Global ESG standards are tightening. However, African markets say compliance cannot be a copy-and-paste approach.

At a high-level policy dialogue, business leaders and governance experts warned that integrity frameworks must reflect local institutional capacity.

The message was clear: alignment, not imitation, will determine Africa's competitiveness in the next decade.

ESG Compliance Meets African Complexity

African corporations face a daunting moment. As global investors tighten their environmental, social and governance (ESG) requirements, local institutions are grappling with capacity gaps, fragmented enforcement and informal economic structures.

At a recent high-level panel discussion, speakers argued that Africa's ESG future depends not on replicating global rules, but on adapting them to domestic realities.

The debate centred on corporate integrity, board oversight, and whether global compliance regimes risk excluding rather than enabling African businesses.

Pressure Builds as Standards Rise

Panellists highlighted that multinationals and export-driven firms increasingly face mandatory climate disclosure regimes, supply-chain traceability rules, and governance transparency standards. However, implementation remains uneven across African jurisdictions.

One speaker noted that "the global system is moving toward mandatory disclosure, but local institutions are still building the infrastructure to support that reporting."

The challenge, participants said, is threefold:

- Limited technical capacity for Scope 1–3 emissions measurement.

- Weak enforcement consistency across regulatory bodies.

- A large informal sector outside structured reporting systems.

