Global growth remains resilient, but underlying risks—from slowing trade to volatile commodity markets—are reshaping the outlook for emerging economies. The World Bank warns that rising long-term yields, moderating trade volumes, and fragile financial sentiment could increase debt burdens and weaken investment momentum.

At the same time, structural shifts in energy markets, declining oil intensity, and evolving commodity supply dynamics are redefining how developing countries manage growth, fiscal stability, and long-term resilience.

Global Growth Holds Amid Rising Risks

Introduction

The global economy continues to expand, but beneath the surface, warning signs are emerging. Trade growth is slowing, financial conditions are tightening, and commodity markets are entering a period of structural uncertainty. While headline indicators suggest resilience, forward-looking signals reveal increasing fragility across advanced and developing economies.

The World Bank’s global economic monitoring report of November 2025 highlights that rising sovereign yields, moderating global trade, and volatile commodity markets are reshaping economic prospects, particularly for emerging and developing economies (EMDEs), which remain highly exposed to global financial and commodity cycles.

For Africa and other developing regions, these shifts represent both risk and opportunity. Navigating tightening global conditions while building resilient domestic economies will define the next phase of global economic development.

Resilient Global Growth Masks Structural Vulnerabilities

Global economic activity continued to expand in late 2025, with the global composite Purchasing Managers’ Index averaging 52.8, indicating ongoing growth across major economies.

However, forward-looking indicators tell a more cautious story.

Global employment growth softened, and future output expectations weakened, signalling concerns among businesses about slowing demand, tighter financial conditions, and rising borrowing costs.

At the same time, sovereign bond yield curves across major economies steepened, reflecting investor concerns about fiscal sustainability and inflation persistence.

Long-term yields increased significantly, raising future debt servicing costs and increasing financial vulnerability, particularly for emerging economies dependent on external financing.

This shift marks a transition from recovery-driven growth to risk-constrained expansion.

Trade Slowdown And Financial Conditions Tighten

Global trade remains positive but is losing momentum.

Goods trade volumes grew by 3.7% year-on-year in August 2025, down from 5.6% the previous month, reflecting weakening export demand and trade policy uncertainty.

The slowdown reflects structural shifts affecting global commerce:

Indicator | Recent Trend | Implication |

|---|---|---|

Global goods trade growth | Slowed to 3.7% | Weakening global demand |

U.S. labour market | Unemployment rose to 4.4% | Slower consumption outlook |

China exports | Contracted 1.1% year-on-year | Reduced global trade momentum |

EMDE bond issuance | Higher than 2023–24 | Increased borrowing activity |

Financial markets have also become more cautious.

Risk appetite weakened amid concerns about equity valuations, the persistence of inflation, and slower monetary easing. Sovereign yields rose, while equity markets experienced broad declines.

Despite this, emerging markets continued to experience capital inflows through bond markets, reflecting investor confidence, but also increasing exposure to future interest rate shocks.

For developing economies, this creates a delicate balance between access to capital and rising debt vulnerability.

Commodity Shifts Redefine Economic Power Dynamics

Commodity markets, which are critical to the development of economies, are undergoing structural transformation.

Oil prices fluctuated between $60 and $66 per barrel amid adjustments in supply and geopolitical developments, while natural gas prices surged due to increased global demand.

Meanwhile, agricultural commodity prices declined, including a 15% drop in cocoa prices due to improved weather conditions in West Africa, highlighting the sensitivity of commodity-dependent economies to external shocks.

At a deeper level, structural shifts in energy are reshaping global markets.

Oil’s share in global energy consumption has declined steadily over the decades, replaced by natural gas and renewable energy sources.

At the same time, the oil intensity of GDP, the amount of oil needed per unit of economic output, has fallen significantly.

These changes create opportunities for developing economies to diversify their economic structures while reducing dependence on volatile commodity cycles.

Commodity Agreements Show Limited Long-Term Stability

Historical efforts to stabilise commodity prices through international agreements have largely failed.

Nearly 40 commodity agreements were created in the twentieth century, covering commodities such as coffee, rubber, sugar, and wheat.

However, market forces, including new supply sources, technological innovation, and shifting demand, eventually undermined these agreements.

OPEC remains the only major commodity supply management system still in operation; however, even its influence has weakened due to structural changes in global energy markets and rising competition.

The lesson is clear: economic resilience depends less on controlling prices and more on building diversified, adaptive economies.

Emerging Economies Must Build Structural Resilience

For emerging economies, the current global environment requires strategic adaptation.

