Across Africa, agrifood innovators are no longer selling promise; they are reporting measurable outcomes.

From 30% yield gains to over 1 million farmers reached, a new generation of ventures is embedding impact into their operations, not fundraising decks.

The AgBase “Seeds of Impact” catalogue reveals a maturing ecosystem where income growth, climate-smart practices, and gender inclusion are increasingly tracked, even if data remains largely self-reported.

Africa’s Agtech Impact, Measured Clearly

Africa’s agrifood sector is undergoing a structural shift. Impact measurement, once a compliance afterthought, is becoming operational infrastructure.

According to the Seeds of Impact directory developed by AgBase in collaboration with ISF Advisors and partners, African agtech ventures are increasingly tracking farmer reach, net income improvements, climate-smart adoption, land under sustainable cultivation, and workforce gender composition.

This is not just storytelling. It is metrics.

Across the catalogue, companies report:

- Farmer reached from 1,000 users to over 5 million

- Yield improvements exceeding 30% in some cases

- Income gains ranging from 20% to 300%

- Land under sustainable cultivation exceeding 100,000 hectares

- Female participation in some ventures reaching 76% – 100%

The data is self-reported, and ecosystem definitions are still evolving, but the direction is clear: impact is becoming measurable.

Impact Is Becoming Operational Infrastructure

The catalogue defines three core impact pillars:

- Farmer & Client Impact: – Reach, income, production, quality of life.

- Climate & Land Impact: – Sustainable cultivation, climate-smart practices.

- Gender & Employment Impact: – Workforce and founder composition

This structure implies comparability across business models, from cold-chain logistics to AI fintech platforms. Impact is no longer anecdotal. It is structured.

The Numbers Behind Africa’s Agrifood Transformation

The diversity of scale is striking.

ThriveAgric (2017) reports:

- 1,000,000–5,000,000 farmers reached

- 100,000 hectares under sustainable cultivation

- 76% – 100% climate-smart adoption

- Over $150M in disclosed funding

Pesira (2022) reports:

- 10,001–50,000 farmers reached

- 76% – 100% net production improvement

- 76–100% net income improvement

- 10,001 – 50,000 hectares under sustainable cultivation

Farm Monitor (2022) reports:

- 10,001 – 50,000 farmers

- 5,001 – 10,000 hectares under sustainable cultivation

- AI-enabled credit systems

- Gender-inclusive onboarding via USSD/SMS

Cold-chain innovators show measurable post-harvest efficiency:

Savanna Circuit Technologies (2017):

- Milk spoilage reduced by over 70%

- Delivery volumes up 25%

- Farmer incomes increased by 20% monthly

Meanwhile, Farm to Feed (2021) reports up to 300% improvements in net income among participating farmers, although broader metric reporting is still in progress.

The data also reveals asymmetry. Some companies report full climate metrics; others note “data not yet reported”. Transparency about data gaps is itself a signal of maturity.

