Africa’s Blue Tech sector has attracted over $230 million across more than 150 deals; however, scale remains elusive. Fewer than one-third of ventures raise more than $1 million, and only about 3% have raised more than $20 million.

A new report argues that the challenge is not relevance but capital design. Blue Tech, including aquaculture, cold chains, circular waste, and marine protection, requires patient, science-aligned funding models that today’s fragmented financing pathways struggle to provide.

Africa’s Blue Tech Funding Bottleneck

The Blue Tech ecosystem in Africa, particularly solutions that advance aquaculture, marine protection, blue infrastructure, circular waste, and renewable ocean energy, has drawn growing investor attention.

Since 2015, the sector has received over $230 million in total funding, across more than 150 deals, supporting over 85 startups and backed by 180 active funders.

Even so, through the momentum, very few efforts leap promising to scale. According to the report “Financing the next wave: Unlocking capital to scale Bluetech ventures and transform the blue economy”, less than one-third of ventures raise above $1 million, and only 3% exceed $20 million.

The report frames this as a structural capital mismatch: Blue Tech is capital-intensive, science-heavy, and systems-oriented, yet funding instruments remain short-term, fragmented, and misaligned with venture maturity cycles.

Scaling Eludes Africa’s Blue Tech Ventures

Blue Tech represents just 6% of total climate tech funding in Africa; however, it accounts for between 18% and 19% of climate tech deals. This suggests high activity but low average ticket sizes.

The report identifies four structural funding constraints:

- Lagging scale despite relevance

- Long and fragmented capital pathways

- Limited financing innovation beyond early stages

- Poor alignment between funders and solution archetypes

The capital journey of SunCulture, which raised over $50M in more than 15 deals over the past decade, combining equity, grants, and debt, illustrates the complexity of scaling science-based ventures.

In Blue Tech, growth is not linear. It is layered.

A System, Not a Sector

Blue Tech cuts across multiple climate tech domains:

