As Gulf sovereign wealth funds and development banks scale up climate finance, a new analysis argues the Middle East could become one of the world’s most consequential backers of clean energy infrastructure, if capital is channelled strategically.

For Africa and other emerging markets, that shift could redefine who funds the energy transition, under what terms, and at what speed.

Middle East Capital Targets Clean Infrastructure Surge

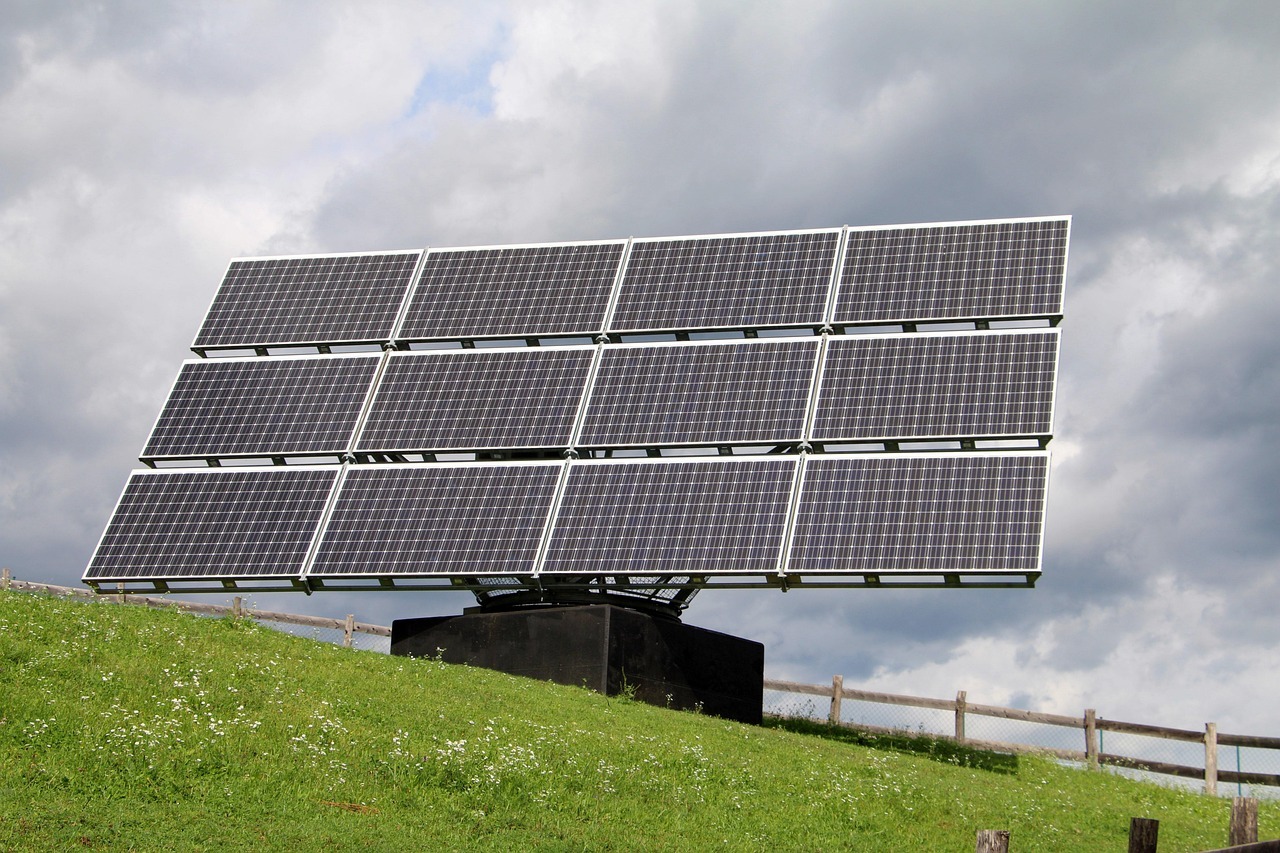

The Middle East is positioning itself not just as a hydrocarbon powerhouse, but as a capital engine for global clean energy infrastructure.

A new analysis by Clean Air Task Force (CATF) argues that sovereign wealth funds, development finance institutions, and state-backed investors across the Gulf have both the liquidity and geopolitical leverage to accelerate large-scale decarbonisation projects worldwide.

With trillions of dollars under management, especially in the Saudi Arabia, United Arab Emirates, and Qatar, the region’s financial institutions are increasingly diversifying portfolios toward renewables, hydrogen, carbon capture and grid infrastructure.

