Ethiopia is seeking to convert its green advantage into export-ready industry; however, stalled pilots, limited private finance and costly certification continue to constrain factories and MSMEs.

A new policy blueprint argues that coordinated de-risking by government, banks and development partners could shift the country from fragmented pilots to bankable pipelines serving premium markets.

From fast-track permitting to a proposed Green Enterprise Hub, the ACCPA outlines a roadmap to scale climate-aligned manufacturing if stakeholders move quickly to secure first-mover gains.

Ethiopia’s Moment To Scale Green Manufacturing

Ethiopia is nearing a critical green industrial tipping point. Abundant renewable energy, an expanding industrial base and a youthful workforce position the country to compete in climate-aligned manufacturing and trade.

However, entry barriers remain steep: high certification costs, unreliable power, permitting delays and thin MSME pipelines sustain a persistent “pilot trap,” where energy efficiency, agro-processing and circular initiatives rarely scale into export-ready programmes.

New analysis from the Africa-China Centre for Policy and Advisory (ACCPA), under the Sino-Africa Green Finance Alliance with support from the African Climate Foundation, argues that targeted system-wide reforms can unlock progress.

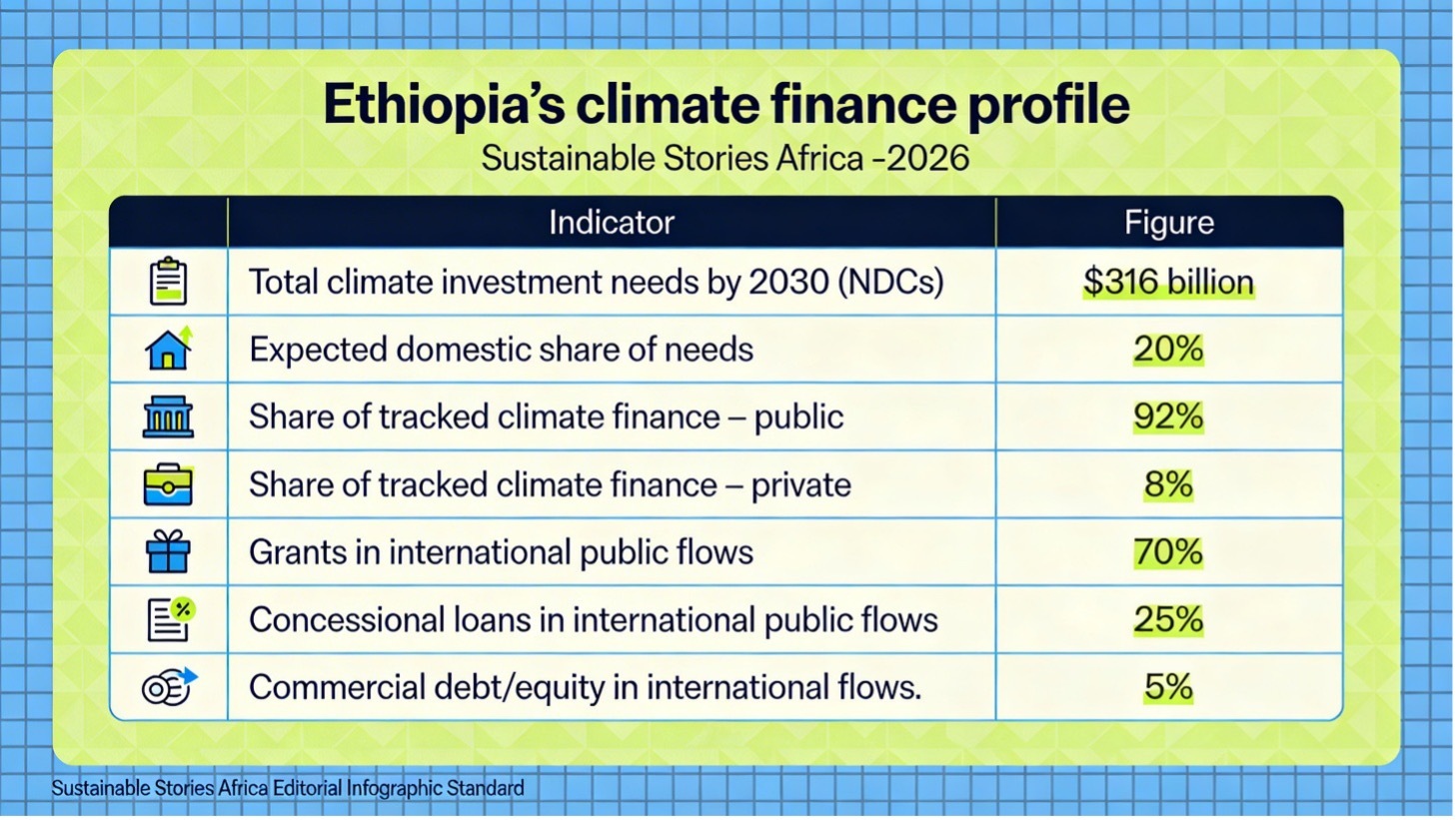

Ethiopia’s updated NDCs estimate climate investment needs of $316 billion by 2030, with only 20% of the investment expected to be raised domestically. Climate finance remains 92% public and only 8% private, signalling binding risk and pipeline constraints.