- Blue Infrastructure & Energy – Cold chains, batteries, hydropower, wave energy

- Blue Food Systems – Aquaculture, fish farming, animal feed

- Blue Circularity – Waste-to-value, biomaterials

- Blue Protection – Robotics, ecosystem monitoring

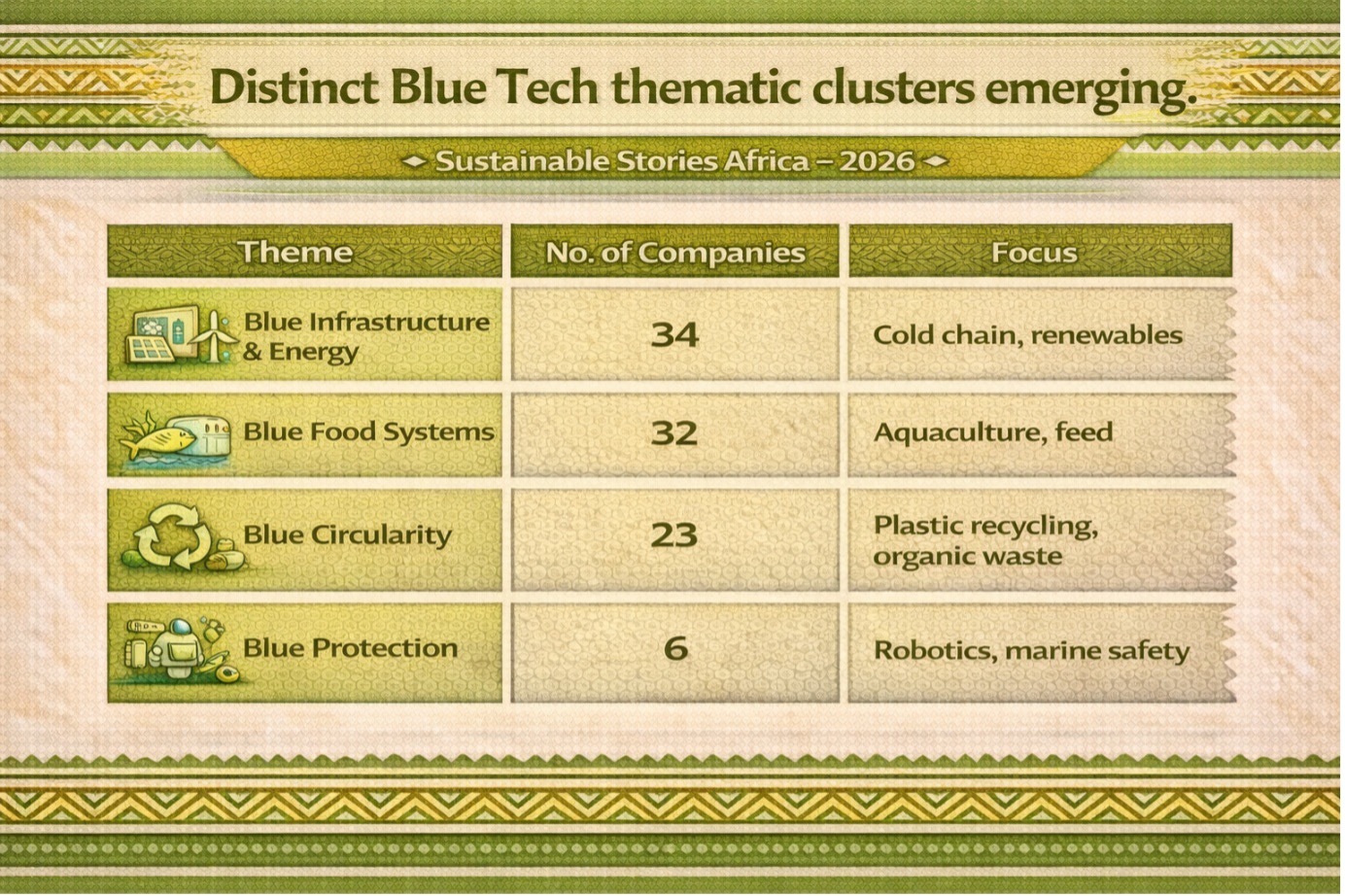

Distinct thematic clusters are emerging:

Theme | No. of Companies | Focus |

|---|---|---|

Blue Infrastructure & Energy | 34 | Cold chain, renewables |

Blue Food Systems | 32 | Aquaculture, feed |

Blue Circularity | 23 | Plastic recycling, organic waste |

Blue Protection | 6 | Robotics, marine safety |

Geographically, ventures cluster in Kenya, Nigeria, and South Africa, with activity expanding into the Great Lakes and coastal markets.

Deal flow mirrors broader climate tech growth trends; however, ticket sizes remain constrained.

