A 1% increase in public investment can raise output by 1.1% within five years across emerging markets and developing economies (EMDEs). In countries with ample fiscal space and efficient public investment systems, that impact climbs to 1.6%.

A World Bank working paper reframes public investment not as routine spending, but as a strategic macroeconomic lever, one whose effectiveness depends critically on timing, governance, and debt sustainability.

Public Investment’s Nonlinear Growth Dividend

Public investment is often described as the engine for growth. However, evidence from the World Bank’s Revisiting Public Investment Multipliers shows that its power is neither automatic nor uniform.

Drawing on data from 129 EMDEs between 1980 and 2019, the paper finds that scaling up public investment by 1% of GDP raises output by 1.1% over five year average.

In capital-scarce economies or during recessions, that multiplier can rise to between 1.6% and 1.7%. In high-debt or low-efficiency contexts, however, the effects sometimes fade, sometimes becoming statistically insignificant.

The message is clear: public investment works, but only under the right conditions.

A 1% Investment, 1.1% Growth

The headline finding is striking.

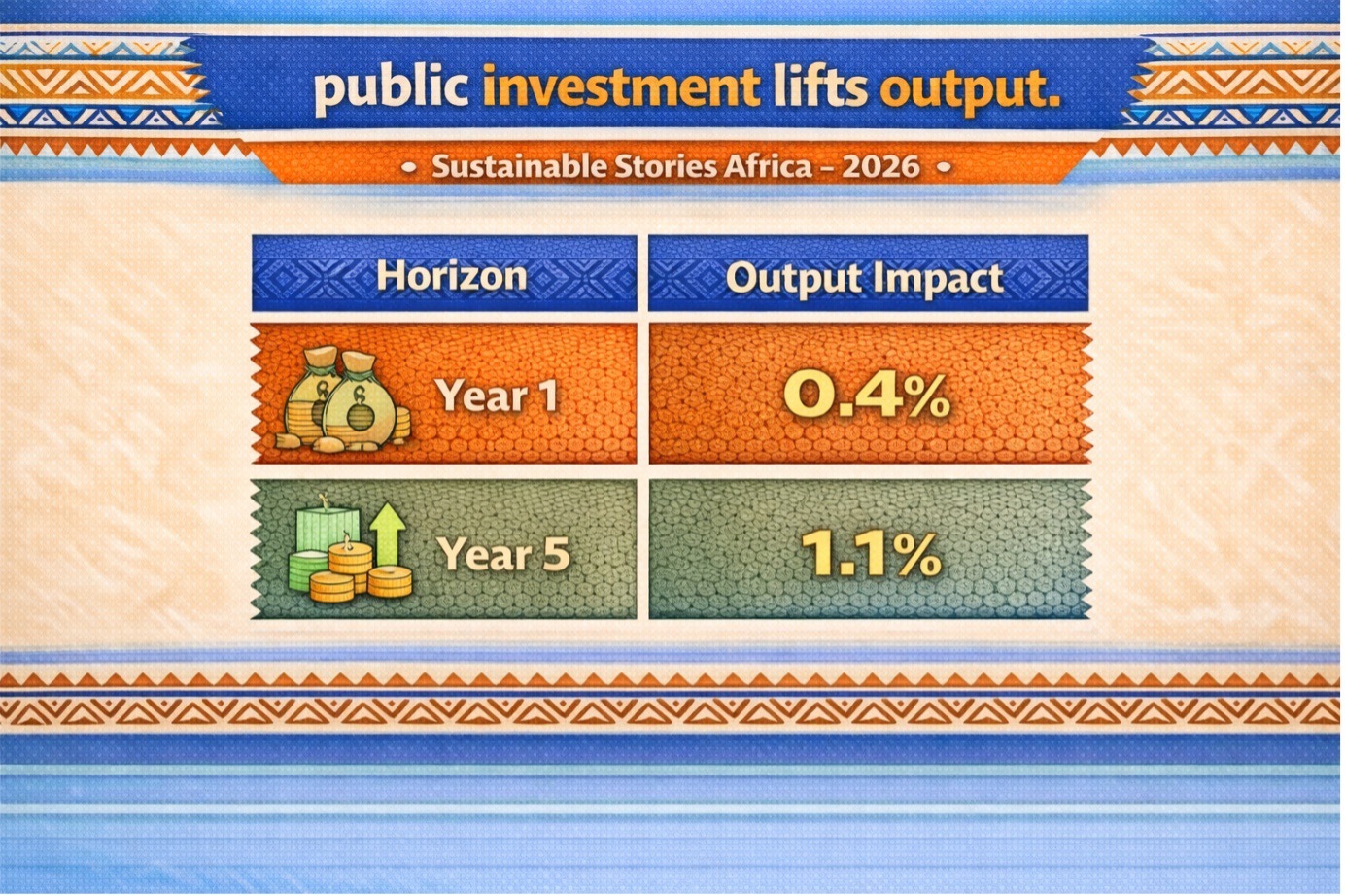

Across EMDEs, a 1% of GDP in public investment lifts output by:

Horizon | Output Impact |

|---|---|

Year 1 | 0.4% |

Year 5 | 1.1% |

Unlike consumption-driven fiscal stimulus, public investment generates effects that build over time. Short-run demand effects are modest; long-run supply effects dominate.

Potential output could increase by up to 1.1% over five years. Labour productivity rises by 1.9%, while total factor productivity climbs by 0.8%. Importantly, inflation remains largely contained.

This confirms both the aggregate demand and supply-side channels of fiscal policy.

Why Context Determines Impact

The study’s most important contribution lies in its nonlinear findings.

- Business Cycle Matters – Public investment multipliers are larger during recessions:

- Expansion: 1.1% after five years

- Recession: up to 1.6% (p.19)

Economic slack enables public investment to mobilise idle capacity and crowd in private activity.

- Fiscal Space Is Decisive – In countries with ample fiscal space (low debt-to-GDP ratios):

- Multiplier: up to 1.6% after five years.

In high-debt contexts:

- Multipliers are small and statistically insignificant.

Debt dynamics influence sovereign risk, borrowing costs, and investor confidence, directly shaping the size of the multiplier.

