Green finance has shifted from a niche buzzword to a central organising logic for how capital, climate and development now intersect; however, the research story behind that shift is only just coming into focus.

A new bibliometric review of 679 Scopus‑indexed articles (2005–2024) traces how ideas, countries and authors have shaped the field, and where the next frontiers will be.

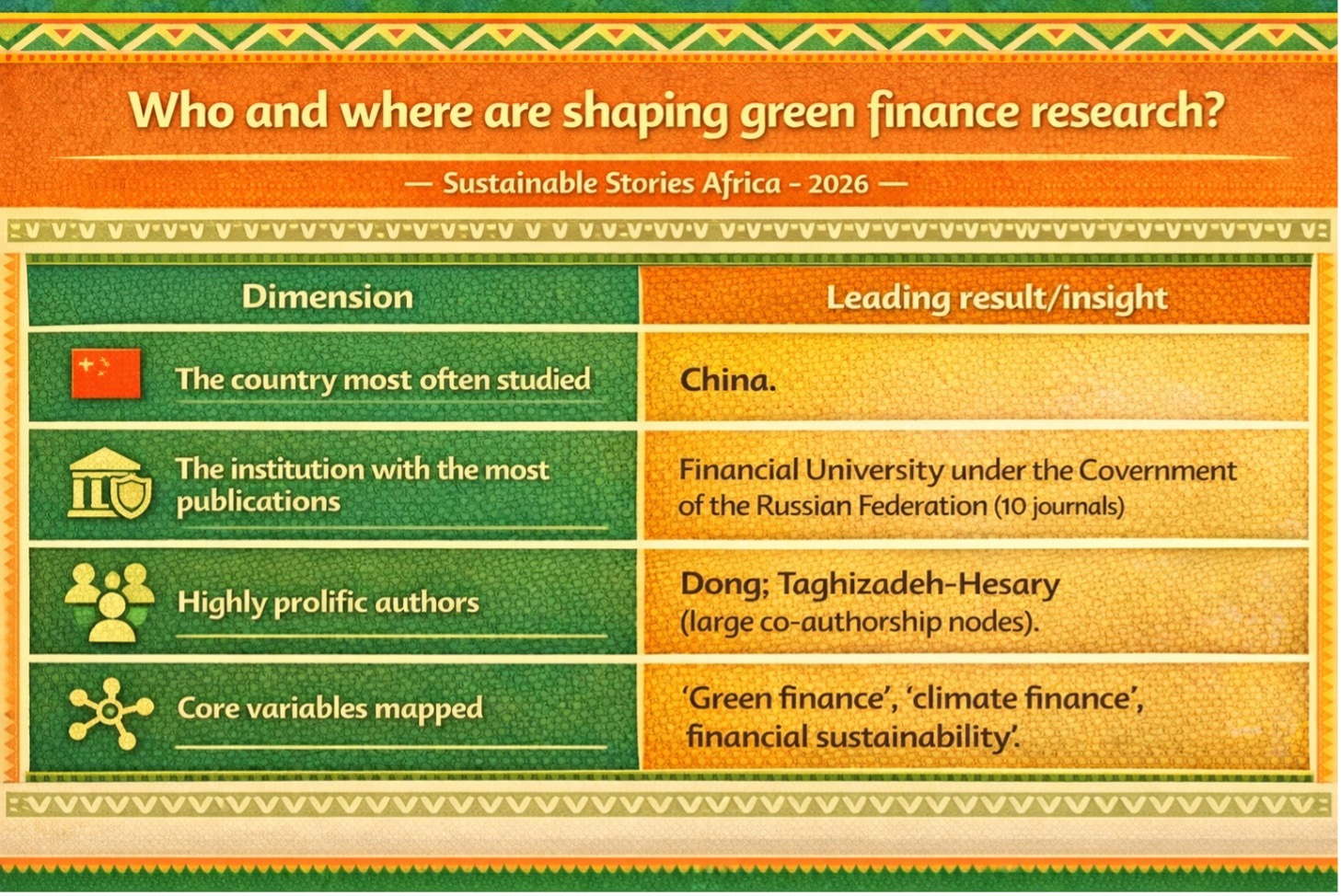

The study highlights that China is clearly out in front, Russian institutions are surprisingly active, and a long tail of underexplored variables and regions is still waiting for attention.

For policymakers, investors and scholars, the message is clear: green finance is consolidating fast, but the agenda is far from complete.

