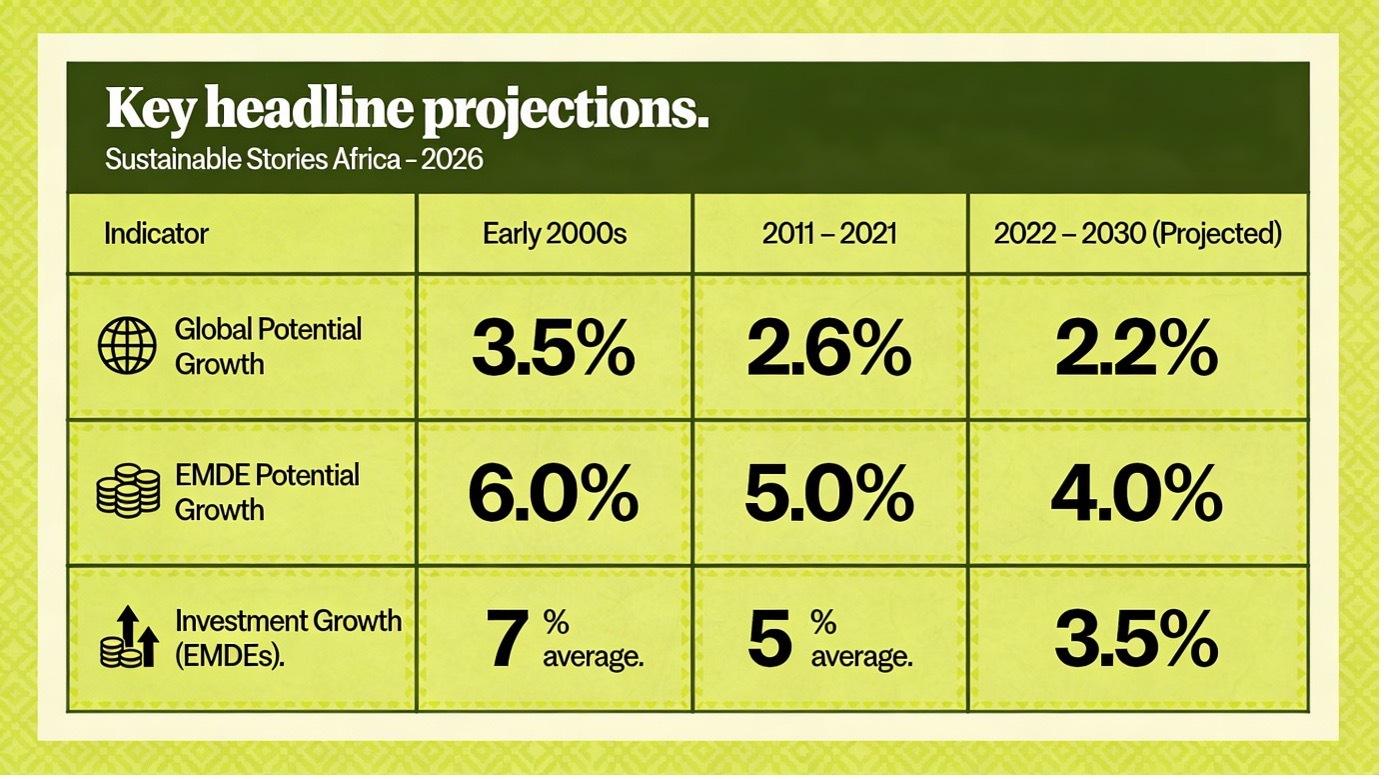

Global long-term growth is slowing in ways not seen in three decades. A new World Bank analysis warns that without decisive reform, potential global GDP growth could fall to 2.2% annually through 2030, down from 3.5% in the early 2000s.

For emerging and developing economies, the stakes are existential. Slower investment, weaker productivity, ageing workforces, and flattening trade are converging into what economists describe as a “structural slowdown.” The policy window to reverse course is narrowing.

