Africa’s energy transition has entered a decisive acceleration phase, enabled by innovative climate finance mechanisms that are reshaping capital flows, infrastructure deployment and economic transformation.

However, the current annual climate finance of $44 billion remains only a fraction of the $277 billion needed to meet 2030 targets.

Innovations, from blended finance and carbon markets to green bonds and debt-for-climate swaps, are unlocking new pathways.

The defining challenge now is scaling these solutions fast enough to close Africa’s financing gap and secure sustainable economic sovereignty.

Innovative finance powers Africa’s energy transformation

Africa’s energy transition is no longer a distant ambition; it is an accelerating structural reality.

Climate finance flows have surged, renewable energy deployment is expanding, and new financing models are reshaping investment pathways across the continent.

These developments mark a historic turning point in Africa’s sustainable development trajectory.

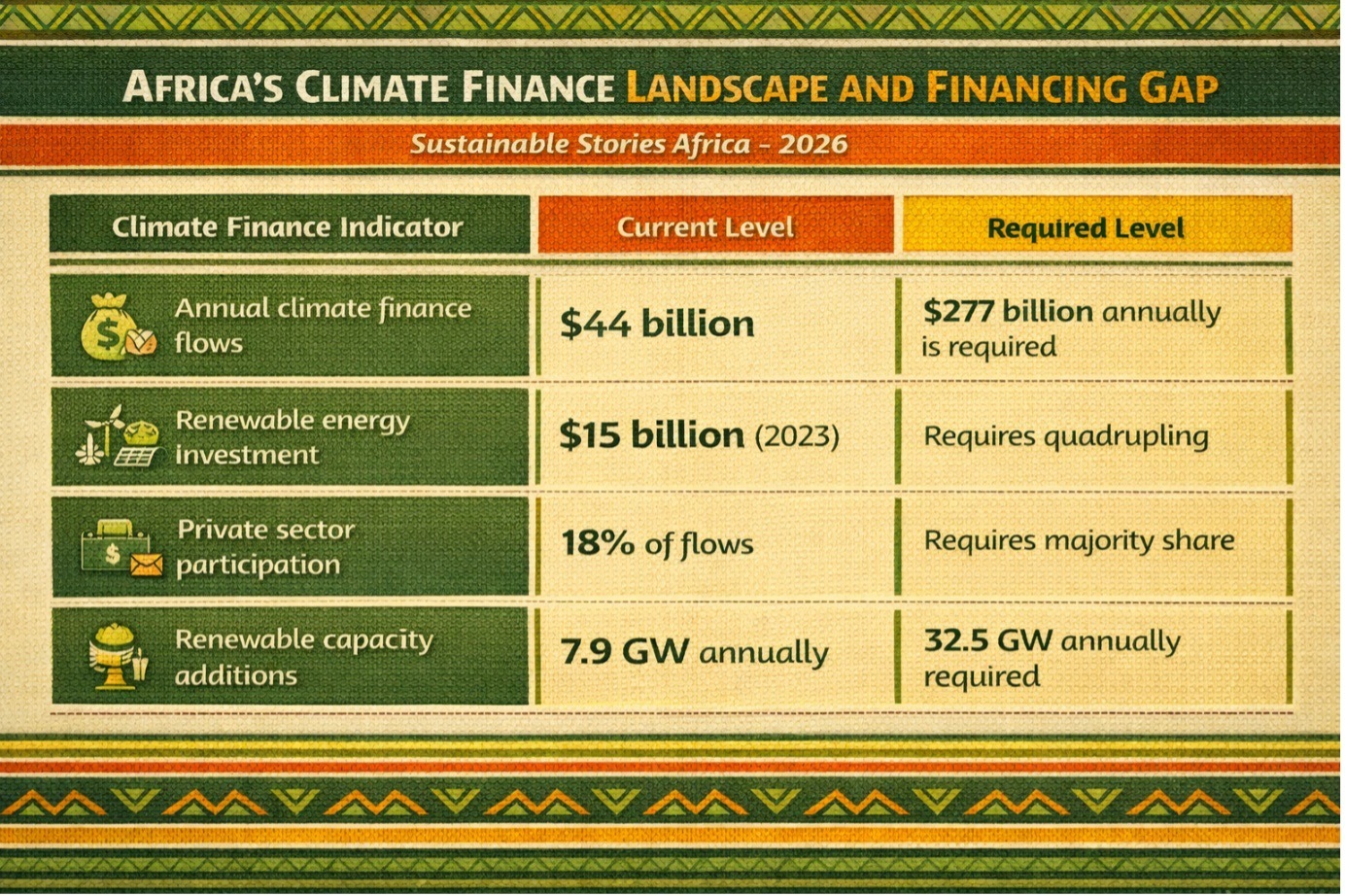

However, the scale of transformation required remains immense. Africa currently receives approximately $44 billion annually in climate finance, which represents only 23% of the $277 billion required each year to meet its 2030 climate and energy goals.