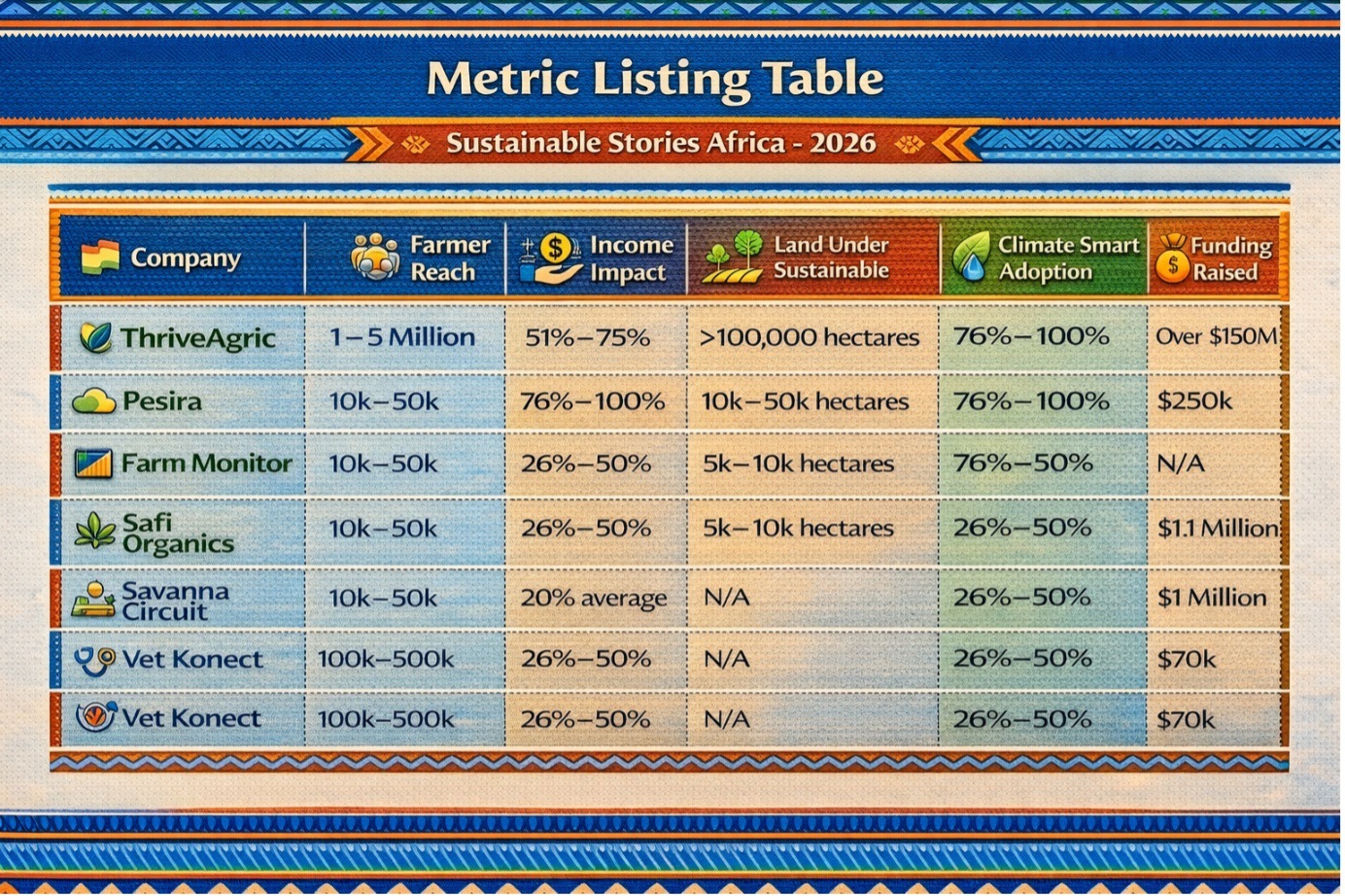

Metric Listing Table

Company | Farmer Reach | Income Impact | Land Under Sustainable Cultivation | Climate Smart Adoption | Funding Raised |

|---|---|---|---|---|---|

ThriveAgric | 1 – 5 Million | 51% – 75% | >100,000 ha | 76% – 100% | Over $150M |

Pesira | 10k – 50k | 76% – 100% | 10k – 50k hectares | 76% – 100% | $250k |

Farm Monitor | 10k – 50k | 26% – 50% | 5k – 10k hectares | 76% – 100% | N/A |

Safi Organics | 10k – 50k | 26% – 50% | 5k – 10k hectares | 26% – 50% | $1.1 Million |

Savanna Circuit | 10k – 50k | 20% average | N/A | 26% – 50% | $1 Million |

Vet Konect | 100k – 500k | 26% – 50% | N/A | 26% – 50% | $70k |

Why Measurement Changes Capital Allocation

Impact metrics increasingly influence capital flows.

The catalogue documents ventures ranging from $70k raised (Vet Konect) to over $150M (ThriveAgric). Funding visibility correlates with structured reporting.

When ventures track:

- Net production improvement

- Net income improvement

- Land under sustainable cultivation

- Climate-smart adoption

They create:

- Bankable signals for blended finance

- Verifiable data for ESG-linked instruments

- Evidence for concessional capital

Measurement reduces perceived risk.

Gender data is becoming material. Several ventures report 51% – 75% female workforce participation or co-founder representation. Inclusion is being operationalised, not merely pledged.

Standardisation Is The Next Frontier

However, the report is candid: most impact data remains self-reported and unevenly defined.

This signals a clear next step:

- Standardise definitions (aligned with IRIS+ and FAO climate metrics already referenced)

- Improve third-party validation mechanisms

- Build low-cost data collection toolkits (AgBase is developing such tools with 60 Decibels)

- Link capital pricing to verified outcomes

The opportunity is not simply to measure impact, but to monetise credibility.

Africa’s agrifood ventures are proving that productivity, climate resilience, and inclusion can co-exist. The major challenge is the interoperability of data.

Impact without comparability limits scale. Comparability unlocks institutional capital.

Path Forward – Harmonising Impact Standards to Finance Agri-Transformation

The priority is harmonised impact standards across Africa’s agrifood ecosystem, anchored in practical metrics that ventures can realistically collect.

Toolkits, validation partnerships, and alignment with global ESG frameworks must accelerate.

Capital providers should link concessional finance and blended structures to verified outcomes.

As impact reporting matures, Africa’s agtech sector can translate from promising pilot metrics to investment-grade climate and income data, reshaping how agricultural growth is financed.