Africa's green business moment is no longer theoretical; it is investable, trackable and fast taking shape in boardrooms from Nairobi to Casablanca. However, a staggering climate finance gap risks stalling the continent's most promising enterprises just as global capital searches for credible transition pipelines.

A UNDP-led Africa Green Business and Financing Index maps where opportunities, instruments and institutions are actually working on the ground and where systemic barriers still choke scale.

It offers a rare, data-rich roadmap for governments, DFIs and private investors determined to move from climate rhetoric to real deals.

Green capital crossroads reshape Africa

Africa stands at a pivotal crossroads for green finance. I t requires an estimated $277 billion annually to meet its climate goals by 2030, but currently attracts only $29.5 billion yearly in climate finance flows.

That gap, layered on top of debt stress in at least 23 African countries, is defining the terms on which green businesses can survive, scale and export into a more demanding global economy.

The Africa Green Business and Financing Report argues that Africa's climate finance story is not just about scarcity; it is about misaligned risks, concentrated flows and underused instruments in markets that could otherwise lead the global green transition.

From Kenya's off-grid innovators to South Africa's green bond pioneers, African dealmakers are already building viable models without a step change in how capital is structured and de-risked; these remain the exception rather than the rule.

Green gap, real money at stake

The most striking figure in the report is also the starkest: Africa is receiving barely 10% of the green capital it says it needs. Against an annual requirement of $277 billion to implement its Nationally Determined Contributions, current flows of $29.5 billion leave a significant climate investment gap, felt most sharply in Central and East Africa.

Shortfalls average between 23% and 26% of GDP. Public money is still doing the heavy lifting but is hitting clear limits, even as climate risks intensify across the continent.

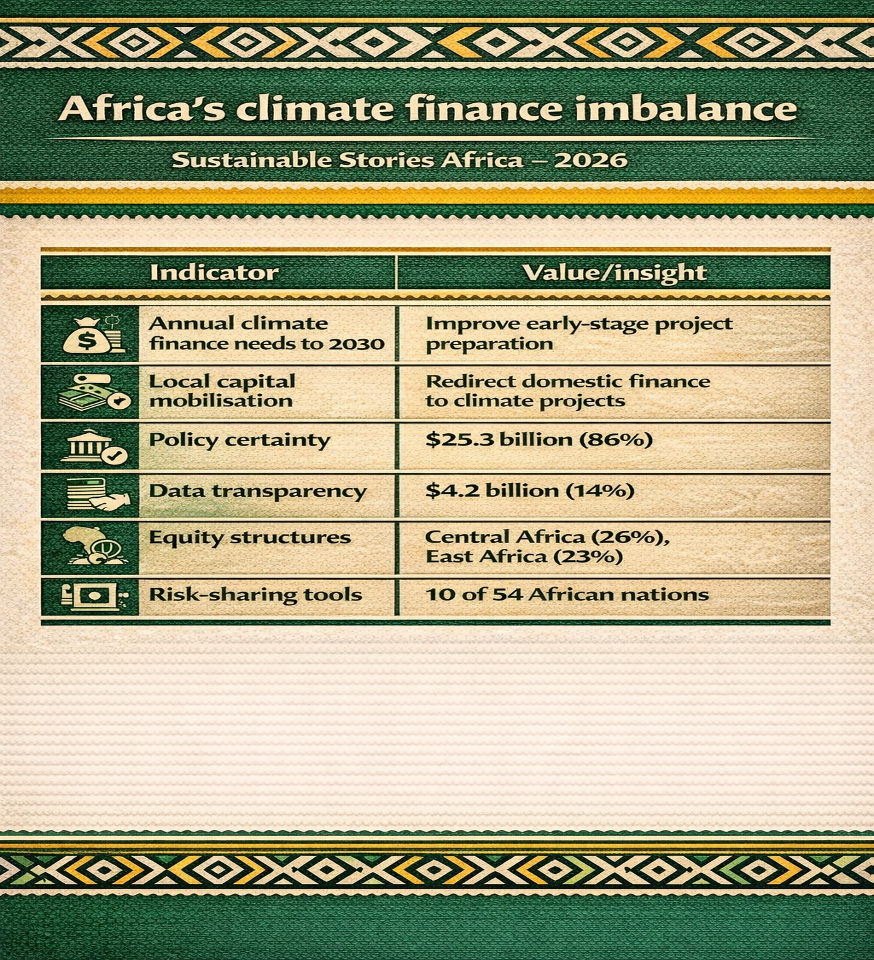

Africa's climate finance imbalance

| Indicator | Value/insight |

|---|---|

| Annual climate finance needs to 2030 | $277 billion per year |

| Current annual climate finance flows | $29.5 billion per year |

| Share from public sources | $25.3 billion (86%) |

| Share from private sources | $4.2 billion (14%) |

| Regions with the largest gap (share of GDP) | Central Africa (26%), East Africa (23%) |

| Countries absorbing over half of the investments | 10 of 54 African nations |

These numbers matter as much for politics as for project finance. Governments have pledged almost $26.4 billion a year from domestic budgets, but inflation, high interest rates and social pressures strain delivery.