Innovative financial instruments, including blended finance, carbon markets, green bonds and debt-for-climate swaps, are emerging as powerful tools to close this gap.

Their success will determine whether Africa achieves energy security, industrial transformation and sustainable economic sovereignty.

Climate finance defines Africa’s development trajectory

Africa’s energy transition represents one of the most consequential economic transformations of the 21st century.

Reliable, affordable energy is the foundation of industrialisation, economic growth and social development. However, Africa faces one of the world’s largest energy access gaps, requiring unprecedented investment to close.

Climate finance flows have increased dramatically, from $30 billion in 2019 to $44 billion annually today, reflecting growing recognition of Africa’s importance in the global energy transition.

Renewable energy deployment is accelerating rapidly. Africa installed 7.9 gigawatts of renewable energy capacity in 2023, led by solar expansion.

However, reaching the African Union’s target of 300 gigawatts of renewable capacity by 2030 requires quadrupling deployment rates to over 32.5 gigawatts annually.

This gap defines Africa’s central development challenge.

Innovative mechanisms unlock unprecedented climate investment opportunities

Innovative financing mechanisms are reshaping Africa’s climate finance architecture, addressing traditional barriers including capital costs, currency risk and limited private sector participation.

Africa’s Climate Finance Landscape and Financing Gap

Climate Finance Indicator | Current Level | Required Level |

|---|---|---|

Annual climate finance flows | $44 billion | $277 billion annually is required |

Renewable energy investment | $15 billion (2023) | Requires quadrupling |

Private sector participation | 18% of flows | Requires majority share |

Renewable capacity additions | 7.9 GW annually | 32.5 GW annually required |

Several innovative financing mechanisms are driving transformation:

- Just Energy Transition Partnerships (JETPs) – South Africa’s JETP has mobilised $11.6 billion, demonstrating the power of international partnerships in accelerating energy transition while supporting economic restructuring.

- Green bond markets – Green bond issuance increased by 125% in 2023, with Nigeria leading sovereign issuance and new solar bonds financing renewable expansion.

- Blended finance mechanisms – Blended finance combines public and private capital to reduce investment risk and attract institutional investors.

- Carbon markets – Africa’s carbon markets could generate up to $120 billion annually by 2050, creating major new financing pathways.

- Debt-for-climate swaps – Innovative debt restructuring mechanisms enable countries to reduce debt burdens while financing climate investments.

These mechanisms represent a structural transformation in Africa’s development financing model.

