Payment failures, fraud risks, and clunky authentication flows are quietly draining revenue from digital finance just as SME lending and supply chain financing become core to growth strategies.

New research argues that senior product managers now sit at the nerve centre of this shift, tasked with integrating smarter authorisation levers and embedded credit into a single, high‑performing stack.

By combining multi-acquiring, partial authorisation, backup payment instruments, and strong customer authentication with SME and supply chain finance platforms, firms can improve approval rates, compress cash‑flow cycles, and improve customer satisfaction.

The message is simple but urgent: authorisation is no longer a back‑office tweak; it is strategic infrastructure for the next wave of financial services innovation.

Orchestrating Smarter Payments For Real Economies

Digital finance is entering a new phase where fine-tuning existing card systems no longer suffices. Product leaders are now being challenged to rebuild the core payment authorisation architecture while layering on full-stack SME lending and supply‑chain finance capabilities.

A peer-reviewed study by Shruti Khandelwal synthesises ten years of empirical evidence, highlighting that when multi-acquiring, partial authorisation, backup instruments, and strong customer authentication are combined with embedded credit, approval rates can exceed 93% and customer drop-offs fall to as low as 5%.

The research proposes a unified framework spanning four layers: Authorisation Optimisation, Financial Product Integration, Risk and Compliance Management, and Data Analytics and AI, designed to function as an integrated engine rather than a collection of features.

Multi-acquiring and backup instruments form the backbone, while SME lending and supply‑chain finance turn real-time authorisation data into working capital triggers.

For banks, fintechs, and B2B platforms, this transformation reframes authorisation policy as a growth and inclusion lever.

Those who can orchestrate these layers holistically could define the next generation of resilient, accessible financial ecosystems.

Where Declined Transactions Become Strategic Risk

At the heart of today’s financial services upheaval is a simple reality: every failed payment is not just a lost sale but a data point about broken product design.

Khandelwal’s review highlights how, in hyper-competitive payments markets, authorisation optimisation has transitioned from a back-office concern to a board-level concern, given its direct link to revenue, fraud losses, and customer blend.

The stakes rise further when payments are tightly tied to SME lending and supply chain finance. For small firms operating on thin margins, a cluster of failed authorisations can mean delayed inventory, missed payroll, or a defaulted loan, outcomes that ripple through entire supply chains.

This is why the research highlights authorisation as foundational infrastructure for operational efficiency, new revenue streams, and access to capital for underserved businesses.

