Emerging-market climate projects often falter on financing bottlenecks. A new legal-and-financial approach by the World Bank leverages securitisation tools to turn long-dated loan reflows into fresh capital, bringing institutional investors into the climate-finance arena.

In Africa and beyond, the challenge lies in converting vast demand for decarbonisation into investible assets. This article provides insights and data on how securitisation, when structured correctly, could unlock private capital and accelerate the transition.

The Capital Gap Is Real

For many climate-relevant projects in emerging and developing economies, the public finance pool is simply not enough. The Clean Technology Fund (CTF) has committed nearly US$6.3 billion through its multilateral development-bank partners, but is reaching resource limits.

In January 2025, the Climate Investment Funds (CIF) launched its inaugural bond: US$500 million, which was six-times oversubscribed. This signals a substantial latent investor demand.

Yet structural issues such as the lack of direct legal personality for many funds and heterogeneous loan portfolios held by multiple MDBs have constrained the use of capital-market tools.

Key Metrics Table

| Metric | Value | Significance |

|---|---|---|

| CTF donor commitments | US$6.3 billion | Highlights public-capital cap |

| CIF bond issuance | US$500 million | Demonstrates investor appetite |

| Oversubscription factor | 6× | Suggests excess demand vs supply |

These figures underline a clear mismatch: demand for scalable, investible climate assets is strong; supply remains constrained by structural and legal hurdles.

Why Securitisation Matters

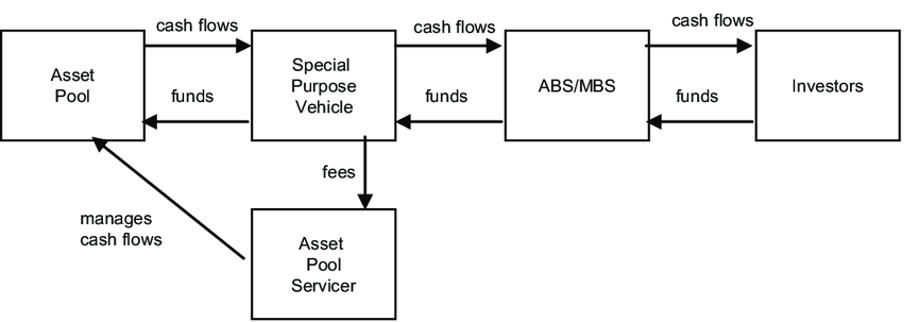

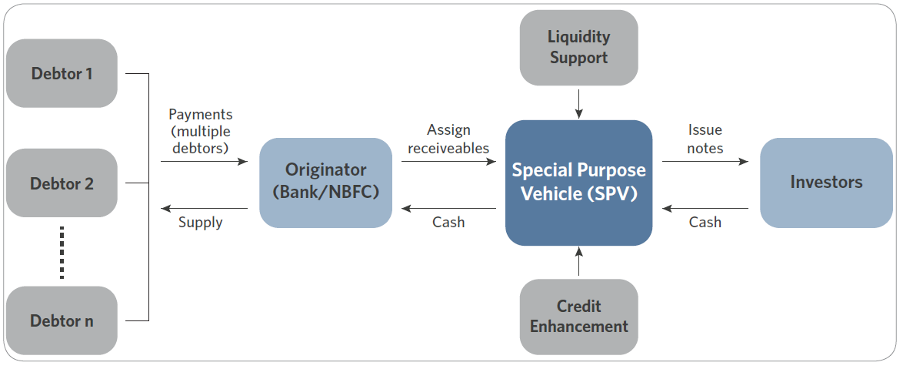

Securitisation refers to packaging income-generating assets and issuing securities backed by them. For climate finance, it means turning long-dated loan-reflows into bonds that institutional investors can buy. CTF's loan reflows through MDBs could be securitised; however, they require innovative legal structures.

By creating a separate legal vehicle to issue bonds and manage the process of passing reflows from CTF, the model converts what is an almost off-balance-sheet portfolio into an investible structure.

In doing so, it offers a path to mobilise private capital rather than relying purely on public funds. This aligns with broader development-finance imperatives: the International Finance Corporation and others are exploring "originate-to-distribute" models to unlock institutional money into emerging markets.

Africa's Opportunity

For Africa-focused climate projects, whether renewable-energy roll-outs, green infrastructure or adaptation finance, the securitisation model opens compelling possibilities.

For instance, pension funds and insurance companies often seek rated, liquid securities rather than direct project debt. Securitised structures can embed credit enhancements, tranches, and liquidity features to make climate assets fit institutional mandates.

Moreover, by broadening the investor base, such structures can reduce the cost of capital, accelerate project timing and scale deployment, which are all vital for African climate action given the scale of needs.

For example, if Africa captures even a modest share of securitised flows, the mobilised private capital could bridge significant portions of the continent's climate-finance gap.