Climate finance unlocks Africa’s economic transformation potential

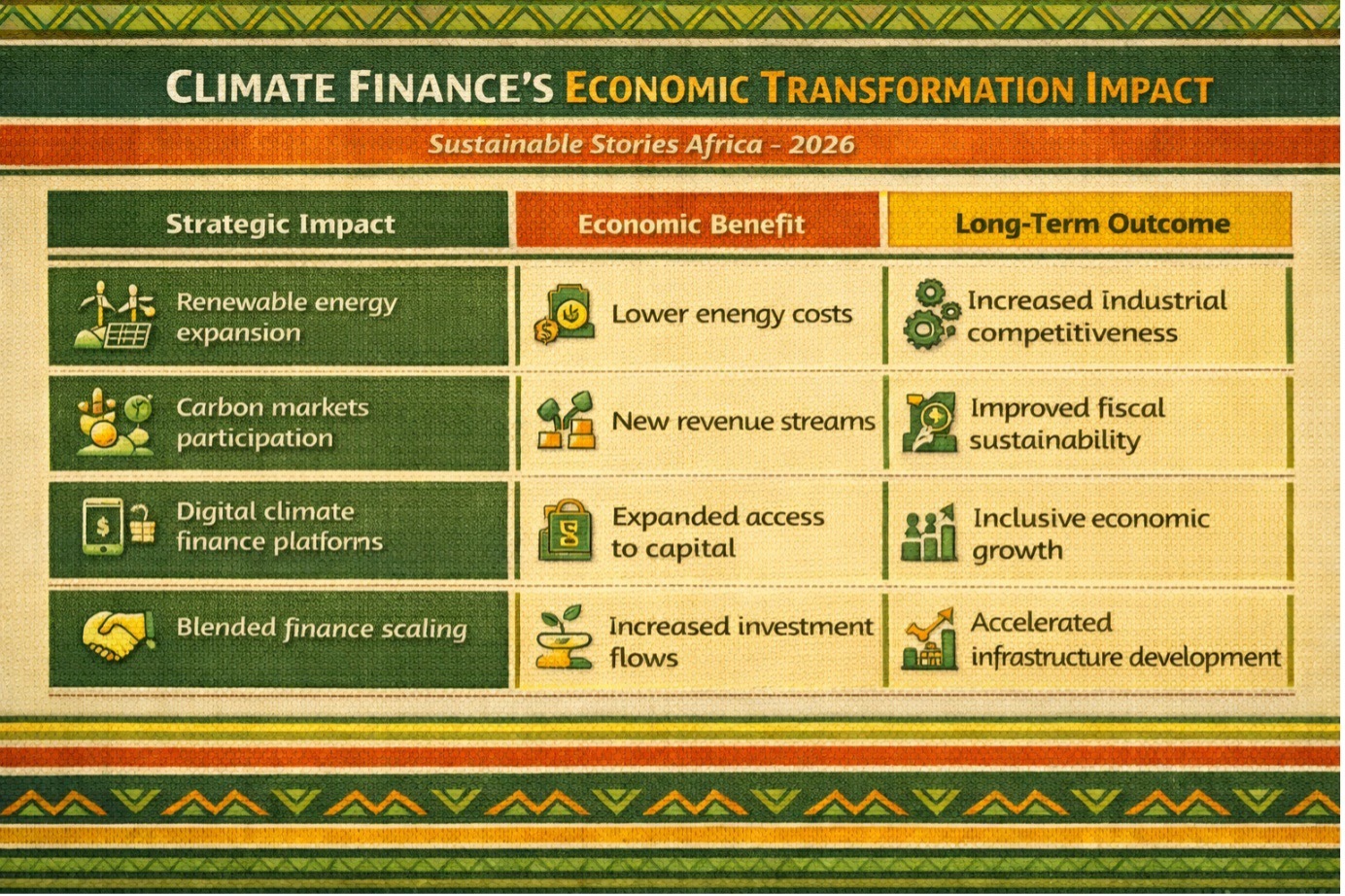

Climate finance offers transformative economic benefits beyond energy access alone.

Renewable energy investment reduces energy costs, accelerates industrial competitiveness and enhances economic resilience.

Climate Finance’s Economic Transformation Impact

Strategic Impact | Economic Benefit | Long-Term Outcome |

|---|---|---|

Renewable energy expansion | Lower energy costs | Increased industrial competitiveness |

Carbon markets participation | New revenue streams | Improved fiscal sustainability |

Digital climate finance platforms | Expanded access to capital | Inclusive economic growth |

Blended finance scaling | Increased investment flows | Accelerated infrastructure development |

Technology plays a crucial enabling role. Africa’s fintech sector has nearly tripled in size, with over 1,263 companies expanding access to climate finance and financial services.

Digital platforms democratise investment access, enabling small businesses and underserved communities to participate in the energy transition.

This ensures climate finance supports inclusive economic transformation.

Scaling climate finance requires systemic institutional reforms

Despite promising progress, several structural barriers constrain scaling.

- High capital costs – Africa’s average cost of capital reaches 15.6%, significantly higher than global averages, increasing investment costs.

- Currency risk – Currency volatility increases financing costs and discourages private investment.

- Debt sustainability challenges – Debt-based financing dominates climate finance flows, increasing fiscal vulnerability.

- Limited private sector participation – Private finance accounts for only 18% of climate finance flows, far below required levels.

- Infrastructure constraints – Grid limitations and regulatory barriers slow renewable deployment.

Institutional coordination is critical to addressing these challenges.

Initiatives like Mission 300 aim to provide electricity access to 300 million Africans by 2030, demonstrating the potential of coordinated institutional action.

Guarantee mechanisms, regulatory reforms and improved governance frameworks can unlock large-scale private investment.

PATH FORWARD – Africa must scale innovative climate financing urgently

Africa’s energy transition depends on rapidly scaling innovative climate finance mechanisms while strengthening governance, regulatory frameworks and institutional capacity.

Expanding blended finance, carbon markets, and digital financing platforms will be essential to mobilise private capital.

With coordinated institutional action, policy reforms and technological innovation, Africa can close its climate finance gap, accelerate renewable deployment and secure a resilient, sustainable energy future.

Strategic Editorial Analysis (SSA Perspective) - Climate finance defines Africa’s economic future

Africa’s climate finance transformation represents a decisive economic turning point.

Innovative financing mechanisms are unlocking unprecedented opportunities for renewable energy deployment, economic growth and sustainable development.

But success depends on scaling these mechanisms rapidly. The next five years will determine whether Africa closes its $277 billion climate finance gap and achieves sustainable prosperity.

Climate finance is no longer simply an environmental tool. It is the foundation of Africa’s economic future.