The result is a policy paradox: ambitious green plans compete against tight fiscal space and fragile enabling environments, leaving even bankable climate projects struggling to reach financial closure.

Where green business is already winning

In energy and clean cooking, companies such as BURN and M-KOPA demonstrate how African innovators are using climate finance and digital tools to tackle long-standing development challenges.

BURN's solar-powered factory in Kenya produces around 200,000 efficient cookstoves every month, generating carbon credit revenues to keep prices within reach while employing more than 2,000 people, 50% of them women.

M-KOPA's asset-financing platform, valued at about $300 million, blends credit, digital payments and distributed solar to serve customers who would otherwise remain invisible to traditional banks.

Digitalisation is amplifying these gains. Today, only 25% of Africans have internet access; however, projections reveal that up to 75% could be first-time users by 2030, with mobile technologies already generating an estimated 1.7 million jobs and contributing roughly $144 an estimated 8.5% of Africa's GDP.

That connectivity is powering everything from AI-driven crop diagnostics in Zambia to health-tech and logistics solutions that cut emissions while expanding access.

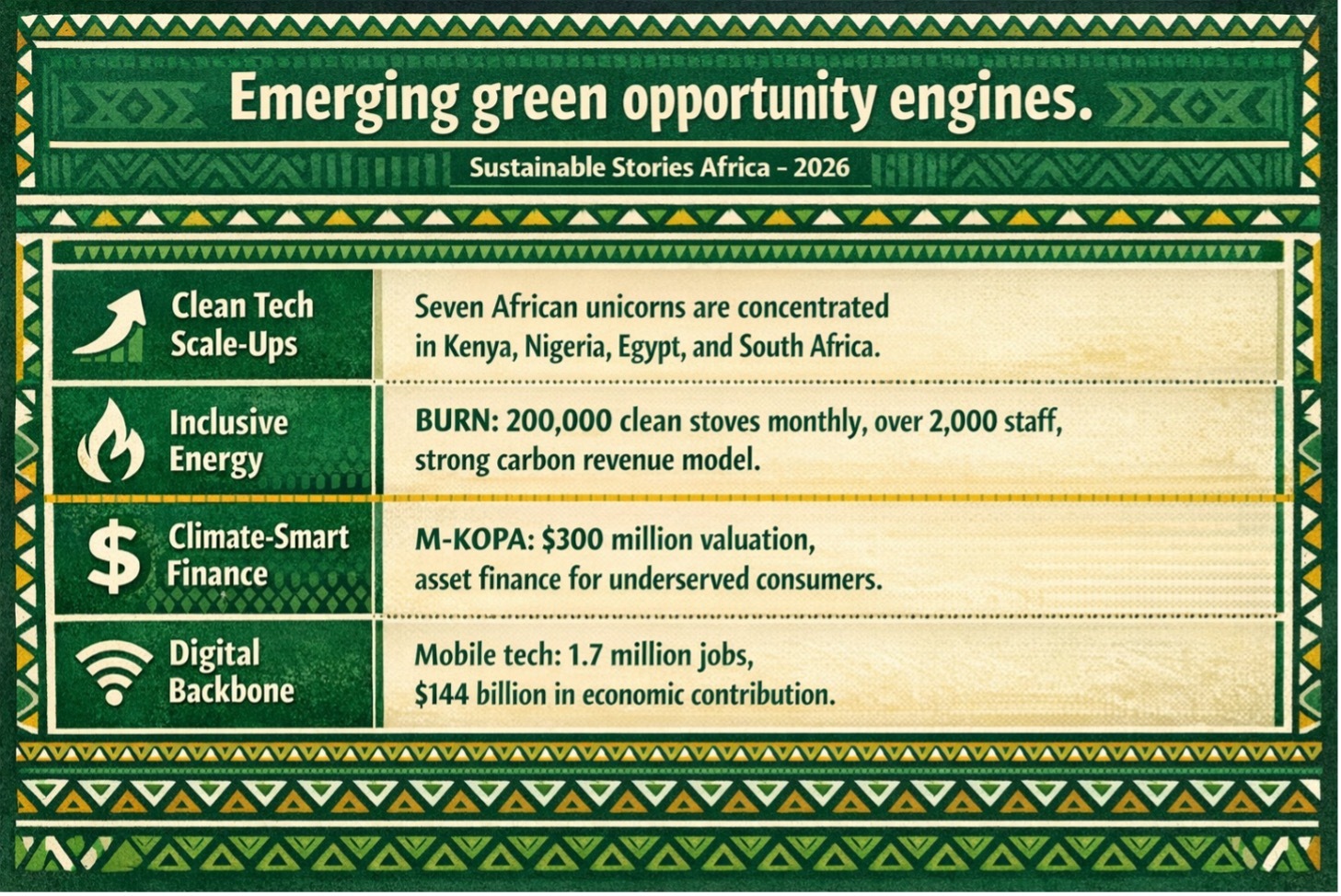

Emerging green opportunity engines

| Theme | Illustrative example/data point |

|---|---|

| Clean tech scale-ups | Seven African unicorns are concentrated in Kenya, Nigeria, Egypt, and South Africa. |

| Inclusive energy | BURN: 200,000 clean stoves monthly, over 2,000 staff, strong carbon revenue model. |

| Climate-smart finance | M-KOPA: $300 million valuation, asset finance for underserved consumers. |

| Digital backbone | Mobile tech: 1.7 million jobs, $144 billion in economic contribution. |

These companies are not outliers; they are early signs of Africa's potential to lead in renewables, green minerals, sustainable agriculture and next-generation digital services.

The real test is moving from isolated success stories to connected corridors and clusters, with policy, infrastructure and finance designed to replicate what works across markets, not just applaud it in one.

Why investors cannot afford to sit out

From an investor's lens, Africa's climate finance story is less a plea for help and more a catalogue of missed opportunities. The gap is not just about risk; it is about unrealised returns in a world hungry for credible, impact-linked assets.

The tools to shift this narrative are already available. Blended finance platforms, unlisted equity and debt, thematic and sustainability-linked bonds, guarantees, and risk-sharing structures are being deployed, as bonds from Standard Bank, Growthpoint and CRDB Bank.

What is missing is alignment, not innovation. Too often, concessional capital is not designed to address real local constraints, including currency volatility, shallow markets and regulatory challenges.

Where these frictions have been addressed head-on, for example, through debt for nature swaps and guarantee-backed solar investments, project economics and investor confidence have moved decisively in favour of green deals.