Blueprint for Implementation

Here is a simplified flow diagram of how the securitisation structure works:

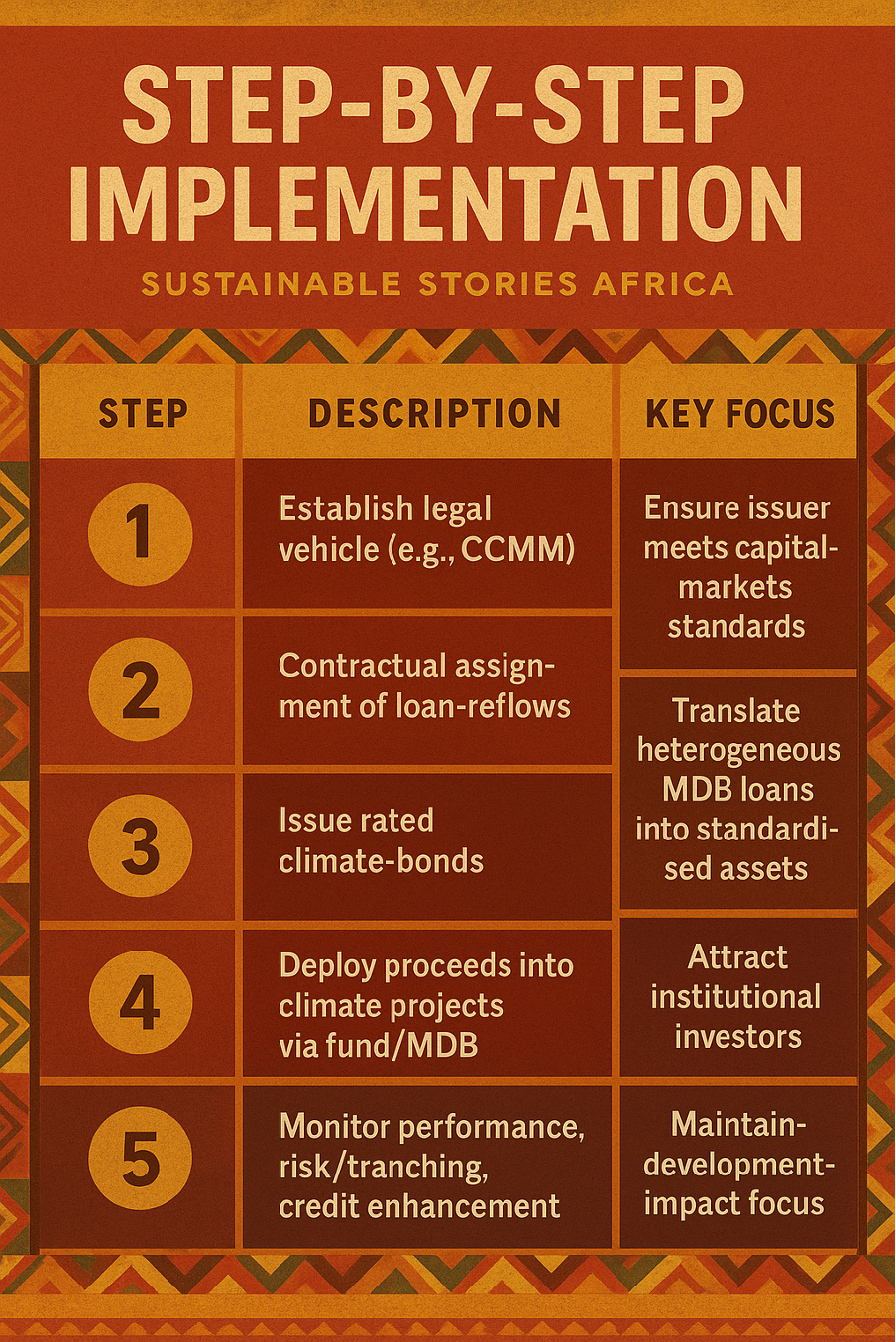

Step-by-step Implementation

| Step | Description | Key Focus |

|---|---|---|

| 1 | Establish legal vehicle (e.g., CCMM) | Ensure issuer meets capital-markets standards |

| 2 | Contractual assignment of loan-reflows | Translate heterogeneous MDB loans into standardised assets |

| 3 | Issue rated climate-bonds | Attract institutional investors |

| 4 | Deploy proceeds into climate projects via fund/MDB | Maintain development-impact focus |

| 5 | Monitor performance, risk/tranching, credit enhancement | Institutional-investment confidence |

For African stakeholders, which include governments, DFIs, and private investors, the message is clear: engage early on legal frameworks, standardise project pipelines, aggregate assets, and design structures suited to institutional investor requirements.

Path Forward – Scale Structures, Mobilise Millions

Looking ahead, the success of this model will depend on several factors: building sufficient deal-flow (aggregated assets in comparable structures), harmonising legal/regulatory frameworks across jurisdictions, and developing investor appetite for climate-securitised products.

African actors (governments, MDBs, DFIs, private-sector platforms) must collaborate to generate the underlying assets and align them with investor expectations.

In short: "Standardise, Aggregate, Launch Climate Securities." By mobilising securitisation at scale, Africa could unlock billions in private capital to power its climate transition not as a token add-on, but as a core financing channel.

The blueprint exists. Execution now defines whether climate-finance moves from fragmented pledges to investible-asset reality.

Culled From: https://blogs.worldbank.org/en/psd/securitization-tools-can-mobilize-private-capital-for-climate-fi