Ghana’s ESG conversation is shifting from buzzword to balance-sheet risk, with a clear warning: by 2028, non-compliant companies could find themselves locked out of parts of global commerce.

In a February 5 Ghana Broadcasting Corporation (GBC) interview, a sustainability practitioner argues that voluntary ESG disclosures, emissions tracking, and governance reforms are becoming the new “license to operate” and could even reshape jobs, banking, and investor confidence.

ESG Readiness Becomes A National Test

Environmental, social and governance (ESG) reporting is moving from “nice to have” to a gatekeeping standard, with a stark prediction now circulating in Ghana’s public discourse: by 2028, companies that are not ESG-compliant “might not be allowed to transact businesses” in some parts of the world.

That warning made during an interview “ESG & Sustainability : How Prepared are we as a Nation? on the GBC on February 5, the interviewee frames ESG as a data-backed duty of disclosure: organisations should track activity across the three pillars, analyse it, and communicate it to stakeholders as an “ESG disclosure” within the business year.

The implication is bigger than reporting elegance: Ghana’s early movers are already treating ESG as a competitiveness strategy, while foot-draggers risk being priced out of finance, exposed by environmental liabilities, and punished by shifting investor preferences.

2028 ESG Deadline Is Closing Fast

ESG has become a “global benchmark,” the interviewee told GBC, arguing that by 2028 non-compliance could restrict companies’ ability to do business in certain markets.

He said some listed companies in Ghana are already producing ESG disclosures voluntarily, positioning themselves early so they are “not found wanting” when tougher expectations come around.

The immediate takeaway for corporate leaders is practical: ESG is not a slogan; it is a reporting system built on evidence, including data collected, analysed, and disclosed to the public and stakeholders.

Ghana’s ESG Reality: Disclosures, Risks, Incentives

The interview laid out ESG in plain operational terms: whether a firm operates in oil and gas, mining, or media, it is expected to align decisions with environmental, social and governance pillars and prove it with disclosures.

On the environmental side, the speaker pointed to illegal small-scale mining (“galamsey”) as a live ESG case study, linking unsustainable mining to deforestation, ecosystem damage, and longer-run economic disruption.

He also tied ESG to climate risk using simple but arresting numbers, saying global temperature has shifted from around 1.42 at a “pre-industrial” baseline to about 1.55, alongside increasingly erratic weather patterns.

The conversation added a pollution lens that corporate risk teams often overlook: some hydrofluorocarbons (HFCs) associated with cooling equipment can persist for “close to 70 years,” and certain mining chemicals (including mercury and hydrogen cyanide) were mentioned as having serious health implications

On the incentives side, the interview described “sustainable banking” and “green funding,” arguing that banks may offer loans at lower rates when companies can show credible ESG reports backed by analysed data.