World Growth Faces a Structural Decade

The global economy is entering what the World Bank describes as a prolonged period of structural weakness, not merely a cyclical slowdown. According to Falling Long-Term Growth Prospects: Trends, Expectations, and Policies (Part II of the report, pp. 225–388), potential global GDP growth, the maximum sustainable rate an economy can maintain without igniting inflation, is projected to decline to 2.2% annually through 2030, the lowest in three decades.

This represents a reduction from the 3.5% average potential growth recorded in the early 2000s, and below the 2.6% average between 2011 and 2021.

For emerging market and developing economies (EMDEs), potential growth could decelerate to 4%, down from 6% between 2000 and 2010.

The implications are profound: weaker poverty reduction, tighter fiscal space, reduced climate investment capacity, and rising social tension.

The slowdown is structural, rooted in declining productivity, weaker investment, demographic headwinds, and fading trade integration, rather than simply the aftermath of COVID-19 or geopolitical shocks.

Global Potential Growth Hits Three-Decade Low

The World Bank’s central warning is stark: absent coordinated reform, the 2020s risk becoming a “lost decade” for global growth.

Key headline projections:

Indicator | Early 2000s | 2011 – 2021 | 2022 – 2030 (Projected) |

|---|---|---|---|

Global Potential Growth | 3.5% | 2.6% | 2.2% |

EMDE Potential Growth | 6.0% | 5.0% | 4.0% |

Investment Growth (EMDEs) | 7% average | 5% average | 3.5% |

The report emphasises that nearly all traditional growth drivers are weakening simultaneously:

- Slower total factor productivity (TFP)

- Ageing working-age populations

- Investment stagnation

- Trade growth now matches GDP growth instead of doubling it

This convergence of headwinds creates a systemic drag on long-term prosperity.

Investment, Productivity, and Demographics Weaken

Investment Slowdown - Part II of the report (pp. 225 – 388) highlights a global deceleration in investment. EMDE investment growth is projected at 3.5% annually, roughly half the rate of the 2000s.

The slowdown is tied to:

- Rising global policy uncertainty

- Elevated debt levels

- Tightened monetary conditions

- Weak private sector confidence

Without stronger capital formation, capital deepening slows and so does potential output.

Total Factor Productivity (TFP) –TFP growth, often described as the “efficiency engine” of economies, is declining. The report notes that TFP is now growing at its slowest pace since 2000.

This reflects:

- Reduced technology diffusion

- Slower sectoral reallocation

- Weak innovation intensity

- Fragmenting global trade architecture

Demographic Headwinds - Global working-age population growth has fallen to a three-decade low. Advanced economies are ageing rapidly; EMDE demographic dividends are narrowing.

Female labour force participation remains approximately three-quarters that of men globally, with larger gaps in regions such as South Asia and MENA.

Trade as a Sputtering Engine – Trade growth once expanded at twice the pace of global GDP (1990 – 2011). It now roughly mirrors global output growth.

Higher logistics costs, supply chain fragmentation, and rising trade restrictions are constraining cross-border efficiency gains.

