The global economy proved more resilient than expected in 2025. Yet beneath the headline recovery lies a sobering truth: growth has reduced to its weakest decade since the 1960s.

While advanced economies are realigning to their pre-pandemic income levels, more than one-quarter of developing countries remain poorer than they were before the pandemic.

For emerging markets, the real challenge now is rebuilding fiscal space, restoring policy credibility, and generating jobs at scale.

Uneven Recovery, Narrowing Policy Space

The global economy has weathered tariff escalations, inflation shocks, and geopolitical conflict with surprising resilience, according to the World Bank’s “Global Economic Prospects Report – Chapter 3”.

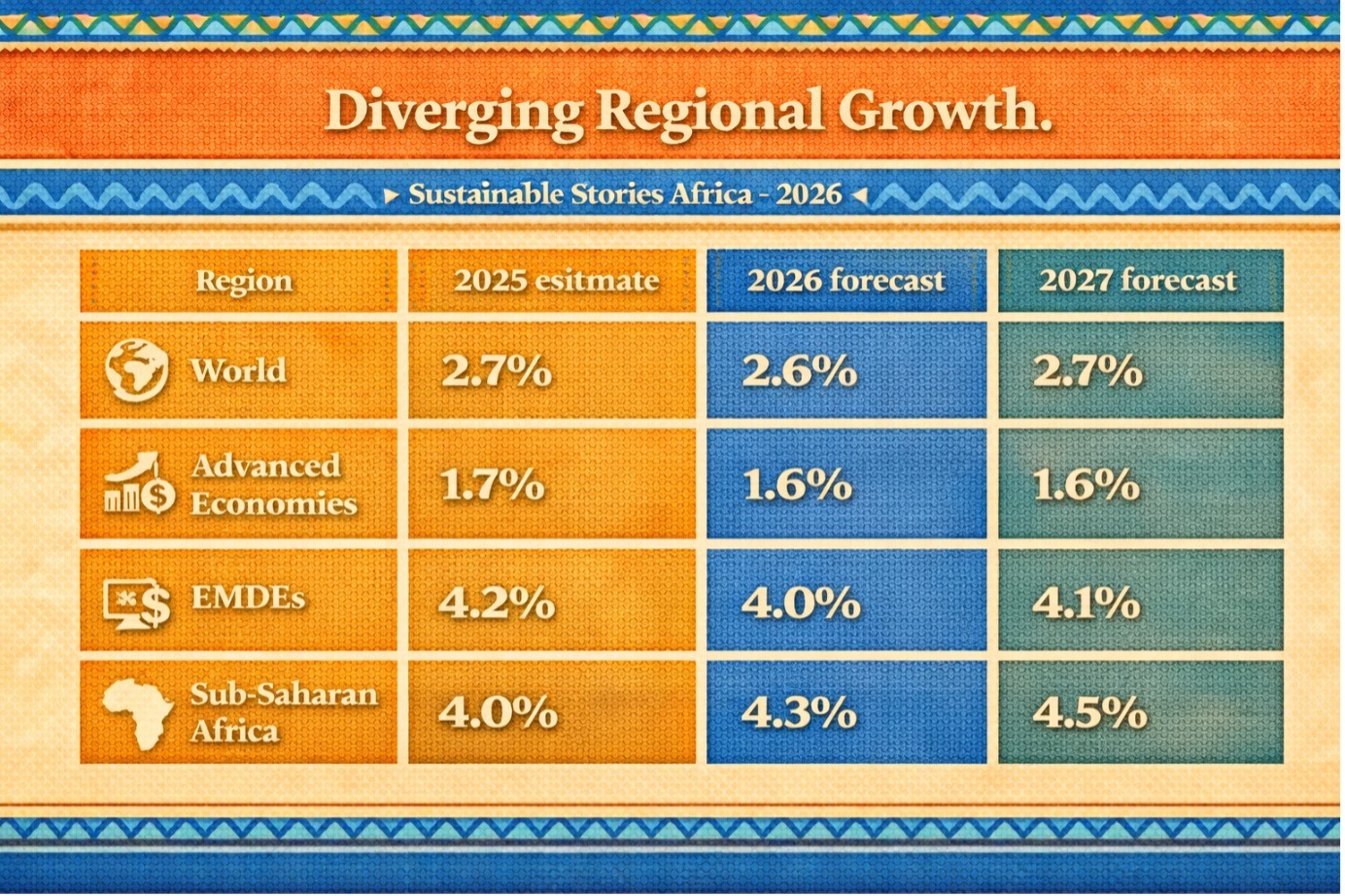

Growth reached 2.7% in 2025, stronger than predicted mid-year, but is projected to edge down to 2.6% in 2026 before stabilising.