Mapping Green Finance’s Research Turning Point

Over the past two decades, green finance has quietly moved from the margins of academic debate to the mainstream of financial policy; however, until recently, no one had mapped that evolution end to end.

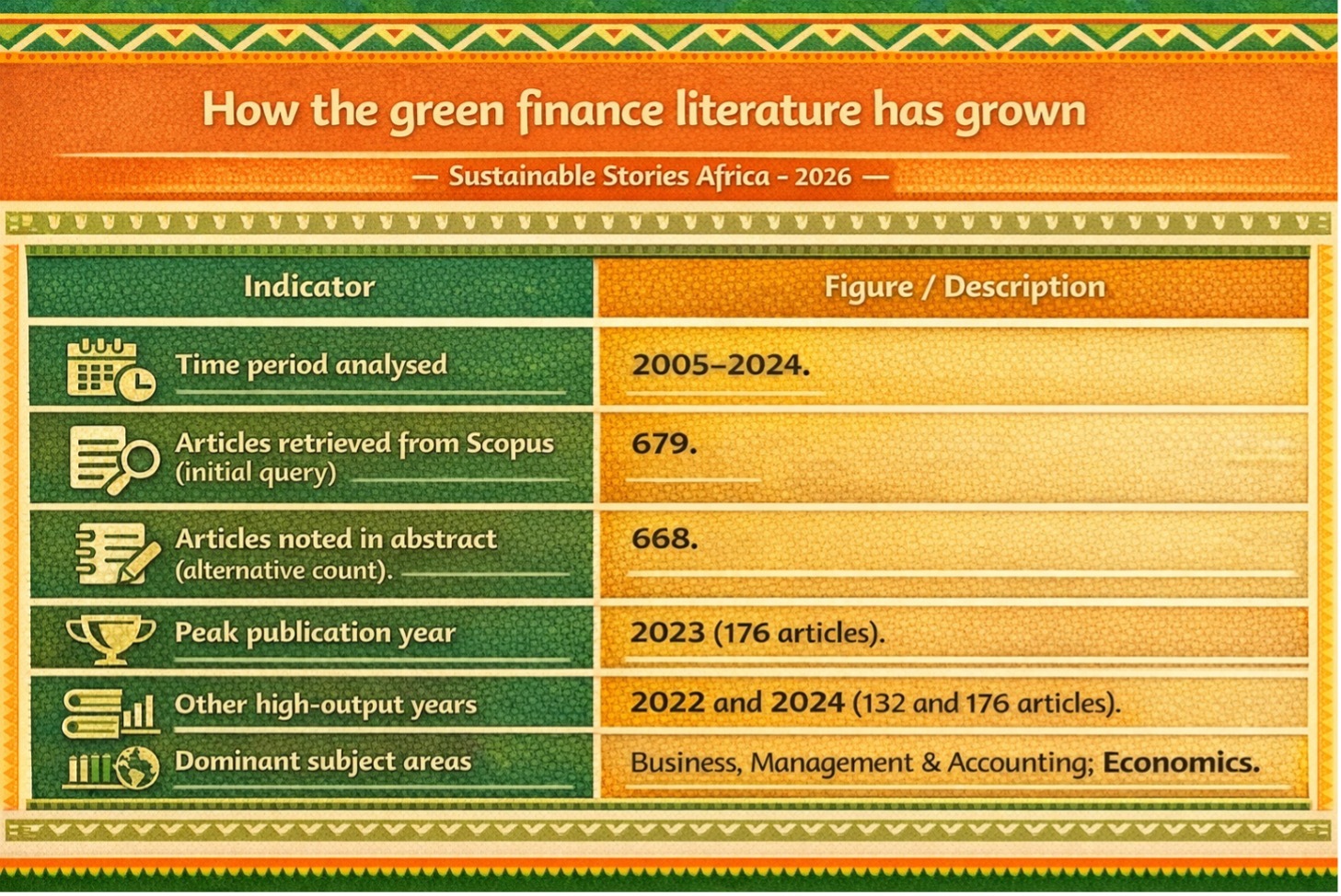

A bibliometric review by Farah Ordina Ardha Sukma and Setianingtyas Honggowati uses 679 Scopus‑indexed journal articles published between 2005 and 2024 to show how the field has grown, where influence is concentrated, and which questions remain under‑explored.

The analysis frames green finance not as a branding exercise, but as an evolving architecture linking financial performance to environmental outcomes and climate resilience.