Capital Stack Constraints

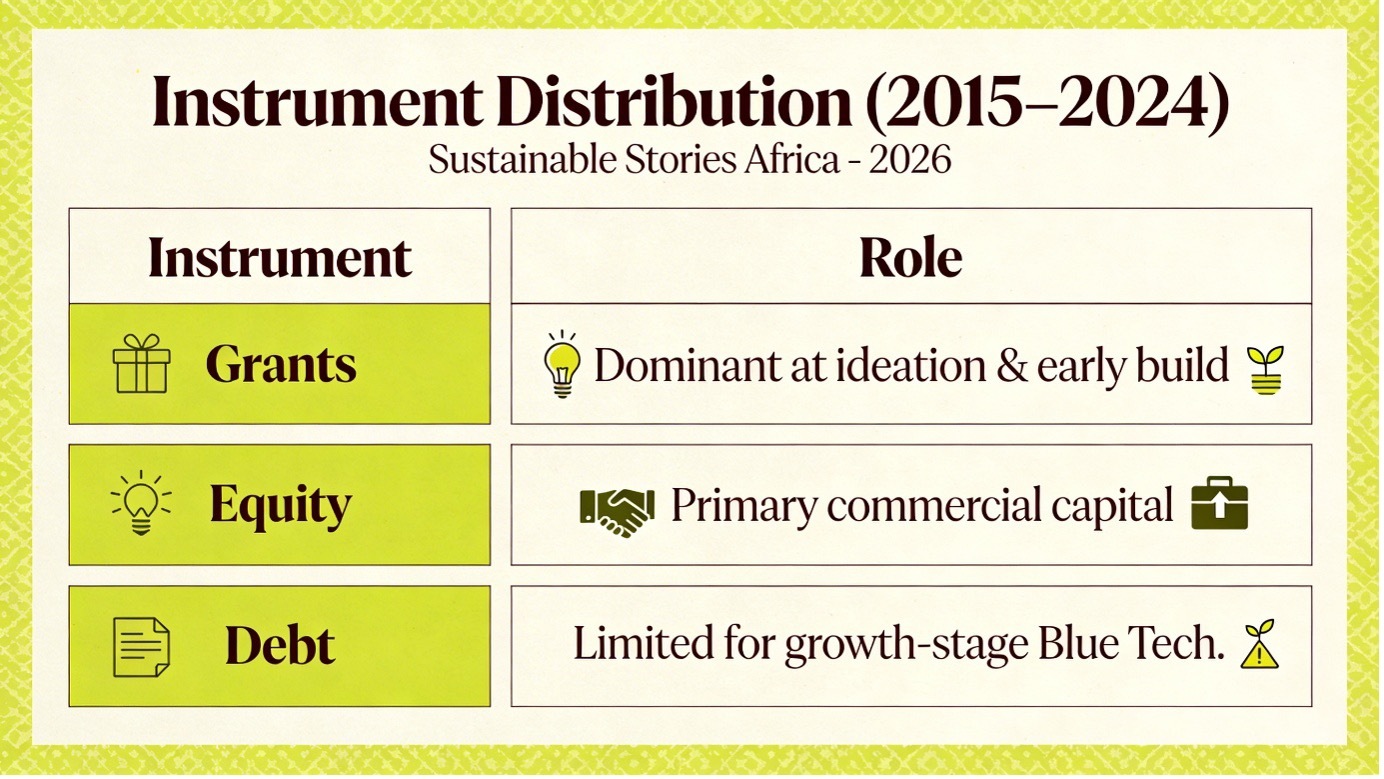

The breakdown of deals by instrument reveals a heavy reliance on grants at early stages, with limited structured innovation for commercialisation and scale.

Instrument Distribution (2015–2024)

Instrument | Role |

|---|---|

Grants | Dominant at ideation & early build |

Equity | Primary commercial capital |

Debt | Limited for growth-stage Blue Tech |

At later stages, debt is common in energy climate tech, which is largely inaccessible to Blue Tech ventures. This keeps many startups “stalled between pilot and scale”.

Science Bias Slows Scaling

Blue Tech is disproportionately science-based. According to the archetype breakdown:

- 30% Science-Based

- 13% Hardware

- 6% Software

Science-heavy models increase development timelines, regulatory requirements, and capital intensity.

Women founders, although a minority overall, are more concentrated in science-based ventures, suggesting untapped opportunities by gender-aligned capital.

