As global ESG rules tighten, African businesses are confronting a critical question: how can they comply with international standards without undermining local realities?

During an interview panel session titled “Scouting for Investment Opportunities in Nigeria's Capital Market,” with the CEO, “Finance with Mukthar”, Mr Mukthar Mohammed argued that the answer lies not in copying global frameworks wholesale, but in recalibrating them for Nigeria’s unique economic terrain.

Mukthar Mohammed, a leading voice in Nigeria’s capital market ecosystem, warned that investors who fail to understand regulatory shifts, governance reforms, and sustainability disclosures risk mispricing opportunities in one of Africa’s most dynamic markets.

Nigeria’s Capital Market Investment Reset

Nigeria’s capital market is undergoing a recalibration. Regulatory reforms, ESG integration, and macroeconomic realignments are converging to reshape how capital is raised, allocated, and governed.

In an exclusive interview session on Scouting for Investment Opportunities in Nigeria's Capital Market, Mukthar Mohammed described the current moment as “a structural pivot rather than a cyclical rebound.” He argued that investors must now assess opportunity through three lenses: governance integrity, regulatory credibility, and sustainability alignment.

“The era of speculative positioning without governance depth is fading,” Mohammed said. “Institutional capital now demands transparency, sustainability metrics, and credible oversight.”

The discussion reflects a broader role in Nigeria’s financial architecture, one shaped by enhanced disclosure expectations, green finance ambitions, and investor appetite for resilient asset classes.

Reform Signals A Structural Pivot

Nigeria’s capital market has entered a decisive reform phase.

From improved regulatory enforcement to sustainability disclosure mandates, the signals are clear: governance is no longer optional.

Mohammed emphasised that recent reforms are aimed at restoring investor confidence, particularly among foreign portfolio investors who have historically exited during periods of volatility.

