited data transparency, and institutional weaknesses.

Deep-rooted structural financing constraints further entrench this dynamic. Africa requires at least $245 billion annually in additional financing to meet development needs.

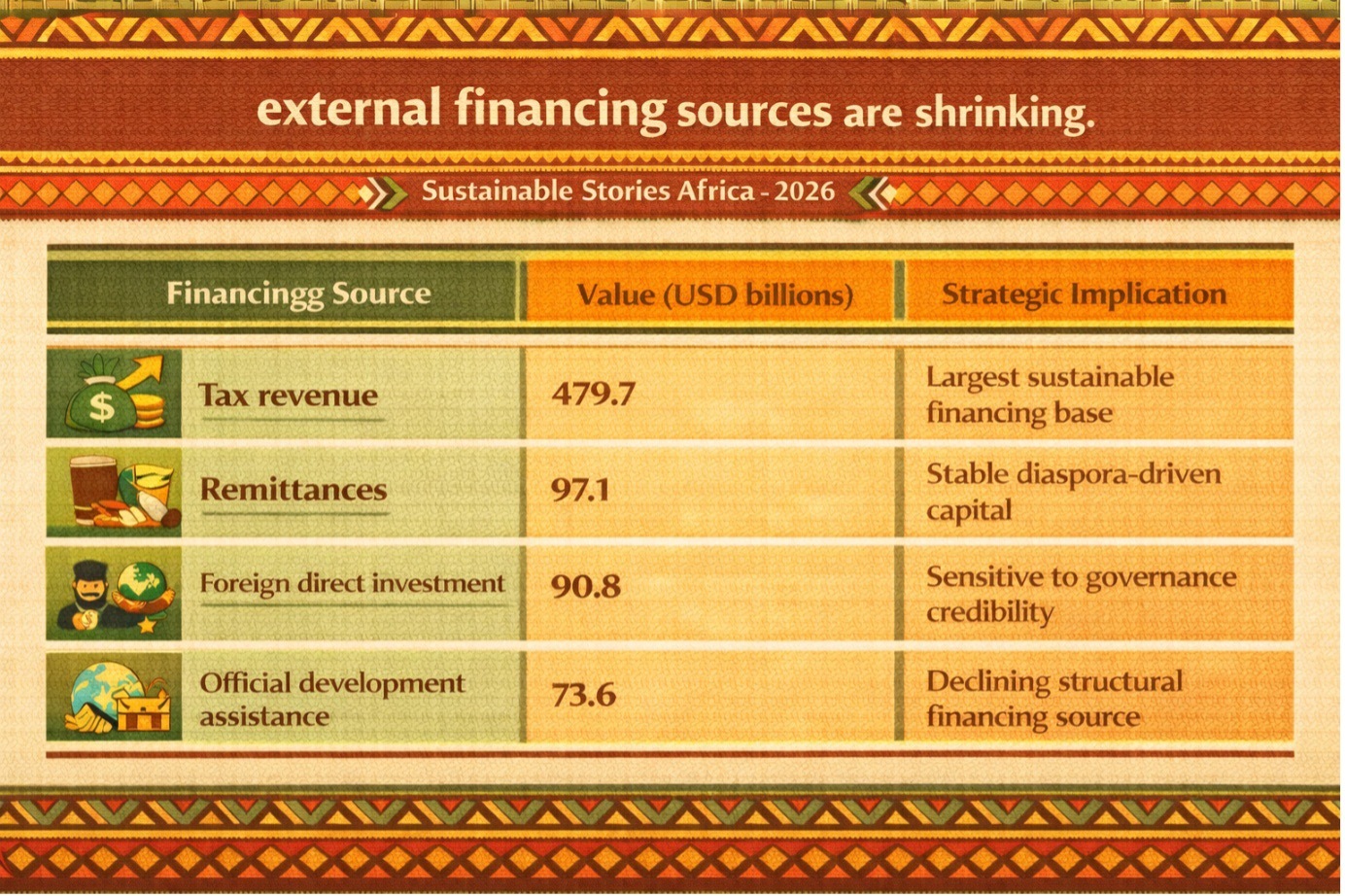

At the same time, external financing sources are shrinking:

Financing Source | Value (USD billions) | Strategic Implication |

|---|---|---|

Tax revenue | 479.7 | Largest sustainable financing base |

Remittances | 97.1 | Stable diaspora-driven capital |

Foreign direct investment | 90.8 | Sensitive to governance credibility |

Official development assistance | 73.6 | Declining structural financing source |

This hierarchy reveals a critical truth: Africa’s most reliable financing sources are those tied directly to governance performance.

Strong governance increases tax revenue, attracts investment, and reduces borrowing costs.

Weak governance undermines all three simultaneously.

Governance Reform Unlocks Africa’s Financing and Development Potential

The opportunity ahead is transformative. Governance reform offers Africa a pathway to financial independence, economic stability, and accelerated development.

Improved governance directly enhances sovereign credit ratings, reducing borrowing costs and expanding access to capital markets. Better ratings can unlock billions in financing, freeing fiscal space for infrastructure, education, and industrial development.

Governance reform also improves domestic resource mobilization. Africa currently loses approximately $90 billion annually through illicit financial flows, reflecting governance gaps in financial oversight and enforcement.

Addressing these leakages could dramatically expand development financing capacity.

Institutional reform also strengthens investor confidence. Private capital, pension funds, and sovereign investors increasingly prioritise governance transparency when allocating capital.

The result is a virtuous cycle:

- Improved governance reduces borrowing costs

- Lower borrowing costs increase investment capacity

- Increased investment accelerates development

- Accelerated development strengthens governance credibility

Governance becomes both the foundation and multiplier of economic transformation.

Africa Must Lead Its Governance Transformation Now

The path forward requires deliberate institutional strengthening, coordinated policy reforms, and strategic investment in governance infrastructure.

Priority actions include:

- Strengthening Sovereign Credit Credibility – African countries must accelerate data transparency, strengthen fiscal governance, and embed credit ratings strategies into national development plans.

- Supporting African-Led Financial Institutions – Africa Credit Rating Agency of the African Union represents a critical step toward correcting structural biases and improving financial credibility globally.

- Improving Domestic Resource Mobilisation – Enhancing tax collection efficiency, reducing illicit financial flows, and strengthening institutional oversight can significantly expand domestic financing capacity.

- Building Transparent Public Financial Systems – Governance credibility requires transparent financial reporting, institutional accountability, and independent oversight.

- Aligning Governance with Development Priorities – Governance reforms must support economic transformation, industrialisation, and job creation, not merely regulatory compliance.

This is not simply about governance reform. It is about economic sovereignty.

Path Forward – Governance Reform Anchors Africa’s Financial Future

Africa’s development trajectory increasingly depends on institutional credibility, transparency in governance, and financial integrity.

Strengthening governance systems will unlock investment, reduce borrowing costs, and expand domestic resource mobilisation capacity.

By embedding governance reform into national development strategies, African countries can secure sustainable financing, accelerate economic transformation, and position themselves as credible and competitive actors in the global economy.