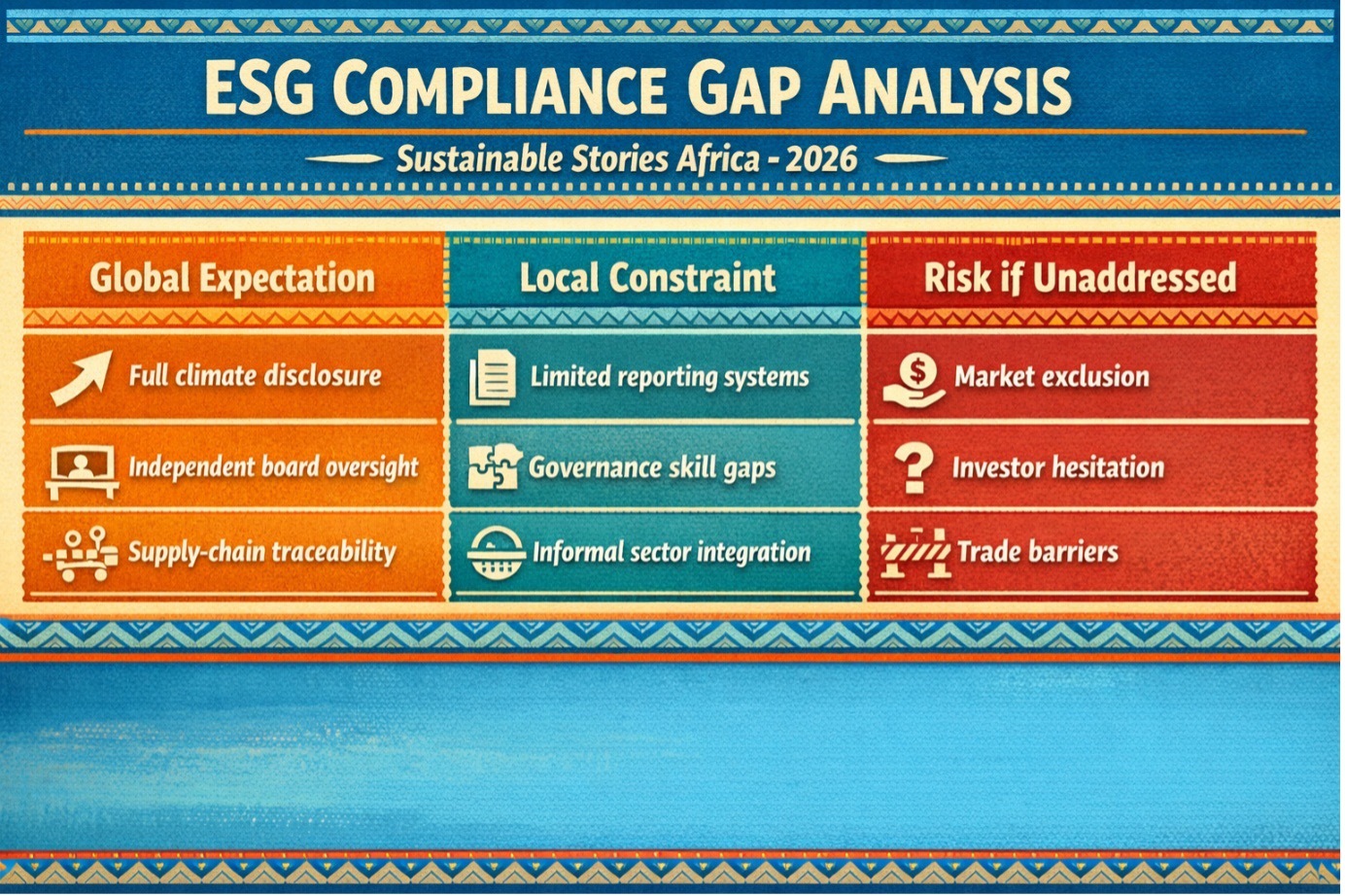

ESG Compliance Gap Analysis

| Global Expectation | Local Constraint | Risk if Unaddressed |

|---|---|---|

| Full climate disclosure | Limited reporting systems | Market exclusion |

| Independent board oversight | Governance skill gaps | Investor hesitation |

| Supply-chain traceability | Informal sector integration | Trade barriers |

Speakers emphasised that the issue is not resistance to reform, but sequencing. "We must build compliance capacity alongside regulatory ambition," another panellist said, warning against regulatory overreach without institutional readiness.

Alignment as Competitive Advantage

Despite the constraints, the tone was forward-looking. The panel argued that properly sequenced ESG reform could unlock capital flows, deepen investor confidence, and strengthen corporate governance across Africa.

Evidence presented during the discussion suggested that companies with stronger governance oversight frameworks demonstrate more stable long-term performance and improved access to international funding pools.

Participants pointed to three levers of progress:

- Board-level ESG accountability structures

- Data-driven reporting systems

- Regional regulatory harmonisation

Decision-to-Impact ESG Framework

| Stage | Leadership Action | Institutional Outcome |

|---|---|---|

| Clarity | Define measurable ESG priorities | Strategic alignment |

| Commitment | Board-level oversight | Credible governance |

| Consistency | Embed reporting discipline | Data reliability |

| Measurement | Track impact metrics | Transparency |

| Compounding | Sustain reform cycles | Investor confidence |

Panellists stressed that integrity frameworks are not merely compliance tools, but competitive differentiators. "Markets reward predictability," one governance expert observed. "Integrity builds that predictability."

The discussion also underscored the risk of inaction. Firms unable to demonstrate ESG alignment may face capital constraints, reputational risk, and exclusion from global value chains.

From Policy Dialogue to Implementation

The panel concluded with a call for collaborative reform. Governments, regulators, universities and corporates were urged to co-develop capacity-building initiatives, including technical training in emissions accounting, governance oversight programs for board members, and harmonised disclosure templates.

Participants advocated phased implementation roadmaps rather than abrupt regulatory shifts. They also called for Africa-led ESG narratives that reflect developmental priorities, energy transition pathways, and socioeconomic realities.

The broader implication is strategic: ESG is no longer optional or reputational. It is structural, shaping access to finance, trade relationships, and corporate resilience.

For business leaders, the message was clear: compliance must evolve from merely ticking the box to value creation. For policymakers, sequencing and institutional strengthening remain critical.

Path Forward – Build Capacity, Align Reform, Scale

African markets must prioritise institutional capacity building alongside ESG regulatory ambition.

Board accountability, technical reporting systems, and regional harmonisation are immediate levers.

By sequencing reform and embedding measurable governance discipline, African corporates can transform ESG from compliance pressure into long-term competitive advantage.

Culled From: https://player.captivate.fm/episode/e8c7fd8d-63d8-4467-87c1-b1901e588f4b