Solar energy attracted the largest share of Africa’s $3.8 billion power-sector investment in 2025, underscoring a decisive shift toward utility-scale photovoltaic expansion across the continent.

The surge reflects falling technology costs, policy reforms, and rising investor appetite for climate-aligned infrastructure.

But analysts caution that grid capacity and financing gaps could determine whether momentum translates into long-term energy security.

Solar Leads Africa’s $3.8 Billion Energy Investment Surge in 2025

Solar power dominated Africa’s $3.8 billion in energy-sector investments in 2025, accounting for the largest share of capital deployed across renewable projects, according to a new industry report by Energy in Africa.

The data confirms a structural pivot toward photovoltaic generation as governments and investors seek scalable, lower-cost alternatives to fossil fuels and volatile hydro systems.

The continent’s renewable investment pipeline has increasingly favoured utility-scale solar parks, reflecting improved procurement frameworks and declining module prices. The report notes that solar projects outpaced wind and other renewables in both project volume and capital allocation during the year.

Africa’s accelerating energy demand, driven by population growth, urbanisation and industrialisation, has intensified the need for reliable, climate-aligned generation. Solar’s ascendancy in 2025 marks a defining moment in that transition.

Solar Dominates Africa’s Capital Flows

The headline figure, $3.8 billion invested in Africa’s energy sector in 2025, is significant not only by its scale but for its composition.

Solar energy emerged as the primary beneficiary, signalling investor confidence in the technology’s bankability and deployment speed.

In a region where energy deficits constrain economic output, the prioritisation of solar underscores its reputation as the fastest route to incremental capacity addition. The combination of lower capital expenditure and shorter construction timelines has repositioned solar as Africa’s frontline power solution.

Investment Patterns Signal Structural Shift

The 2025 investment distribution reflects evolving risk appetites in development finance institutions, commercial banks and private equity participants.

Solar projects, particularly in North, West and Southern Africa, secured many new commitments.

