Global ESG frameworks are increasingly determining where capital flows within Africa’s mining sector.

Investors are recalibrating risk models, linking access to financing to governance standards, environmental stewardship and community impact disclosures.

For resource-rich economies, the shift marks a structural transition: mineral wealth alone no longer guarantees investment.

Capital Discipline Rewrites Mining Investment Rules

Environmental, Social and Governance (ESG) frameworks are reshaping investment patterns across Africa’s mining sector, influencing how global financiers allocate capital to resource projects.

As sustainability reporting standards tighten and institutional investors demand stronger risk transparency, mining companies are facing heightened scrutiny over environmental management, community relations and governance practices.

The consequence is immediate: access to financing increasingly depends on measurable ESG performance rather than geological potential alone.

For African mining jurisdictions, this signals a transition from extraction-led capital attraction to compliance-driven competitiveness.

Why ESG Now Determines Capital Allocation

Institutional investors, including pension funds, sovereign wealth funds and development finance institutions, are integrating ESG screening tools into project evaluation models.

This shift reflects three converging pressures:

- Global climate commitments requiring reduced carbon intensity

- Rising litigation and reputational risks tied to environmental harm

- Shareholder activism demanding stronger governance accountability

Mining projects with inadequate environmental safeguards or weak community engagement frameworks are increasingly classified as high-risk assets.

ESG Influence on Mining Finance

ESG Dimension | Investor Expectation | Capital Impact |

|---|---|---|

Environmental | Emissions reduction, water stewardship | Lower financing costs if compliant |

Social | Community benefit agreements, labour standards | Reduced project delay risk |

Governance | Transparent reporting, board oversight | Stronger institutional backing |

Disclosure | IFRS/ISSB-aligned reporting | Expanded global investor pool |

Companies aligning with recognised frameworks, including global sustainability reporting standards and emerging climate disclosure regimes, are seeing improved investor confidence and broader access to blended finance mechanisms.

The African Mining Context

Africa holds significant reserves of critical minerals essential for global energy transition technologies, including copper, cobalt, lithium and rare earth elements.

However, investors increasingly distinguish between resource availability and regulatory integrity.

Countries demonstrating:

- Clear environmental permitting processes

- Transparent revenue management

- Strong anti-corruption safeguards

- Consistent ESG disclosure enforcement

They are more likely to attract long-term institutional capital.

Conversely, governance opacity or regulatory unpredictability elevates sovereign and project risk premiums.

From Extractive Model to Sustainable Value Creation

If ESG frameworks are embedded effectively, the mining sector could evolve in three structural ways:

- Improved Community Outcomes – Revenue-sharing mechanisms and social investment programmes reduce conflict risk.

- Lower Cost of Capital – Transparent governance lowers perceived project risk.

- Enhanced Export Competitiveness – Compliance strengthens access to global supply chains, prioritising responsible sourcing.

Failure to adapt, however, carries escalating consequences:

- Project financing withdrawals

- Increased insurance and compliance costs

- Supply chain exclusion from ESG-sensitive markets

Mining competitiveness is no longer measured solely by ore grades or output volumes, but by governance quality and environmental credibility.