The strategic question, CATF notes, is not whether capital exists, but how it is deployed.

For African markets seeking concessional and blended finance for transmission lines, green industrial zones and resilient grids, this emerging capital pivot could prove pivotal.

Capital Repositions for Energy Transition

At the heart of CATF’s argument is a simple but powerful proposition: Middle Eastern public finance institutions are uniquely positioned to underwrite high-risk, high-impact clean infrastructure projects that many Western investors deem too uncertain.

The region’s sovereign wealth funds, including the Public Investment Fund (PIF), Abu Dhabi Investment Authority (ADIA), and Qatar Investment Authority (QIA), collectively manage well over $3 trillion in assets.

Their long-term investment horizons, coupled with state alignment, give them unusual latitude to fund infrastructure with extended payback periods.

CATF suggests this capital base could support cross-border transmission, green hydrogen corridors, advanced nuclear, carbon capture and storage (CCS), and industrial decarbonisation sectors requiring patient capital and sovereign-level risk tolerance.

For countries in Africa and South Asia, where grid deficits and financing constraints remain acute, this shift signals more than portfolio diversification. It represents a structural rebalancing of global clean energy finance.

Strategic Leverage, Not Just Liquidity

The report highlights that Middle Eastern investors are not merely passive financiers.

Many are aligning clean energy investments with domestic industrial strategies, especially in hydrogen exports, petrochemical decarbonisation, and advanced manufacturing.

The Abu Dhabi Developmental Holding Company (ADQ) and Saudi-backed infrastructure vehicles are already co-investing in renewables and transmission assets across emerging markets.

The Islamic Development Bank (IsDB), headquartered in Jeddah, has long played a catalytic role in blended finance structures linking Gulf capital with African infrastructure.