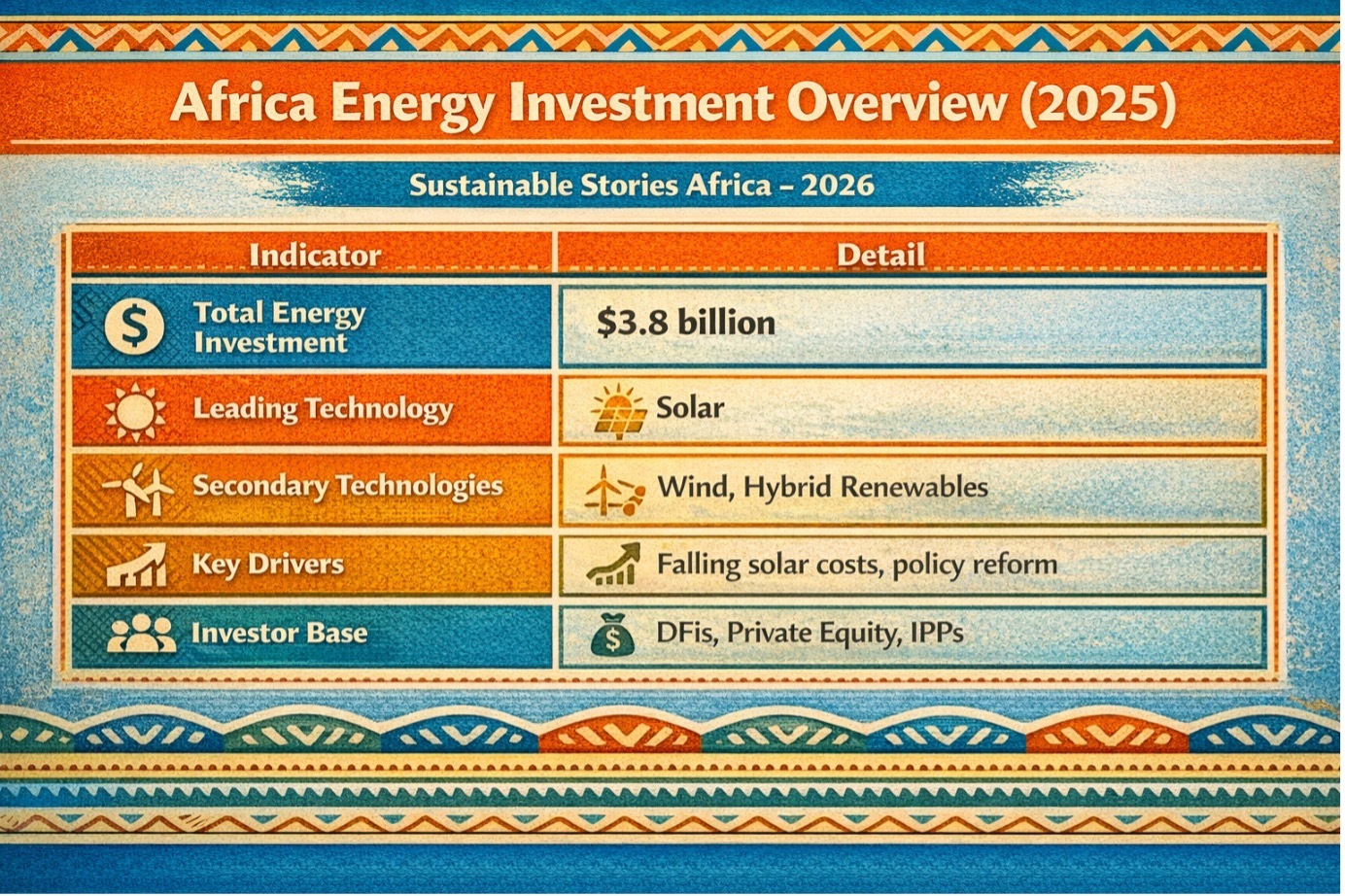

Africa Energy Investment Overview (2025)

Indicator | Detail |

|---|---|

Total Energy Investment | $3.8 billion |

Leading Technology | Solar |

Secondary Technologies | Wind, Hybrid Renewables |

Key Drivers | Falling solar costs, policy reform |

Investor Base | DFIs, Private Equity, IPPs |

Policy reforms, including competitive auctions and clearer power purchase agreement (PPA) frameworks, have strengthened investor confidence. Several governments streamlined permitting processes and enhanced grid integration planning, reducing execution risk.

However, structural challenges remain. Grid bottlenecks, transmission capacity constraints and currency volatility continue to influence project viability in several markets.

Clean Energy as Economic Catalyst

Beyond capacity expansion, solar’s dominance carries broader macroeconomic implications. Expanded renewable portfolios can reduce fuel import bills, mitigate pressure on exchange rates and support long-term fiscal stability.

Solar deployment also stimulates local value chains, from engineering services to operations and maintenance.

As regional supply chains strengthen, they unlock new opportunities for domestic industries and expand the potential for job creation across local economies.

Strategic Impact Dimensions

Dimension | Projected Outcome |

|---|---|

Energy Access | Faster deployment in underserved regions |

Fiscal Stability | Lower fossil fuel import exposure |

Climate Alignment | Increased renewable penetration |

Investment Climate | Strengthened private participation |

Industrial Development | Local supply chain growth |

If sustained, the momentum could support Africa’s energy transition targets and reinforce commitments under global climate frameworks.

Scaling Infrastructure Beyond Generation

Industry observers caution that capital allocation alone does not guarantee systemic transformation. Transmission expansion and grid modernisation must keep pace with generation growth.

Power-sector regulators are increasingly focused on balancing generation incentives with storage investment and flexible grid solutions. Without these complementary measures, solar penetration could face curtailment risks in certain markets.

Investors are also advocating predictable tariff structures and currency hedging mechanisms to sustain momentum beyond 2025. The next phase of Africa’s renewable trajectory will depend on integrated planning across generation, transmission and distribution.

Path Forward – Strengthening Grids, Sustaining Investment

Governments are prioritising grid upgrades, regional interconnection and storage solutions to absorb rising solar capacity. Competitive auctions and transparent PPAs remain central to sustaining investor confidence.

If infrastructure and regulatory reforms align with capital flows, solar’s 2025 dominance may mark the beginning of a deeper structural transformation in Africa’s energy economy.

Culled From: Solar energy tops Africa’s $3.8 billion investment in 2025 — Report - Energy in Africa