Designing a Staged Financing Continuum

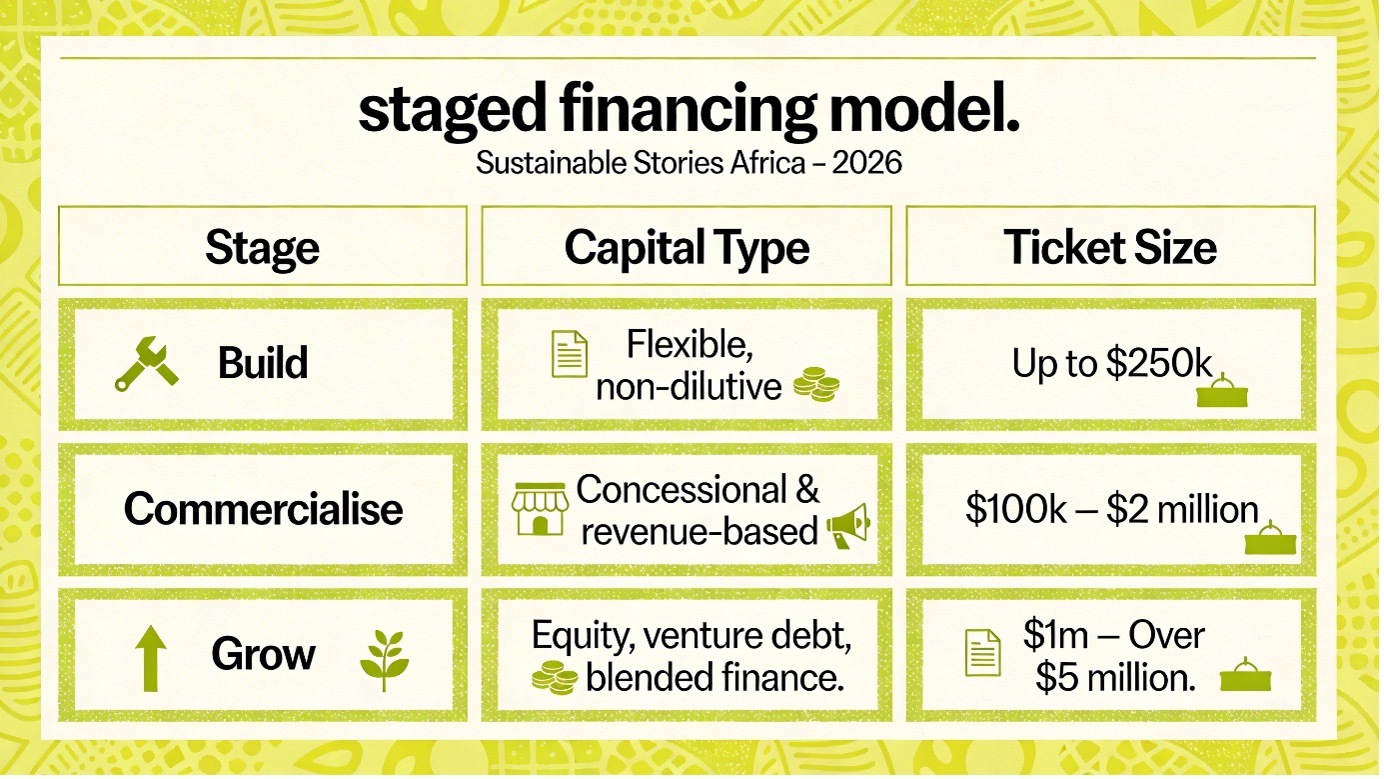

The report proposes a staged financing model:

Stage | Capital Type | Ticket Size |

|---|---|---|

Build | Flexible, non-dilutive | Up to $250k |

Commercialise | Concessional & revenue-based | $100k – $2 million |

Grow | Equity, venture debt, blended finance | $1m – Over $5 million |

This continuum requires alignment across:

- Donors

- DFIs

- Accelerators

- Impact investors

- Venture capital firms

- Banks

Ticket sizes currently vary widely across actors, creating coordination gaps.

The opportunity lies in synchronising instruments, timelines, and risk tolerance with solution archetypes.

Aligning Capital With Solution Archetypes

The report emphasises:

- Grants are essential at ideation but insufficient for scale.

- Revenue-based financing, asset financing, and working capital solutions are critical at commercialisation.

- Growth-stage ventures require preferred equity, venture debt, mezzanine finance, and local-currency debt.

Better coordination among funders deploying different ticket sizes and instruments could facilitate smoother capital transitions.

Blue Tech’s financing puzzle is not about scarcity of capital, but sequencing and structure.

Path Forward – Align Capital With Science Cycles

Scaling the Blue Tech sector in Africa requires coordinated financing across build, commercialisation, and growth stages.

Grants must evolve into concessional commercial capital, and later-stage blended finance instruments aligned with science-driven development cycles.

Donors, DFIs, corporates, and private investors are urged to synchronise ticket sizes and risk appetite, ensuring capital continuity from ideation to scale.