As governments lean on private capital to restore degraded ecosystems, a new scientific checklist is raising urgent questions about the credibility of nature and carbon credits.

Researchers warn that without stronger verification, transparency and long-term enforcement, many credits may fail to deliver genuine environmental gains.

For investors and policymakers, the message is clear: integrity, not volume, will determine the future of global nature markets.

Five Rules to Safeguard Nature Credit Integrity

Global leaders have pledged to halt and reverse biodiversity loss within the next few decades. However, tight public budgets have pushed governments to look increasingly toward nature markets, systems that convert ecological improvements into tradable credits to mobilise private capital.

A peer-reviewed study published in Nature Ecology & Evolution outlines a five-point checklist designed to verify whether nature-based carbon credits genuinely deliver environmental benefits.

As voluntary and compliance markets expand from the EU's nature credits roadmap to England's biodiversity net gain policy and the international voluntary carbon market, the stakes are rising.

Integrity Now Defines Nature Markets

Nature markets promise to channel billions into conservation. But the reality, researchers caution, is "much more complicated".

Offset systems enable buyers to articulate net-neutral outcomes by compensating for ecological damage in one location with improvements in other places.

Places like the US wetland mitigation markets have delivered measurable gains. Others, such as certain Australian regeneration credits, have faced scrutiny for limited ecological outcomes.

The difference lies not in ambition, but in design.