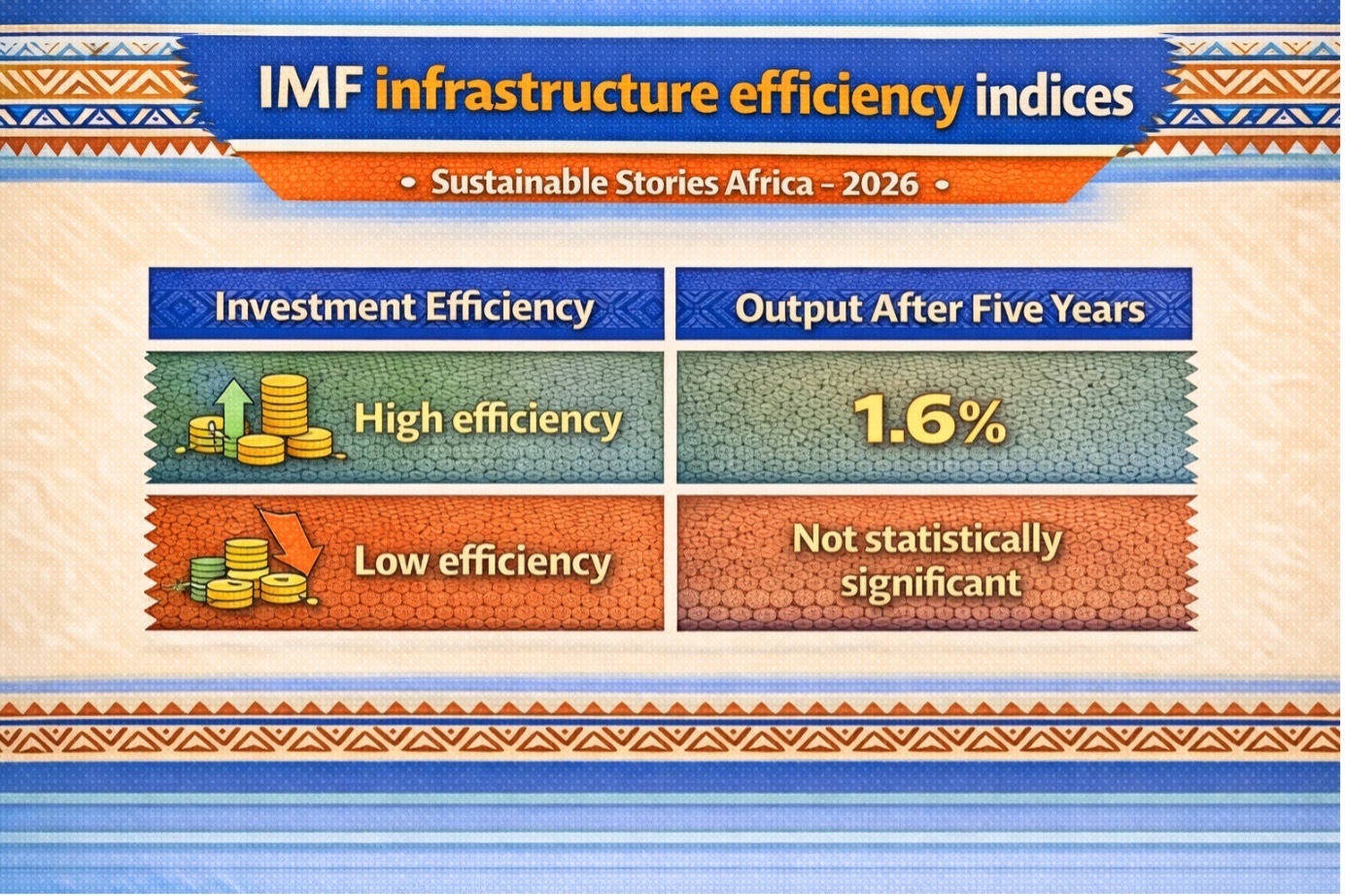

- Efficiency Determines Returns – Public investment efficiency, measured using IMF infrastructure efficiency indices, makes a material difference:

Investment Efficiency | Output After Five Years |

|---|---|

High efficiency | 1.6% |

Low efficiency | Not statistically significant |

Leakages through corruption, weak procurement, or poor project design can neutralise fiscal effort.

- Capital Scarcity Amplifies Gains – In capital-scarce economies:

- Multiplier: 1.7% after five years.

In high capital-stock economies:

- Effects fall below 1%, often insignificant.

Diminishing returns matter.

Crowding In, Not Crowding Out

One of the study’s most compelling findings concerns private investment.

A 1% increase in GDP public investment raises private investment by up to 2.2% over five years.

Initial crowding-out effects are small and short-lived. Over time, public infrastructure raises private returns by improving connectivity, reducing uncertainty, and lowering transaction costs.

Public investment amplifies potential output and productivity, reinforcing the long-term foundations of growth.

In a period where private investment remains subdued across many EMDEs, public capital formation may provide the catalytic push needed to restore momentum.

Designing Smarter Fiscal Strategy

The policy implications are precise:

- Prioritise investment during downturns when multipliers are strongest.

- Protect fiscal space to preserve multiplier effectiveness.

- Strengthen public investment management systems.

- Target capital-scarce sectors and regions for maximum marginal return.

- Break long-term investment programs into five-year credible pipelines.

Importantly, public investment is not a substitute for reform. Without institutional quality and debt sustainability, fiscal stimulus can misfire.

The paper also introduces a replicable method for identifying public investment shocks based on cyclically adjusted spending changes that exceed country-specific thresholds, offering policymakers a practical monitoring tool.

Path Forward – Efficiency And Fiscal Space Determine Returns

Public investment delivers meaningful growth dividends when deployed countercyclically, financed sustainably, and executed efficiently.

Governments should embed investment strategies within credible fiscal frameworks, strengthen project appraisal and procurement systems, and prioritise capital-scarce sectors.

When this is done correctly, public investment can crowd in private capital, raise productivity, and anchor long-term growth across emerging markets.