Nigeria's sustainable finance landscape is defined by tangible barriers yet rich in catalytic opportunities. Innovations in solar energy, blended finance, and digital platforms are unlocking capital, building resilience, and promoting equity.

From policy reform to fintech empowerment, stakeholders must drive public-private collaboration for an inclusive, results-driven ESG transformation. Transformative finance is not only about bridging gaps, but also about redesigning the ecosystem for resilient environmental, social, and economic growth.

Finance, Reform, Innovation: Transform Nigeria's Future

Nigeria stands at a critical juncture in its sustainable finance transformation, where new financial tools, policy reform, and digital platforms offer lifelines to climate resilience and ESG innovation.

Over the past decade, breakthroughs in solar energy, waste-to-energy, and smart agriculture have spotlighted Nigeria's leadership in West Africa but exposed substantial barriers to scaling these achievements for social equity and environmental regeneration.

Despite landmark projects and rising impact investment, low access to affordable finance, weak institutional frameworks, and regulatory uncertainty continue to limit Nigeria's aspirations.

High borrowing costs, underdeveloped public-private partnerships, and currency volatility threaten the sustainability journey, especially as climate goals become non-negotiable in the development agenda.

Amid these headwinds, opportunities abound. Digital fintech ecosystems, blended finance, green bonds, and bold public-private collaboration promise a new era of inclusive, results-driven, sustainable investment. This review unpacks the barriers, catalysts, and systemic innovations redefining finance for Nigeria's sustainable future.

