Global sustainability disclosure has surged to cover 91% of global market capitalisation, yet crucial gaps persist between regions, industries, and the depth of information companies choose to reveal.

The Global Corporate Sustainability Report 2025 uncovers a world striving for transparency while wrestling with fragmentation, assurance inconsistencies, and uneven adoption of standards.

A World Reporting More, Understanding Less

Sustainability reporting has never been more widespread, or more uneven. The Global Corporate Sustainability Report 2025 reveals that 12,900 companies, representing 91% of global market capitalisation, now disclose sustainability-related information.

This represents a 5.81% increase from 86% two years prior. However, beneath this headline success lies an uncomfortable truth: disclosure quality, consistency, and depth vary so dramatically that the global surge in reporting often conceals as much as it reveals.

In the energy sector, disclosure rates are high, but meaningful scope 3 reporting remains scarce outside Europe. In real estate, sustainability metrics, despite high climate exposure, remain thin.

Across all industries, companies overwhelmingly disclose what is easiest, not what is most consequential. Human rights, biodiversity, and ecosystem risks continue to be under-reported, under-assured, and underweighted, even though global markets depend on these systems for long-term resilience.

The report's infographics, particularly the ones on pages 10–12, show significant data asymmetry between regions and industries, reinforcing the uneven maturity of sustainability practices.

Our exclusive article examines the key findings through Sustainable Stories Africa's opinion lens, using our AIDAP framework for narrative intimacy. It interrogates both the momentum and fragility of global disclosure. The world may be reporting more, but whether it is truly understanding more is another matter entirely.

When Disclosure Grows but Clarity Shrinks

The numbers seem breathtaking - 91% of global market capitalisation now produces sustainability-related disclosures. From Tokyo to Toronto, Johannesburg to Jakarta, sustainability reporting has become a default expectation of the corporate world. Policymakers cite it as evidence that the market is shifting. Regulators treat it as a milestone. Investors describe it as progress.

However, the Global Corporate Sustainability Report 2025 tells a more layered story. Yes, disclosure is rising, but clarity is not. Europe leads with nearly universal reporting; China's state-owned enterprises (SOEs) report at 95% of their market share; the U.S. hovers above 93%. Yet an estimated 31% of total corporate emissions come from the energy sector, where scope 3, which is arguably the most significant driver of real-world climate impact, remains sporadically disclosed outside Europe.

Meanwhile, commercial data providers increasingly fill disclosure gaps with estimates, especially in China, the Middle East, and Africa. But estimates, as the report warns on pages 14–16, can obscure company-level innovations and risks, replacing transparency with statistical approximation.

In short, we know more, but not enough. And what we do know is far from evenly distributed.

The Numbers Behind the New Transparency Divide

The OECD's data, charts, and infographics across pages 10–28 spotlight the growing fragmentation in global sustainability practices.

Regional Disclosure Landscape

| Region | Disclosure by Market Cap | Scope 1 & 2 Disclosure | Scope 3 Disclosure | Assurance Coverage |

|---|---|---|---|---|

| Europe | 98% | 98% | 97% | 93% |

| US | 93% | 95% | 80% | 83% |

| China | 95% | 81% | 29% | 51% |

| Emerging Asia | 87% | 91% | 47% | 73% |

| Middle East & Africa | 85% | 92% | 47% | 73% |

Europe emerges as the global anchor for sustainability transparency. China demonstrates high disclosure but mixed depth. Emerging markets show meaningful progress, but with scope 3 and assurance lagging significantly.

This reveals a transitional world, oscillating between voluntary legacy frameworks and emerging global standards.