However, resilience masks divergence. Nearly 90% of advanced economies now exceed pre-pandemic per capita income levels.

In contrast, more than 25% of emerging market and developing economies (EMDEs), particularly low-income and fragile states, remain below 2019 income levels.

The message is clear: the recovery is strong in aggregate, but incomplete in distribution.

Resilience Masks Structural Slowdown

At first glance, the numbers are comforting.

Global GDP expanded to 2.7% in 2025, buoyed by front-loaded trade, easing financial conditions, and a surge in investments in artificial intelligence (AI). Inflation is moderating. Financial markets remain buoyant.

However, the forward trajectory signals caution.

Global growth is projected at 2.6% in 2026 and 2.7% in 2027. This is insufficient to meaningfully reduce poverty or create jobs where they are most needed.

The 2020s, if current projections hold, will be the slowest decade of growth since the 1960s.

Trade, Debt and Divergence Define 2026

- Trade Headwinds Intensify – Global trade growth is expected to decelerate sharply in 2026 as stockpiling fades and tariff effects deepen.

Higher trade barriers and policy uncertainty continue to dampen investment sentiment.

Oil markets are projected to move into surplus as demand softens, and OPEC increases supply. Brent crude is projected at $60 per barrel in 2026, down from $69 in 2025.

- Diverging Regional Growth

Region | 2025 estimate | 2026 forecast | 2027 forecast |

|---|---|---|---|

World | 2.7% | 2.6% | 2.7% |

Advanced Economies | 1.7% | 1.6% | 1.6% |

EMDEs | 4.2% | 4.0% | 4.1% |

Sub-Saharan Africa | 4.0% | 4.3% | 4.5% |

Sub-Saharan Africa is projected to grow modestly by 4.3% in 2026 and 4.5% in 2027; however, this remains below levels needed to accelerate poverty reduction.

China’s growth is expected to slow from 4.9% in 2025 to 4.4% in 2026 amid structural headwinds.

- Fiscal Stress at Historic Highs – EMDE government debt stands at a 55-year high.

More than half of EMDEs now operate along fiscal rules, up from 15% in 2000. Evidence shows that adopting fiscal rules improves cyclically adjusted primary balances by up to 1.4 percentage points of trend GDP within five years.

However, design and timing matter. Rules adopted during crises often underperform.

Rebuilding Fiscal Credibility, Unlocking Frontier Potential

The January 2026 report devotes significant focus to two strategic levers:

- Rebuilding Fiscal Space – Well-designed fiscal rules:

- Increase the likelihood of fiscal consolidation episodes

- Improve medium-term budget balances

- Strengthen credibility in bond markets

Consolidation episodes improve primary balances by an average of 1.6 percentage points per year during adjustment periods.

For African economies navigating debt sustainability pressures, credible fiscal frameworks are not austerity tools; they are growth enablers.

- Frontier Markets: Untapped Scale – Frontier markets:

- Account for 20% of the global population

- Represent just 5% of global output

Since 2000, however, roughly 40% of frontier markets have defaulted at least once.

Per capita output growth in the median frontier market halved between the 2000s and early 2020s.

However, faster-growing frontier markets share three traits:

- Stronger investment growth

- Improved institutions

- Better-managed government debt

The implication is that policy quality, not geography, determines convergence.

Jobs, Investment and Structural Reform

The demographic clock is ticking.

By 2035, 1.2 billion young people in EMDEs will reach working age.

Without stronger growth and investment, labour markets will strain.

Policy priorities include:

- Strengthening fiscal frameworks and domestic revenue mobilisation

- Safeguarding monetary independence

- Deepening regional trade integration

- Investing in physical, digital, and human capital

- Mobilising private capital for infrastructure, energy, agribusiness and manufacturing

Investment growth remains the decisive lever; the EMDEs with higher investment growth record significantly stronger employment outcomes than those with stagnating investment.

Resilience alone will not secure prosperity. Structural reform must follow.

Path Forward – Discipline, Diversification, Dynamism

Rebuilding fiscal discipline and institutional credibility is essential to restoring investor confidence and safeguarding macroeconomic stability.

Simultaneously, EMDEs must accelerate structural reforms to diversify exports, deepen regional integration, mobilise private capital, and generate labour-intensive growth.

The next decade’s outcomes will depend not on external conditions, but on domestic policy resolve.