Rewiring risk, rules and relationships

The report's most compelling contribution is its practical blueprint for shifting Africa's green finance story from pilot to portfolio.

It highlights four levers that, taken together, could move the needle from billions to the "trillions" conversation in a way that is grounded in African realities rather than copied from other regions.

- Fix the policy plumbing, not just the headlines – The analysis shows that high-level commitments from NDCs to the Nairobi Declaration only translate into green investment when sector-level rules and institutions are clear, predictable and enforced. Countries that have adopted renewable energy feed‑in tariffs, green budgeting tools, gender-responsive climate policies and targeted fiscal incentives are seeing more consistent pipelines and investor interest.

- Empower sub-national climate dealmaking – Urbanisation is reframing where and how green projects get built, making local governments critical players in resilience and decarbonisation. Kenya's Financing Locally Led Climate Action Programme is a standout example, channelling resources to counties to design and implement climate solutions with those most affected, rather than imposing national blueprints from above.

- Use MDBs and DFIs as genuine risk partners – Currently, every dollar of public climate finance in Africa mobilises only about $0.16 (16 Cents) of private capital, the lowest leverage ratio of any region. The report advocates for more sophisticated use of guarantees, currency-risk structures, insurance, and open access to risk databases, enabling private investors to price African credit and project risk with fewer assumptions and more data.

- Build an ecosystem, not just projects – Recommendations range from establishing a pan-African Green Business Institute to curating city-level green investment plans and innovation awards that link entrepreneurs to financiers and regulators. The aim is to transition from scattered one-off transactions to coherent value chains in green minerals, agriculture, nature-based solutions and urban infrastructure, with African governments and communities capturing a greater share of the value created.

PATH FORWARD – Turning ambition into investable momentum: Bridging Africa's $277‑billion green gap

The report urges African policymakers, financiers and businesses to treat the climate finance gap as a design challenge, not a fixed constraint.

That means aligning green growth plans with capital market instruments, using fiscal reforms and budget‑tagging to reward low-carbon choices, and hard‑wiring gender-responsive, inclusive approaches so resilience reaches beyond connected elites.

On the investment side, the priority is scale and replication, not isolated flagships. Deepening blended finance, greening trade and mineral corridors, strengthening urban climate finance and pushing multilaterals to de-risk African deals more boldly could unlock around $100 billion a year, thereby positioning Africa as a driver of the next wave of green, inclusive growth.