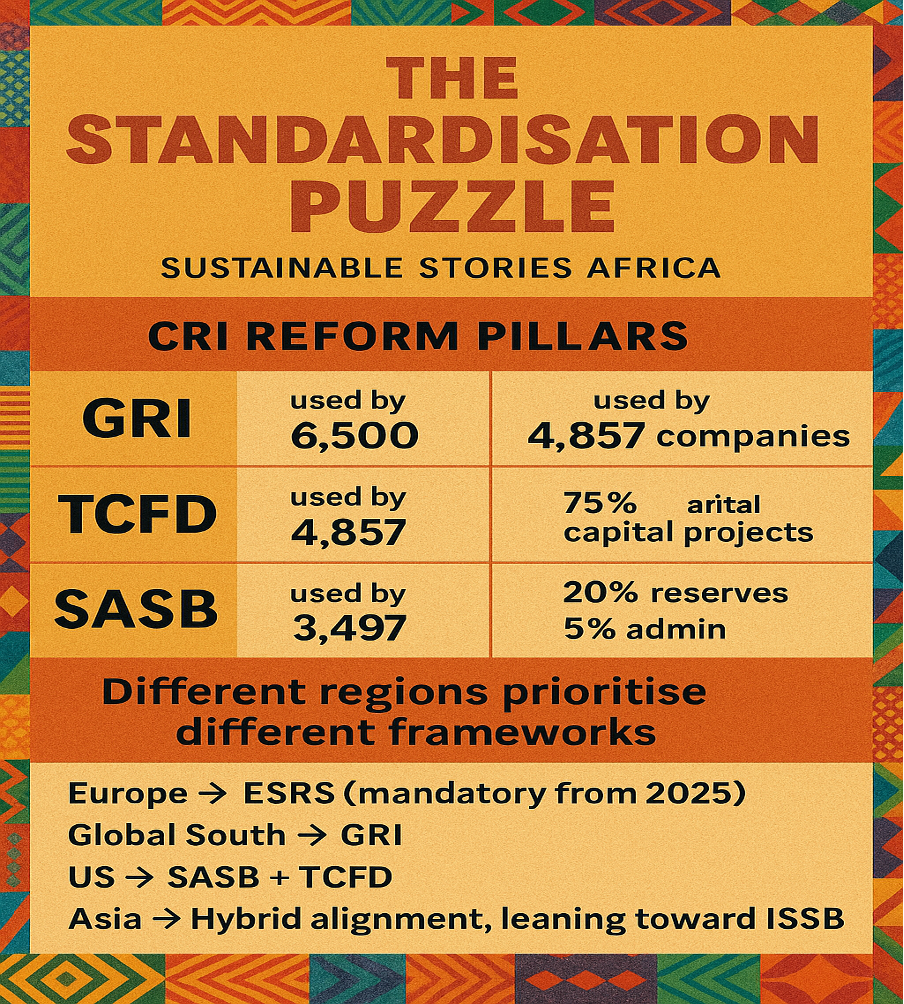

The challenge – Different regions prioritise different frameworks

As the report notes on Page 18, interoperability is not yet mature, leaving multinational companies navigating complex structures of reporting standards and not a unified path.