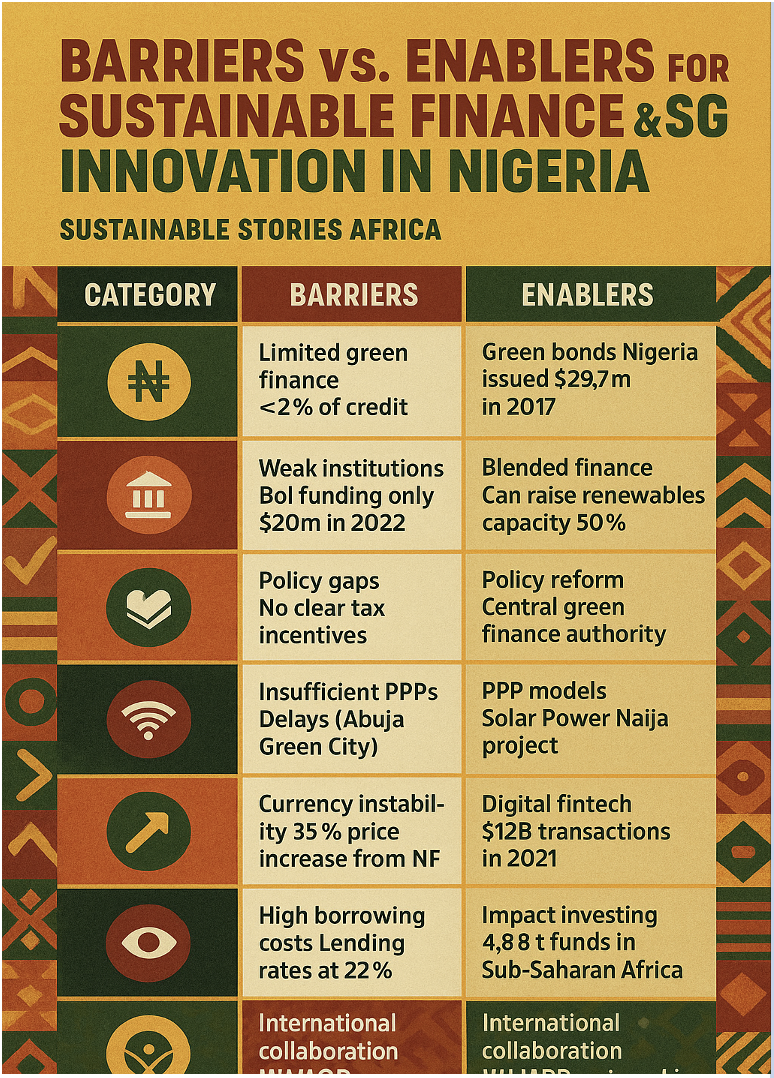

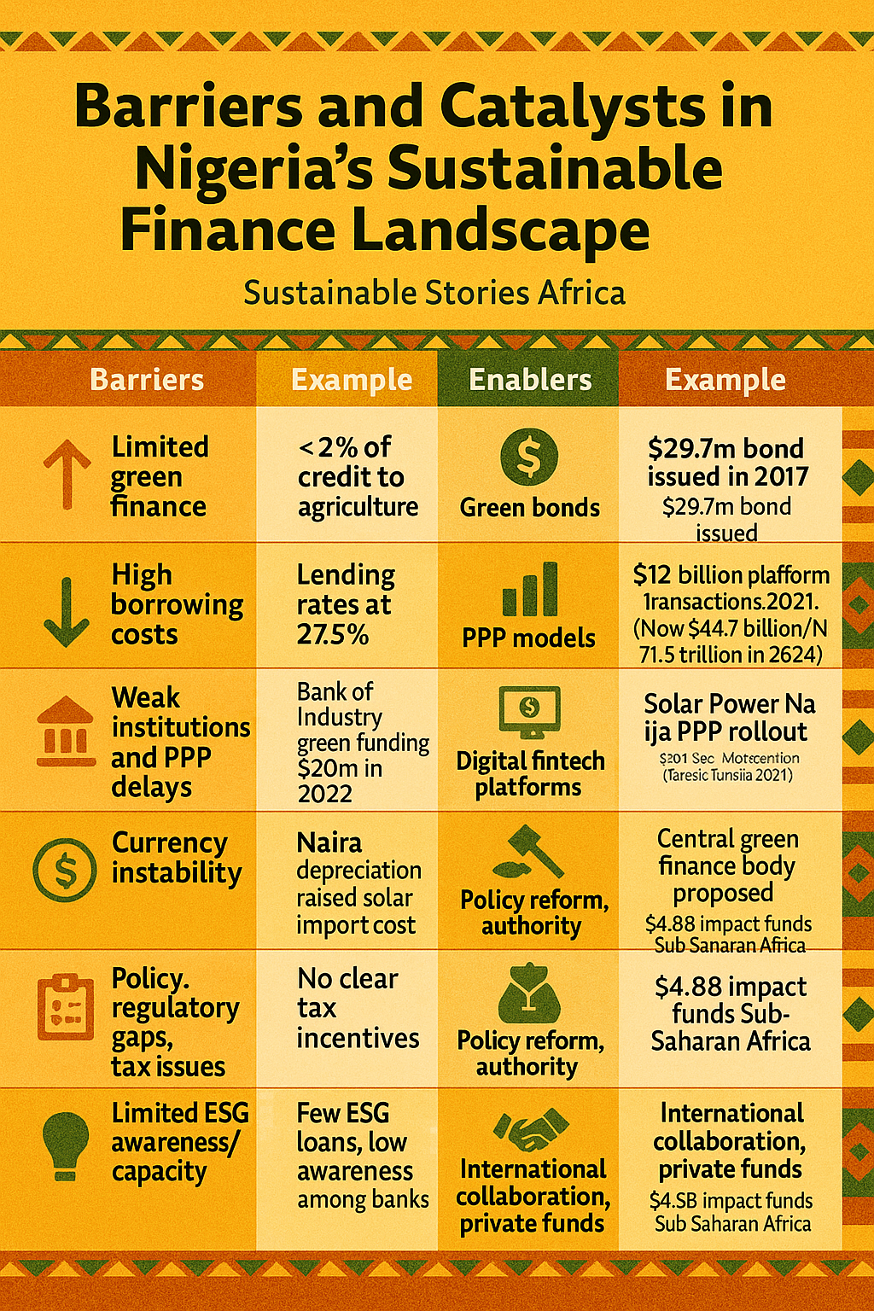

Barriers and Catalysts in Nigeria's Sustainable Finance Landscape

Nigeria's push for sustainable finance is defined by both formidable barriers and bold new enablers.