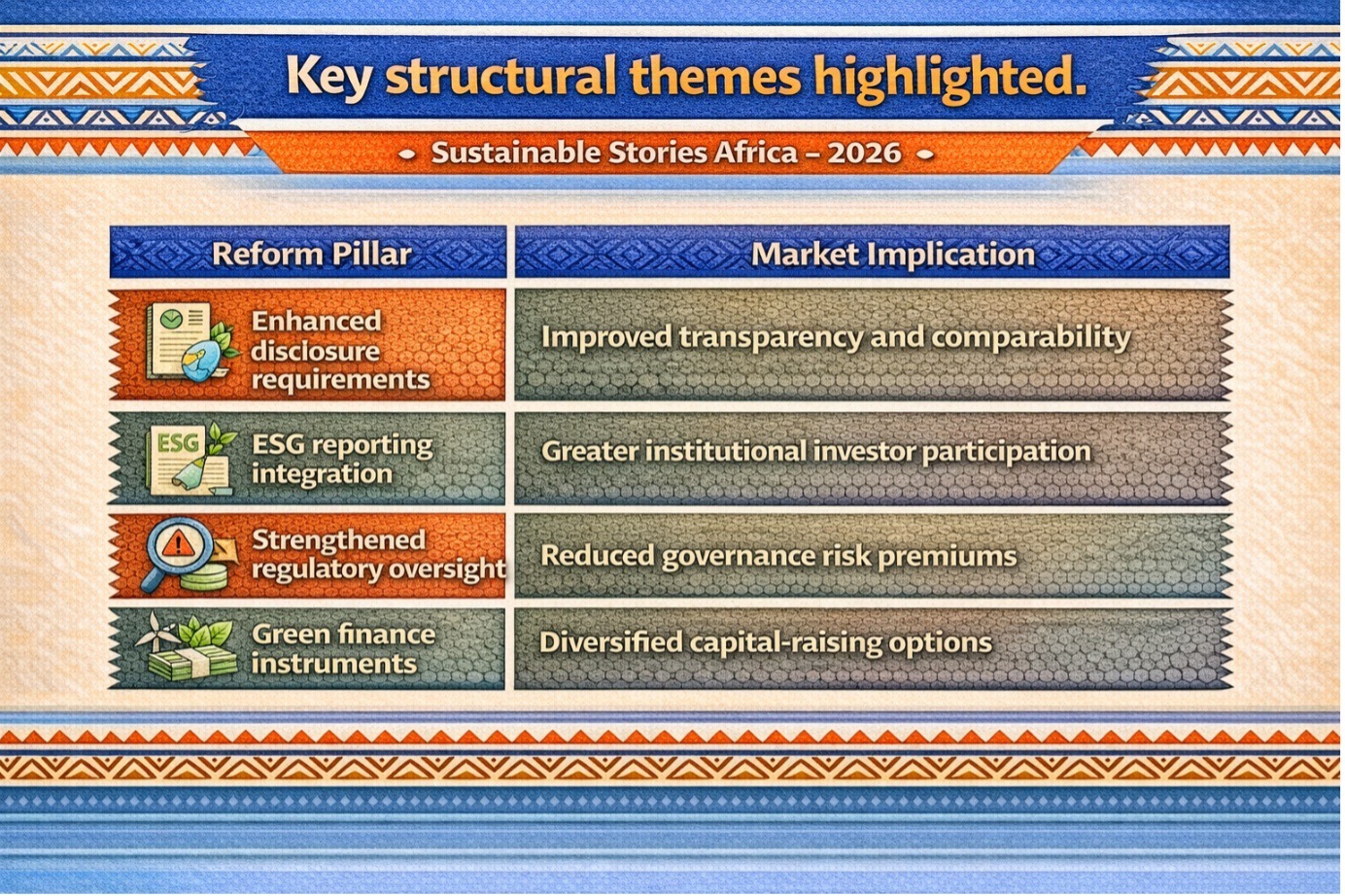

Key structural themes highlighted:

Reform Pillar | Market Implication |

|---|---|

Enhanced disclosure requirements | Improved transparency and comparability |

ESG reporting integration | Greater institutional investor participation |

Strengthened regulatory oversight | Reduced governance risk premiums |

Green finance instruments | Diversified capital-raising options |

He noted that Nigeria’s positioning within Africa’s financial ecosystem offers scale advantages, but only if governance credibility is sustained.

“Confidence is cumulative,” Mohammed said. “Markets reward consistency, not rhetoric.”

Where Capital Is Quietly Moving

Beyond reforms, Mohammed highlighted sector-specific signals attracting both domestic and international capital.

He identified three areas gaining investor traction:

- Infrastructure-linked instruments

- Sustainability-aligned debt

- Dividend-resilient equities

According to Mohammed, investors are shifting from short-term speculative equities to assets backed by cash-flow stability and regulatory clarity.

“Yield is still important,” he explained, “but quality of governance is now a screening filter.”

He emphasised that Nigeria’s capital market is no longer driven solely by oil-linked volatility but increasingly by diversification narratives, including renewable energy financing, digital infrastructure bonds, and sustainable finance instruments.

Investment Opportunity Signals

Investment Theme | Strategic Rationale | Risk Mitigation Factor |

|---|---|---|

Green Bonds | Climate-aligned capital mobilisation | Regulatory-backed issuance frameworks |

Infrastructure Funds | Long-term asset-backed returns | Public-private partnership structures |

ESG-Compliant Equities | Institutional investor preference | Enhanced corporate disclosures |

These signals suggest a maturing ecosystem, where long-term capital is beginning to anchor the market.

Why Governance Depth Determines Returns

Mohammed noted that governance reform is not singularly a compliance exercise; it is a catalyst for valuation.

“Markets price uncertainty harshly,” he said. “When governance improves, the discount rate falls.”

He argued that Nigeria’s opportunity lies in reducing the risk premium attached to emerging markets through regulatory credibility and ESG transparency.

This, in turn, can unlock lower borrowing costs and broader investor participation.

The upside scenario he described includes:

- Reduced capital flight during macro volatility

- Improved access to international sustainability-linked funds

- Increased local institutional investor confidence

- Strengthened capital formation for SMEs and infrastructure

However, he cautioned that reform momentum must be sustained. “Markets forgive mistakes,” he said, “but they punish inconsistency.”

Aligning Policy, Capital, And Credibility

He concluded with a call for coordinated action across regulators, issuers, and investors.

Mohammed advocated for:

- Continuous regulatory capacity strengthening

- Standardised ESG reporting frameworks

- Investor education on sustainability-linked instruments

- Stronger enforcement of corporate governance codes

He emphasised that Nigeria’s capital market growth trajectory will depend less on episodic reforms and more on institutional reliability.

“Capital is mobile,” he said. “It flows where integrity is predictable.”

Path Forward – Governance Credibility Unlocks Capital

Nigeria’s capital market stands at an inflexion point. Sustained regulatory enforcement, credible ESG integration, and investor transparency are central to unlocking long-term institutional capital.

The objective is clear: reduce governance risk premiums, deepen sustainable finance markets, and position Nigeria as a credible destination for both domestic and global investment flows.