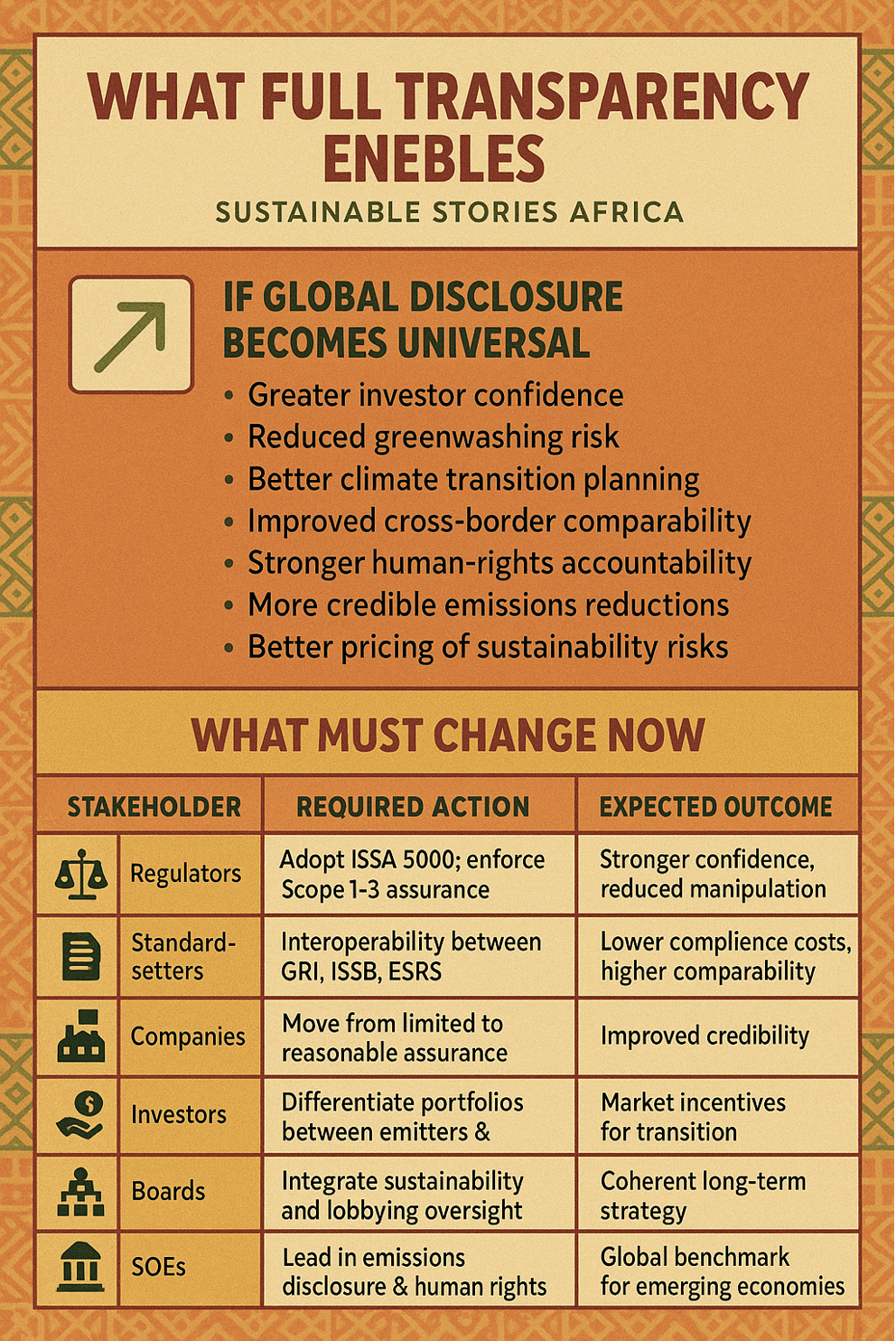

What Equal Transparency Could Unlock

Imagine an economy where sustainability disclosure is not just widespread, but comparable, verified, and meaningful. The report's findings point to several transformative gains:

Uniform assurance standards, especially via ISSA 5000, could close credibility gaps. Scope 3 disclosures would allow markets to accurately assess long-term climate liabilities.

Enhanced human rights due diligence transparency would protect millions in global supply chains. And consistent board oversight, already rising to 70% of market capitalisation, could embed sustainability into corporate strategy, not PR.

Markets thrive on clarity. Sustainability thrives on accountability. The global economy needs both.

Fixing the Global Machinery of Sustainability Reporting

The report outlines numerous areas where policymakers, regulators, and corporations can act decisively.

What Must Change Now

| Stakeholder | Required Action | Expected Outcome |

|---|---|---|

| Regulators | Adopt ISSA 5000; enforce Scope 1–3 assurance | Stronger confidence, reduced manipulation |

| Standard-setters | Interoperability between GRI, ISSB, ESRS | Lower compliance costs, higher comparability |

| Companies | Move from limited to reasonable assurance | Improved credibility |

| Investors | Differentiate portfolios between emitters & innovators | Market incentives for transition |

| Boards | Integrate sustainability and lobbying oversight | Coherent long-term strategy |

| SOEs | Lead in emissions disclosure & human rights | Global benchmark for emerging economies |

Key Policy Imperatives

- Mandate reasonable assurance for Scope 1 & 2 emissions.

- Increase regulatory oversight for combined audit + assurance providers.

- Expand sector-specific guidance, especially for real estate and tech.

- Require transparent lobbying disclosures to align policy engagement with sustainability targets.

- Strengthen human-rights due diligence reporting in line with OECD MNE Guidelines.

The world has upgraded reporting but must now upgrade reliability.

PATH FORWARD – Harmonising Standards, Strengthening Global Transparency

Global sustainability reporting is expanding rapidly, but lasting progress requires globally consistent standards, wider reasonable assurance, and sector-specific transparency mandates. Aligning GRI, ISSB, and ESRS frameworks will be key to reducing compliance burdens while increasing comparability.

To build a truly transparent global market, policymakers must push Scope 3 disclosure, strengthen human rights reporting, and encourage investor stewardship that rewards sustainable innovation. Only then can disclosure serve as a foundation for climate resilience, social stability, and long-term value creation.