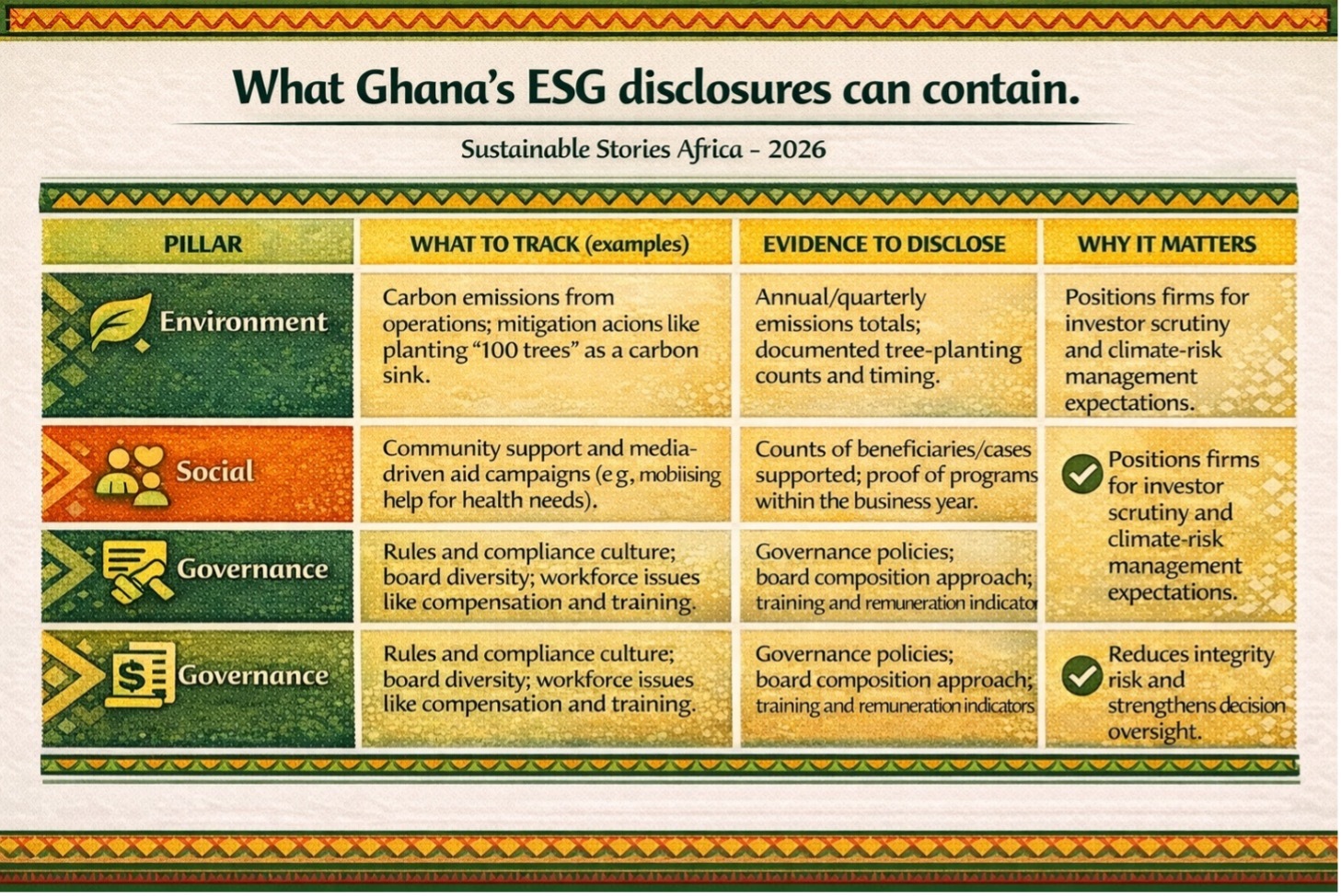

What Ghana’s ESG disclosures can contain

| Pillar | What to track (examples) | Evidence to disclose | Why it matters |

|---|---|---|---|

| Environment | Carbon emissions from operations, mitigation actions like planting “100 trees” as a carbon sink. | Annual/quarterly emissions totals; documented tree-planting counts and timing. | Positions firms for investor scrutiny and climate-risk management expectations. |

| Social | Community support and media-driven aid campaigns (e.g., mobilising help for health needs). | Counts of beneficiaries/cases supported; proof of programs within the business year. | Signals social license to operate and stakeholder value creation. |

| Governance | Rules and compliance culture; board diversity; workforce issues like compensation and training. | Governance policies; board composition approach; training and remuneration indicators. | Reduces integrity risk and strengthens decision oversight. |

What Compliance Unlocks: Capital, Trust, Competitiveness

The most commercially consequential claim in the GBC interview is that ESG can change a company’s cost of capital: credible disclosures can influence whether lenders and financiers view an entity as “sustainable,” affecting access to financing and pricing.

It can also reframe corporate integrity as strategy, governance is not abstract “rules,” the speaker argued, but how boards are formed (including gender balance), how staff are treated, and whether decision-making anticipates long-term impacts.

The interview further suggested ESG could become a national development lever, not only a corporate exercise, by formalising sustainability roles across institutions and turning compliance capacity into jobs and competence.

How Companies Can Now Move Credibly

- Start with scope, then measure: the interview emphasised defining the “scope” of an ESG disclosure, what will be covered for the business year, before deciding what to report.

Build a metrics needle that can survive scrutiny: emissions were described as a common starting point internationally, supported by routine activity data (vehicles, cooling, energy use) and backed by analysis before publication.

- Embed ESG into risk management: the speaker urged organisations to treat ESG as part of the risk register, beginning with “material topics” that already affect operations, and gathering structured feedback (he referenced Likert-scale style questionnaires) to rate severity and guide management attention.

- Treat finance as a forcing function: if “green funding” is offered on better terms to entities with evidence-backed disclosures, then treasury teams should treat ESG data quality like credit documentation, standardised, auditable, and timely.