Evidence Shows Levers Shift Core Economics

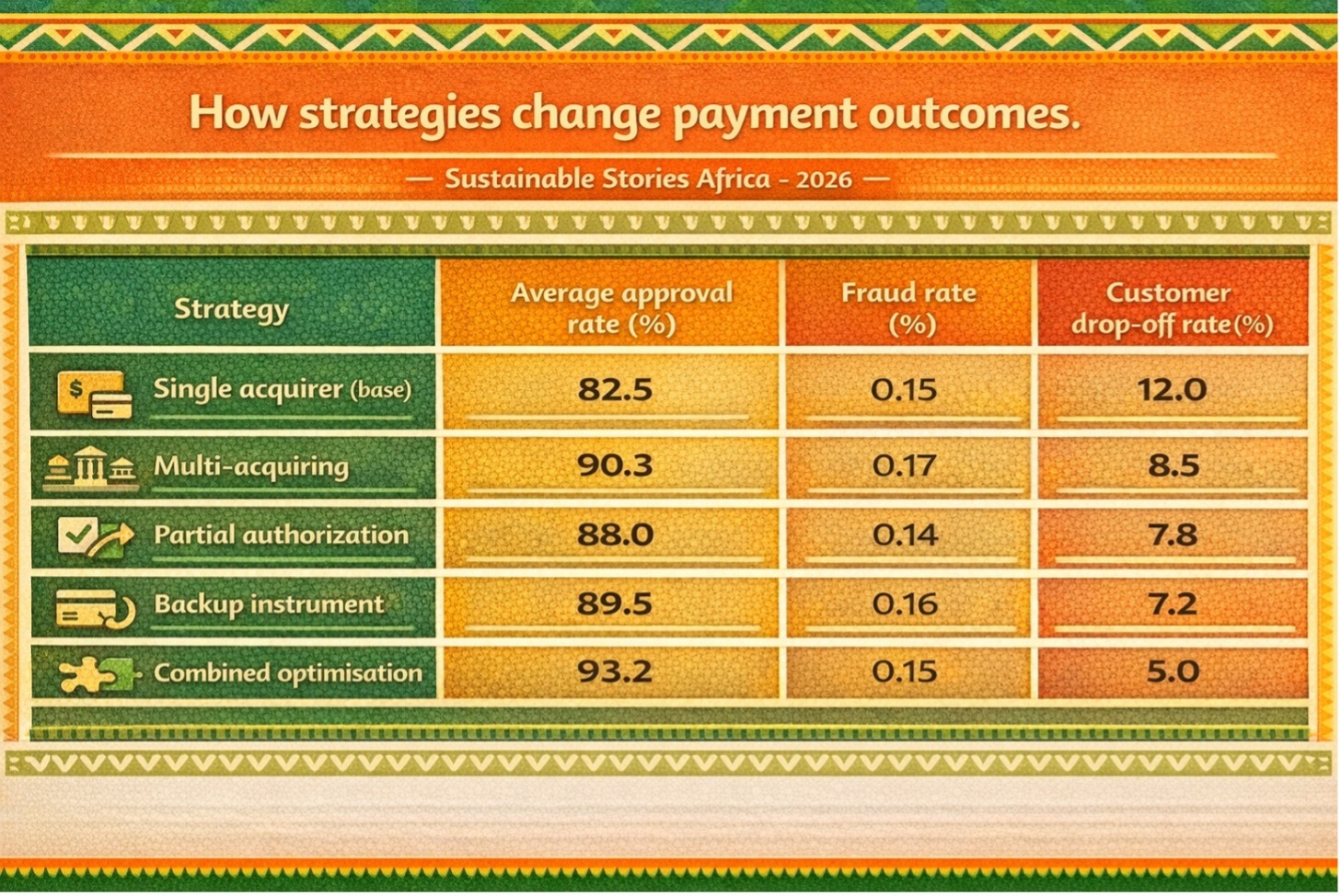

The study consolidates experimental and real-world data to measure how the different segments of authorisation levers, including multi-acquiring, partial authorisation, backup instruments, and strong customer authentication, perform separately and interdependently.

How strategies change payment outcomes

| Strategy | Average approval rate (%) | Fraud rate (%) | Customer drop‑off rate (%) |

|---|---|---|---|

| Single acquirer (base) | 82.5 | 0.15 | 12.0 |

| Multi‑acquiring | 90.3 | 0.17 | 8.5 |

| Partial authorization | 88.0 | 0.14 | 7.8 |

| Backup instrument | 89.5 | 0.16 | 7.2 |

| Combined optimisation | 93.2 | 0.15 | 5.0 |

Its findings show that the real gains come from integration. Multi-acquiring improves approval odds, partial authorisation saves constrained transactions, and backup options prevent cart abandonment.