Reforms Could Lift Global Growth

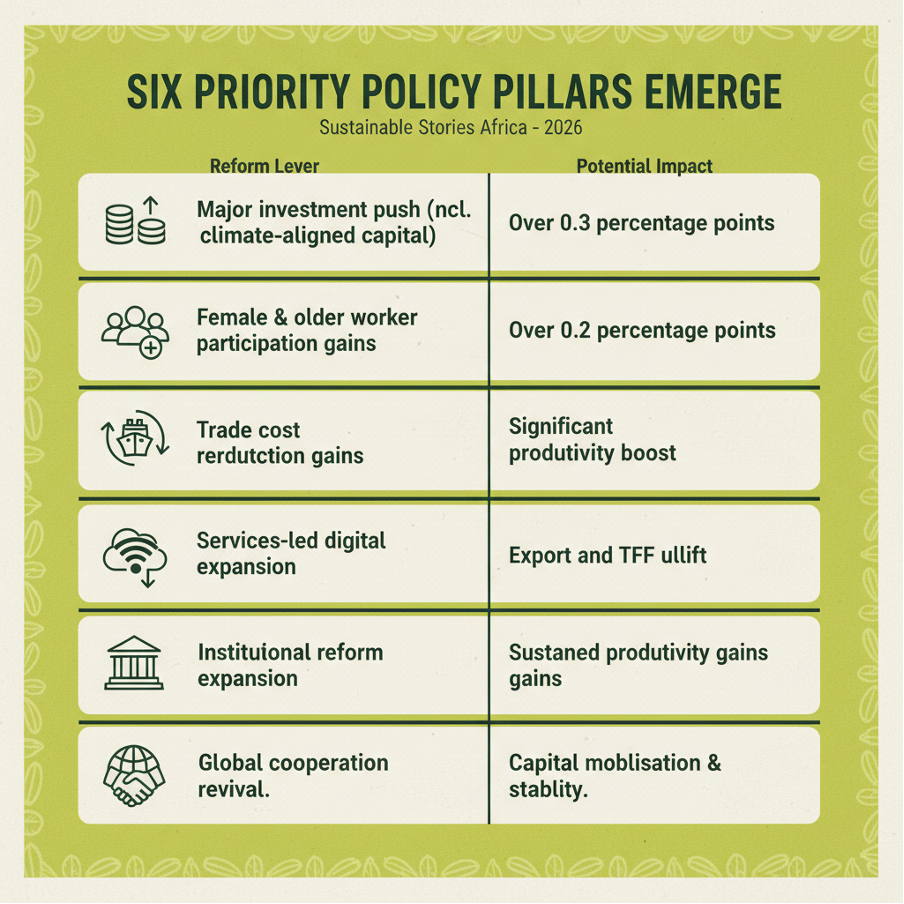

The report is not fatalistic. It models an upside scenario: if countries replicate their strongest reform episodes of the past decade, global potential growth could increase by 0.7 percentage points, lifting it to 2.9% annually.

Six priority policy pillars emerge:

Reform Lever | Potential Impact |

|---|---|

Major investment push (incl. climate-aligned capital) | Over 0.3 percentage points |

Female & older worker participation gains | Over 0.2 percentage points |

Trade cost reductions | Significant productivity boost |

Services-led digital expansion | Export and TFP uplift |

Institutional reform | Sustained productivity gains |

Global cooperation revival | Capital mobilisation & stability |

Notably, climate-aligned infrastructure investment is presented not as a trade-off, but rather it is expected accelerate growth.

Climate investment could simultaneously:

- Increase resilience

- Create employment

- Raise long-term productivity

- Support SDG attainment

This reframes sustainability as a macroeconomic strategy.

Policy Windows Narrow, Coordination Essential

The report stresses that restoring growth requires:

- Robust macroeconomic frameworks

- Fiscal-monetary alignment

- Private capital mobilisation

- Institutional reform

- Trade facilitation

- Services sector digital integration

Crucially, the policy response must be both national and global.

International cooperation on:

- Trade

- Debt transparency

- Climate finance

- Infrastructure

- Health resilience

is described as indispensable.

Without coordinated reform, slower growth could compound fiscal stress, social unrest, and climate vulnerability.

Path Forward – World Bank’s Reform Blitz for Growth

The World Bank calls for a coordinated global reform push centred on investment expansion, productivity-enhancing reforms, female labour participation, trade cost reductions, and climate-aligned capital deployment.

Countries are encouraged to replicate their most significant historical reform episodes while strengthening macroeconomic credibility.

If implemented decisively, potential global growth could rise by 0.7 percentage points, reversing the projected slowdown.

Without action, however, the 2020s risk becoming a structurally weaker decade for prosperity, poverty reduction, and climate resilience.