The Science Behind Credible Credits

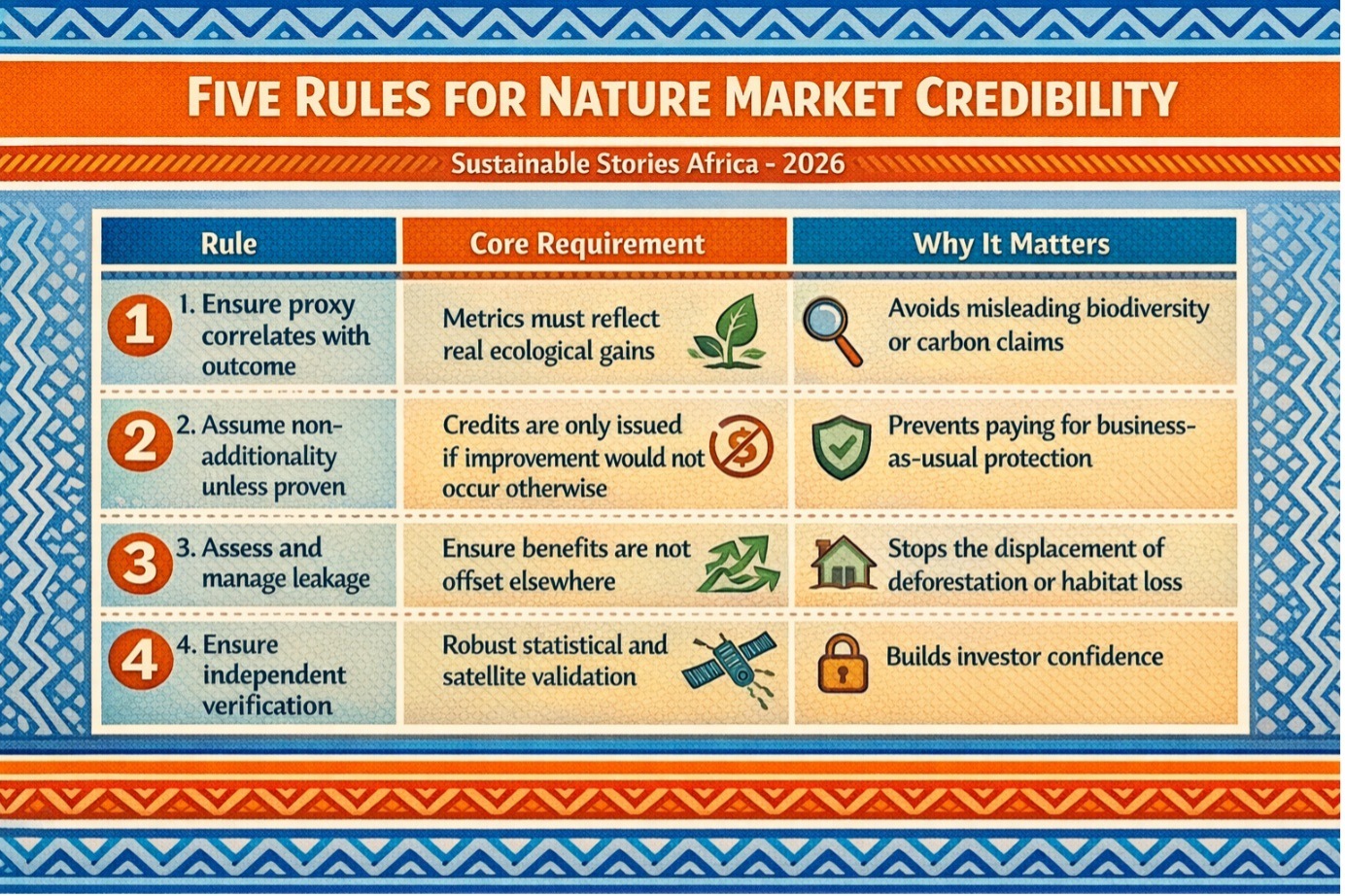

The researchers distilled lessons from seven major global markets into five rules for scientifically credible nature markets.

Five Rules for Nature Market Credibility

| Rule | Core Requirement | Why It Matters |

|---|---|---|

| 1. Ensure proxy correlates with outcome | Metrics must reflect real ecological gains | Avoids misleading biodiversity or carbon claims |

| 2. Assume non-additionality unless proven | Credits are only issued if improvement would not occur otherwise | Prevents paying for business-as-usual protection |

| 3. Assess and manage leakage | Ensure benefits are not offset elsewhere | Stops the displacement of deforestation or habitat loss |

| 4. Ensure independent verification | Robust statistical and satellite validation | Builds investor confidence |

| 5. Ensure long-term compliance and enforcement | Legal accountability over decades | Protects the permanence of outcomes |

A central issue is additionality, ensuring projects would not have occurred without credit revenues. Past deforestation-prevention credits often protected forests unlikely to be cleared in the first place.

Advanced satellite monitoring and statistical techniques now enable a more rigorous evaluation.

However, the study highlights a sobering finding: every evaluated nature market to date has fallen short of fully achieving its environmental objectives.

Transparency is critical. "Without public data, there's no way of checking whether things are working," the authors warn.

What a High-Integrity Market Could Unlock

If strengthened, nature markets could attract higher-quality, long-term investment into restoration.

For Africa, home to vast carbon sinks, biodiversity hotspots and emerging carbon initiatives, the implications are profound. High-integrity markets could unlock climate finance, improve rural livelihoods, and position African issuers as premium suppliers in global voluntary markets.

Conversely, weak standards risk reputational damage, stranded credits and diminished investor trust.

Risks vs. Reform Outcomes

| Weak Standards Risk | Reform-Driven Outcome |

|---|---|

| Overstated biodiversity gains | Scientifically verified improvements |

| Non-additional carbon claims | Measurable climate mitigation |

| Opaque data systems | Transparent investor confidence |

| Reversal of credits | Durable, legally protected restoration |

Integrity, the study suggests, is not an academic exercise—it is the foundation of market survival.

Raising the Bar for Nature Finance

For regulators, the checklist signals the need for stronger enforcement frameworks and legally binding accountability over multi-decade horizons.

For corporate buyers, it calls for deeper due diligence before claiming climate neutrality.

For investors, it reframes nature credits not as symbolic ESG instruments but as performance-based environmental assets which require verification equivalent to financial audits.

As voluntary carbon markets face increased scrutiny globally, the report effectively raises the bar for compliance. Markets that adapt may mature into credible climate-finance tools. Markets that do not risk contraction.

Path Forward – Integrity First, Volume Later

Governments and market operators must embed additionality tests, transparent public data systems and independent verification as non-negotiable standards.

Long-term legal enforcement should underpin every issued credit to safeguard permanence.

For investors and African policymakers alike, the priority is clear: build fewer credits but build them right. Credibility will determine capital flows and define whether nature markets truly restore ecosystems or merely repackage ambition.