Namibia is seeking to unlock $1.76 billion in renewable energy investment through private sector financing, marking one of its most ambitious power-sector expansions to date.

The strategy aims to reduce electricity imports, enhance grid stability, and position the country as a regional exporter of clean energy.

At stake is more than capacity; it is Namibia’s economic resilience in an era of volatile energy markets and climate risk.

Namibia Targets $1.76 Billion Private-Led Renewable Expansion

Namibia is seeking to mobilise $1.76 billion in private capital to expand its renewable energy capacity, signalling a decisive shift toward market-driven power sector reform.

The plan, reported by Energy in Africa, forms part of a broader strategy to reduce reliance on electricity imports and strengthen domestic generation through solar, wind and related infrastructure.

The southern African nation currently imports a significant portion of its electricity from neighbouring countries, leaving it exposed to supply shocks and regional price volatility. Officials say the proposed expansion will prioritise independent power producers (IPPs), competitive procurement frameworks and grid integration upgrades to unlock capacity at scale.

At the centre of the initiative is a recognition that public financing alone cannot meet Namibia’s energy ambitions. Instead, authorities are positioning regulatory clarity and structured procurement pipelines as catalysts for institutional and private investors.

Private Capital Powers Energy Pivot

The headline figure, $1.76 billion, underscores the scale of Namibia’s intent. This is not incremental reform; it is structural repositioning.

By actively courting private-sector participation, Namibia joins a growing cohort of African economies recalibrating energy policies to attract capital rather than rely solely on sovereign borrowing.

Energy security has become a macroeconomic priority. In a region grappling with drought-driven hydro variability and rising demand, renewable diversification offers both climate and fiscal hedging.

From Imports to Infrastructure Scale-Up

Namibia’s electricity system has historically depended on imports, particularly from the Southern African Power Pool.

While regional interconnection has provided stability, it has also created vulnerability during peak demand cycles.

The expansion strategy focuses on utility-scale solar and wind developments, supported by grid modernisation.

Officials have emphasised competitive bidding processes to ensure cost efficiency and investor transparency.

