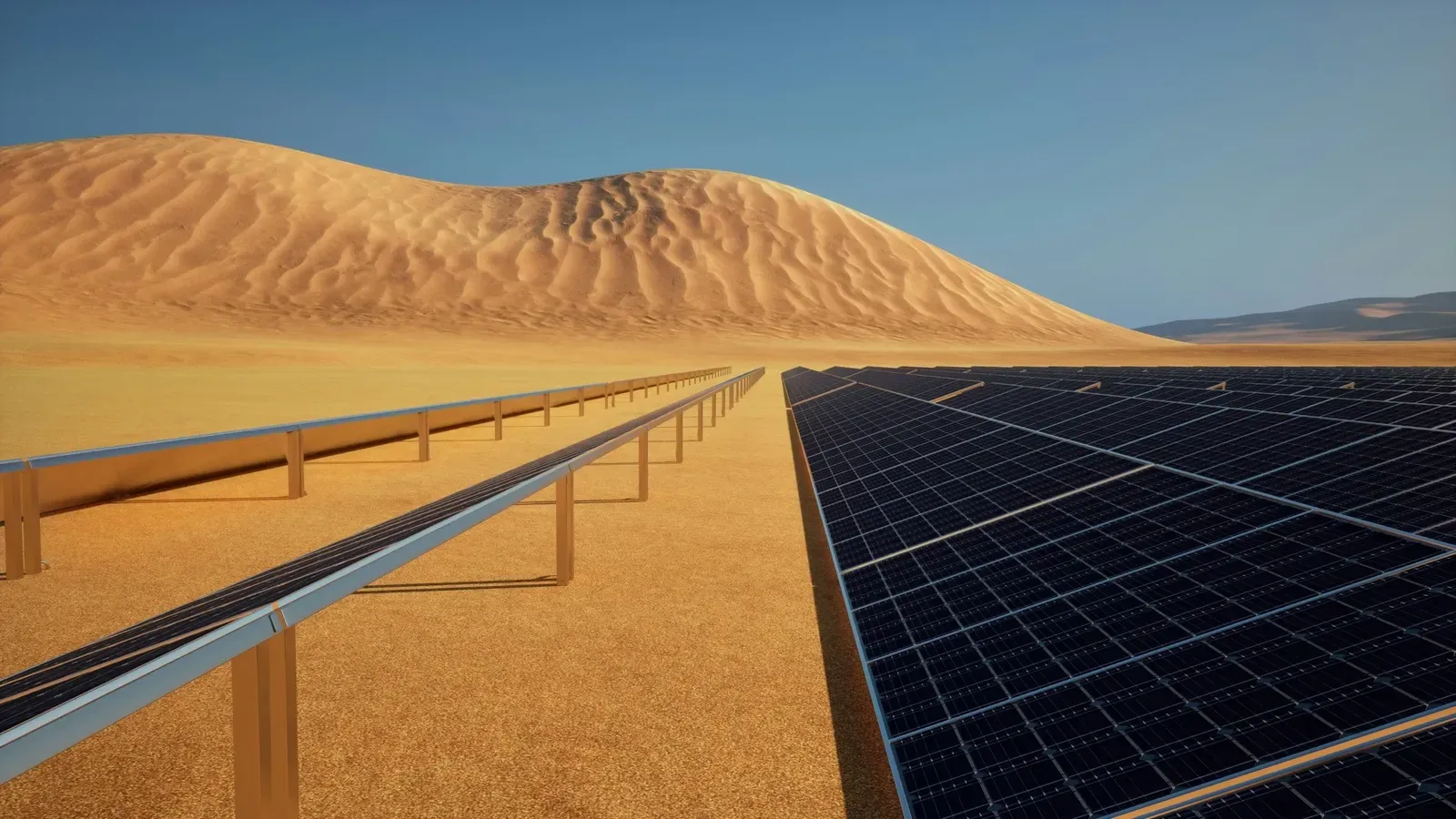

Africa’s energy transition gained measurable ground in 2025, as five landmark solar projects reached completion across North, East and Southern Africa.

Together, they add gigawatts of renewable capacity, reduce fossil-fuel dependency and signal stronger investor confidence in utility-scale solar infrastructure.

Beyond megawatts, these projects reveal a structural shift: solar is moving from pilot ambition to backbone infrastructure in Africa’s power mix.