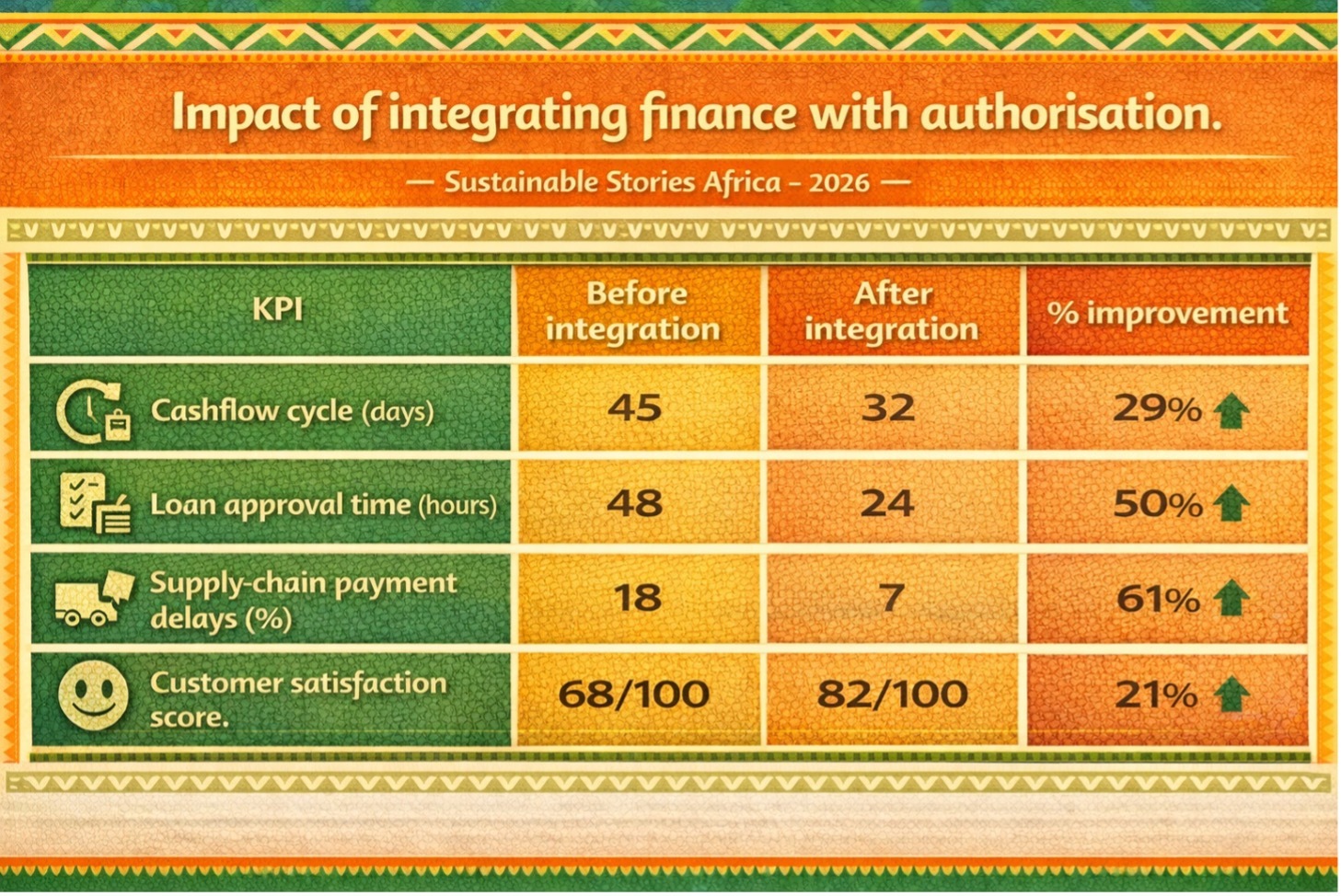

Meanwhile, strong authentication strengthens security when paired with adaptive user flows. When these mechanisms combine SME lending and supply chain financing, outcomes expand beyond payments, accelerating cash flow, halving loan processing time, and reducing supply‑chain delays for business customers.

Impact of integrating finance with authorisation

| KPI | Before integration | After integration | % improvement |

|---|---|---|---|

| Cashflow cycle (days) | 45 | 32 | 29% |

| Loan approval time (hours) | 48 | 24 | 50% |

| Supply‑chain payment delays (%) | 18 | 7 | 61% |

| Customer satisfaction score | 68/100 | 82/100 | 21% |

Building An Integrated Intelligence Layer

The study outlines a four-layer model: Authorisation Optimisation, Financial Product Integration, Risk and Compliance Management, and Data Analytics and AI, operating as one interconnected system.

Each authorisation event becomes a data point for risk, fraud, credit, and liquidity decisions within SME and supply‑chain finance.

This integrated architecture helps institutions grow responsibly: AI-driven risk engines reduce false declines, while embedded lending translates real-time insights into faster, tailored credit.

SMEs benefit from smoother cash flow and more predictable working capital. The research also highlights ESG integration as a new frontier, enabling financial products that align commercial efficiency with social and environmental goals, positioning digital finance as a driver of sustainable growth in emerging markets.

Design Playbooks Around Holistic Optimisation

The review offers a clear roadmap for senior product managers built on design, integration, and governance.

Design demands treating authorisation tools, including multi-acquiring, partial authorisation, backup instruments, and SCA, as a unified system, guided by rigorous A/B testing and shared metrics for approval, fraud, and lifetime value.

Integration calls for embedding SME lending and supply‑chain financing within payment flows, linking authorisation data to credit and liquidity models.

Governance completes the triad, aligning PSD2‑level compliance, AI-driven transparency, and seamless authentication to balance risk control with user experience across diverse markets.

Path Forward – Aligning Optimisation, Embedded Credit, Regulation, And ESG

Khandelwal’s review suggests that the next frontier in financial services is not a single breakthrough product but the quiet, disciplined integration of authorisation optimisation, embedding SME and supply chain financing, AI-driven risk tools, and ESG-aligned lending.

Product leaders who can treat these elements as one design problem, rather than four separate road maps, are most likely to build resilient, inclusive rails that lift approval rates, expand access to capital, and maintain trust in increasingly complex digital ecosystems.