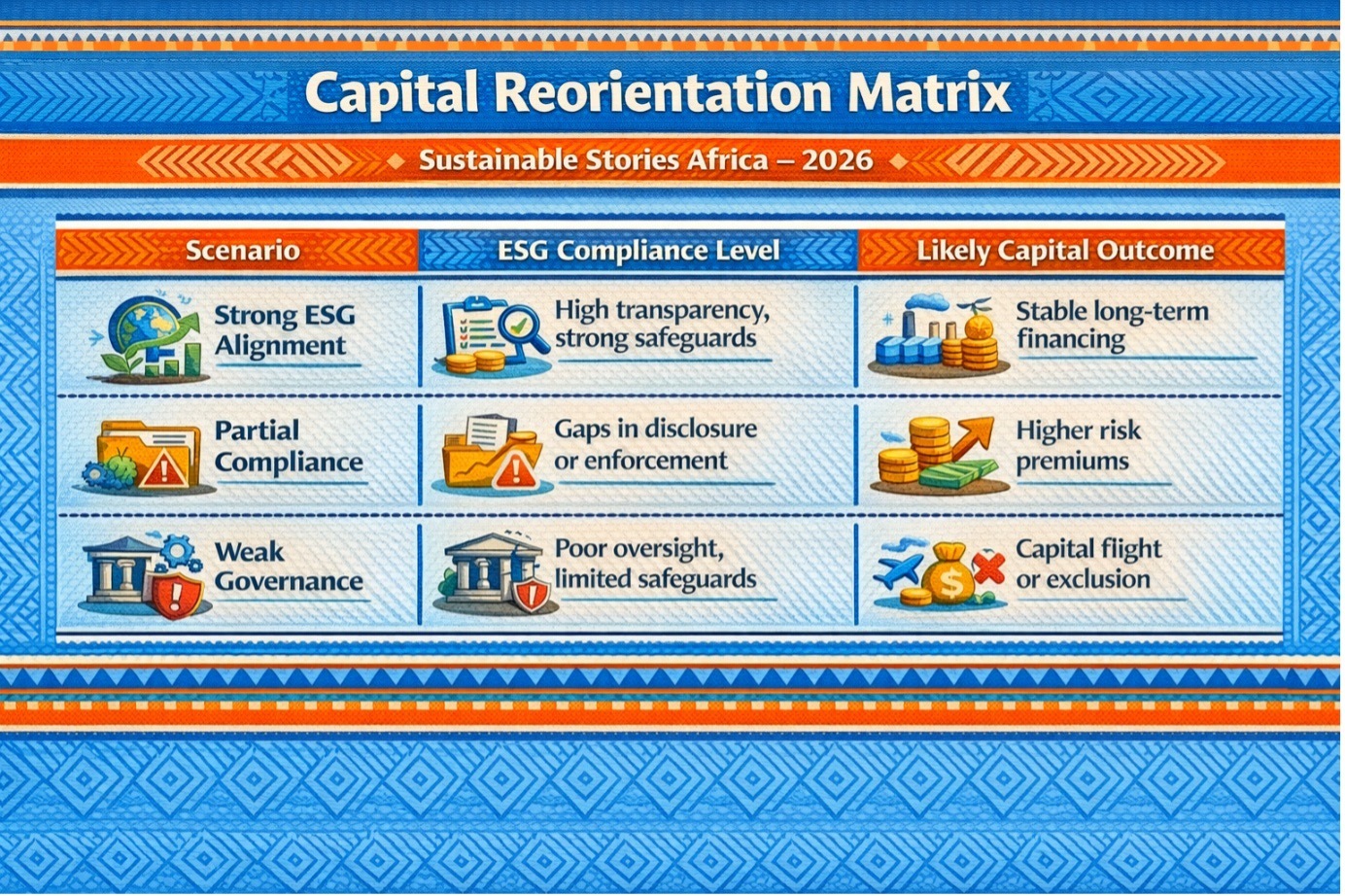

Capital Reorientation Matrix

Scenario | ESG Compliance Level | Likely Capital Outcome |

|---|---|---|

Strong ESG Alignment | High transparency, strong safeguards | Stable long-term financing |

Partial Compliance | Gaps in disclosure or enforcement | Higher risk premiums |

Weak Governance | Poor oversight, limited safeguards | Capital flight or exclusion |

This recalibration positions African policymakers at a strategic crossroads: strengthen regulatory ecosystems or risk diversion of capital to jurisdictions with clearer ESG frameworks.

Institutional Reform Becomes Competitive Advantage

Governments must:

- Harmonise mining codes with global ESG disclosure standards

- Enforce environmental compliance consistently

- Strengthen revenue transparency mechanisms

- Align national reporting with emerging climate disclosure frameworks

Mining boards must:

- Integrate ESG oversight at the board level

- Publish credible sustainability reports

- Link executive incentives to ESG metrics

Investors must:

- Demand measurable KPIs rather than policy statements

- Support capacity building in emerging mining jurisdictions

- Engage in long-term partnership models rather than short-cycle capital deployment

ESG integration is no longer reputational positioning; it creates a capital preservation strategy pathway.

PATH FORWARD – Governance Now Anchors Mining Competitiveness

Africa’s mining future will be defined by institutional credibility and not by resource endowment.

Aligning ESG frameworks with regulatory enforcement and transparent reporting will determine whether capital deepens or diverts in the coming decade.

Sustainable mining is becoming a prerequisite for sustainable finance.