Publications accelerated after the mid-2010s, tracking the 2015 SDGs and the Paris Agreement’s push for climate-aligned capital. Annual output peaked at 176 papers in 2023, with 2022 and 2024 also in triple digits, signalling sustained momentum. Research spans multiple journals, with the Financial University under the Government of the Russian Federation notable for 10 publications.

China dominates as a country of study, reflecting its large-scale green finance experiments. Co-authorship and keyword mapping show “green finance” anchoring clusters around climate finance and sustainability, underscoring the field’s policy relevance.

Tracing Capital’s Shift To Climate Consciousness

The review situates green finance within a familiar tension: economic growth has raised incomes and expanded opportunity, but often at the cost of environmental degradation and climate risk.

As sustainability climbs policy agendas, green finance has emerged as a key enabler of low-carbon production, energy-efficient infrastructure and climate-resilient growth.

Broadly defined, green finance channels capital into environmentally and socially responsible activities, from renewables to sustainable agriculture and transport.

It is framed not as a labelling exercise, but as a systematic effort to align financial returns with environmental outcomes, with empirical links to poverty reduction and climate alignment.

Inside Two Decades Of Green Finance Literature

To trace the field’s evolution, the study applied bibliometric tools, co-occurrence and co-authorship analysis, to 679 Scopus-indexed journal articles published between 2005 and 2024 across business, economics and finance disciplines

How the green finance literature has grown

| Indicator | Figure / Description |

|---|---|

| Time period analysed | 2005–2024. |

| Articles retrieved from Scopus (initial query) | 679. |

| Articles noted in abstract (alternative count) | 668. |

| Peak publication year | 2023 (176 articles). |

| Other high‑output years | 2022 and 2024 (132 and 176 articles). |

| Dominant subject areas | Business, Management & Accounting; Economics. |

Findings signal a fluctuating but rising trajectory, with sharp growth in the early 2020s and broad journal dispersion, underscoring mainstream acceptance.

The Financial University under the Government of the Russian Federation, with 10 publications, is an institutionally significant standout.

China dominates as the primary country of study, while co-authorship mapping highlights Dong and Taghizadeh-Hesary as central contributors within dense research networks.

Who and where are shaping green finance research?

| Dimension | Leading result/insight |

|---|---|

| The country most often studied | China. |

| The institution with the most publications | Financial University under the Government of the Russian Federation (10 journals). |

| Highly prolific authors | Dong; Taghizadeh‑Hesary (large co‑authorship nodes). |

| Core variables mapped | “Green finance”, “climate finance”, “financial sustainability”. |

Why Bibliometrics Matter For Future Green Deals

Beyond publication counts, the review maps how concepts cluster around green finance. Unsurprisingly, “green finance” anchors the largest node, with “sustainability”, “climate finance” and “financial sustainability” forming dense linkages, positioning the field at the intersection of development, financial stability and climate policy debates.

However, important white spaces remain. Smaller nodes and thin connections suggest limited depth on social equity, sector-specific applications and regions beyond China and Europe.

The authors frame this as a frontier opportunity, from fintech-enabled green credit to just-transition finance in fossil-dependent economies.

For policymakers, the evidence base is strongest on poverty reduction, sub-national green growth and low-carbon transitions, while thinner areas point to priorities for future research and collaboration.

Turning Literature Insights Into Policy And Research Playbooks

Sukma and Honggowati conclude with practical implications. They urge funders and universities to treat green finance as a strategic research domain, reflecting its sustained growth and alignment with SDGs and climate commitments.

Strengthening co-authorship networks between leading hubs in China, Europe and Russia and under-represented regions could broaden perspectives and applications.

They also call for fresh variables and contexts, particularly in emerging markets, from just-transition finance to digital inclusion and blended capital across governance systems, inviting Global South scholars to shape the agenda.

Finally, they frame bibliometrics as a governance tool, helping treasuries and regulators track evidence density, blind spots and policy uptake as climate rules accelerate.

Path Forward – Connecting Research Gaps, Emerging Markets, Future Green Capital

The bibliometric record shows green finance as a fast-expanding, mainstream field, with China and a small cluster of institutions and authors shaping much of the agenda.

The next decade’s task is to broaden that centre across themes and geographies by elevating underrepresented regions and strengthening links between research and policy design.

For researchers, tools such as VOSviewer should guide forward-looking inquiry. For policymakers and investors, the literature is a strategic asset for aligning finance with measurable environmental and developmental impact.