Cybersecurity, liquidity stress, fraud, and digital disruption now define Africa’s corporate risk landscape, according to the 2026 Africa Risk in Focus report.

Based on 1,043 African survey responses across 39 countries, the report finds that 62% of Chief Audit Executives (CAEs) rank cybersecurity as their top risk and 43% cite financial and liquidity pressures, levels higher than the global average.

The findings suggest that ESG governance, resilience, and digital integrity are now inseparable in African markets.

Africa’s Risk Map Redrawn

Africa’s corporate risk landscape is undergoing structural realignment. The 2026 Africa Risk in Focus report, based on 1,043 African responses and 4,073 globally, reveals a region navigating interconnected shocks: cybersecurity threats, financial liquidity pressures, fraud exposure, digital disruption, and climate volatility.

Cybersecurity ranks first, with 62% of African CAEs listing it among their top five risks.

Financial and liquidity risks follow at 43%, which is significantly higher than the global average of 31%.

Fraud is equally elevated at 43%, nearly double the global figure of 23%.

The message is clear: risk convergence, not isolated events, is shaping corporate governance priorities across the continent.

Cybersecurity Tops Africa’s Risk Agenda

Cybersecurity remains Africa’s highest-ranked risk at 62%. However, the most striking movement is digital disruption, which rose from sixth to third place year-on-year, climbing 10 percentage points to 44% (Exhibit 3, p.11).

Africa lost an estimated $10 billion to cybercrime in 2023, according to the report’s cybersecurity section (p.23). As artificial intelligence lowers barriers for cyberattacks, organisations face escalating threats amplified by limited digital literacy and uneven regulatory frameworks.

Four of the top five risks, including cybersecurity (62%), business resilience (49%), digital disruption (44%), and fraud (43%), are technology-linked and deeply interconnected.