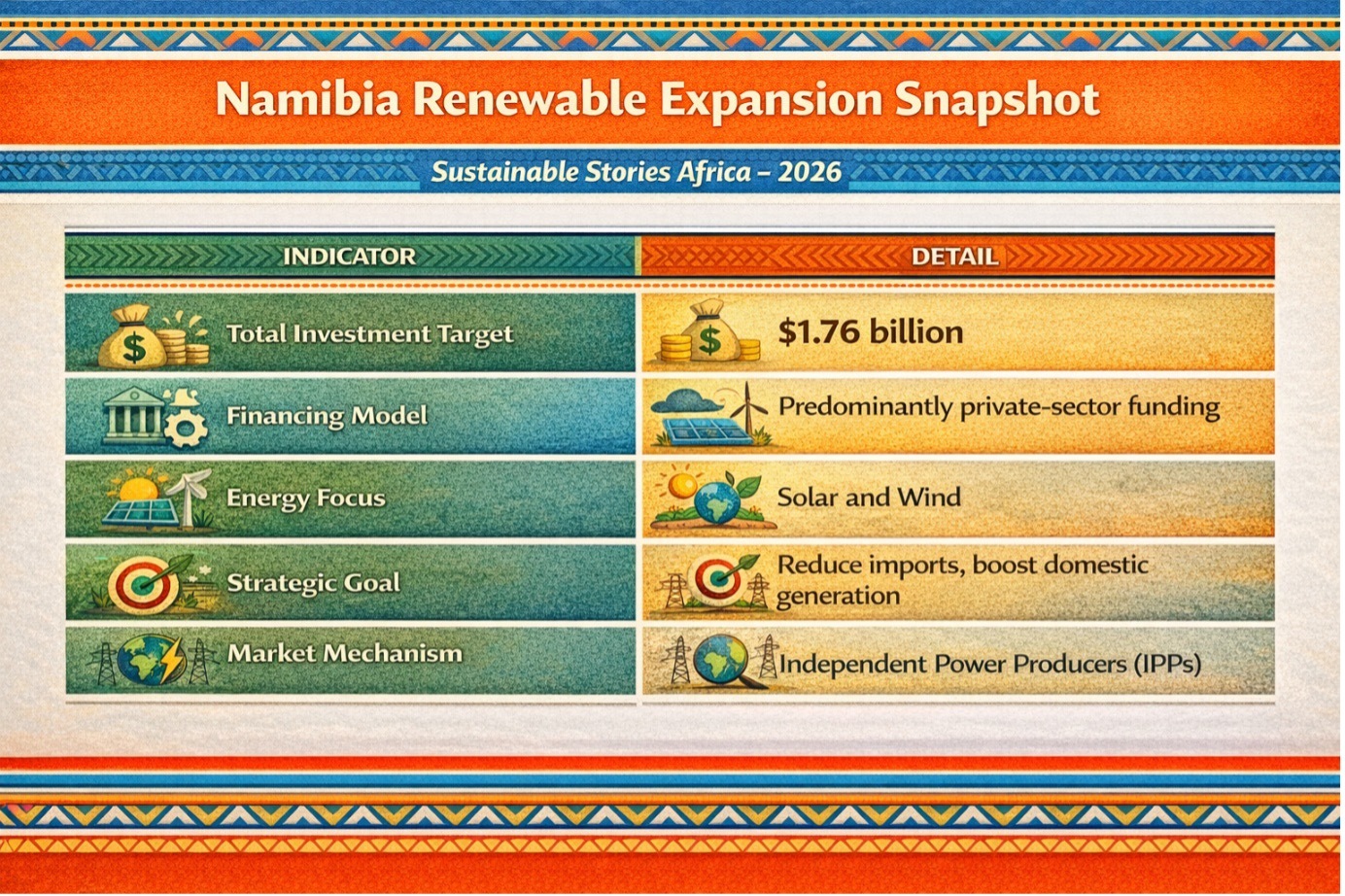

Namibia Renewable Expansion Snapshot

Indicator | Detail |

|---|---|

Total Investment Target | $1.76 billion |

Financing Model | Predominantly private-sector funding |

Energy Focus | Solar and Wind |

Strategic Goal | Reduce imports, boost domestic generation |

Market Mechanism | Independent Power Producers (IPPs) |

By structuring projects to attract private capital, Namibia aims to deepen its domestic power market and strengthen investor confidence.

Economic Resilience Through Clean Power

The implications extend beyond megawatts. Renewable expansion can lower long-term power costs, reduce foreign exchange exposure from imports, and stimulate domestic employment across engineering, construction and operations.

Moreover, investor-led models often accelerate delivery timelines compared with purely state-funded infrastructure.

For Namibia, this signals a broader ambition: positioning itself not just as an energy consumer but as a potential regional exporter of green power, particularly as southern Africa’s demand continues to rise.

In climate terms, scaling renewables enhances Namibia’s contribution to decarbonisation while aligning with international energy-transition financing flows.