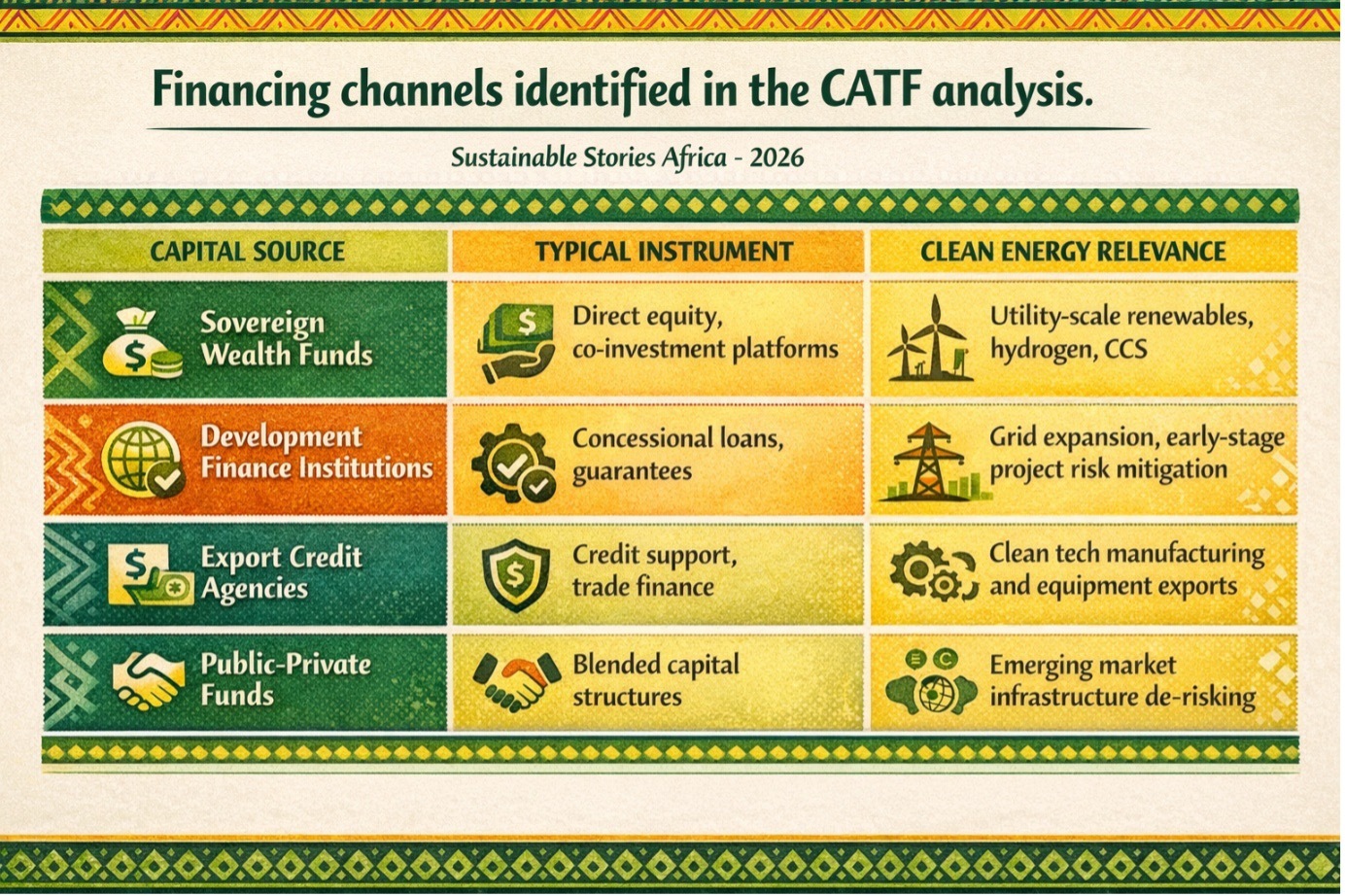

Below is a summary of the financing channels identified in the CATF analysis:

Capital Source | Typical Instrument | Clean Energy Relevance |

|---|---|---|

Sovereign Wealth Funds | Direct equity, co-investment platforms | Utility-scale renewables, hydrogen, CCS |

Development Finance Institutions | Concessional loans, guarantees | Grid expansion, early-stage project risk mitigation |

Export Credit Agencies | Credit support, trade finance | Clean tech manufacturing and equipment exports |

Public-Private Funds | Blended capital structures | Emerging market infrastructure de-risking |

The report highlights that state-backed Gulf institutions often move faster than multilateral lenders, particularly where strategic bilateral ties exist. That agility could shorten project timelines in markets facing urgent power shortages.

However, CATF cautions that credibility hinges on governance standards, environmental safeguards and transparent risk assessment frameworks, especially when investing in frontier markets.

A New Financing Architecture Emerges

For emerging economies, the implications are compelling.

Africa alone requires an estimated $100 billion annually for clean energy and grid expansion to meet development and climate goals.

Traditional development finance has struggled to close that gap. If even a fraction of Gulf sovereign capital were systematically directed toward climate-aligned infrastructure, the multiplier effect could be transformative.

CATF argues that Middle Eastern leadership could:

- Expand global carbon management capacity through CCS investments.

- Anchor green hydrogen supply chains linking the Middle East, Africa and Europe.

- Accelerate grid modernisation in under-electrified regions.

- De-risk early-stage clean industrial projects via blended finance mechanisms.

There is also a geopolitical dividend. By positioning themselves as climate infrastructure partners, Gulf states can reinforce diplomatic ties, diversify revenue streams beyond hydrocarbons, and shape emerging global standards for clean energy trade.

For African governments, this offers an opportunity to negotiate structured partnerships, combining Gulf equity with multilateral guarantees and local regulatory reforms, to unlock large-scale infrastructure deployment.

Align Capital with Climate Credibility

However, the pathway is not automatic.

CATF stresses that capital allocation must align with robust environmental standards and transparent governance frameworks.

Investments that merely rebadge fossil assets without genuine emissions reduction would undermine credibility.

Policy alignment, particularly on methane abatement, carbon accounting, and grid decarbonisation strategies, will be critical.

Strong regulatory signals from host governments can further ensure that Gulf investments accelerate, not dilute, the energy transition.

For policymakers across Africa and Asia, the next step is strategic engagement: structuring bankable project pipelines, strengthening procurement transparency, and leveraging blended finance instruments to crowd in Middle Eastern sovereign capital.

For Gulf institutions, the challenge is to convert financial strength into measurable climate impact, backed by clear emissions metrics and long-term infrastructure resilience.

Path Forward – Strategic Climate Capital Partnerships

Middle Eastern sovereign investors are poised to reshape clean infrastructure finance, but impact depends on disciplined capital deployment and transparent governance.

Structured partnerships with emerging markets, especially in grid expansion, hydrogen and carbon management, can accelerate decarbonisation while supporting economic diversification.

The next phase requires coordinated project pipelines, blended finance tools, and enforceable climate standards.

If aligned effectively, Gulf capital could become a cornerstone of global clean energy infrastructure build-out.