Five Solar Projects Signal Structural Shift

In 2025, Africa commissioned five major solar power projects that collectively reinforce the continent’s pivot toward renewable generation at scale.

From North Africa’s desert corridors to East Africa’s expanding grids, these installations reflect growing institutional alignment between policy reform, blended finance and long-term infrastructure planning.

The projects stand out not merely for their capacity size, but for their financing structure, grid integration strategy and national energy security implications.

Solar is no longer peripheral in Africa’s power discourse. It is increasingly central to fiscal stability, industrial policy and climate alignment.

Ranking Africa’s Top Solar Completions

Below is a structured ranking of the five most consequential solar projects completed in 2025.

Benban Expansion – Egypt

Capacity: 1.1 GW (expansion phase)

Significance: Reinforces Egypt’s position as North Africa’s renewable anchor.

Impact: Supports green hydrogen ambitions and regional electricity exports.

Egypt’s scaling strategy demonstrates how early regulatory clarity and sovereign guarantees catalyse private capital inflows.

Noor Midelt Solar Complex – Morocco

Capacity: 800 MW (hybrid solar phase)

Significance: Integrates concentrated solar and PV systems.

Impact: Strengthens Morocco’s export competitiveness in clean energy.

Morocco continues to deploy hybrid models that combine storage and grid reliability, a differentiator in African solar deployment.

Redstone Solar Thermal Project – South Africa

Capacity: 100 MW (with storage)

Significance: Adds dispatchable renewable capacity.

Impact: Mitigates load-shedding pressures.

Redstone’s inclusion of molten salt storage underscores the importance of firm renewable power in energy-constrained systems.

Garissa Solar Expansion – Kenya

Capacity: Over 200 MW (expanded capacity)

Significance: Enhancement of East Africa’s renewable share.

Impact: Reduces reliance on thermal backup generation.

Kenya’s solar growth complements its geothermal dominance, diversifying baseload resilience.

Kairouan Solar Plant – Tunisia

Capacity: 100 MW

Significance: Strengthens domestic renewable penetration.

Impact: Reduces fiscal pressure from energy imports.

Tunisia’s solar momentum illustrates how smaller economies leverage renewables to stabilise trade balances.

Solar Capacity Snapshot (2025 Completions)

Project | Country | Capacity (MW) | Strategic Impact |

|---|---|---|---|

Benban Expansion | Egypt | 1,100 | Export & hydrogen alignment |

Noor Midelt | Morocco | 800 | Hybrid innovation |

Redstone | South Africa | 100 | Dispatchable power |

Garissa Expansion | Kenya | Over 200 | Grid diversification |

Kairouan | Tunisia | 100 | Import substitution |

Structural Drivers Behind the Surge

Several macro drivers underpin this acceleration:

- Rising fossil-fuel import bills

- Grid reliability crises

- Multilateral climate finance mobilisation

- Green industrialisation strategies

- Declining solar technology costs

These drivers create an enabling policy-finance ecosystem where solar becomes economically rational, driven by ideology.

Capital, Competitiveness, and Grid Security

If sustained, these projects offer three measurable advantages:

- Energy Security Gains – Reduced fuel imports ease fiscal strain.

- Industrial Competitiveness – Lower electricity volatility supports manufacturing growth.

- Investor Signalling Effect – Demonstrates bankability of African renewable assets.

Conversely, without grid upgrades and storage integration, solar growth could face curtailment risks.

Solar capacity alone is insufficient. Transmission reform, tariff stability and regulatory enforcement determine durability.