ACCPA proposes fast-tracked upgrades, certification support and scaled blended finance. Its message: green growth must anchor core industrial policy.

Green Advantage Risks Becoming Missed Moment

Ethiopia’s structural advantages, including its hydro, wind, solar and geothermal potential, strategic trade corridors and a youthful workforce, align closely with a green industrial pathway.

These assets could anchor low-carbon textiles, climate-smart agro-products, circular inputs and clean-tech components for regional and global markets.

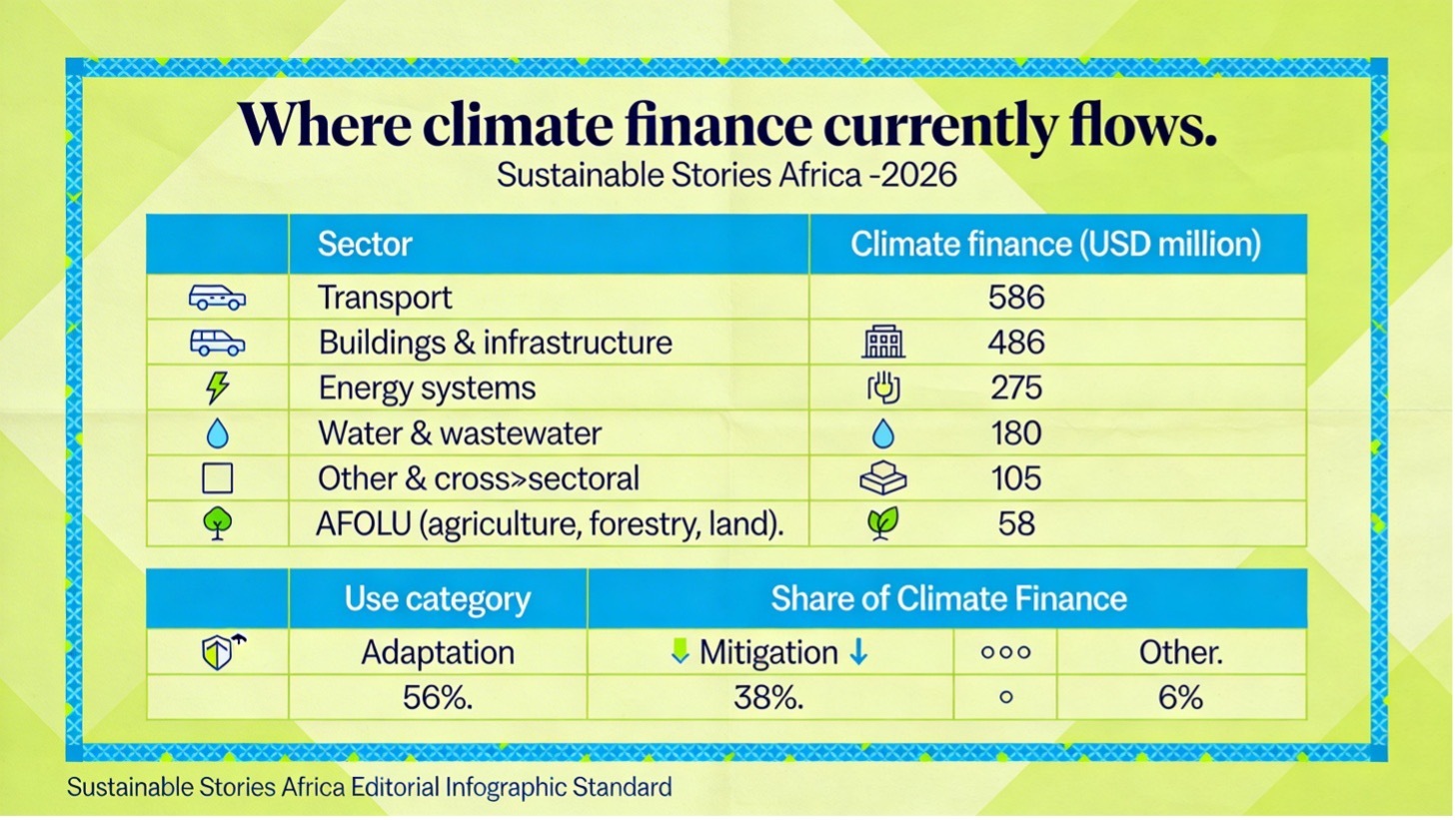

However, enabling systems remain weak. Climate finance is largely public and concessional, with 56% directed towards adaptation, while investment in critical manufacturing areas lags.