The high cost of borrowing 27.5% lending rates in 2025 means ESG innovators struggle for capital, especially in renewable energy and agriculture, where green finance supplies less than 2% of the sector's needs.

Institutional gaps and PPP delays have led to underfunded projects across grid extension and urban greening.

Currency instability, regulatory vagueness, and limited ESG capacity among financial actors further stifle progress. Yet, this adversity fuels new urgency and innovation, placing Nigeria's financial ecosystem at a turning point.

| Barriers | Example | Enablers | Example |

|---|---|---|---|

| Limited green finance | <2% of credit to agriculture | Green bonds | $29.7m bond issued in 2017 |

| High borrowing costs | Lending rates at 27.5% | Blended finance | Can raise renewable capacity by 50% |

| Weak institutions, PPP delays | Bank of Industry green funding $20m in 2022 | PPP models | Solar Power Naija PPP rollout |

| Currency instability | Naira depreciation raised solar import cost | Digital fintech platforms | $12 billion platform transactions 2021, (Now $44.7 billion/N71.5 trillion in 2024) |

| Policy, regulatory gaps, tax issues | No clear tax incentives | Policy reform, authority | Central green finance body proposed |

| Limited ESG awareness/capacity | Few ESG loans, low awareness among banks | International collaboration, private funds | $4.8B impact funds Sub-Saharan Africa |

Innovation and Impact – Key Sustainable Projects Drive Momentum

Nigeria's most prominent sustainable finance wins have come from solar mini-grids, off-grid electrification, vibrant waste-to-energy initiatives, and agri-tech platforms.

The Solar Power Naija PPP now aims to light up 5 million homes; Lumos and the NEP project have already impacted millions, reducing fossil fuel use and spurring job creation.

Waste-to-energy programmes in Lagos and Abuja are treating hundreds of thousands of tonnes of waste, using biogas and recycling as urban power solutions.

In agriculture, platforms like Hello Tractor have connected 500,000 smallholder farmers with tech-driven mechanization, boosting output while cutting water use and agrochemical dependence.

Green building technology and the electric bus fleet in Lagos exemplify infrastructure improvements with climate dividends.

Digital fintech platforms such as Farmcrowdy show how blended finance and impact investing can democratise funding access for SMEs, driving sustainable food production in rural economies.

Pathways to Scale – Blended Finance, PPPs, and Digital Inclusion

Amid barriers, Nigeria's finance innovators are building foundations for scale. Blended finance, leveraging public, private, and philanthropic capital, is being pushed as the key to de-risk high-potential investments.

The emergence of green bonds and mandatory ESG reporting is set to boost transparency and attract new pools of capital and international climate finance.

Fintech's rapid growth ($44.7 billion/N71.5 trillion in platform transactions in 2024) shows that digital financial inclusion is becoming Nigeria's strongest lever for SME empowerment and sectoral resilience.

Regional collaboration through ECOWAS opens cross-boundary infrastructure for energy and water, pooling resources to fine-tune investment risk and foster economies of scale.

Policy Reform, Partnerships, and Institutional Strengthening

Systemic reform is essential. Nigeria must create a comprehensive green finance framework, setting streamlined procedures, clear policy incentives, and mandatory reporting to foster investor trust.

Strengthening financial and regulatory institutions, including specialised green finance authorities, will speed up loan processing and ensure proper risk management. Unlocking supply chains through green certifications and lean procurement strategies can boost productivity and enterprise value.

Private sector incentives, tax rebates, risk-sharing guarantees, and impact investment platforms must be paired with robust ESG, CSR and collaborative international partnerships, especially with the UN and AfDB.

Policy harmonisation, integrating green objectives into budget planning, will ensure sustainability goals are institutionally embedded. Regional and global alliances, as well as digital solutions like blockchain for project transparency and digital marketplaces for democratized funding, are vital steps forward.