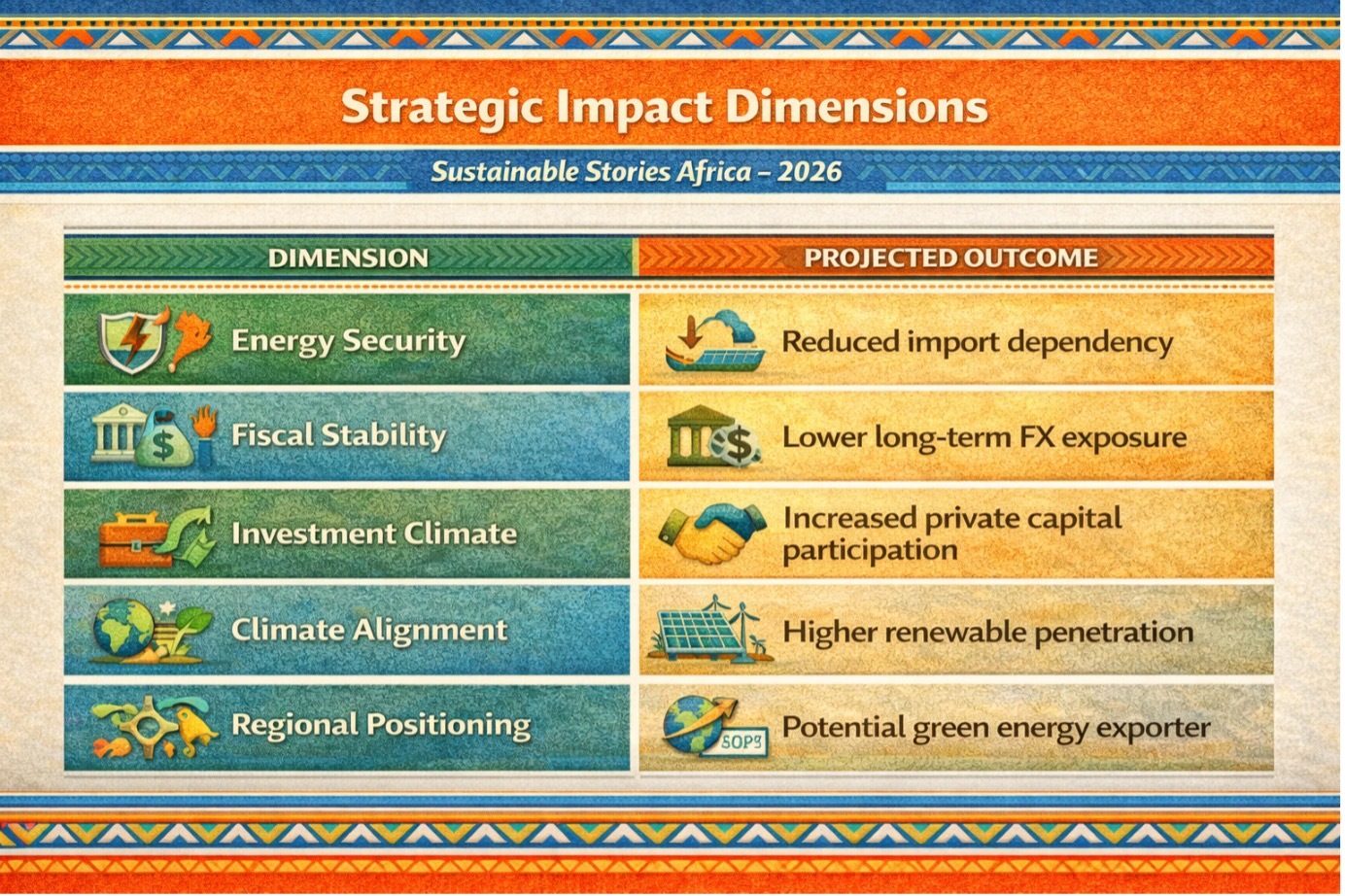

Strategic Impact Dimensions

Dimension | Projected Outcome |

|---|---|

Energy Security | Reduced import dependency |

Fiscal Stability | Lower long-term FX exposure |

Investment Climate | Increased private capital participation |

Climate Alignment | Higher renewable penetration |

Regional Positioning | Potential green energy exporter |

The broader message is clear: energy infrastructure aligns with their economic infrastructure.

Regulatory Certainty Drives Investor Confidence

For private capital to materialise at the projected scale, regulatory consistency will be decisive. Investors typically evaluate tariff clarity, grid access guarantees, currency risk frameworks, and contract enforcement standards.

Namibia’s policy direction suggests an awareness of these fundamentals. Competitive procurement pipelines, bankable power purchase agreements (PPAs), and grid expansion planning will determine whether the $1.76 billion ambition translates into operational capacity.

As African energy markets evolve, Namibia’s approach may serve as a case study in how frontier economies mobilise private finance to close infrastructure gaps without overextending public balance sheets.

Path Forward – Mobilising Capital, Modernising Grid

Namibia’s next priority is translating investor interest into bankable projects through transparent procurement and enforceable PPAs.

Strengthening Namibia’s grid and expanding transmission networks are essential in transforming and integrating new generation capacity efficiently.

If successfully implemented, the strategy could reposition Namibia as a renewable growth node within southern Africa, reducing import vulnerability while strengthening fiscal resilience and climate alignment.

Culled From: Namibia eyes $1.76 billion renewable expansion with private sector funding - Energy in Africa