Without targeted de-risking and stronger pipelines, ACCPA warns that Ethiopia risks missing the rising demand for low-carbon goods.

Finance Structures Keep Green Firms Stranded

The report snapshot highlights a green finance landscape that is tilted heavily towards public money, grants, and adaptation.

Tracked climate finance stands at 92% public versus 8% private, with international public flows dominated by grants (70%), followed by concessional loans (25%) and just 5% commercial debt or equity.

This suggests a system where risk‑sharing instruments and bankable deal pipelines have not yet mobilised market‑rate capital at scale.

Ethiopia’s climate finance profile

| Indicator | Figure |

|---|---|

| Total climate investment needs by 2030 (NDCs) | $316 billion |

| Expected domestic share of needs | 20% |

| Share of tracked climate finance – public | 92% |

| Share of tracked climate finance – private | 8% |

| Grants in international public flows | 70% |

| Concessional loans in international public flows | 25% |

| Commercial debt/equity in international flows | 5% |

On the firm side, MSMEs face high interest rates, strict collateral demands and limited green finance products, widening the pilot-to-scale gap.

Weak investor confidence, unreliable power, slow permitting, and fragmented coordination further raise risk and undermine the economics of green manufacturing.

Export readiness remains constrained. Costly certification, weak recognition of local standards and limited trade facilitation hinder entry into premium markets, alongside regulatory barriers, thin networks and high production costs.

De‑Risking Green Deals Unlocks Shared Value

ACCPA frames green growth as a core industrial policy, arguing that resource efficiency, clean energy and circularity can enhance competitiveness, shield firms from energy shocks, and unlock premium markets.

The goal is to shift from scattered pilots to scalable programmes across energy systems, agro-processing, textiles, construction materials and circular value chains, where green jobs and export potential are strongest.

Where climate finance currently flows

| Sector | Climate finance (USD million) |

|---|---|

| Transport | 586. |

| Buildings & infrastructure | 486. |

| Energy systems | 275. |

| Water & wastewater | 180. |

| Other & cross‑sectoral | 105. |

| AFOLU (agriculture, forestry, land) | 58. |

| Use category | Share of Climate Finance |

|---|---|

| Adaptation | 56%. |

| Mitigation | 38%. |

| Other | 6%. |

Targeted de-risking through blended finance, including concessional lending, partial guarantees and performance-based incentives, could attract private capital.

A standards accelerator, climate finance registry and stronger institutional capacity would underpin scale. Central to this strategy is an MSME-focused Green Enterprise Hub.

Five Policy Shifts To Catalyse Investment

To shift from margin to mainstream, ACCPA outlines five mutually reinforcing policy actions that directly target firm-side frictions, financial bottlenecks, and ecosystem gaps.

- Fast-track green investments through SLAs and reliability pacts – Create a green industry fast‑track by combining streamlined permitting, service level agreements across power, environmental, and industry agencies, and infrastructure reliability commitments in priority zones to shorten project timelines and enable bankability.

- Operationalise a Green Standards Accelerator – Establish a national platform offering technical assistance for certification (ISO 14001 and sector ecolabels), testing labs, conformity assessment, and cost‑sharing schemes, especially for SMEs, to improve export and procurement readiness.

- Deploy blended on‑lending and project preparation windows – Channel concessional finance into dedicated on‑lending facilities for green manufacturers and clean‑tech MSMEs, paired with feasibility, permitting, and monitoring support; use partial guarantees and outcome‑linked subsidies to de‑risk private capital.

- Launch a Green Enterprise Hub for MSMEs – Set up a one‑stop support facility bundling technical assistance, matchmaking with financiers, and streamlined templates to lower entry barriers and embed MSMEs in industrial value chains.

- Build a national green registry and training platform – Develop a unified registry tracking disbursements, commitments, and outcomes across public, donor, and private portfolios, coupled with cross‑sector training for banks, DFIs, and developers on blended finance, ESG risk, and MRV.

Taken together, these levers are designed to convert isolated pilots into repeatable, investable programmes while signalling to domestic and international investors that Ethiopia is serious about green industry at scale.

Path Forward – Aligning Capital, Standards, Reliability, and MSMEs

If Ethiopia synchronises fast-track permitting, power reliability compacts, a standards accelerator and blended de-risking with targeted MSME support, it can shift from fragmented pilots to export-ready pipelines.

Strengthening domestic demand for certified green products, alongside AfCFTA-aligned export support, would embed green growth as a core industrial strategy.

The window is narrow: swift action could secure first-mover advantage in African green manufacturing, or risk late entry into crowded markets.