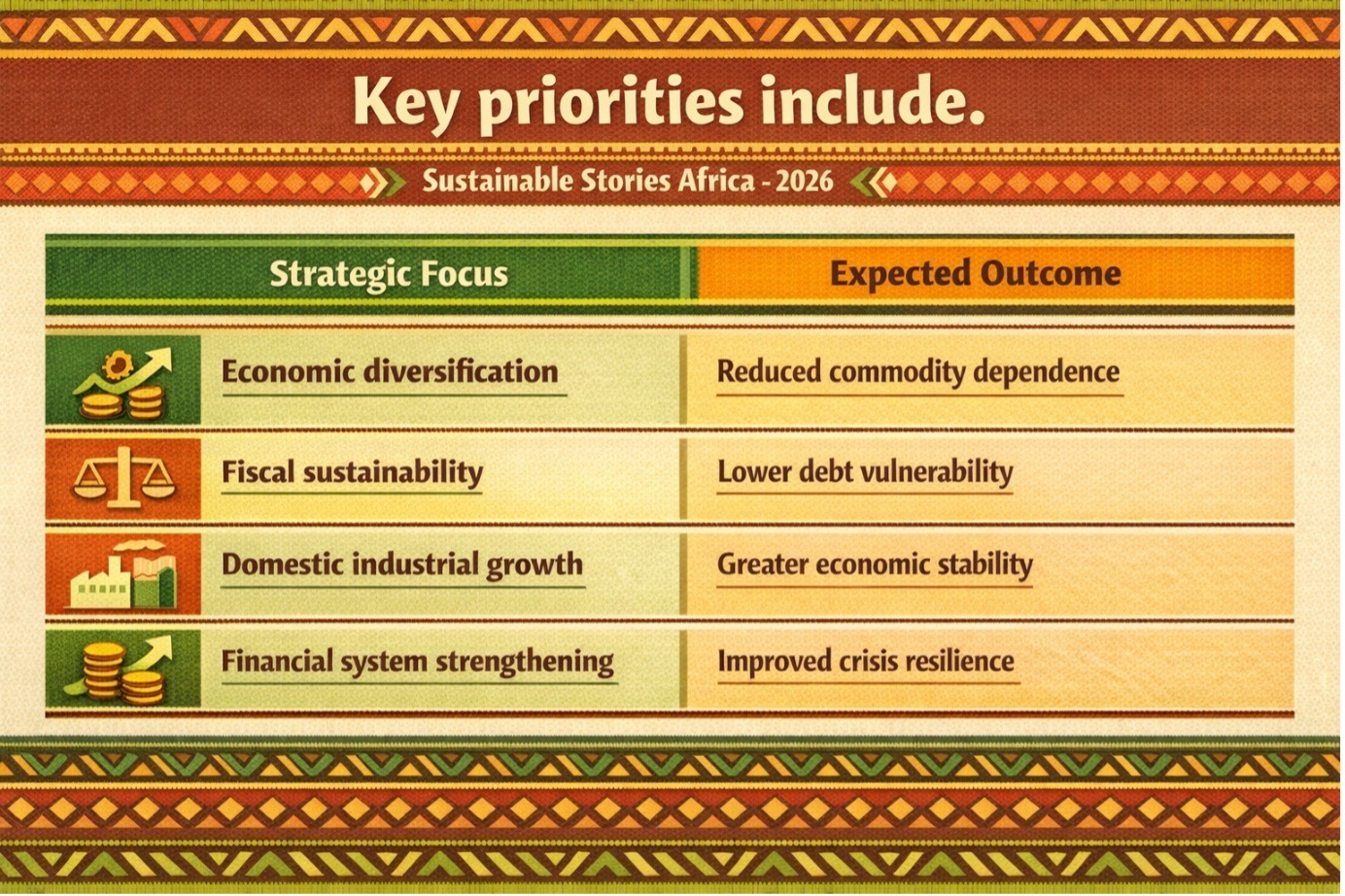

Key priorities include:

Strategic Focus | Expected Outcome |

|---|---|

Economic diversification | Reduced commodity dependence |

Fiscal sustainability | Lower debt vulnerability |

Domestic industrial growth | Greater economic stability |

Financial system strengthening | Improved crisis resilience |

Emerging markets, particularly in Asia, have emphasised strong resilience, with composite PMIs rising to 53.8, reflecting solid growth in manufacturing and services.

However, other regions, including parts of Africa and Latin America, have faced weaker manufacturing performance due to demand constraints and trade uncertainty.

This divergence emphasises the significance of domestic policy, industrial development, and investment in productivity-enhancing sectors.

Countries that strengthen economic fundamentals and diversify production will be better positioned to navigate global volatility.

PATH FORWARD – Resilient Economies Require Structural Policy Transformation

Emerging economies must focus on diversification, fiscal discipline, and industrial growth to reduce vulnerability to global shocks.

Investment in domestic productivity, innovation, and economic resilience will be critical to sustaining growth.

Global economic resilience will depend on strengthening domestic economic foundations rather than relying solely on favourable external conditions.