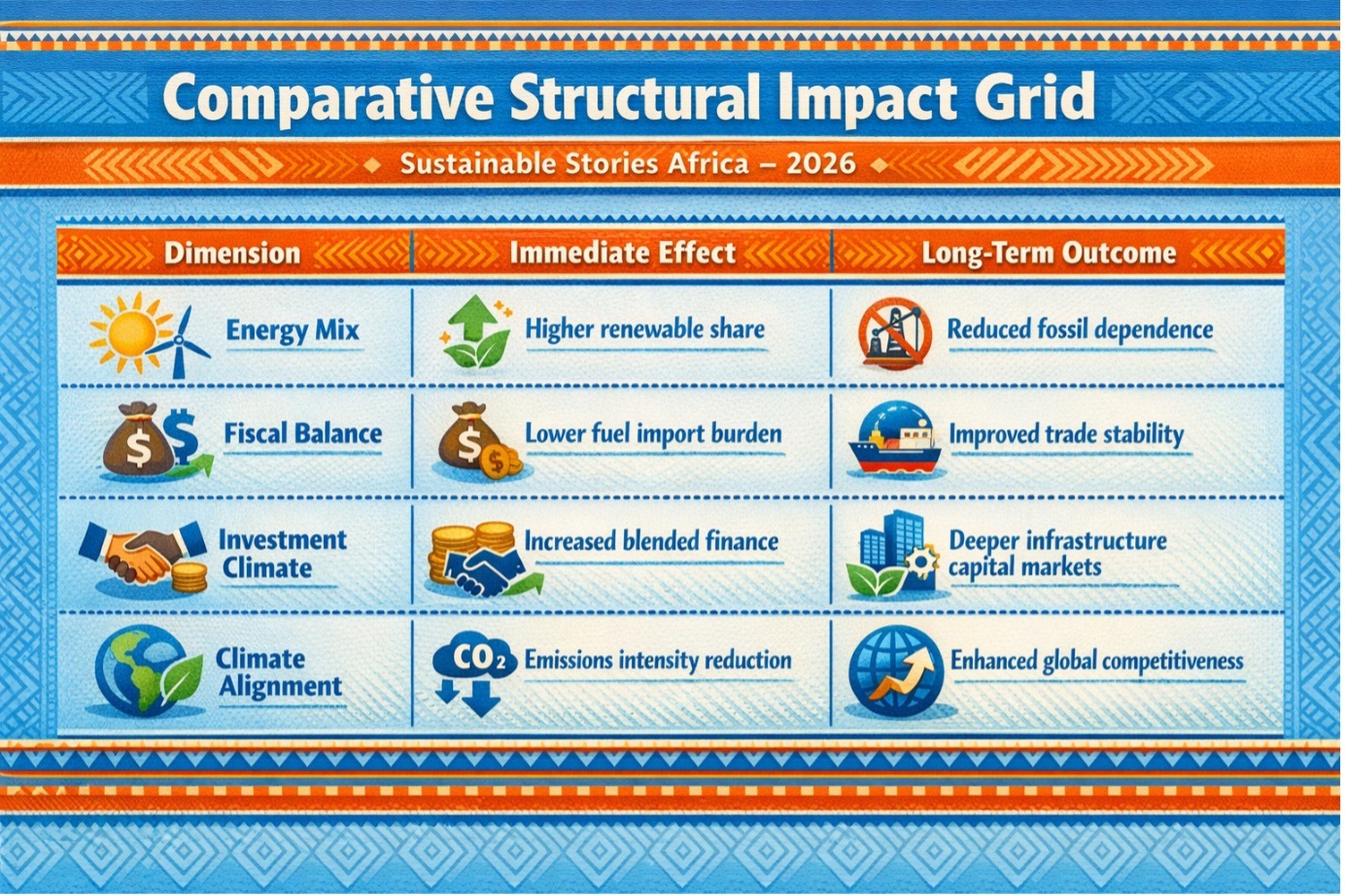

Comparative Structural Impact Grid

Dimension | Immediate Effect | Long-Term Outcome |

|---|---|---|

Energy Mix | Higher renewable share | Reduced fossil dependence |

Fiscal Balance | Lower fuel import burden | Improved trade stability |

Investment Climate | Increased blended finance | Deeper infrastructure capital markets |

Climate Alignment | Emissions intensity reduction | Enhanced global competitiveness |

From Projects to System Reform

Policymakers must now:

- Accelerate transmission upgrades

- Institutionalise storage incentives

- Strengthen tariff transparency

- De-risk currency exposure for investors

Boards and regulators must:

- Enforce ESG disclosure standards

- Improve procurement governance

- Align renewable rollout with industrial policy

Investors must:

- Demand bankable PPAs

- Prioritise grid stability frameworks

- Monitor sovereign reform credibility

The 2025 solar milestone is not an endpoint. It is a stress test of execution capacity.

PATH FORWARD – Solar Scale Must Meet System Discipline

Africa’s 2025 solar completions confirm that renewable ambition is translating into infrastructure reality.

The next phase requires system coherence, storage, grids, governance and capital discipline to convert megawatts into durable competitiveness.

Solar is rising. Institutional execution will determine whether it transforms.

Culled From: Top five solar power projects completed in Africa in 2025 - Energy in Africa