Global regulators have issued 192 green-claim warnings, casting a spotlight on a climate business projected to unlock $15 trillion in value.

As scrutiny intensifies, companies face a defining question: which sustainability strategy is grounded in measurable impact, or marketing narrative?

The answer could determine capital access, investor trust and long-term competitiveness.

192 Green Warnings and a $15 Trillion Test

The global climate economy is entering its most consequential phase yet. With regulators issuing 192 warnings over misleading environmental claims, scrutiny is rising just as clean-energy and climate-aligned sectors are projected to mobilise up to $15 trillion in opportunity over the coming decade.

For investors, the signal is unmistakable: capital will flow, but credibility must lead the way. Greenwashing is no longer a reputational risk; it is becoming a regulatory, financial and governance fault line.

For African markets navigating the adoption of ISSB, the carbon market frameworks and sustainable finance taxonomies, the implications are immediate.

Integrity will determine who competes and who is sidelined in the next wave of global capital allocation.

Regulators Tighten Grip on Green Claims

The climate business is accelerating, but so is enforcement.

Regulators across major markets have issued 192 formal warnings relating to environmental and sustainability claims. The message is clear: vague net-zero pledges, unverified carbon neutrality labels and loosely defined "green" branding are under scrutiny.

This matters because climate-aligned investment is not marginal capital. It is core capital. Estimates suggest the broader green transition could mobilise approximately $15 trillion across renewable energy, electrification, energy efficiency, climate tech, adaptation and sustainable infrastructure.

However, regulators are signalling that scale without substance will not be tolerated.

The enforcement trend marks a structural shift: sustainability reporting is transitioning from voluntary narrative to measurable compliance.

Growth Meets Governance Reckoning

Climate business growth is no longer theoretical. Electrification strategies, industrial decarbonisation plans, and sustainable supply chains are reshaping balance sheets. However, scrutiny now matches ambition.

Climate Market Opportunity vs Compliance Pressure

| Indicator | Signal |

|---|---|

| Projected Climate Business Opportunity | $15 Trillion |

| Regulatory Green-Claim Warnings | 192 Cases |

| Focus of Enforcement | Misleading labels, vague net-zero pledges, unverifiable offsets |

| Core Risk | Capital misallocation and investor distrust |

The emerging pattern reflects three structural shifts:

- From Marketing to Measurement – ESG disclosures must now be traceable, data-backed and auditable.

- From Voluntary to Enforceable – Regulators are moving beyond guidance into penalties.

- From Narrative to Numbers – Scope emissions accounting, lifecycle transparency and supply-chain traceability are no longer optional.

For African corporations, this transition aligns with ISSB-aligned reporting standards, evolving carbon market rules, and growing scrutiny from development finance institutions and global asset managers.

In other words, climate capital is now a conditional capital.

Credible Climate Strategy Attracts Capital

While enforcement signals risk, it also clarifies opportunity.

Companies that embed measurable sustainability governance are positioned to benefit from three distinct advantages:

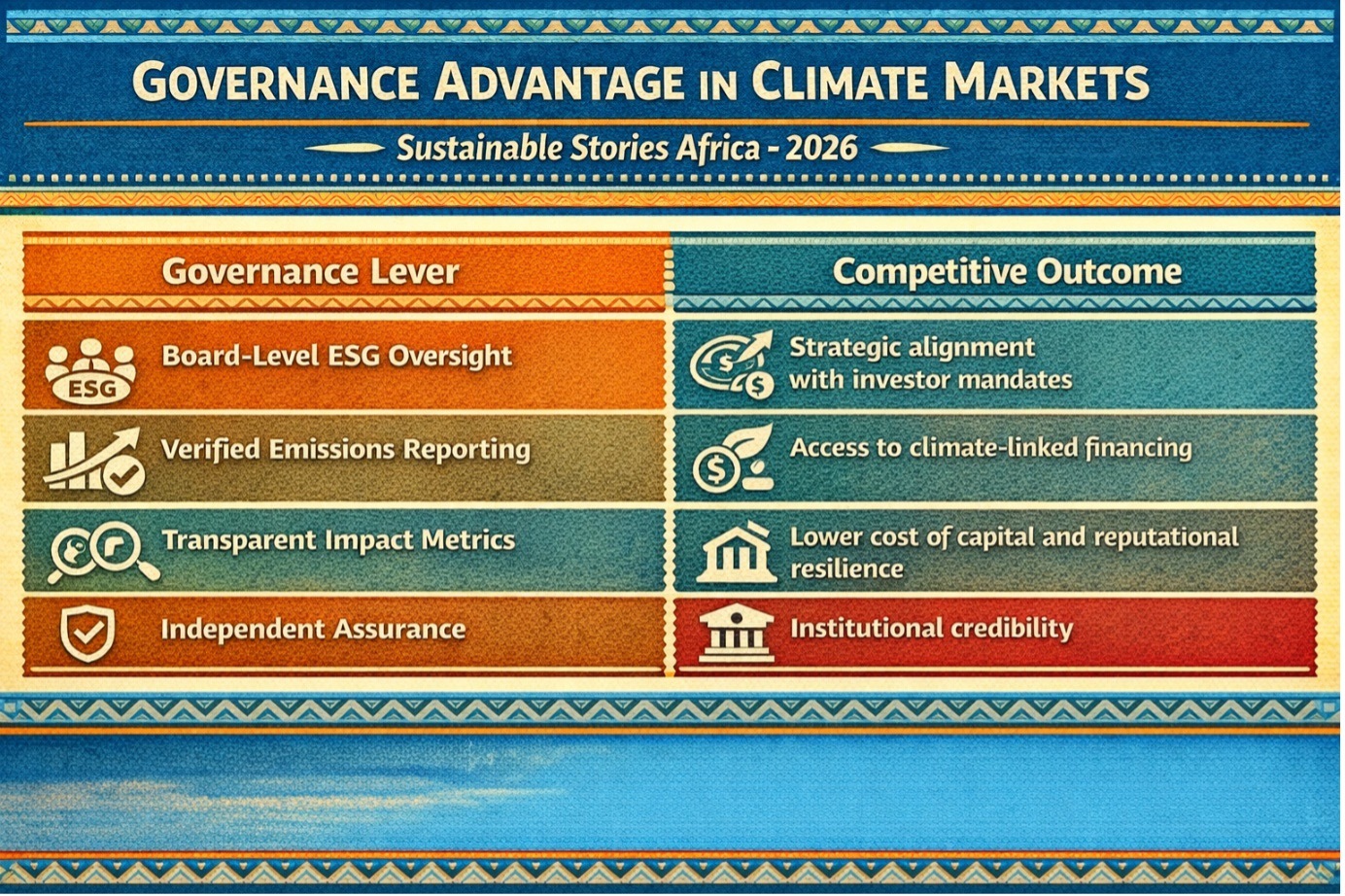

Governance Advantage in Climate Markets

| Governance Lever | Competitive Outcome |

|---|---|

| Board-Level ESG Oversight | Strategic alignment with investor mandates |

| Verified Emissions Reporting | Access to climate-linked financing |

| Transparent Impact Metrics | Lower cost of capital and reputational resilience |

| Independent Assurance | Institutional credibility |

The climate transition is not merely technological; it is governance driven.

Investors are increasingly differentiating between firms that integrate sustainability into enterprise risk management and those that treat it as a communications exercise.

In African markets, where climate vulnerability intersects with infrastructure deficits, credible ESG positioning could unlock blended finance, green bonds, sustainability-linked loans and transition capital.

Failure, however, carries escalating consequences: investor withdrawal, litigation exposure, regulatory fines and brand erosion.

The divergence between authentic strategy and performative sustainability is widening.

Integrity Must Anchor Climate Expansion

The 192 warnings serve as a cautionary signal, and serves as a roadmap.

Executives must move beyond aspirational statements toward operational accountability. That requires:

- Board-approved sustainability KPIs

- Clear linkage between climate targets and capital expenditure

- Transparent methodologies for carbon accounting

- Independent third-party assurance

- Ongoing regulatory monitoring

For African organisations, aligning with global disclosure frameworks, while adapting to local realities, will be critical. Policymakers, regulators and corporate leaders must collaborate to build systems that reward measurable performance rather than rhetorical positioning.

The $15 trillion climate market will not reward ambiguity. It will reward discipline.

And in a tightening regulatory environment, discipline is becoming the ultimate competitive advantage.

PATH FORWARD – Measured Integrity Drives Climate Capital

The climate opportunity remains immense, but access will depend on transparency, governance and verifiable outcomes.

Regulatory scrutiny is reshaping sustainability from a branding exercise to a fiduciary responsibility.

Boards and policymakers must institutionalise measurable ESG systems, strengthen assurance mechanisms and align disclosures with global standards. The next decade of climate finance will reward those who treat integrity not as compliance—but as strategy.

Culled From: https://www.linkedin.com/pulse/climate-business-192-green-claim-warnings-15-trillion-jordanova-bixxe/