Liquidity, Climate, Governance Pressures Intensify

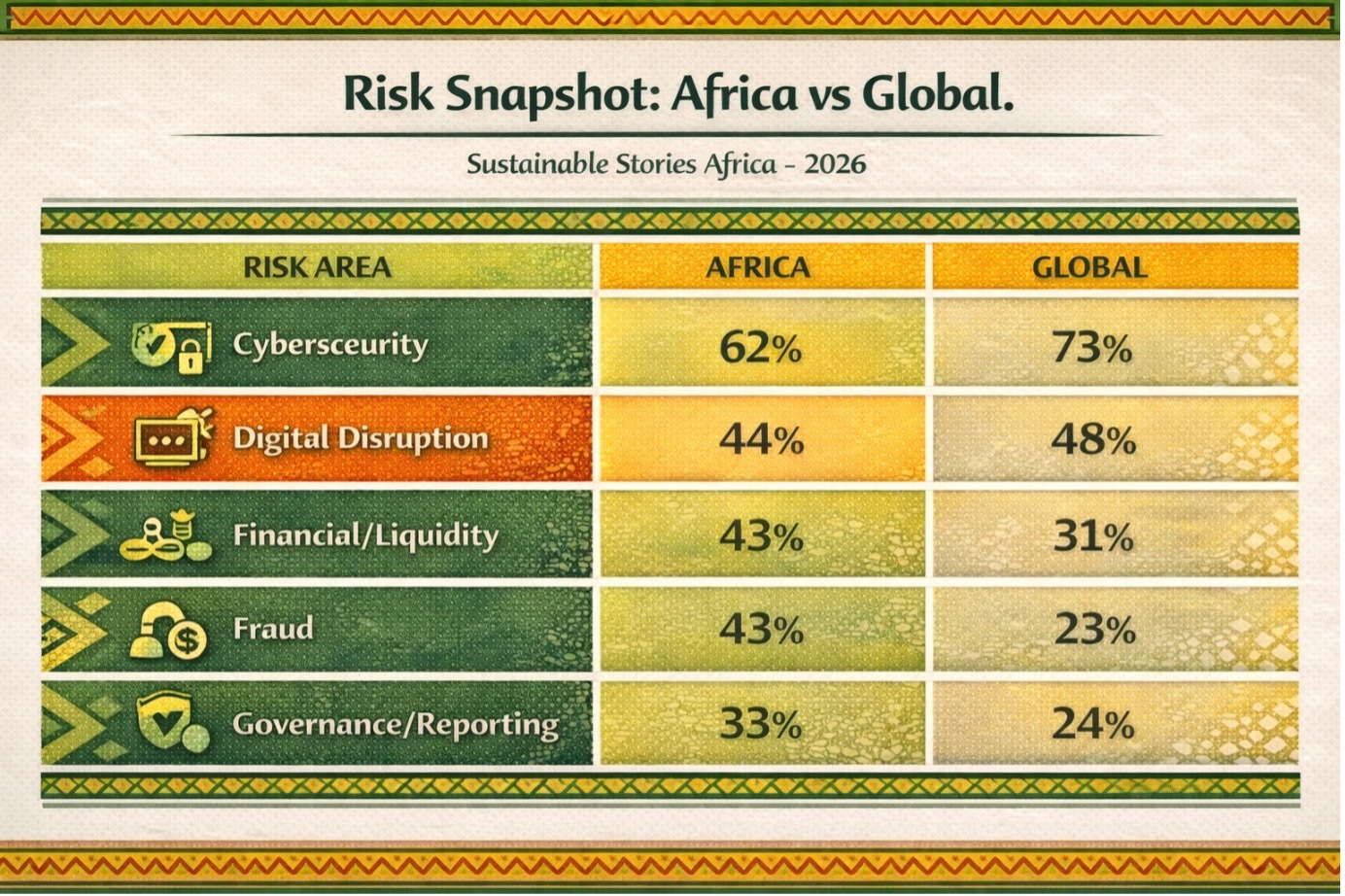

Risk Snapshot: Africa vs Global

Risk Area | Africa | Global |

|---|---|---|

Cybersecurity | 62% | 73% |

Digital Disruption | 44% | 48% |

Financial/Liquidity | 43% | 31% |

Fraud | 43% | 23% |

Governance/Reporting | 33% | 24% |

Financial and liquidity risks reflect dependency on foreign currency flows, exchange rate volatility, and constrained capital markets.

Several African banks struggled with foreign currency liquidity during 2024–2025

Extreme weather compounds fiscal stress. Zambia’s 2024 drought affected 9.8 million people, representing almost 48% of the population, triggering inflation spikes and emergency spending.

Although climate risk ranks twelfth overall (24%), Africa was the only global region to increase the audit effort on climate change this year, up 5 percentage points to 14%.

Governance and corporate reporting risk stands at 33%. This exceeds the global average of 24%. The adoption of International ESG standards is increasing pressure on reporting integrity.

Resilience and Digital Governance Create Opportunity

The report’s conclusion emphasises that resilience, not reaction, is the pathway forward.

Business resilience ranks second in audit priority at 54%. Governance/corporate reporting follows at 51%, and fraud at 50%.

- Internal audit functions are rebalancing their models:

- Traditional audits now consume roughly 60% of time, with advisory services expanding to respond to emerging risks.

- Cybersecurity audit priority stands at 60%, aligned closely with risk exposure.

- Financial/liquidity audit priority at 47% mirrors risk ranking (43%).

However, digital disruption presents a governance gap:

Digital Disruption | Risk Level | Audit Priority |

|---|---|---|

Africa | 44% | 30% |

This gap reflects skills shortages. Human capital risk ranks sixth (35%), and several CAEs cited migration of skilled professionals, even referring to “Canada risk” in lending assessments.

However, opportunity is evident. The African fintech sector is described as one of the world’s most dynamic. Digitalisation is boosting revenue collection and reducing leakages in public institutions.

Mobile money enhances social inclusion. Cloud strategies and digital identity systems can strengthen transparency.

The implication being that digital transformation must be matched by digital governance.

Boards Must Strengthen Risk Governance

The report outlines practical internal audit strategies across financial and cybersecurity domains.

Key governance imperatives include:

- Strengthening liquidity stress testing and scenario planning

- Embedding cybersecurity into organisational culture with KPIs

- Enhancing fraud transparency and whistleblower frameworks

- Benchmarking governance structures globally

- Investing in digital audit tools and AI-enabled assurance

- Improving board-level communication clarity

Importantly, CAEs are urged to inform boards of internal audit skill maturity and recommend targeted improvements where deficiencies exist.

The conclusion emphasises culture as a persistent theme, from fraud prevention to cybersecurity awareness.

In Africa’s risk landscape, governance integrity is no longer peripheral; it is systemic infrastructure.

Path Forward – Embedding Resilience Into Governance

African organisations must align cybersecurity controls, liquidity management frameworks, and governance reporting structures into a unified resilience strategy.

Strengthening audit committees, investing in digital assurance tools, and embedding cybersecurity culture across operations are immediate priorities.

Boards are being encouraged to balance assurance and advisory roles within internal audit, close digital skills gaps, and integrate climate, liquidity, and fraud oversight into enterprise-wide governance frameworks.