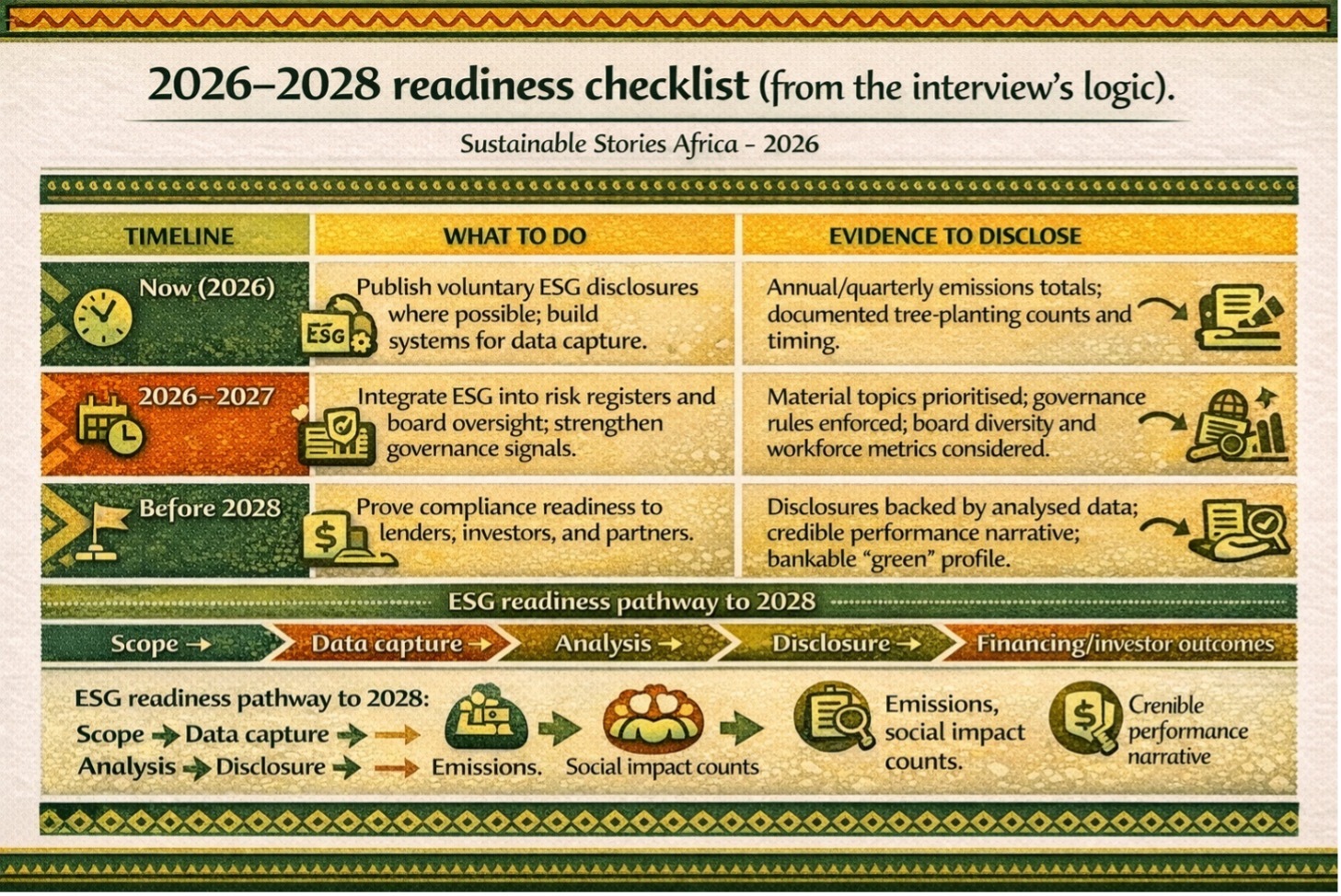

2026–2028 readiness checklist (from the interview’s logic)

| Timeline | What to do | What “good” looks like |

|---|---|---|

| Now (2026) | Publish voluntary ESG disclosures where possible; build systems for data capture. | A clear scope statement; quarterly tracking; transparent communication to stakeholders. |

| 2026 – 2027 | Integrate ESG into risk registers and board oversight; strengthen governance signals. | Material topics prioritised; governance rules enforced; board diversity and workforce metrics considered. |

| Before 2028 | Prove compliance readiness to lenders, investors, and partners. | Disclosures backed by analysed data; credible performance narrative; bankable “green” profile. |

Path Forward – Four Priorities For 2026 Readiness, Nationally

A practical national play, argued in the interview, is to institutionalise ESG capacity. He proposed sustainability directorates across state-owned institutions, suggesting each directorate could hire a director and five graduates, turning ESG into both compliance infrastructure and employment.

He also framed public sensitisation as a cost issue, claiming that distributing ESG “ambassadors” across regions could reduce the need for expensive nationwide awareness drives (he cited hypothetical budgets from $2 million to $10 million).